Risk appetite has returned, plus U.S. trade, rate cut expectations, and parents are (still) not ok

The Sandbox Daily (5.28.2024)

Welcome, Sandbox friends.

Starting this week, U.S. exchanges will settle common stock and exchange-traded fund (ETF) trades in a single day. This change towards “T+1” settlement aims to reduce counterparty risk and improve capital market efficiency by speeding up transactions and thus changes in ownership. Today marks the continuation of a years-long regulatory oversight process to help limit risks of securities trading, enhance liquidity, and improve market efficiency.

Today’s Daily discusses:

record risk appetite, per Goldman Sachs

shifting trade partners

markets pricing out central bank rate cuts

parents are (still) not ok

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.32% | S&P 500 +0.02% | Russell 2000 -0.14% | Dow -0.55%

FIXED INCOME: Barclays Agg Bond -0.47% | High Yield -0.40% | 2yr UST 4.974% | 10yr UST 4.542%

COMMODITIES: Brent Crude +1.68% to $84.50/barrel. Gold +1.04% to $2,381.5/oz.

BITCOIN: -1.56% to $68,364

US DOLLAR INDEX: 0.00% to 104.598

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: +4.53% to 12.92

Quote of the day

“Never forget – happiness ends when selfishness begins.”

- Bill Walton, RIP

Record risk appetite, per Goldman Sachs

Approaching the midpoint of 2024, markets continue to exhibit strength and come into the week on a positive tone, even as bond yields remain higher for longer and rate cut expectations have been mostly unwound.

While equities – especially AI beneficiaries – have been the key drivers of market optimism, over more recent months other cyclical assets have also started to price a better growth outlook – in particular financials, industrials, credit, and SMID-cap stocks.

The Goldman Sachs Risk Appetite Indicator Index (GSRAII) has reached a new high dating back roughly three years to mid-2021. This proprietary model aggregates 28 risk premia and procyclical pair trades across multiple asset classes (see Exhibit 2 below) to disentangle and quantify the macro drivers of risk appetite.

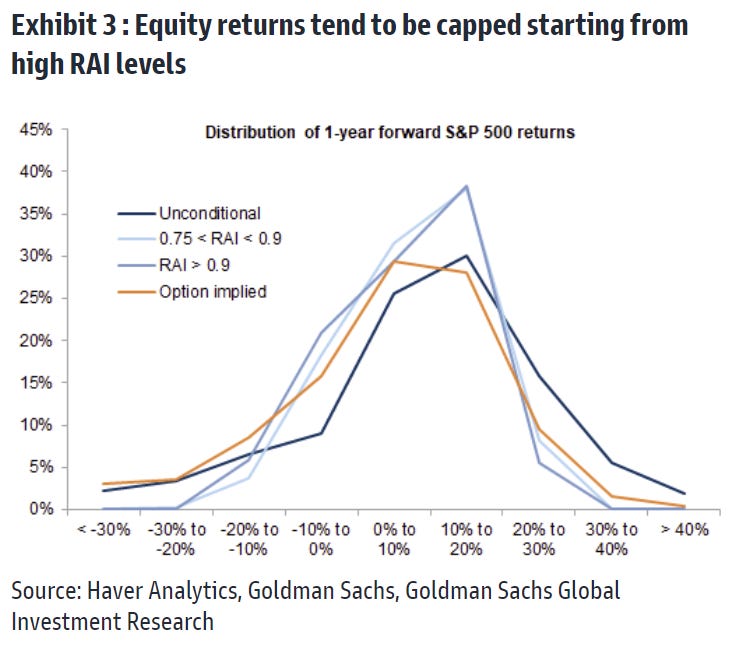

As the RAI score approaches 1 or more (i.e. very bullish levels) – as you can see in Exhibit 1 below – it can often indicate more muted returns ahead and/or a higher chance of a near-term pullback. At risk of stating the obvious, market timing based on sentiment and positioning measures like the RAI alone is difficult. It can stay at elevated levels for a long time during a strong bull market when supported by macro fundamentals.

There have been some divergences underneath the headline level. Credit is the asset class with the highest z-scores on average, driven by tighter spreads both for corporates and sovereign bonds. The weakness in 'safe haven' JPY and CHF (against higher beta currencies) also supported the broad risk appetite, but was counterbalanced by the exceptionally sharp rally in Gold prices driven also by central bank buying – the RAI would already be at 1.0 excluding Gold. Lastly, MSCI EM vs. DM has witnessed the strongest momentum thanks to the strong China equity rebound.

