Relief in Treasury yields, plus earnings, Black Friday, U.S. oil production, and Amazon's delivery business

The Sandbox Daily (11.27.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

relief in Treasury yields

can upcoming earnings deliver the goods?

consumers vote with their wallet, Black Friday sales explode

record U.S. oil production helps tame prices

Amazon to become largest U.S. delivery business

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.13% | Dow -0.16% | S&P 500 -0.20% | Russell 2000 -0.35%

FIXED INCOME: Barclays Agg Bond +0.57% | High Yield +0.15% | 2yr UST 4.891% | 10yr UST 4.392%

COMMODITIES: Brent Crude -0.65% to $80.06/barrel. Gold +0.60% to $2,035.6/oz.

BITCOIN: -1.31% to $36,891

US DOLLAR INDEX: -0.17% to 103.226

CBOE EQUITY PUT/CALL RATIO: 0.91

VIX: +1.85% to 12.69

Quote of the day

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

- Peter Lynch, Former PM of the Fidelity Magellan Fund in One Up on Wall Street

Relief in Treasury yields

The retreat in yields over the past month has been a reprieve for both stock and bond prices alike.

Here are the current U.S. Treasury yields (blue) across the curve versus the peak yields (orange) during the current tightening cycle:

Some pressure has come off the boil as recent Treasury auctions have started to improve, chatter about fiscal deficits eases, the short trade unwinds, peak Fed hawkishness abates, and inflationary measures remain contained.

Source: Bespoke Investment Group

Can upcoming earnings deliver?

