Quantifying the wealth destruction in 2022, plus the Fed's preferred yield curve measure inverts, Europe's latest inflation data, and Taylor Swift

The Sandbox Daily (10.31.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the wealth destruction across global equity and debt markets in 2022, the Federal Reserve’s preferred yield curve measure now forecasts a recession, Europe's ugly inflation print, and Taylor Swift releases Midnights.

Happy Halloween to all. Enjoy a fun and safe evening trick-or-treating. My favorite tradition still belongs to Michael Myers:

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 0.00% | Dow -0.39% | S&P 500 -0.75% | Nasdaq 100 -1.22%

FIXED INCOME: Barclays Agg Bond -0.34% | High Yield -1.50% | 2yr UST 4.489% | 10yr UST 4.056%

COMMODITIES: Brent Crude -1.22% to $94.85/barrel. Gold -0.58% to $1,635.5/oz.

BITCOIN: -1.35% to $20,374

US DOLLAR INDEX: +0.74% to 111.577

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: +0.50% to 25.88

Wealth destruction

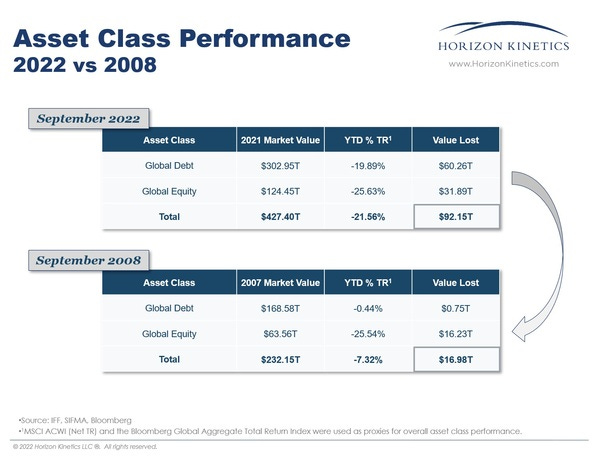

In the first three quarters of 2022, global equity and debt markets lost $92 trillion dollars in value. The scale of this loss is similar to global GDP for 2021, which totaled $96.3 trillion dollars (source: International Monetary Fund). In comparison, in 2008, global markets lost $17 trillion dollars in the first three quarters, relative to 2007 global GDP of $58 trillion.