While an elevated RAI is not a bearish signal by itself, historically subsequent S&P 500 returns have been capped starting from current RAI levels – see below.

Source: Goldman Sachs Global Investment Research

Shifting trade partners

Despite China’s reduction in overall reliance on trade, their trade balance (i.e. exports minus imports) continues to climb, with the 12-month total surplus hovering near all-time highs in April.

This comes despite several years of hefty tariffs from the United States, China’s largest single-economy trading partner.

Although trade ties between China and the U.S. have faded due to the tariffs and simmering political tensions, they have been offset by rising shares elsewhere.

China’s trade value shares with Association of Southeast Asian Nations (ASEAN), India, and Latin America have been trending higher for several years. China’s share to Europe has been in a tight range in recent years, as fading ties with Germany have been offset by a much stronger relationship with Russia.

A similar trend can be observed in the United States.

As shown below, U.S. trade ties with China peaked right before the Trump tariffs and have fallen by a third since then, as President Biden maintained the same policies.

But, instead of the intended result of onshoring and a smaller trade deficit, trade just moved to allies, including Europe, Latin America, south and southeast Asia.

Source: Ned Davis Research

Markets pricing out central bank rate cuts

Coming into 2024, futures markets had priced in 6 Fed rate cuts this year, 6 European Central Bank cuts, and 5 Bank of England cuts.

Today, markets are pricing 2.5 cuts by the ECB and 1.5 cuts by both the Fed and BofE.

The reality is the global economy has not slowed down the way many central bankers had initially expected, and the Fed’s policy pivot in November/December 2023 has provided a strong tailwind to growth and financial conditions ever since. At the same time, several underlying measures of trend inflation have moved higher in 2024 – or at least stop going down in any meaningful way.

Of course, while regional differences exist over labor markets, manufacturing conditions and output, and capital markets activity, on balance the global economy seems to be ok and has not tipped into recession as many called for.

Keep in mind, however, central banks and the market’s forecasts about the future path of interest rates are almost always wrong.

Source: Torsten Slok

Parents are (still) not ok

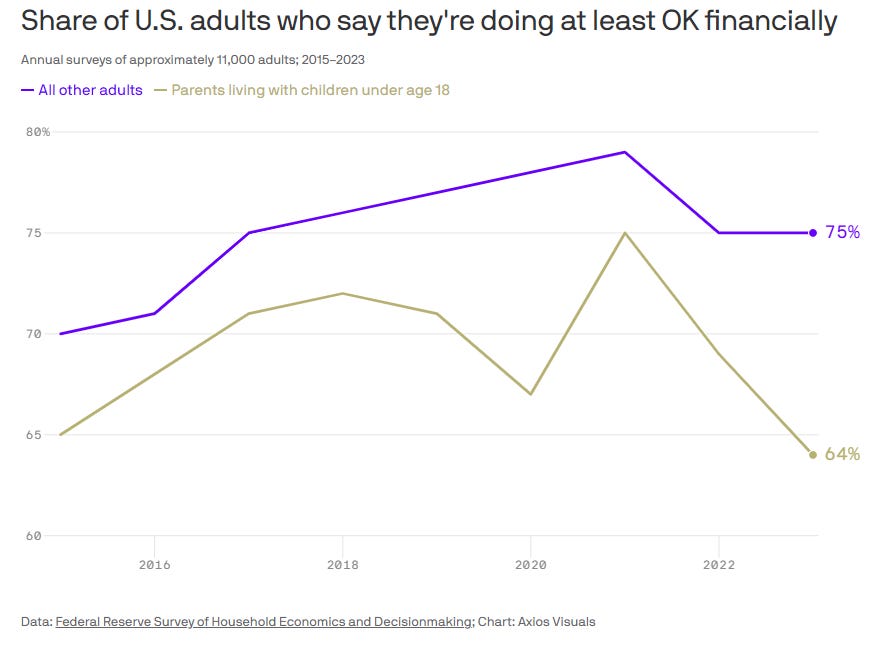

The share of parents who say they're doing OK financially dropped significantly in 2023 while holding relatively steady for other adults.

While parents' financial well-being has always trailed that of other adults, the recent downdraft – see the gold line below – has mostly been attributed to the skyrocketing costs of child care.

Source: Federal Reserve Bank, Axios

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.