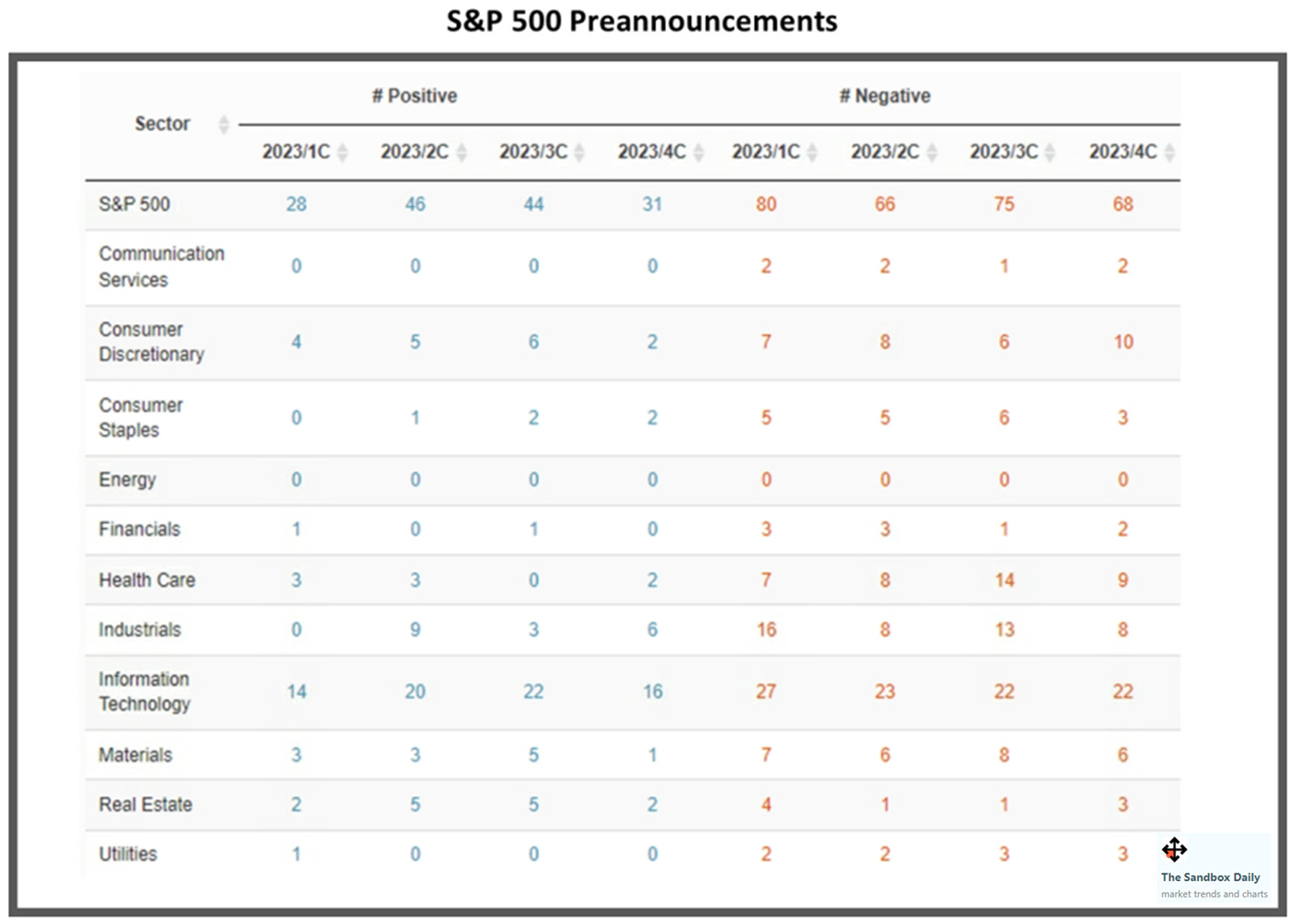

3rd quarter earnings season is nearly over and investors are now looking ahead to the next earnings season. This matters for investors because stock prices generally track earnings cycles and investors have their eyes on the horizon with the expectation for corporate profits to expand.

4th quarter expectations have declined 5% since the start of the year, however there has been little change in expectations as a result of 3Q reporting. Even though analysts’ expectations have been little changed, 4Q has seen the highest negative preannouncement ratio since the first quarter of 2023 due to the dropoff in positive preannouncements from companies. This makes intuitive sense because C-suites across many companies came out with cautious 4th quarter guidance, which caused weak stock price action in response to the most recent earnings period.

For the 4th quarter there have been 2.2 companies with negative announcements for each company coming out with a positive preannouncement, a reversal in the downward, albeit choppy, tragectory throughout the year (Q1=2.9, Q2=1.4, Q3=1.7).

The bigger earnings question is whether or not current 2024 and 2025 expectations can materialize. Many do not believe so.

Currently, expectations are for EPS margins to grow +11.4% in 2024 and +12% for 2025. While anything is possible, an acceleration of that magnitude would be unprecedented with so much tightening in the system.

