Real estate market, plus inflation expectations, tech, and corporate earnings

The Sandbox Daily (6.12.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Real Estate strength or weakness?

inflation expectations continue to ease, give Fed room to pause/skip

tech stock leadership

corporate earnings expected to rebound in 2nd half of 2023

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.76% | S&P 500 +0.93% | Dow +0.56% | Russell 2000 +0.40%

FIXED INCOME: Barclays Agg Bond +0.17% | High Yield -0.11% | 2yr UST 4.585% | 10yr UST 3.743%

COMMODITIES: Brent Crude -3.70% to $72.02/barrel. Gold -0.29% to $1,971.5/oz.

BITCOIN: -0.75% to $25,926

US DOLLAR INDEX: +0.07% to 103.626

CBOE EQUITY PUT/CALL RATIO: 0.50

VIX: +8.53% to 15.01

Quote of the day

“A bull market is when you check your stocks every day to see how much they went up. A bear market is when you don't bother to look anymore.”

- John Hammerslough

Real Estate strength or weakness?

Homebuilders have been some of the strongest stocks since last year. However, the same cannot be said for all equities with exposure to real estate. In fact, real estate has been the worst sector by many measures over the same time frame.

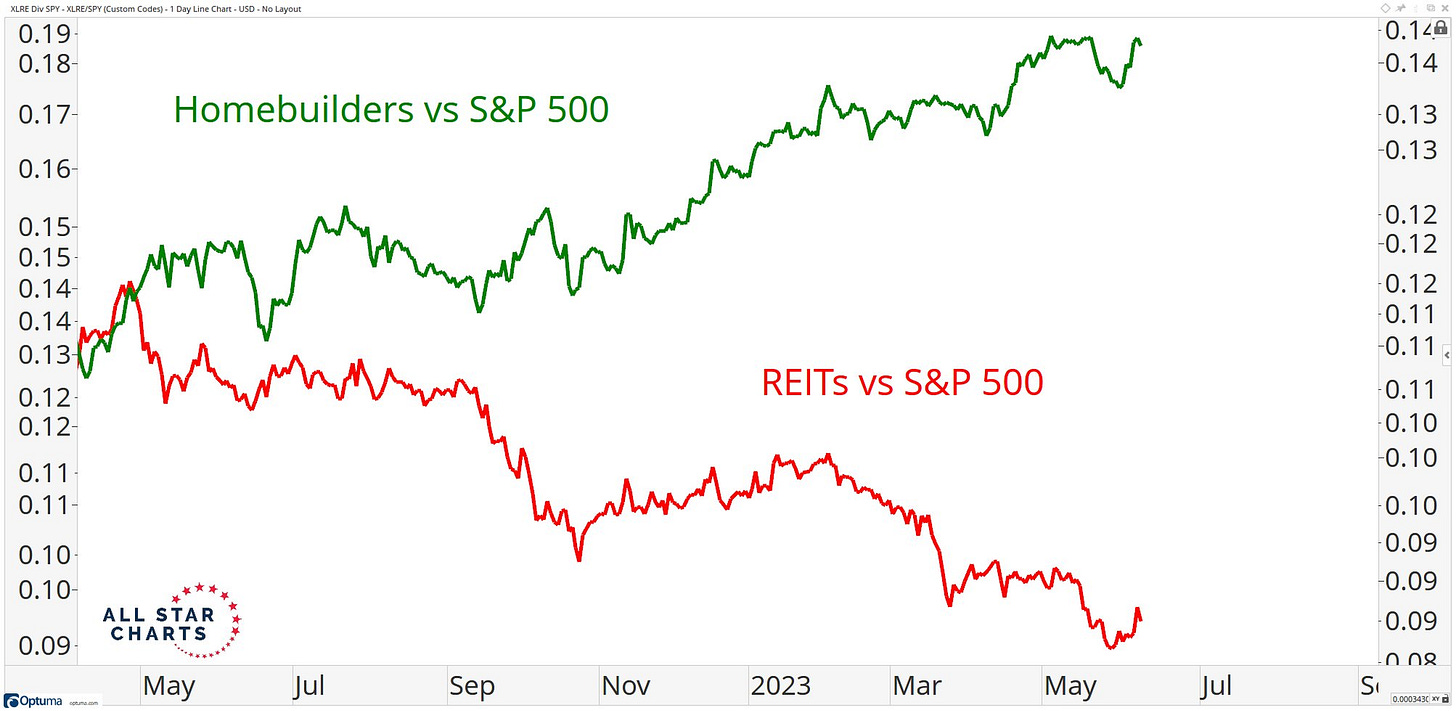

The chart below from All Star Charts shows the opposing paths that these two groups of stocks are taking:

While the iShares U.S. Homebuilders ETF (ITB) is pressing to new highs relative to the broader market (SPX), the relative trend for Large-Cap Real Estate (XLRE) recently made new all-time lows – the divergence between these groups is crystal clear when put side-by-side.

One of these groups has been trending steadily higher on both absolute and relative terms. The other has been falling steadily. This begs the question as to which group is providing the right read when it comes to the health of the broader real estate and housing market.

