Rolling drawdowns, plus consumer confidence, stock market pullbacks, loss aversion, and Barbenheimer!

The Sandbox Daily (7.25.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

rolling drawdowns

consumer confidence jumps higher, again

stocks average 14% pullbacks

how Loss Aversion impacts our investing behavior

the box office is back (!!) with “Barbenheimer”

Let’s dig in.

Markets in review

EQUITIES: Dow +0.08% | S&P 500 +0.28% | Russell 2000 +0.02% | Nasdaq 100 +0.73%

FIXED INCOME: Barclays Agg Bond -0.11% | High Yield -0.07% | 2yr UST 4.879% | 10yr UST 3.891%

COMMODITIES: Brent Crude +0.83% to $83.43/barrel. Gold +0.37% to $1,995.4/oz.

BITCOIN: +0.13% to $29,223

US DOLLAR INDEX: -0.07% to 101.277

CBOE EQUITY PUT/CALL RATIO: 0.50

VIX: -0.36% to 13.86

Quote of the day

“Investors should use more simplified thinking. Markets are endlessly complicated, investors are endlessly emotional, and there are no points awarded for difficulty.”

- Morgan Housel, How to Win By Doing Less (The Motley Fool days)

Rolling drawdowns

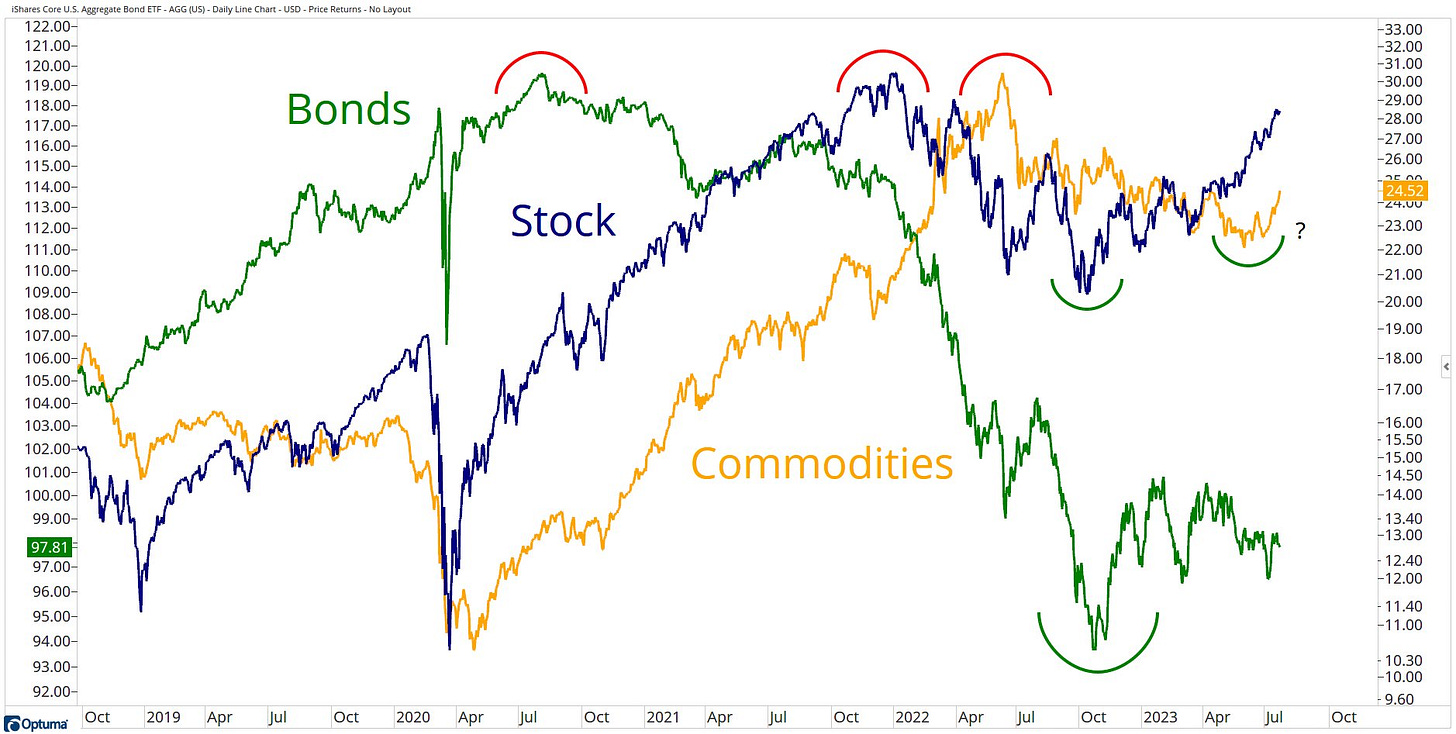

Instead of synchronous global drawdowns, the market has experienced something more akin to rolling pockets of weakness.