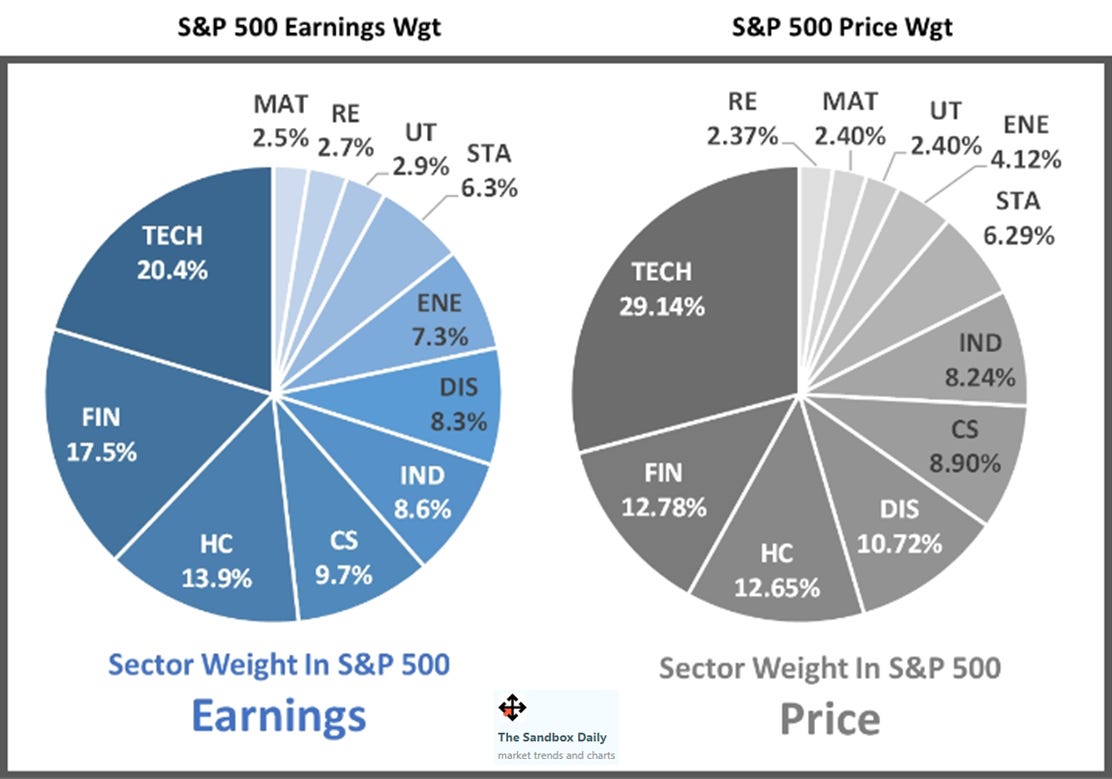

One important consideration when looking at index earnings is that the weight of a sector’s contribution to price can be very different than its contribution to earnings.

For example, the Tech sector has a 29.1% price contribution to the S&P 500 (based on its market cap) but its earnings represent only 20.4% of the total earnings in the index. On the other side of the ledger, Financials have a 12.8% price contribution and a 17.5% earnings contribution.

The wide range of P/Es across sectors explains these differentials.

