Revisiting February 19, 2020

The Sandbox Daily (2.19.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

February 19, 2020

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.24% | S&P 500 -0.28% | Nasdaq 100 -0.41% | Dow -0.54%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield +0.04% | 2yr UST 3.466% | 10yr UST 4.073%

COMMODITIES: Brent Crude +6.10% to $71.88/barrel. Gold +0.16% to $5,017.2/oz.

BITCOIN: +1.41% to $67,022

US DOLLAR INDEX: +0.18% to 97.874

CBOE TOTAL PUT/CALL RATIO: 1.01

VIX: +3.11% to 20.23

Quote of the day

“The time your game is most vulnerable is when you’re ahead; never let up.”

- Rod Laver

It’s February 19, 2020

Imagine we’ve traveled back in time to February 2020.

A strange virus is spreading. The global world order is about to change. Lockdowns are coming. Millions of people will die. Nobody knows how long it will last or what it will break.

You mind your own business and have cash to put to work.

So you do the “responsible” thing. You invest a lump sum into the S&P 500 on February 19, 2020. Oh shoot, should I have dollar-cost averaged?

Oh well, too late.

Within weeks, you feel sick to your stomach.

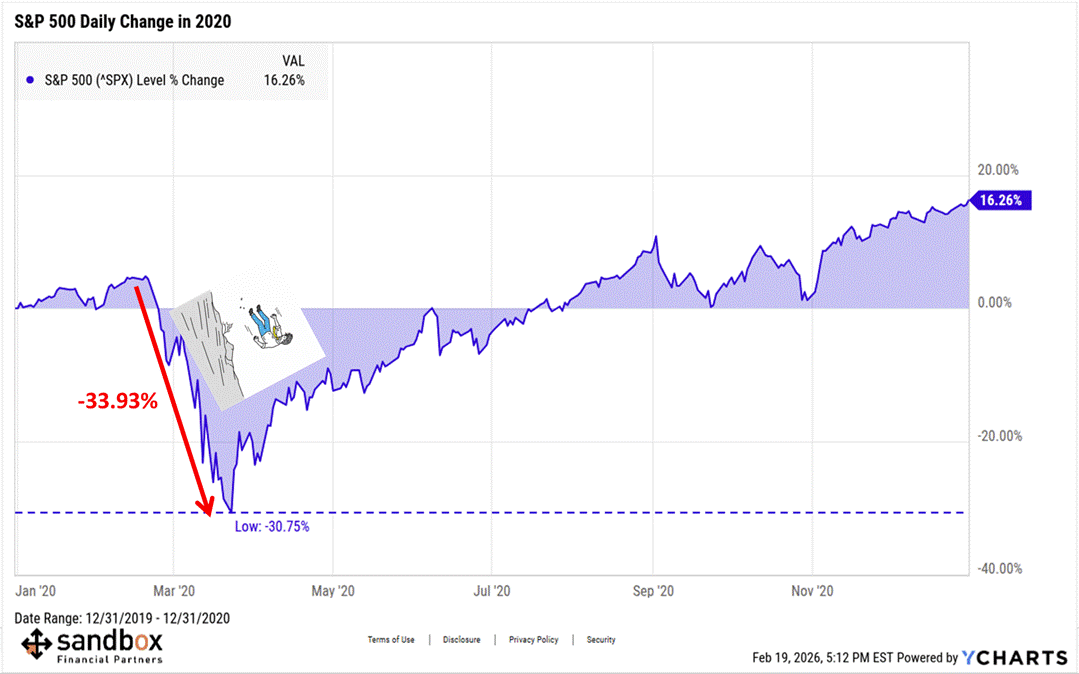

From February 19 to March 23, the S&P 500 falls off a cliff, dropping -33.93% in just six weeks. Your fresh investment is instantly underwater. The headlines are terrifying. Your group chats are full of panic. Grandma is terrified. Every day feels like the start of a financial apocalypse.

This is an investor’s worst nightmare.

But there’s a twist: despite that gut-wrenching drawdown, the S&P 500 finished the year higher, up +16.26%. The market recovered faster than almost anyone believed possible, and then it never really looked back.