As Grant Hawkins points out below, bonds rolled over first in 2020, then stocks followed suit in 2021, and finally commodities got hit in 2022.

Somewhat related, these rolling bouts of discomfort seem to mirror what the economy underwent as the Federal Reserve tried to put the economy on ice via interest rate hikes and quantitative tightening. The Fed’s attempts to chill demand has rolled through various sectors, including the real estate market, manufacturing, and technology.

Yet, despite these rolling recessions, the overall market, and the global economy itself, have continued to chug along. When one thing derailed, others picked up the slack. It seems this part of the cycle will be defined by rolling recessions that ultimately led to… that elusive soft landing.

Source: Grant Hawkridge

Consumer confidence jumps higher, again

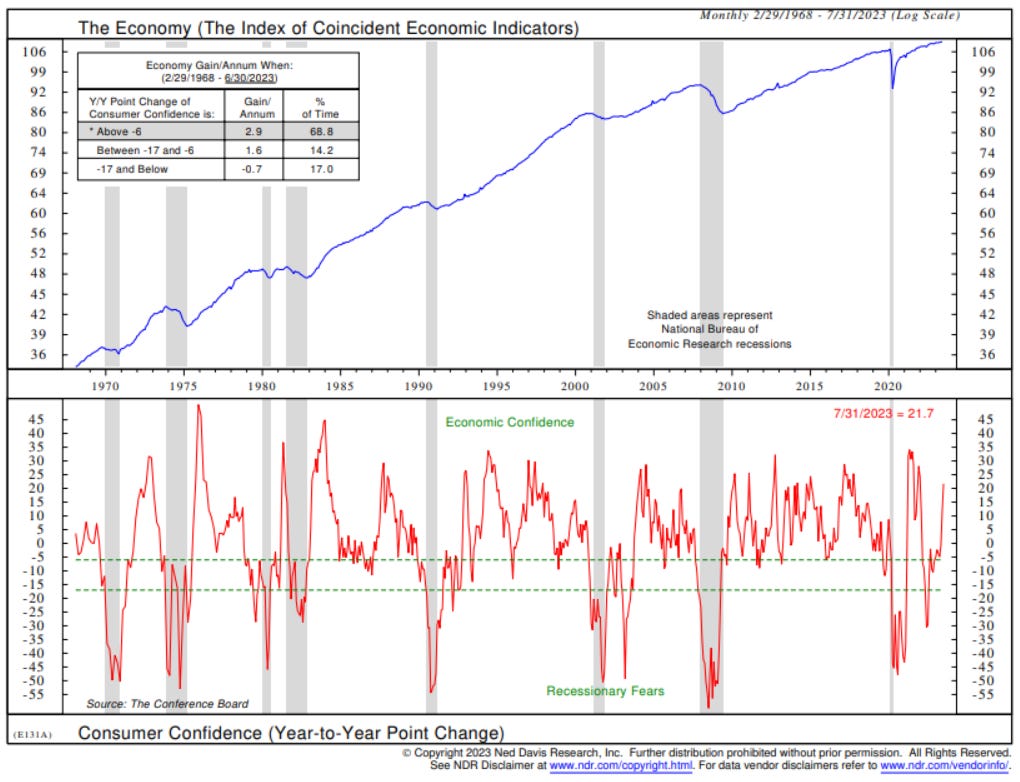

The Conference Board’s Consumer Confidence Index increased 6.9 points in July to 117.0, the highest level since July 2021 and above the consensus of 112.0.

The increase this month followed a 7.6 point climb in the month before, resulting in the biggest back-to-back gain since April 2021. Additionally, confidence was up 21.7 points from a year ago, the strongest YoY momentum since early 2022.