Source: Piper Sandler

Consumers vote with their wallet, Black Friday sales explode

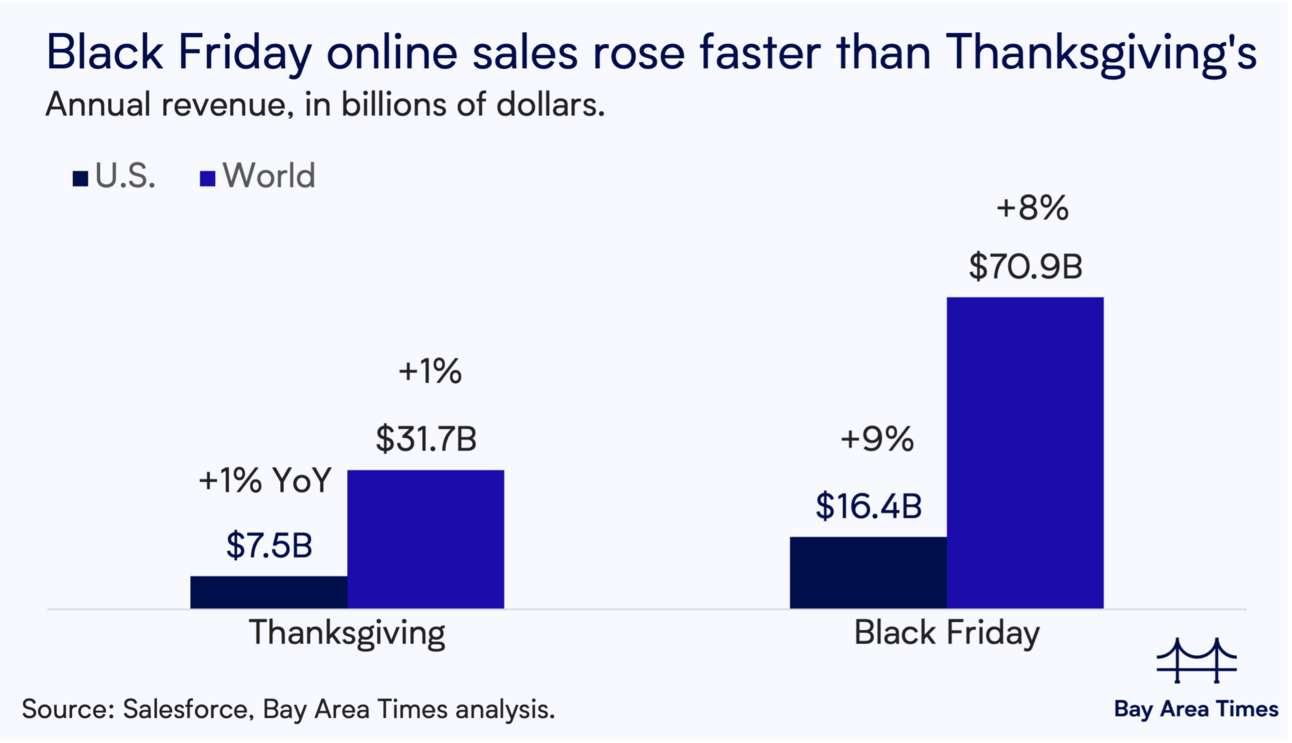

The spike in spending this Black Friday reflects a consumer who continues to show an unrelenting propensity to spend, despite the many reports that households are managing tighter budgets from multi-decade highs in inflation and interest rates.

According to data from Salesforce, online sales for Black Friday gained +8% year-over-year (YoY) from $65.3 billion to $70.9 billion globally, while rising +9% YoY to $16.4 billion in the United States.

Mastercard’s Spendingpulse, its proprietary tracker which measures in-store and online retail sales across all forms of its card payment, showed that U.S. retail sales on Black Friday rose +2.5% YoY.

Elsewhere, Shopify’s saw its global sales from both online and offline mediums increase +22% YoY to a record $4.1 billion. A special Black Friday was captured by the 13,000+ merchants who registered their 1st-ever sale online through the Shopify platform, a wonderful day for small businesses and entrepreneurs.

And the shopping weekend was just gaining momentum, where Adobe is expecting record numbers globally through Cyber Monday.

Last year, Salesforce saw a total of $281 billion in global online sales and $68 billion in the U.S. across what it calls Cyber Week, the period between Black Friday and Cyber Monday. Salesforce projects a 1% increase in U.S. Cyber Week online sales this year and a 4% increase globally.

