Robust equity allocations, plus markets in transition, Nvidia, Costco, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (7.12.2024)

Welcome, Sandbox friends.

The Dow Jones Industrial Average eclipsed 40,000, various money center U.S. banks stumble after earnings missteps, and Jason Voorhees came oh-so-close to celebrating his favorite day.

Today’s Daily discusses:

equity allocations near top-end of post-GFC period

markets are shifting gears

Nvidia ahead of earnings season

$1.50 hot dogs

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.09% | Dow +0.62% | Nasdaq 100 +0.59% | S&P 500 +0.55%

FIXED INCOME: Barclays Agg Bond +0.28% | High Yield +0.26% | 2yr UST 4.451% | 10yr UST 4.185%

COMMODITIES: Brent Crude -0.46% to $93.26/barrel. Gold -0.23% to $2,416.3/oz.

BITCOIN: +0.31% to $57,703

US DOLLAR INDEX: -0.32% to 104.109

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: -3.56% to 12.46

Equity allocations near top-end of post-GFC period

The chart below shows the implied allocations of non-bank investors to equities.

At 49.0%, equity allocations are currently at the top-end of the post-GFC range (yellow bar below) and approaching the previous peak of 49.6% seen in October 2007.

Equity positioning still has never reclaimed the levels of ≥50% reached prior to the GFC, labeled below as “Pre-Lehman.”

In contrast to the positioning in stocks, the 31.9% implied cash allocation breached its previous historical low of 32.4% from August 2000.

Source: J.P. Morgan Markets

Markets are shifting gears

The U.S. dollar breaking down to multi-week lows, coupled with U.S. Treasury yields breaking down to multi-month lows (see below), confirm the probability of rate cuts is rising.

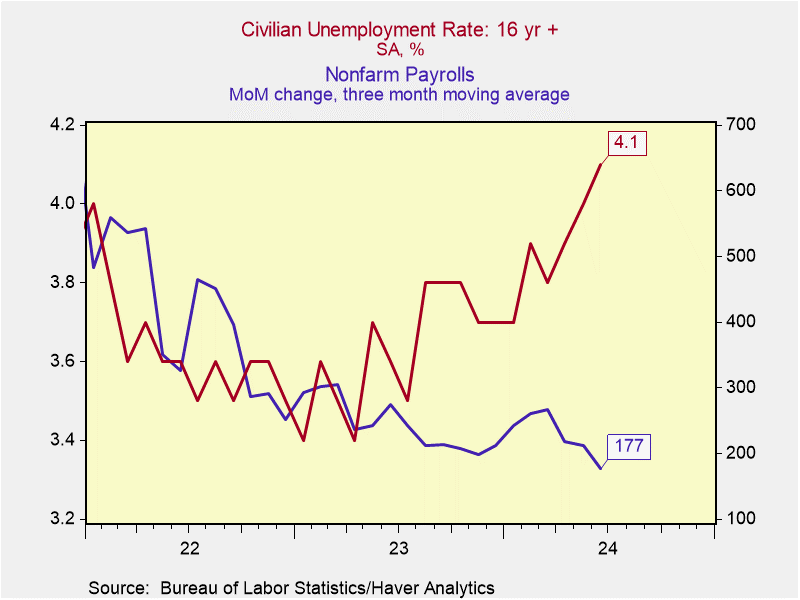

Thursday’s cashmere-soft CPI report, coupled with various data points showing the labor market has come into better balance over the past few months (rising unemployment rate, slowing monthly payrolls, lower average hourly earnings growth, rise in part-time job hirings vs. full-time, increase in foreign-born workers relative to native), is helping underpin some of the move.