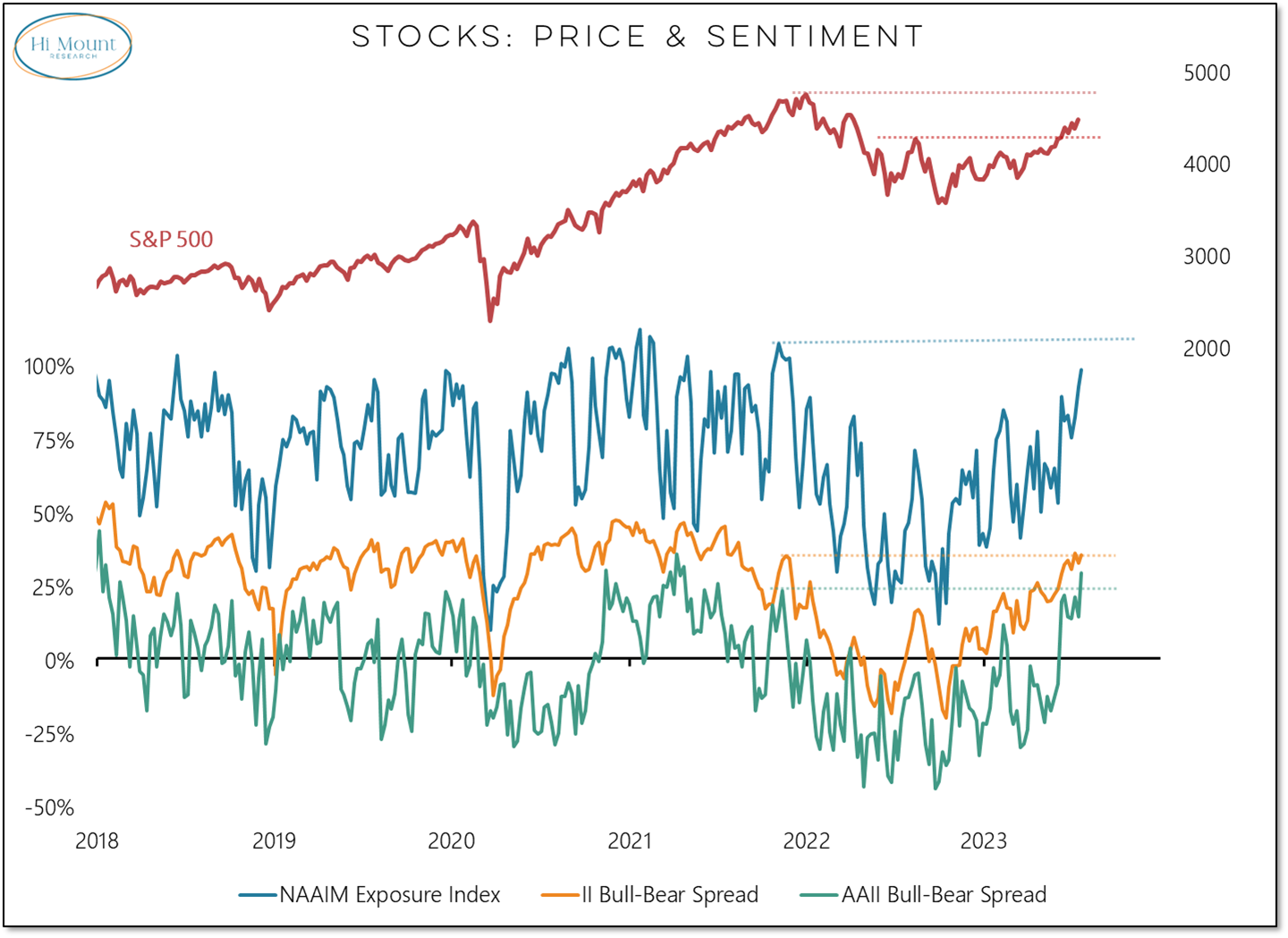

The level of confidence, as well as the YoY momentum, remain consistent with continued economic expansion. We are witnessing consumer confidence expand across the board. In fact, here’s Willie Delwiche of Hi Mount Research: “sentiment has moved quickly from widespread pessimism to excessive optimism.”