The everything bubble unwind of historic proportions…

Source: Horizon Kinetics

Fed’s yield curve forecasts recession

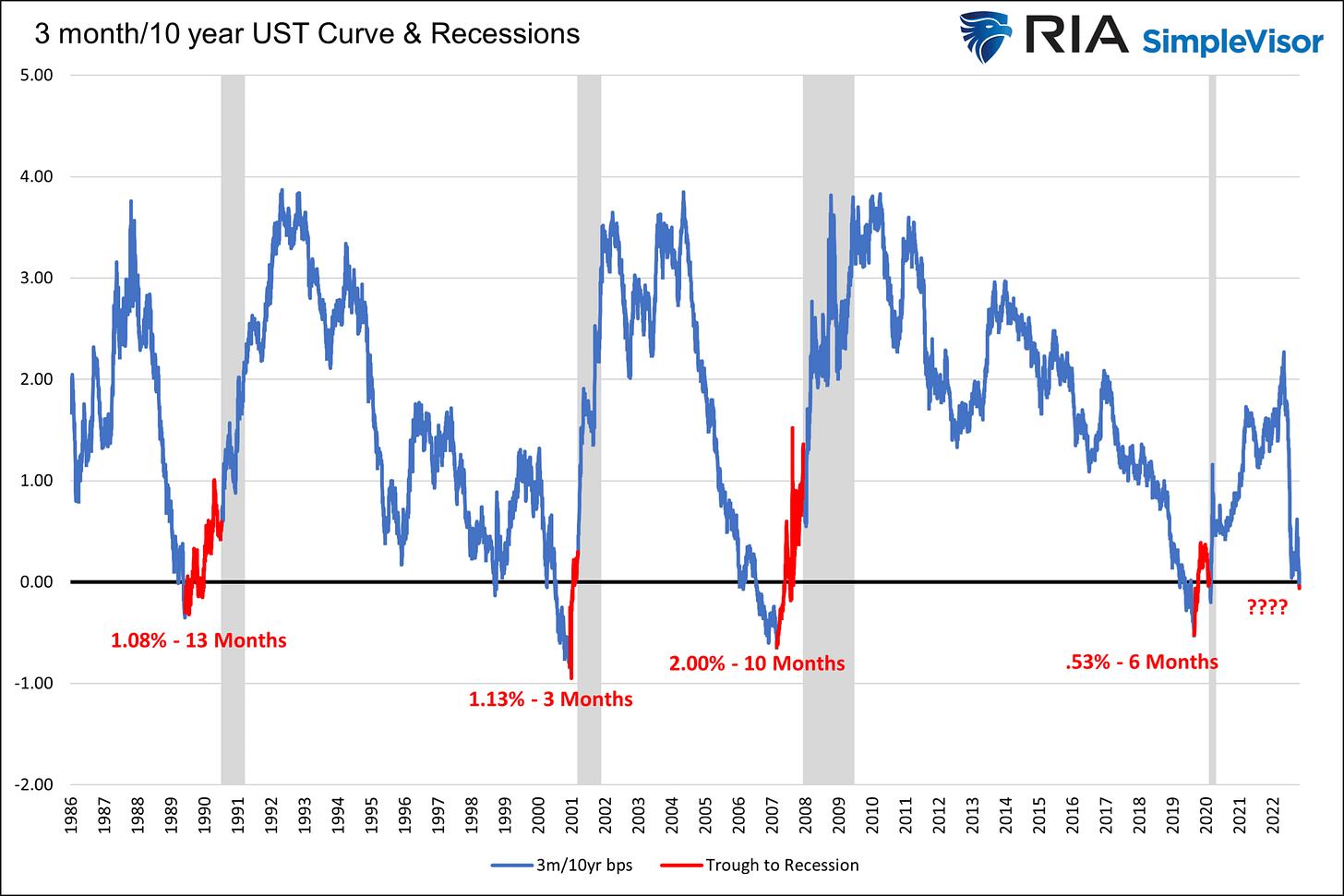

US 3rd quarter GDP rose nicely, but the Fed's preferred yield curve has spoken. It says a recession is coming. The graph below charts the yield difference between the 3-month Treasury bill and the 10-year Treasury note. The Fed often reminds us that an inversion in the 3m/10yr UST curve is a precursor for recessions. Every time, as notated in red, the ten yield is lower than the three-month yield for more than a few days, a recession follows.

When should we expect a recession? As the chart below highlights, it has taken between 3 and 13 months from the trough of the yield curve inversion until the official National Bureau of Economic Research (NBER) recession declaration. Making timing a little tricky is the clock doesn’t start ticking until the yield curve troughs. Based on Fed Funds futures, the three-month yield should rise from 4.05% to 4.80%. Unless the 10-year yield falls by .75% over the coming months, the Fed's yield curve will invert further. Such a trough in the Fed's yield curve may take another couple of months to form. Then we can start the recession clock.

Source: Lance Roberts

Europe's ugly inflation print

Eurozone inflation rose +10.7% in October from the same period a year ago — a new record, according to a preliminary estimate from the European Commission. That's a rapid acceleration from the +9.90% reached in September. The key driver is soaring energy costs, as fallout from Russia's invasion of Ukraine continues to hit the economy. Energy prices were up +42% from a year ago in October; warm weather and a strong buildup of natural gas supplies have led to a decline in wholesale prices, but that has yet to trickle down to household energy bills.

The Eurozone is facing a toxic mix of rising inflation and slowing growth. The European Central Bank (ECB) acknowledged the risk of a slowdown last week but remained focused on stamping out inflation, with little signal that it will abandon its interest rate hiking mission. That's setting up the Eurozone for bleaker outcomes in the months ahead; while the economy grew +0.2% compared to the prior quarter, it's a notable slowdown from the +0.8% registered during the April-June period.

Source: Axios

Taylor Swift’s ‘Midnights’ blasts in at No. 1 on Billboard 200 Chart with biggest week for an album in 7 Years

The final numbers are in, and Taylor Swift’s Midnights sold 1.578 million equivalent album units in the United States in its first week, the biggest week for an album in seven years, since Adele’s 25 sold 3.482 million units in December 2015. Midnights is now definitively the single-week bestselling vinyl record of the modern post-1991 era, with 575,000 LPs sold, beating out the previous record made by Harry’s House from Harry Styles. It’s also the best week for CD sales of an album since reputation by Taylor Swift in 2017.

Selling albums in the first week of a release used to be the key metric of success for an artist when coming out with new work. First-week sales figures have deteriorated in recent years as customers overwhelmingly shifted away from purchasing CDs and albums on iTunes to streaming them on services such as Spotify and Apple Music. Here are other albums that sold a million copies in a week – Taylor is a mainstay on this list.

Source: Numlock News, Billboard, Wall Street Journal

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.