Residential housing market, plus emotional biases, stock ownership, and consumer spending

The Sandbox Daily (6.3.2024)

Welcome, Sandbox friends.

Roaring Kitty and GameStop ($GME) are back (again) though early reports are surfacing that E*Trade may shut down Keith Gill’s trading account, another trading session features a surge of afternoon buying, Bill Ackman plans to IPO his Pershing Square hedge fund, and Kylian Mbappé completes Real Madrid transfer after his Paris Saint-Germain departure.

Today’s Daily discusses:

residential housing market remains in flux

avoid emotional biases by sticking to your plan

stock ownership

consumer spending’s influence over GDP

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.35% | S&P 500 +0.11% | Dow -0.30% | Russell 2000 -0.50%

FIXED INCOME: Barclays Agg Bond +0.29% | High Yield -0.16% | 2yr UST 4.812% | 10yr UST 4.392%

COMMODITIES: Brent Crude -3.67% to $78.13/barrel. Gold +1.06% to $2,370.6/oz.

BITCOIN: +1.94% to $69,179

US DOLLAR INDEX: -0.57% to 104.077

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: +1.47% to 13.11

Quote of the day

“Everyone must choose one of two pains: the pain of discipline or the pain of regret.”

- Jim Rohn, Author and Entrepreneur

Residential housing market remains in flux

The sharp decline in mortgage rates at the end of 2023 led to a pop in existing home sales at the start of this year. However, the prospect of a later start to the Fed’s cutting cycle has pushed interest rates higher across the curve since the start of this year.

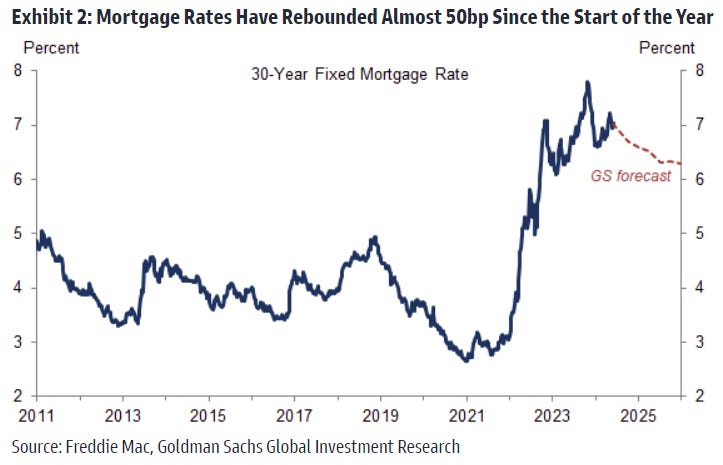

The chart below shows that mortgage rates have increased by almost 50bps since their trough in January, and Goldman Sachs strategists expect them to remain elevated for the foreseeable future, dipping to just 6.6% at end-2024 and 6.3% at end-2025.

As such, the residential housing market remains in a state of flux amidst decade-high mortgage rates, a high share of housing stock locked into low fixed-rate loans, tighter lending standards and availability of credit, and chronic undersupply.