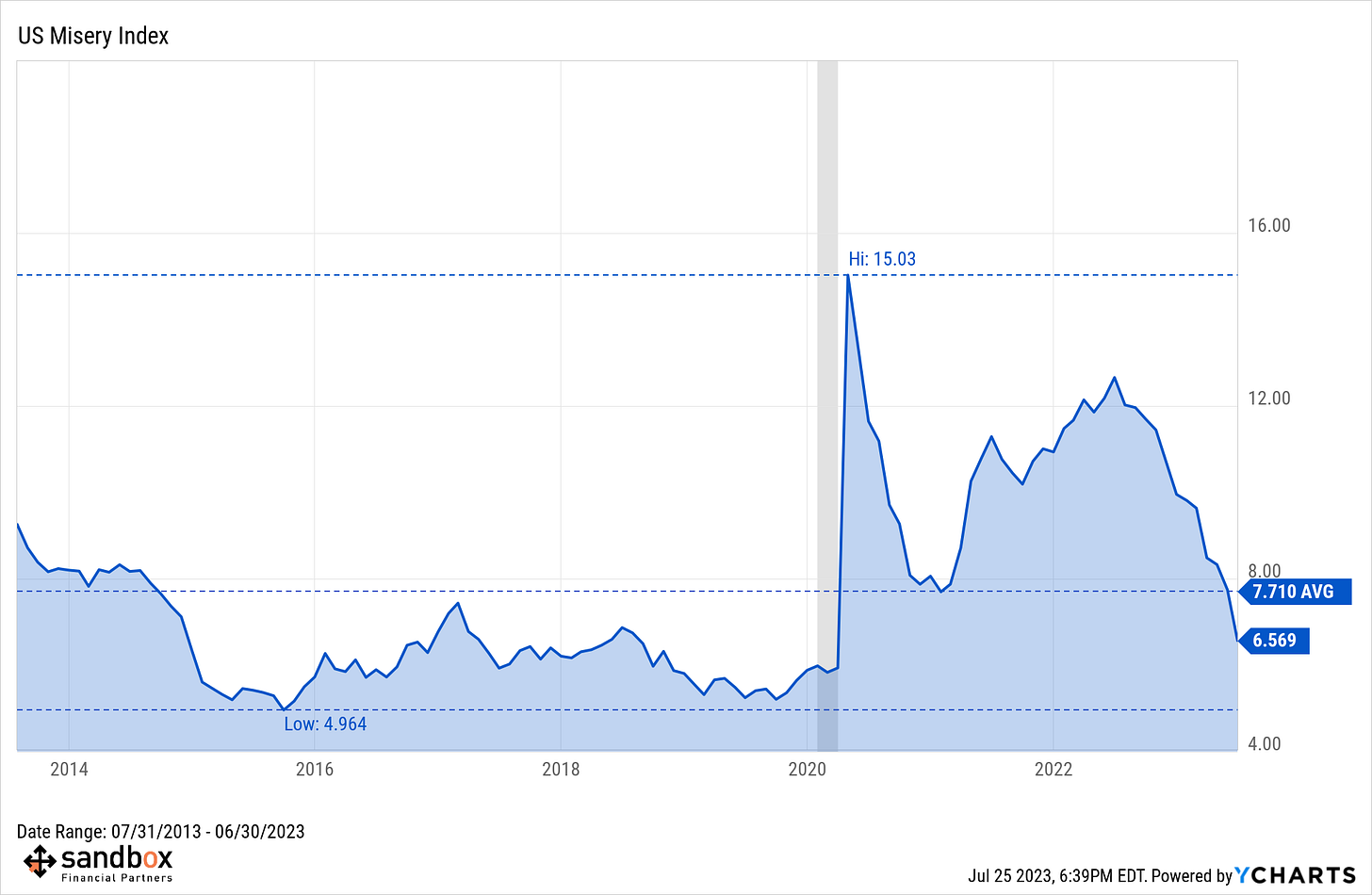

The report attributed the improvement in confidence to "lower inflation and a tight labor market." After all, inflation and unemployment rates comprise the so-called Misery index, which had fallen in June to its lowest level since March 2020. Historically, the Misery index has been negatively correlated with consumer confidence, explaining the rise in optimism in recent months.

Nothing like price to change sentiment (and positioning).