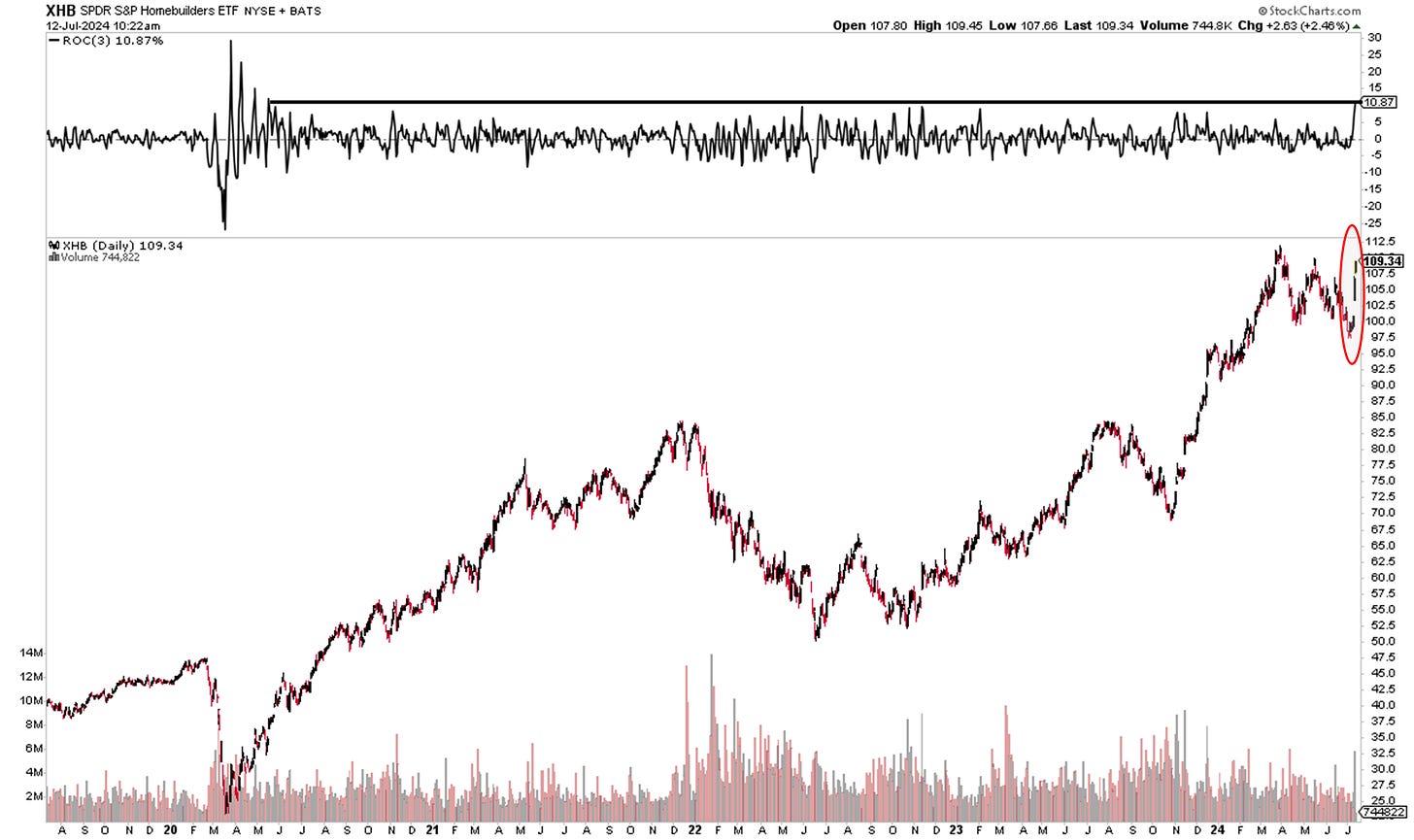

As such, interest-rate sensitive groups like Homebuilders, Solar stocks, REITs, Regional Banks, and various lending/leasing stocks are ripping to the upside this week.

Here are the Homebuilders with their best 3-day rally since May 2020.

One notable group that has lagged all year is now catching a bid higher, which is being confirmed by volume spikes and momentum (things we like to see) – small caps, which just printed a new 52-week high yesterday.

Per Charlie Bilello: “Small-caps outperformed large-caps by 4.5% yesterday, a 6 standard deviation event and the 2nd biggest outperformance on record (trailing only the 10 sigma differential on October 10, 2008).”

It’s too early to judge if these are sustainable moves because the technical evidence isn’t quite there yet, but the current rotation away from mega-cap growth leadership into other areas, like small-caps in particular, is noteworthy.

The table below shows small-cap performance after each 3% Russell 2000 daily advance since 1979. In other words, are we to learn anything from yesterday’s moves?

Historically, this type of signal has shown follow-through when looking at 3-mo, 6-mo, and 12-month returns.

With a likely policy pivot coming on July 31st when the Federal Reserve meets next (where it’s expected to give forward guidance on the September rate cut), markets are repositioning themselves with all major asset classes shifting directions over recent time frames.

Source: Barchart, Renaissance Macro Research, Mike Zaccardi CFA CMT, All Star Charts, Charlie Bilello, Piper Sandler

Nvidia ahead of earnings season

2nd quarter earnings season will be an important litmus test for the level of optimism built into investor’s expectations.