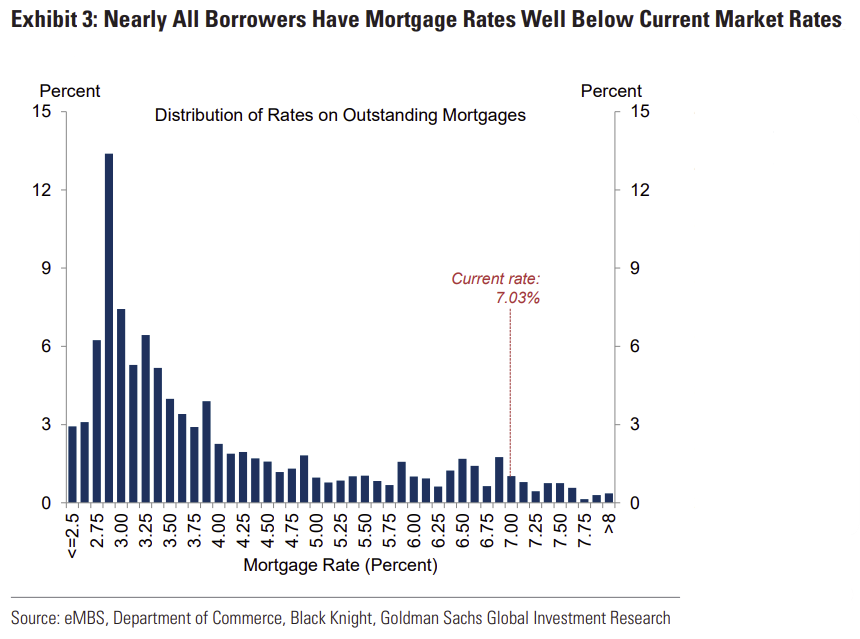

The concentration of borrowers locked into low fixed-rate mortgages have blunted the impact of higher rates, with roughly ~60% of borrowers paying a mortgage rate of 4% or less and 95% of mortgage borrowers having interest rates below current market rates. This dynamic has resulted in few buyers and few sellers in both 2023 and 2024.

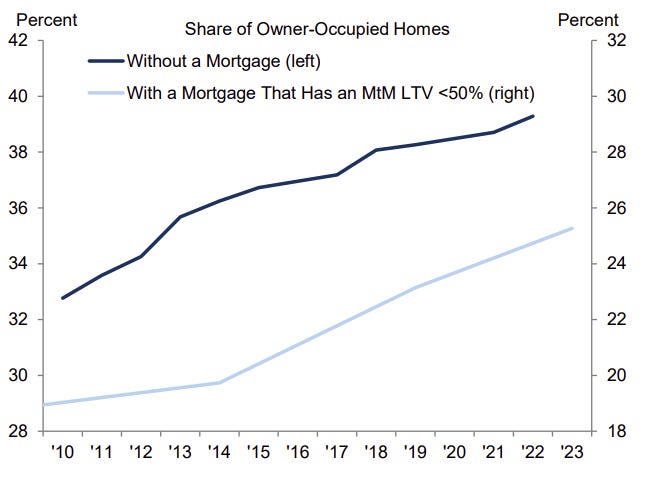

Furthermore, the share of homeowners without a mortgage or with a low remaining balance on their mortgage – both of which lower the financial disincentive to move – has increased meaningfully over the last decade.

Bottom line, the rebound in interest rates since the start of the year and the prospect that they will remain elevated present headwinds to the economy’s most interest rate sensitive sector.

Source: Goldman Sachs Global Investment Research

Avoid emotional biases by sticking to your plan

The urge to time the market is real and quite normal – after all, we are human beings – but market timing can be a dangerous habit. Sometimes, investors think they can outsmart the market; other times, fear and greed push them to make emotional, rather than logical, decisions.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets in general and stocks in particular. However, history suggests that trying to time markets in this way is a mistake.

Over the last 50 years, there have been nine distinct peaks and troughs in the University of Michigan Consumer Sentiment Index. On average, buying at a confidence peak yielded a return of just 3.5%, while buying at a trough returned +24.1%.

Source: J.P. Morgan Guide to the Markets

Stock ownership

Per a recent Gallup poll, 62% of U.S. adults have money invested in the stock market, which is the highest percentage since 2007. This is a slightly higher share than last year and a 7% increase since 2020.

Stock ownership is highly correlated with income. Across income brackets, 87% of households with annual income above $100,000 own stocks. However, only 25% of households with a yearly wage of $40,000 or less own stocks.

Gallup estimates 65% of the middle class is invested in the stock market.

The stock market is still the best way to build wealth and beat inflation over the long run.

Source: Gallup Poll

Consumer spending’s influence over GDP

Consumer spending is the backbone of the U.S. economy, constituting over two-thirds of our $28 trillion GDP. GDP is often broken out into 4 categories: consumer spending, business investment, government expenditures, and the trade balance (i.e. net exports).

When consumers spend money on everyday goods and services, and make large one-time purchases, it not only helps to spur economic growth but is also a reflection of economic trends. This is because many factors affect consumer purchases including consumer sentiment, the job market, household net worth, inflation, housing prices, the stock market, and more.

Of the various components of GDP, consumer spending has been the most stable over the past decade at a time when government spending has fluctuated, business investment has been low, and the country has been a net importer of goods. Consumer spending has increased as a share of GDP over the past 20 years, while government spending has declined.

In the 1st quarter of 2024, the economy grew 1.3% with consumer spending – our economy’s main growth engine – advancing 2.0%. The strength of the consumer has helped the economy stay out of recession despite persistent inflation, higher costs of capital, and ongoing uncertainty. In turn, this has helped to propel the stock market to new all-time highs.

Source: Bloomberg, Clearnomics

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.