Source: Ned Davis Research, Hi Mount Research

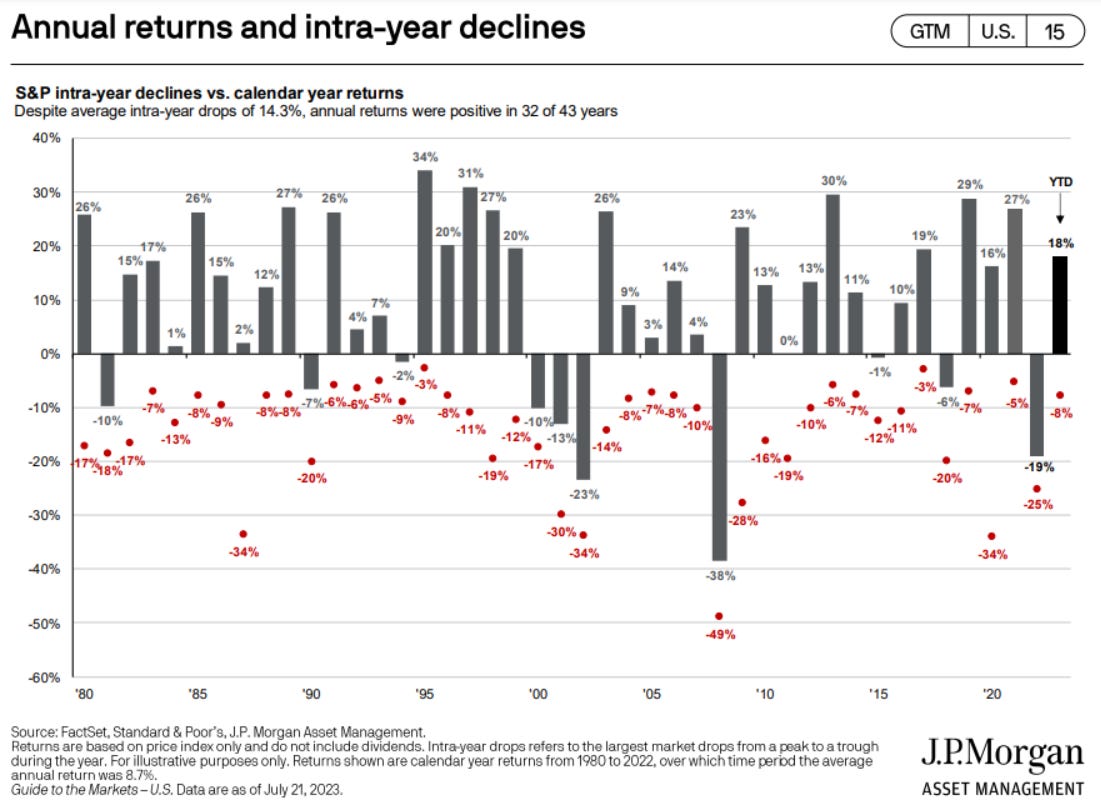

Stocks average 14% drawdowns

Stomach-churning stock market selloffs are perfectly normal – table stakes for investing in public equities.

Investors should always be mentally prepared for when they come. It’s part of the deal when you invest in an asset class that is sensitive to the corporate earnings cycle, interest rates, investor flows and sentiment, and the like.

Since 1950, the S&P 500 index has seen an "average" annual drawdown of ~14%.

Yet, despite those intra-year market corrections, the S&P 500 was positive 32 of 43 years, or ~75% of those up years.

Source: J.P. Morgan Guide to the Markets

How loss aversion impacts our investing behavior

Loss Aversion is a critical bias of behavioral finance to understand.

On its surface, this one might seem obvious: after all, who isn't averse to losses? But thinking deeper, especially with the way our brains are wired, losses leave much more of an impression than gains. And those memories stick with us.

If you've experienced a significant loss – no matter how long ago – you can probably relate. But gains, on the other hand, leave far less of an impression. We don't spend as much time thinking about all of those years when the stock market delivered 20% or 30% or more.

Meaning – people look at potential losses and potential gains differently. People dislike a $1 loss more than they enjoy a $1 gain. In fact, research shows that it takes a gain of about $2 to mentally offset a loss of just $1. Investors just really hate losses.

Unfortunately, losses are a part of the investing process and trying to avoid them can be costly to your future self.

