S&P 500 after Fed hiking cycles, plus bond volatility, EPS cuts, OPEC+, and renewable energy

The Sandbox Daily (4.3.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

S&P 500 performance following the end of Fed hiking cycles

key bond volatility measure finally breaking lower

larger than average cuts to S&P 500 EPS estimates for 1Q23

OPEC+ surprise announcement

U.S. renewables surpass coal

Let’s dig in.

Markets in review

EQUITIES: Dow +0.98% | S&P 500 +0.37% | Russell 2000 -0.01% | Nasdaq 100 -0.25%

FIXED INCOME: Barclays Agg Bond +0.43% | High Yield -0.08% | 2yr UST 3.978% | 10yr UST 3.419%

COMMODITIES: Brent Crude +6.13% to $84.79/barrel. Gold +0.77% to $2,001.5/oz.

BITCOIN: -1.16% to $27,679

US DOLLAR INDEX: -0.43% to 102.069

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: -0.80% to 18.55

Quote of the day

“Goals can provide direction and even push you forward in the short-term, but eventually a well-designed system will always win. Having a system is what matters. Committing to the process is what makes the difference.”

-James Clear

S&P 500 performance following the end of Fed hiking cycles

In recent market history, U.S. equities have generally rallied in the months following the end of past Fed tightening cycles.

In the three months following the peak Fed Funds Rate, the S&P 500 has returned an average of +8%, ranging from +14% to -1% and rising in 5 of 6 episodes. On a 12-month basis, the S&P 500 has returned an average of 19%, rising in 5 of 6 episodes and rallying by more than 10% in each of those.

However, equities performed poorly when the economy entered recession near the end of tightening cycles. In most instances, months passed between the end of Fed tightening, the start of easing, and the start of recession. The instances when a recession occurred within 12 months of the end of the tightening cycle (for example, the recessions of 1973, 1981, and 2001) were also the instances when the S&P 500 performed poorly.

As a reminder, the median consensus estimate by economists calling for a recession in the next 12 months is roughly 65%.

Source: Goldman Sachs Global Investment Research

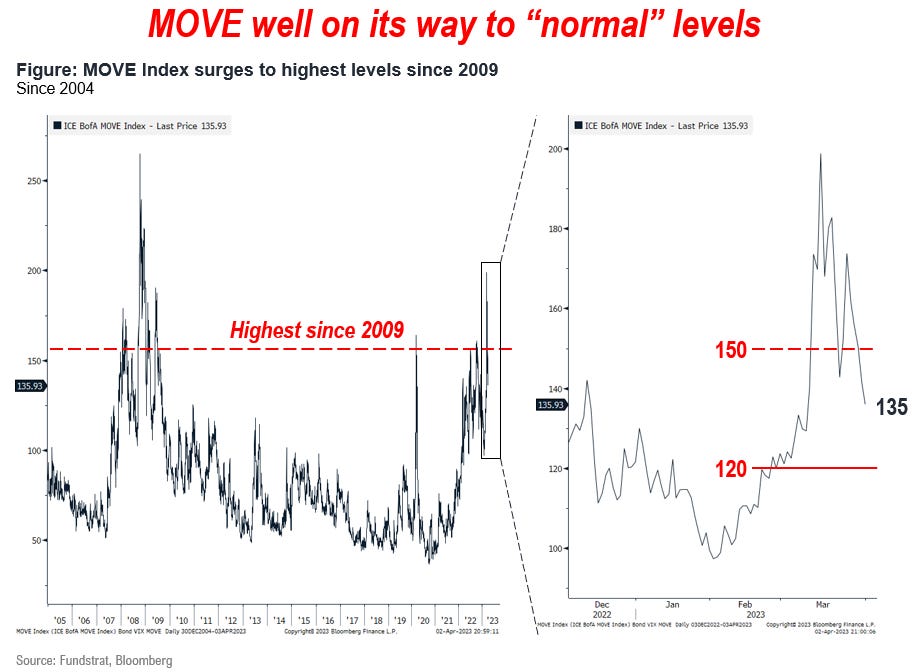

Key bond volatility measure finally breaking lower

The bond market closed the quarter after unprecedented volatility rocked U.S. Treasuries at their very core, spurred by the banking crises that began on March 9th.

After all, as we heard from Federal Reserve Chairman Jerome Powell's speech after the FOMC's 25 bps rate hike on March 22nd, the pervasive volatility in the market gave the Fed cover to consider pausing their rate hiking campaign.

Today, nearly 4 weeks later, the ICE BofA MOVE Index – which tracks fixed income market volatility – is recovering to levels that suggest the crisis could be ebbing. The MOVE Index is now 135, which is below 150 (a common barometer of crisis-level bond volatility) and hopefully aiming to settle below 120-125 (the high end of normal).

The MOVE Index had recently spiked to >200, which is the equivalent to the equity market volatility VIX indicator surging >50.

The Fed and FDIC ring-fencing the banking crises has brought stability to the largest asset class in markets, at least for now.

Source: Fundstrat

Larger than average cuts to S&P 500 EPS estimates for 1Q23

During the first quarter, analysts lowered their S&P 500 bottom-up EPS estimates by 6.3% for the upcoming earnings season.

It is typical for analysts to reduce their earnings estimates during the quarter, but not by this magnitude. During the past ten years, the average decline in estimates during a quarter has been 3.3%; over the past 20 years, the drop was 3.8%. Thus, the decline over the last few months has been substantial versus 10- and 20-year averages.

It’s also noteworthy that the forward 12-month P/E ratio for the S&P 500 has increased from 16.7 to 17.8 since December 31, as the price of the index has increased while EPS estimates for calendar year 2023 have decreased during this time.

Source: FactSet

OPEC+ surprise announcement

Crude prices and energy stocks jumped Monday after OPEC+ members announced a surprise production cut that threatens to tighten the market and deliver a fresh inflationary jolt to the world economy.

Saudi Arabia and fellow members of the Organization of Petroleum Exporting Countries (OPEC) announced they are reducing oil output targets by a combined 1.16 million barrels per day. The planned reduction — set to go into effect in May and last through 2023 — is a “precautionary measure aimed at supporting the stability of the oil market,” Saudi Arabia’s energy ministry said in a statement.

This latest production decrease is in addition to the 2-million-barrels-per-day cut implemented in November 2022 by OPEC and a group of partner producers led by Russia, together known as OPEC+ – the oil cartel’s effective market share is estimated to be just over 50% of global production.

Several sell-side analysts raised their oil prices targets in response to the production cut, including Goldman Sachs, which now sees Brent at $95 per barrel at 2023 year-end, up from $90.

In contrast, Citigroup analysts cautioned that “headwinds still lie ahead” for global oil markets, even if an initial spike in prices is “inevitable.” Eventually, there could be a “realization that the market is a lot weaker than people think,” pointing to China’s slower-than-expected Covid reopening and diminished demand in many Western economies.

The White House administration called the reductions in output “ill-advised” given current market conditions.

Source: Goldman Sachs Global Investment Research, CNBC, Reuters, Liz Young

Power up

In 2022, the U.S. electric power sector produced 4,090 million megawatthours (MWh) of electric power. Generation from renewable sources – wind, solar, hydro, biomass, and geothermal – surpassed coal-fired generation in the electric power sector for the first time. Natural gas remained the largest source of U.S. electricity generation.

It's been a big few years for renewables after they surged above nuclear in 2021, as the continued growth of wind and solar power helped propel the eco-friendlier electric sources to second place in domestic production.

Source: U.S. Energy Information Administration

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.