Red Sea crisis, plus the trouble with small-caps and an update on the consumer

The Sandbox Daily (1.17.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Red Sea crisis raising concerns for global trade, inflation

measurement challenges with the Russell 2000

Retail Sales show a resilient consumer

Let’s dig in.

Markets in review

EQUITIES: Dow -0.25% | Nasdaq 100 -0.56% | S&P 500 -0.56% | Russell 2000 -0.73%

FIXED INCOME: Barclays Agg Bond -0.27% | High Yield -0.23% | 2yr UST 4.357% | 10yr UST 4.108%

COMMODITIES: Brent Crude -0.31% to $78.05/barrel. Gold -1.05% to $2,008.8/oz.

BITCOIN: -1.59% to $42,742

US DOLLAR INDEX: +0.02% to 103.376

CBOE EQUITY PUT/CALL RATIO: 0.84

VIX: +6.86% to 14.79

Quote of the day

“Rome wasn't built in a day, but they were laying bricks every hour.”

- John Heywood

Red Sea crisis raises fears for global trade, inflation

The Red Sea, a key global trade route, faces material disruption from Iran-backed Houthi rebel attacks on commercial ships.

Ground zero to this crisis?

The Bab el-Mandeb Strait, a 20-mile-wide geographical chokepoint between Yemen (the Arabian Peninsula, below right) and Djibouti (the Horn of Africa, below left), connecting the Gulf of Aden with the southern Red Sea and eventually the Suez Canal to the north.

This small body of water has an outsized influence on world affairs – it’s the key passageway of almost all shipping between the Indian Ocean and the Mediterranean Sea via the Suez Canal.

The International Maritime Organization estimates ~25% of global shipping passes along this route. That includes an estimated 4.5 million barrels of oil every day that originates in Persian Gulf and Asian countries.

Recently, however, vessels are being rerouted elsewhere to avoid drone- and water-based attacks. As a result, trade volume in the region has completely collapsed.

The disruption in the Red Sea trade route from attacks by Yemen-based Houthi forces directly leads to higher shipping costs.

Ships must now take longer, alternative routes which increases fuel usage and extends delivery times. What’s more, the cost of insuring the ship, its crew, and the containers in transit has skyrocketed – making matters even worse.

Container shipping rates across major global routes, as measured by the Drewry World Container Index, has recently gone parabolic, increasing 122% since the end of November.

This rise in operational expenses inevitably trickles down as increased costs for importing goods into the United States. When businesses face higher costs, those are eventually passed along to the consumer via higher prices.

That’s right, just as it seems we normalized from the COVID-19 pandemic mess, supply chain disruptions and the (real) potential for rising prices are potentially back. Consumers should brace for delayed shipments and more expensive goods, unless this conflict is resolved in the near future.

The chief executive of Danish shipping giant AP Møller-Maersk has warned the Red Sea shipping disruption may last for months and the persistent attacks will have “significant consequences” for global growth.

A protracted escalation of conflict in the region may lead to higher oil prices, higher equity risk premiums, and the classic flight-to-quality trade that often accompanies rising geopolitical tensions.

Source: Financial Times, Bloomberg, Jim Bianco, Sal Mercogliano, Drewry

Measurement challenges with the Russell 2000 index

While many investors prefer P/E valuations to P/B multiples, earnings-based valuations measures are less useful for the Russell 2000 index.

Roughly a third of Russell 2000 constituents are unprofitable. In addition, only 5 sell-side analysts cover the median Russell 2000 stock, compared with 18 analysts covering the median S&P 500 stock. 13% of Russell 2000 constituents currently have no estimates or just one estimate for 2024 EPS.

Nonetheless, looking only at profitable Russell 2000 stocks with forward analyst EPS estimates, small-cap P/E multiples also register below historical averages.

Source: Goldman Sachs Global Investment Research

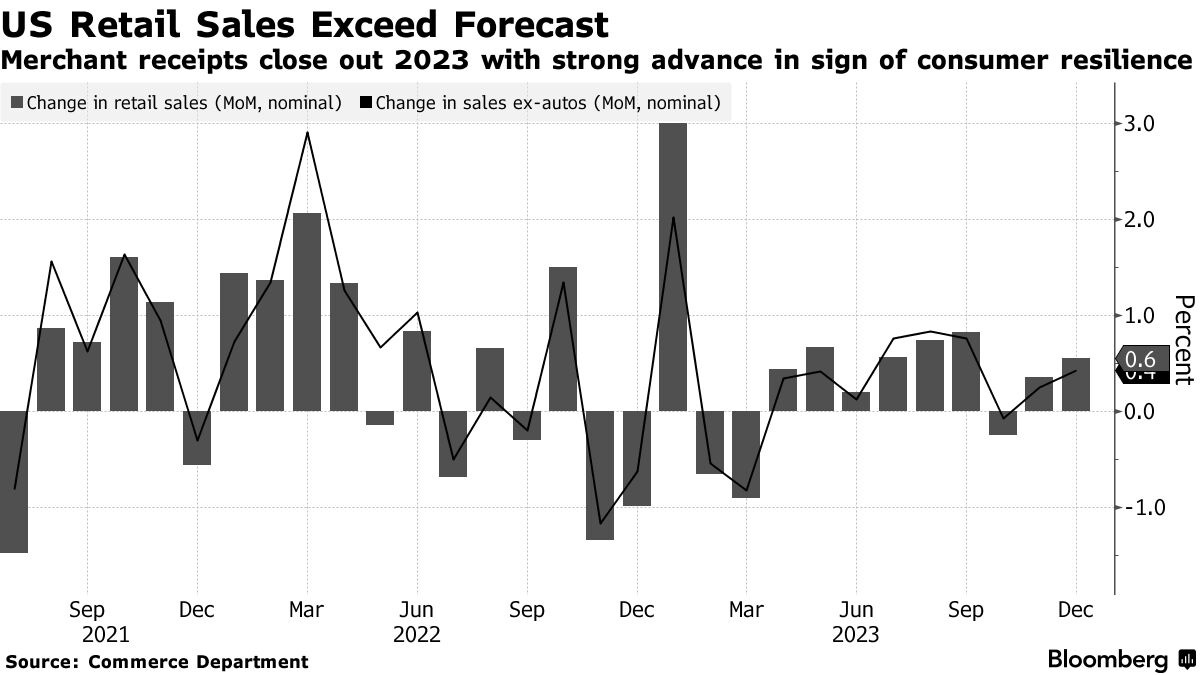

Retail Sales show a resilient consumer

Retail Sales – an important and closely watched economic metric that tracks consumer demand for goods – surprised today to the upside against expectations, climbing +0.6% in December and above the consensus estimate of +0.4%. Importantly, this measure is not adjusted for inflation.

9 of the 13 categories posted increases – the biggest gains coming from clothing, e-commerce, and general merchandise (think department stores).

On a YoY trend basis, retail sales were up +3.9% which is the fastest pace in 10 months.

The acceleration confirms that despite headwinds from high interest rates, tighter bank lending standards, and the resumption of student loan payments a couple of months ago, consumer demand remains strong.

The current momentum supports a positive outlook for economic growth in early 2024. As a result, Treasury yields gained while stocks fells as the market reassesses expectations for Fed rate cuts this year – ie, good news is bad news.

Source: Ned Davis Research, Bloomberg, Mike Zaccardi, YCharts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.