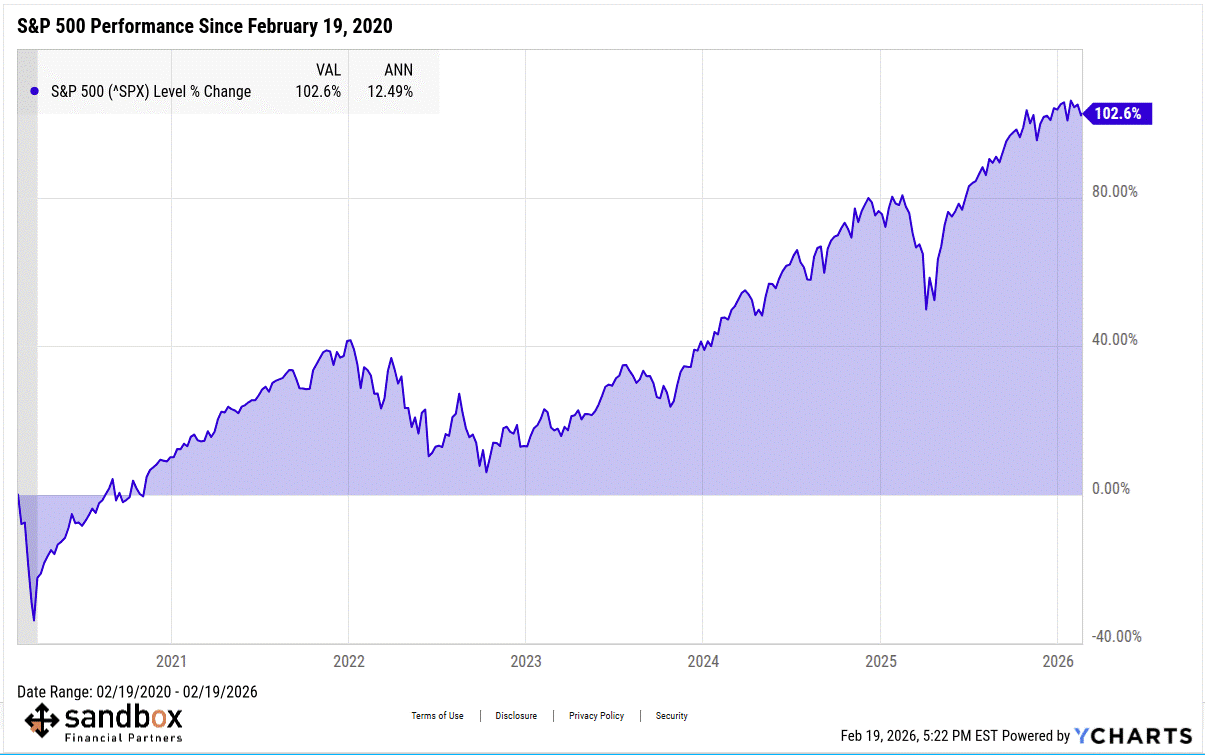

Fast forward to today – February 19, 2026 – and that hapless investor is now sitting on a gain of +102.6% in the S&P 500.

That advance comes in spite of a global pandemic, the supply chain bullwhip effect, a bear market, inflation hitting multi-decade highs, the fastest interest rate hiking cycle ever, a regional banking crisis, DeepSeek, a close encounter with nuclear war, election cycles, and dozens of other risks.

Time in the market beats timing the market, they say.

Most investors don’t fail because they picked the wrong investment. They fail because they quit at the wrong time. Or worse, they quite altogether.

They confuse volatility with danger. They treat temporary declines as permanent losses.

Looking back on 2020, a lump-sum investment felt reckless because it exposed you to immediate regret. Dollar-cost averaging would have felt safer because it spreads out the emotional pain. And yet, both strategies still work if you stay the course.

The real edge isn’t brilliance. It’s endurance.

Investing is a marathon, not a sprint. Financial goals and plans take time, and a few bumps and bruises (and perhaps a broken arm or two) will be incurred along the way.

With a bit of time and perspective, here are some takeaways that stuck with me from the incredible uncertainty investors faced during the covid-19 pandemic that persist across time, circumstance, and investor type:

Markets recover faster than your emotions do. Stated differently, the hardest part of investing is managing yourself.

Volatility is the price of admission for compounding.

The scariest moments often create the best long-term entry points.

Time in the market beats timing the market.

A suboptimal strategy you can live with is better than the optimal one you can’t. The plan only works if you stick with it.

The future is always uncertain. Volatility will test the deepest fibers in your body.

But, if you can stay the course, you give yourself the one advantage that actually matters: time.

Source: YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)