Recession outlook, plus earnings estimates, market internals, the internet, and the week in review

The Sandbox Daily (1.6.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the recession outlook for the U.S. economy, analysts earnings estimates, market internals showing some improvement, one minute on the internet, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.78% | S&P 500 +2.28% | Russell 2000 +2.26% | Dow +2.13%

FIXED INCOME: Barclays Agg Bond +1.07% | High Yield +1.42% | 2yr UST 4.262% | 10yr UST 3.565%

COMMODITIES: Brent Crude -0.14% to $78.58/barrel. Gold +1.66% to $1,871.1/oz.

BITCOIN: +0.51% to $16,944

US DOLLAR INDEX: -1.08% to 103.905

CBOE EQUITY PUT/CALL RATIO: 0.86

VIX: -5.92% to 21.13

Recession outlook

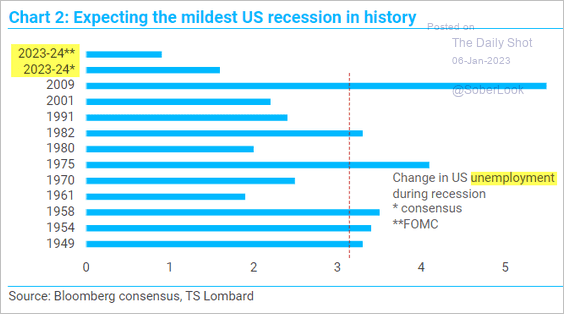

The threat of a U.S. recession remains high in 2023 – perhaps the most telegraphed in history and so obvious that it’s become consensus by a large swathe of investors.

Consensus estimates put the probability of a meaningful downturn in the American economy in the next 12 months at 65%. But Goldman Sachs’ chief U.S. economist and chief U.S. political economist both foresee the risk of recession is much lower, roughly 35%.

Goldman believes the U.S. will narrowly avoid recession as core Personal Consumption Expenditures Price Index (PCE) inflation slows from 5% now to 3% in late 2023 with just a 0.5% rise in the unemployment rate. But how can core inflation fall so much with such a small employment hit?

Goldman rationalizes this cycle as different from prior high-inflation periods. 1st, post-pandemic labor market overheating showed up not in excessive employment (supply) but in unprecedented job openings (demand), which are much less painful to unwind. 2nd, the disinflationary impact of the recent normalization in supply chains and rental housing markets still has a long way to go. And 3rd, long-term inflation expectations remain well-anchored. Finally, real disposable income continues to rebound from the plunge in 1H22 so the consumer should remain in decent shape.

One thing most economists do agree upon: the Fed-induced recession should be shallow, mostly due to a tight labor supply.

Source: MarketDesk Research, Goldman Sachs Global Investment Research, TS Lombard, Daily Shot

Analysts’ earnings estimates

The worst kept secret on Wall Street is earnings estimates remain too high, given the economic backdrop and monetary tightening cycle.

BUT, analysts did lower earnings-per-share (EPS) estimates by a margin larger than normal for the S&P 500 during the 4th quarter. The Q4 bottom-up EPS estimate – which is an aggregation of the median EPS estimates for Q4 for all the companies in the index – decreased by 6.5% (to $54.01 from $57.78) from September 30 to December 31.

In a typical quarter, analysts usually reduce earnings estimates during the quarter. So that is normal. Here is the average decline in the bottom-up EPS estimate during a quarter in the past:

Five years (20 quarters): 2.5%

Ten years, (40 quarters): 3.3%

Fifteen years, (60 quarters): 4.8%

Twenty years (80 quarters): 3.8%

So analysts clearly decreased EPS estimates during the 4th quarter by more than the 5-, 10-, 15- and 20-year averages.

What about calendar year 2023 where greater vulnerabilities lie? Well, analysts were also decreasing EPS estimates in aggregate for CY 2023. The bottom-up EPS estimate for CY 2023 declined by 4.4% (to $230.51 from $241.20) from September 30 to December 31 – which is also greater than the 5-, 10-, 15- and 20-year averages.

The problem is Wall Street analysts don’t think EPS estimates have come down far enough. Only time will tell…

Source: FactSet

Breadth and internals making some progress

While the long-term price chart for the S&P 500 is still in a downtrend, internals and breadth measures look quite a bit better than what’s happening at the index level.

The percentage of stocks trading above their 200 daily moving average (DMA) climbed above their August peak even though the price level of the index didn’t.

Another important breadth measure – the net “new highs list” (S&P 500 stocks making new highs vs. constituents making new lows) – made a higher low in October and have held up well recently.

This is a market of stocks, and when less stocks are going down at the same time – i.e. breadth improvement – then momentum to the downside is subsiding (for now).

Source: Bespoke Investment Group

Data consumption, by the numbers

There’s a massive amount of data that gets transferred across the Internet every minute.

Try to imagine – 8 billion people in the world, how many are currently watching a series on Netflix? Or brain-draining on TikTok? Perhaps sending a meme to friends over Instagram. Well, a lot…

Source: Genuine Impact

The week in review

Stocks: The major markets finished higher to begin the New Year thanks to Friday’s rally on the jobs report. Slower job growth and moderating wage gains gave market participants the Goldilocks-type report they wanted to help ease concerns about an overly aggressive Fed. Earnings should soon begin to get more attention as reporting season approaches.

International equities performed well this week as China’s policy for the New Year focuses on economic growth vs. COVID-19 containment. In addition, developed international equities outperformed the S&P 500 Index as Eurozone headline inflation slowed sharply in December given lower energy prices. However, the core inflation rate, which strips out food and energy prices, reached a record high.

Bonds: The Bloomberg Aggregate Bond Index finished the week higher as yields declined on the latest evidence of easing wage pressures. In addition, high-yield corporate bonds, as tracked by the Bloomberg High Yield index, finished the week higher.

Commodities: Both oil and natural gas prices sold off this week. Warmer-than-expected weather in Europe caused this week’s selloff in natural gas given a volatile year for the commodity. Moreover, European natural gas prices have now fallen to their lowest level since before the Russia-Ukraine conflict. The major metals, including gold, silver, and copper finished the week mixed.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.