Source: Salesforce, Reuters, Barron’s, Shopify, Mastercard

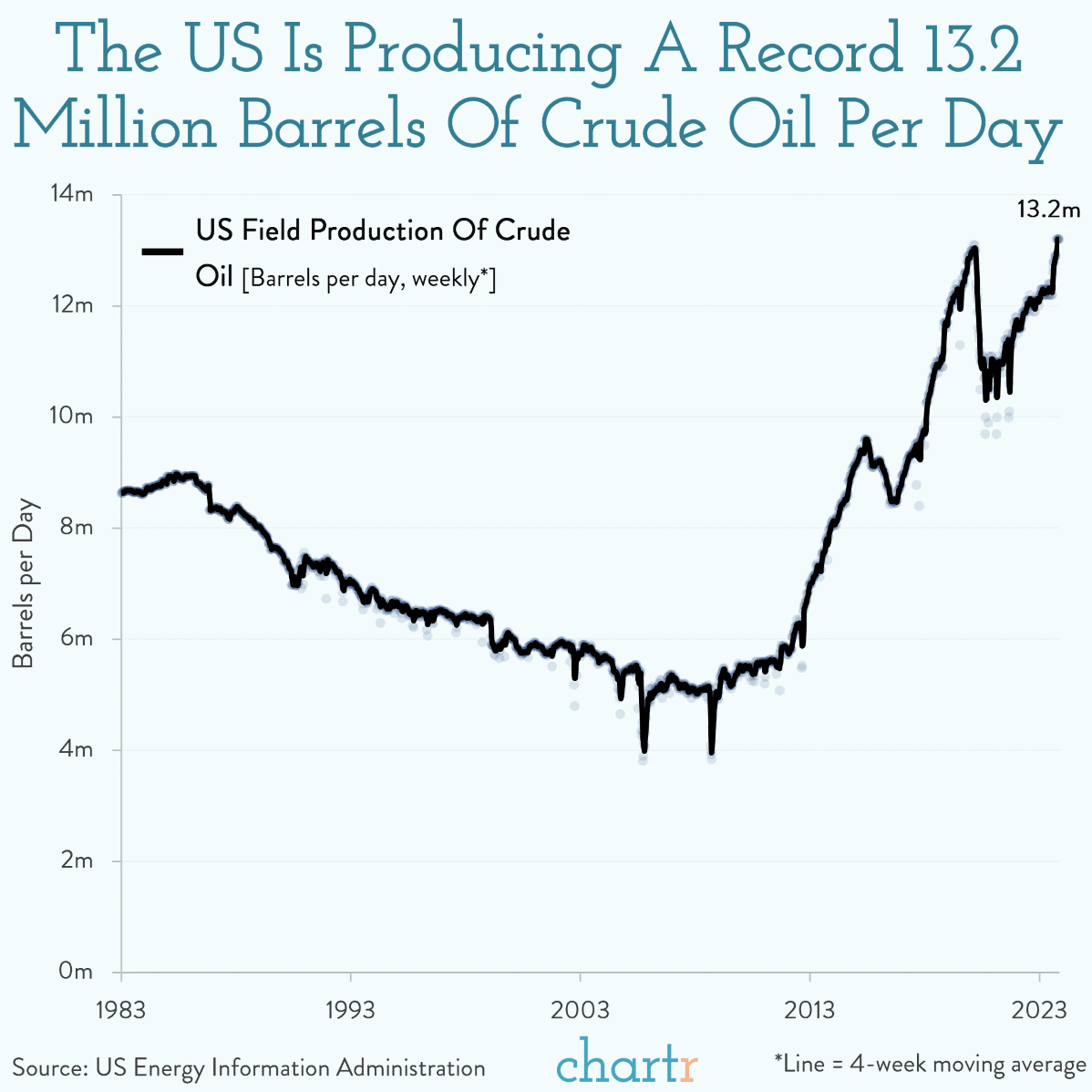

Record U.S. oil production helps tame prices

The United States is pumping oil at a record rate. That’s according to the latest data from the Energy Information Administration, which revealed that the nation’s crude oil production hit 13.2 million barrels per day, surpassing the pre-Covid peak.

The United States’ status as the world’s leading oil and gas behemoth has only strengthened this year after relying on imported oil from around the world for decades. Domestic oil production has more than doubled since 2012 — which has made the U.S. the world's leading producer, after beating Russia for the top spot in 2018.

As of 2022, the U.S. accounted for nearly 15% of the world's crude oil production, with Texas alone contributing more than 40% of that.

These production levels are helping send crude prices lower, which have fallen for two straight months and find crude prices down ~15% since the end of September.

Source: U.S. Energy Information Administration, Chartr, Axios

Amazon overtakes UPS to become largest U.S. delivery business

Amazon has become the biggest delivery business in the United States according to an internal company report, which showed that the e-commerce giant delivered more packages to homes in 2022 than UPS, after overtaking FedEx in 2020.

The U.S. Postal Service is still the largest parcel service by volume.

As Amazon’s share of deliveries has increased, FedEx and UPS have said in recent years they weren’t in a race for volume and were instead focused on delivering more profitable parcels.

Source: Wall Street Journal

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.