Source: Simple Psychology

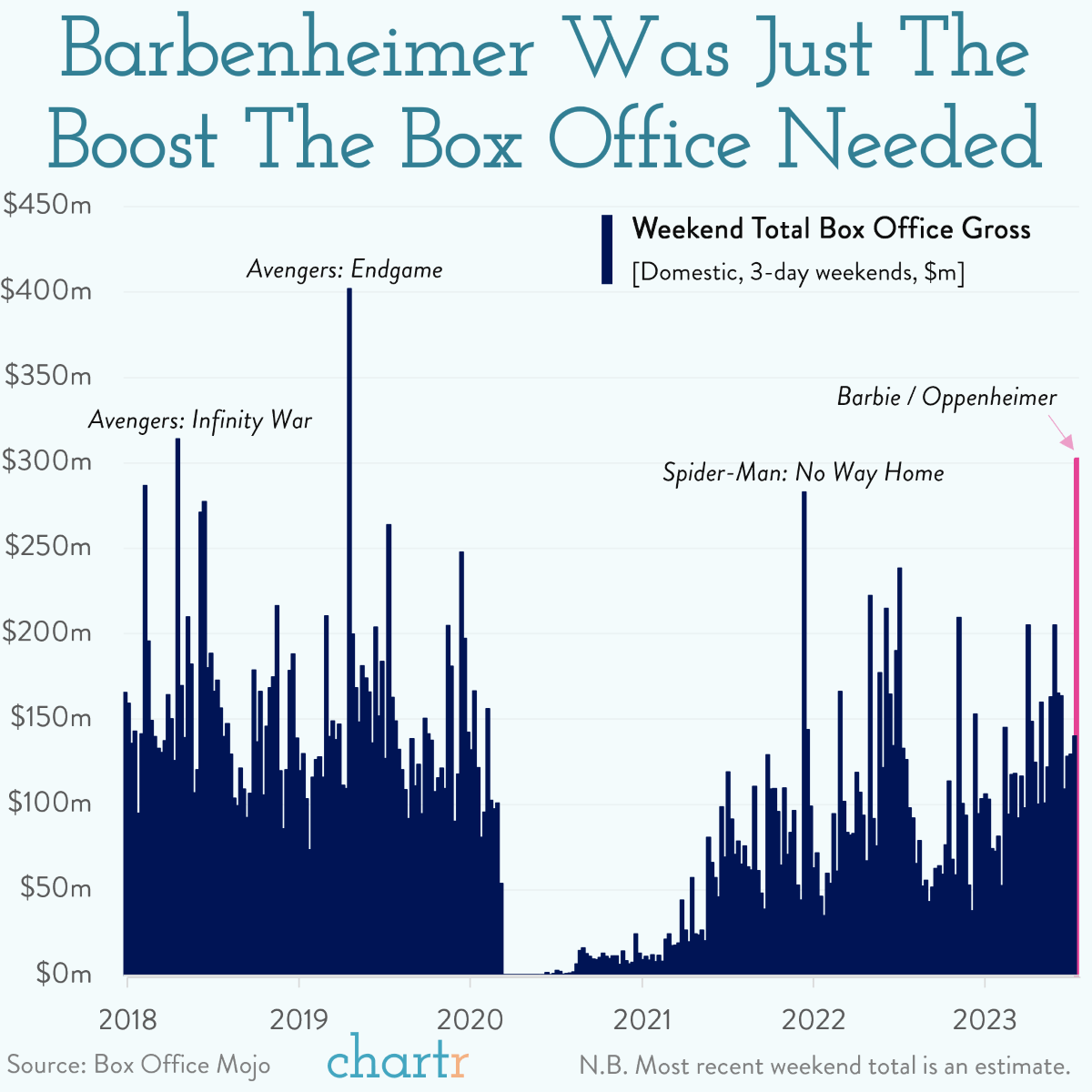

The box office is back!

The wait is over.

Mattel’s Barbie and Christopher Nolan’s Oppenheimer – affectionately dubbed “Barbenheimer” – delivered the goods and then some. People got excited about movie theaters again, not just meme-stock APE trading to the moon.

Barbie pulled in $162 million at the box office in the United States last weekend, while Oppenheimer raked in $82 million. Including other films currently playing in theaters (Mission Impossible, Indiana Jones, Spider-Man), the weekend was a smashing success with the final tally topping $300 million – the 4th best domestic box office weekend of all time!

Box office sales this year are still down from 2022 — and 28% below 2019 levels – but the viral excitement and media buzz from a famous fashion doll and inventor of the atomic bomb are a welcome reprieve from an industry suffering from twin strikes (actors AND writers – ouch!).

Source: Chartr, Variety, Wall Street Journal

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.