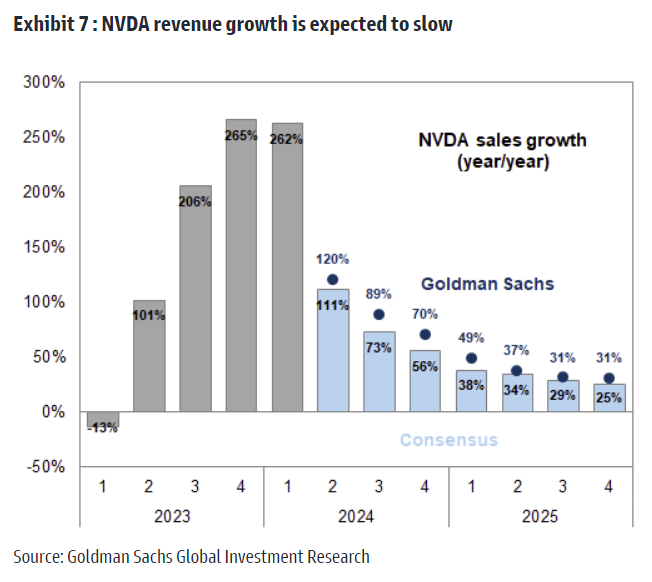

For Nvidia – the darling of the ball – the stock’s valuation remains above it’s 10-year average despite analyst expectations that its revenue growth will decelerate from +265% in 4Q23 to +25% by 4Q25.

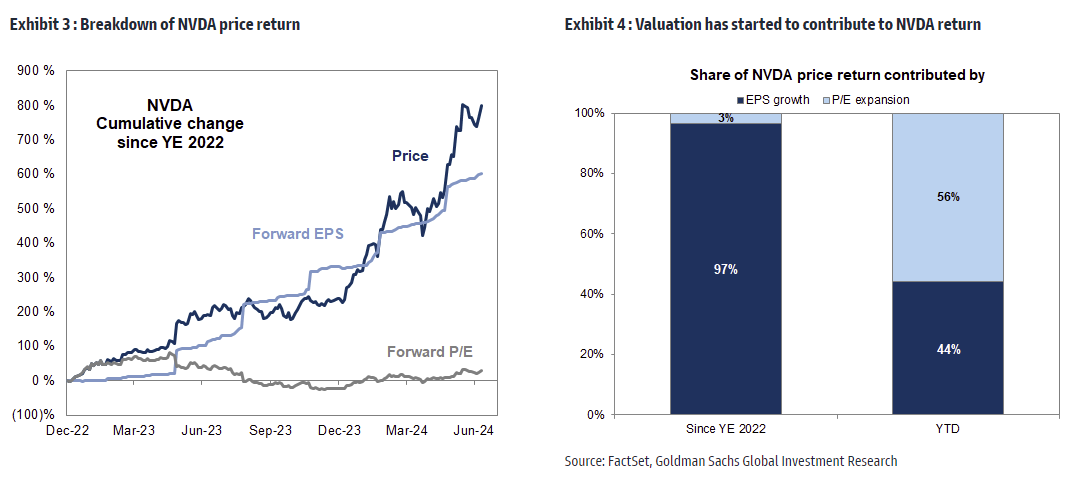

Interestingly enough, despite the AI trade and Nvidia coming under increasing scrutiny, the drivers of performance show it’s not just all hype, as you’d expect in a P/E multiple meltup.

Since year-end 2022, 97% of NVDA’s return has been driven by greater earnings. Only in 2024 has the majority (56%) of NVDA’s return come from multiple expansion.

Source: Goldman Sachs Global Investment Research

$1.50 hot dogs

Costco hot dogs have cost $1.50 since the 1980s, despite inflation saying the price tag should be closer to $4.50 these days.

While most companies have been busy raising prices the last few years to squeeze extra revenue from their customers, Costco hasn’t blinked on its mainstay item.

Costco would rather operate its hot dog business at a loss because it builds customer loyalty and brings customers in the door (in which people buy higher margin items). After all, it’s membership business is the golden ticket.

In a year where dozens of management teams have destroyed shareholder value based on management missteps, this C-Suite continues to best understand their customer base and execute its strategy.

Source: National Public Radio

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Of Dollars and Data – Only the passionate survive (Nick Maggiulli)

Wall Street Journal – The S&P 500 isn’t as diverse as it used to be. Here’s why that matters. (Derek Horstmeyer)

Retirement Researcher – How useful is historical data in predicting future returns? (Bob French, CFA)

The Big Picture – It’s only a point… (Barry Ritholtz)

Podcasts

New Hampshire Public Radio – Bear Brook: A True Crime Story (Spotify, Apple Podcasts)

Facts vs Feelings – Here’s Our Midyear Outlook (Spotify, Apple Podcasts)

Movies

The International – Clive Owen, Naomi Watts, Armin Mueller-Stahl (IMDB, YouTube)

Marauders – Bruce Willis, Christopher Meloni, Dave Bautista, Adrian Grenier (IMDB, YouTube)

Music

Harry Styles – Cinema (Spotify, Apple Music)

Kid Cudi feat. Wiz Khalifa – Diamonds Lights Fast Cars (Spotify, Apple Music)

Death Cab for Cutie – I Will Possess Your Heart (Spotify, Apple Music)

Pop Culture

The Daily Show – Jon Stewart’s debate analysis: Trump’s blatant lies and Biden’s senior moments (YouTube)

Books

Kyla Scanlon – In This Economy? (Amazon)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.