Rate cuts after long pauses have been bullish

The Sandbox Daily (8.20.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

rate cuts after long pauses have been bullish

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.04% | S&P 500 -0.24% | Russell 2000 -0.32% | Nasdaq 100 -0.58%

FIXED INCOME: Barclays Agg Bond +0.06% | High Yield -0.04% | 2yr UST 3.748% | 10yr UST 4.291%

COMMODITIES: Brent Crude +1.92% to $67.05/barrel. Gold +0.98% to $3,391.5/oz.

BITCOIN: +0.78% to $114,116

US DOLLAR INDEX: -0.01% to 98.252

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: +0.77% to 15.69

Quote of the day

“The lesson you struggle with will repeat itself until you've learned from it.”

- Michael Yardney

Rate cuts after long pauses have been bullish

Combined with the weak jobs growth over the last three months, the latest consumer inflation data suggest there is room for the Federal Reserve to lower its key benchmark interest rate at its next FOMC meeting on September 16-17. It would be the committee’s first cut since December 18, 2024.

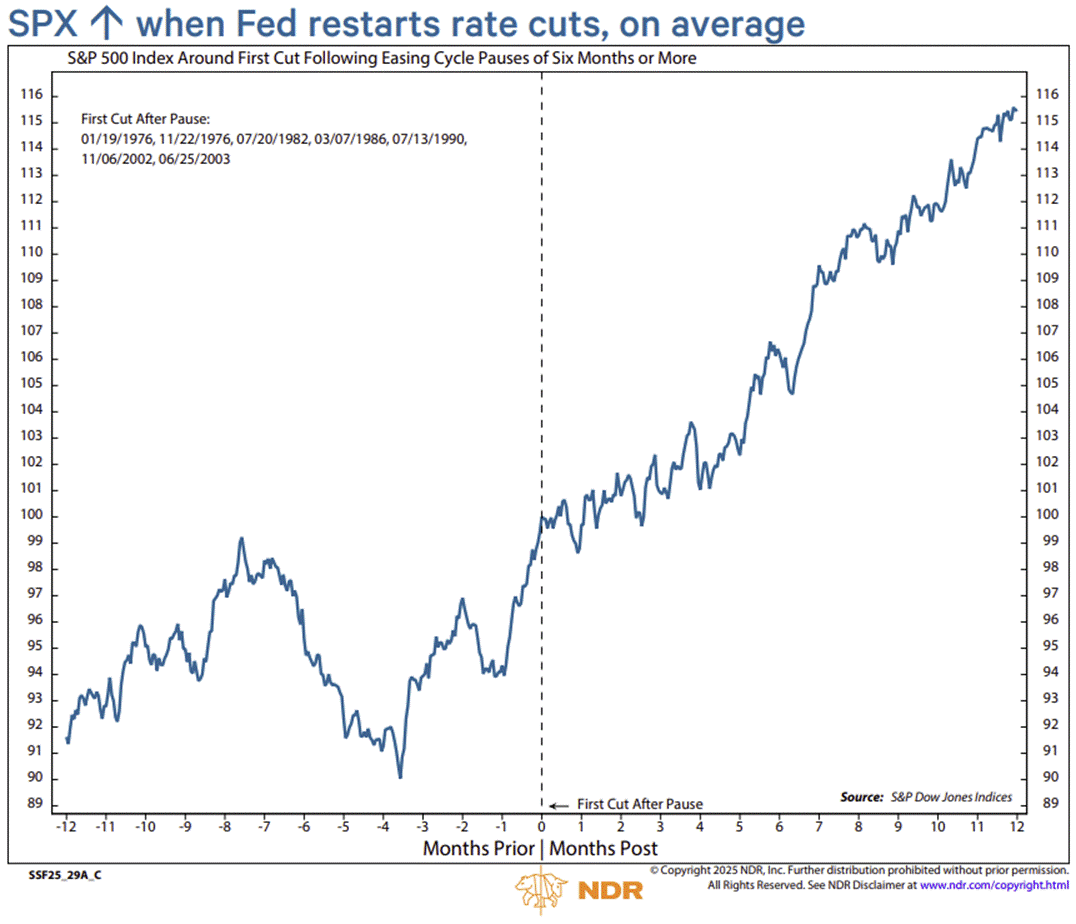

Historically, the S&P 500 has tended to rally in the months before and after it resumes an easing cycle after pausing for six months or more – as is the case today. See the chart below, indexed to the seven most recent historical analogs.

The rationale is that the Fed likely paused over a combination of inflation concerns and confidence the economy did not need additional stimulus. The resumption often means inflation fears have been addressed.

And yet, the data dependent Fed is waiting for tariffs to show up in input prices for goods (it’s beginning to), while potential leadership instability at the Fed – repeated calls by President Trump to fire Fed Chair Jerome Powell and Fed Governor Adriana Kugler’s abrupt resignation on August 8 – could both undermine the bullish message from lowering rates from overly restrictive policy.

Further complicating the Fed’s path forward is a divided committee over the best course of monetary policy to administer in the intermediate term, where today’s release of the July FOMC meeting minutes depicted a growing divergence of opinion among the central bankers.

“Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment,” the minutes noted. While “a majority of participants judged the upside risk to inflation as the greater of these two risks” a couple saw “downside risk to employment the more salient risk.”

Sources: Federal Reserve, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)