Source: All Star Charts

Inflation expectations continue to ease, give Fed room to pause/skip

Federal Reserve Chairman Jerome Powell testified to the U.S. Congress in 2019 that “inflation expectations are the most important driver in actual inflation.”

Inflation expectations are simply the rate at which people – consumers, businesses, investors – expect prices to rise in the future. They matter because actual inflation depends, in part, on what we expect it to be. The decision to consume certain goods and services now versus the future depends on what we expect prices to be.

1-year inflation expectations just hit their lowest level since May 2021.

Longer dated measures of 5-year, 7-year, and 10-year inflation expectations also remain well anchored.

By this measure, the Federal Reserve has contained inflation.

Source: Axios, Bespoke Investment Group, Brookings Institute

Tech stock leadership

Roughly 20 years ago, tech got wrecked during the bursting of the DotCom bubble, the time period in which the Information Technology sector peaked relative to the S&P 500 Index (SPX). From its DotCom bubble highs in 2000 to the lows in late 2002, Tech dropped 80% and lost two-thirds of its value relative to the rest of the market.

After spending nearly a decade consolidating in no man’s land, tech rallied in the 2010s due to disruptive innovation, low interest rates from easy monetary policy, and tremendous investor interest from the VC investing community. More recently, AI has fueled investor enthusiasm in this space and helped propel Information Technology back to new relative highs against the broader market.

Tech valuations and 2023 year-to-date performance have many analysts skeptical on this sector’s outlook, however it’s worth noting the recent strength in price action is aligning with a multi-decade technical base that should be supportive of further advances. Perhaps some consolidation of recent gains is to be expected, but if even some version of the AI story is to come to fruition, the hyper-scalers and other innovative C-Suites across corporate America will drive innovation to the bottom line and further profits for their shareholders for years to come.

Source: Dan Ives, Grindstone Intelligence

Corporate earnings expected to rebound in 2nd half of 2023

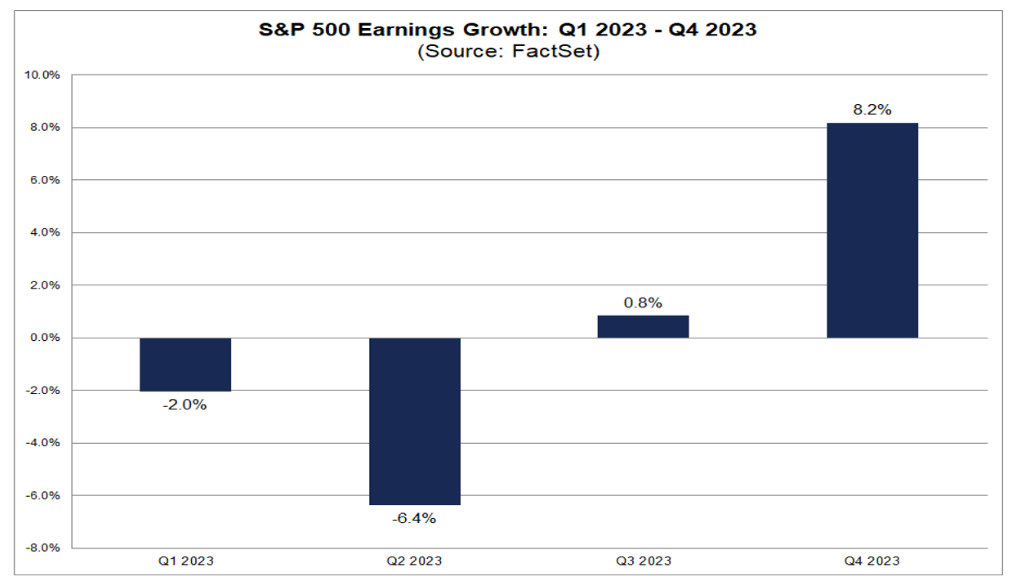

Analysts expect corporate earnings for the S&P 500 Index (SPX) to return to growth mode in the 2nd half of 2023 after experiencing consecutive declines in both 4Q22 and 1Q23, as well as expectations for a 3rd sequential quarter of declines when companies begin reporting their 2Q23 results next month in July.

For 3Q23, the estimated earnings growth rate is +0.8%. For 4Q23, the estimated earnings growth rate is +8.2%!

Looking specifically at the 4th quarter when earnings are expected to re-accelerate, nine of the eleven sectors are predicted to report year-over-year earnings growth – led by Communication Services, Utilities, and Consumer Discretionary. The Communication Services and Information Technology sectors are expected to be the largest contributors to earnings growth for the fourth quarter of all eleven sectors, given their size in relation to the index (Comm Services 8.6%, Info Tech 27.6%) and expected earnings growth.

At the company level, Amazon (AMZN), Meta Platforms (META), Alphabet (GOOGL), and NVIDIA (NVDA) are expected to be the largest contributors to earnings growth for the S&P 500 Index for Q4 2023 – with expectations to report year-over-year EPS growth of more than 100% in 4Q23! Perhaps that is in part why the market is rewarding these companies with tremendous price gains in 2023 year-to-date: AMZN (+46.9%), META (+120.2%), GOOGL (+38.5%), and NVDA (+165.3%).

Source: FactSet

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.