S&P 500 breath metrics improve but remain weak, plus existing home sales, yields, and Netflix

The Sandbox Daily (10.20.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the internal breadth metrics on the S&P 500, existing home sales data showing further softening in the housing market, yields need to digest gains, and Netflix is back and filling the gap.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.30% | Nasdaq 100 -0.51% | S&P 500 -0.80% | Russell 2000 -1.24%

FIXED INCOME: Barclays Agg Bond -0.64% | High Yield -0.55% | 2yr UST 4.609% | 10yr UST 4.234%

COMMODITIES: Brent Crude +0.21% to $92.43/barrel. Gold -0.17% to $1,631.4/oz.

BITCOIN: +0.17% to $19,070

US DOLLAR INDEX: +0.13% to 113.032

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -2.54% to 29.98

Internal breadth metrics remain very weak but improved this week

Breadth metrics for the S&P 500 improved on the week, but there is still a lot of work to be done before we can make the claim that breadth is healthy.

Advance/Decline Line: below the 50-day moving average, made a new cycle low on Friday of last week

S&P 500 % of issues above 200-Day Moving Average: 19%, from 15% last week

S&P 500 % of issues above 50-Day Moving Average: 21%, from 10% last week

S&P 500 % of issues above 20-Day Moving Average: 57%, from 20% last week

Source: Potomac Fund Management

More data confirming housing market is softening

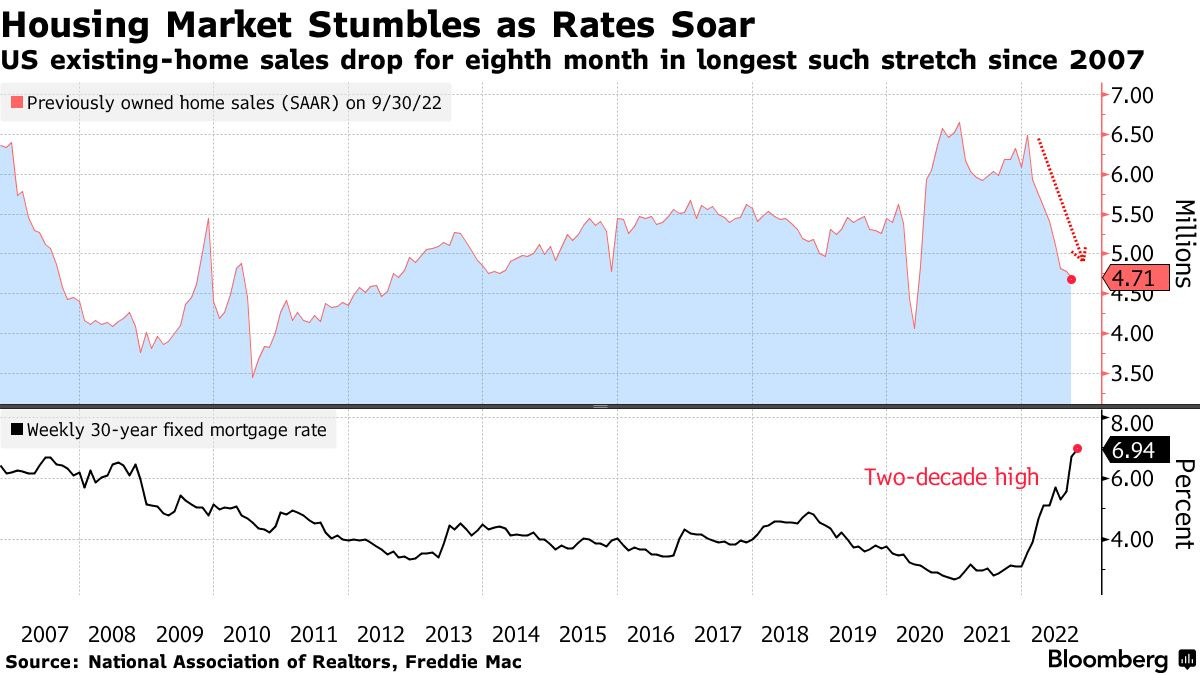

Sales of existing homes sank in September for the eighth consecutive month, underscoring how soaring mortgage rates are punishing demand in the housing market.

The National Association of Realtors (NAR) reported existing home sales dropped -1.5% from August to an annualized pace of 4.71 million. Except for a few months during the initial outbreak of COVID-19, that was the lowest total in a decade. Year-over-year sales declined -23.8%!

NAR Chief Economist Lawrence Yun explained that the housing sector “continues to undergo an adjustment due to the continuous rise in interest rates.” Yun added that average rates for 30-year, fixed-rate mortgages are approaching 7%. Yesterday, the Mortgage Bankers Association (MBA) noted those rates averaged 6.94% last week.

Source: Bloomberg

Yields need to digest gains

The U.S. 10-year Treasury yield is up for 11 consecutive weeks, posting a stretch of upside momentum not seen since the late 1970s. If today’s action holds into tomorrow’s close, it would mark 12 weeks in the green for the 10-year yield.

As the benchmark rate takes out the key psychological level of 4%, this could be a logical place and time to see the explosive rise in rates take a breather. While yields across the curve continue to rise, the current rally is looking less and less sustainable. We could expect some backing and filling over the weeks to come.

Source: All Star Charts

Netflix is back and filling the gap

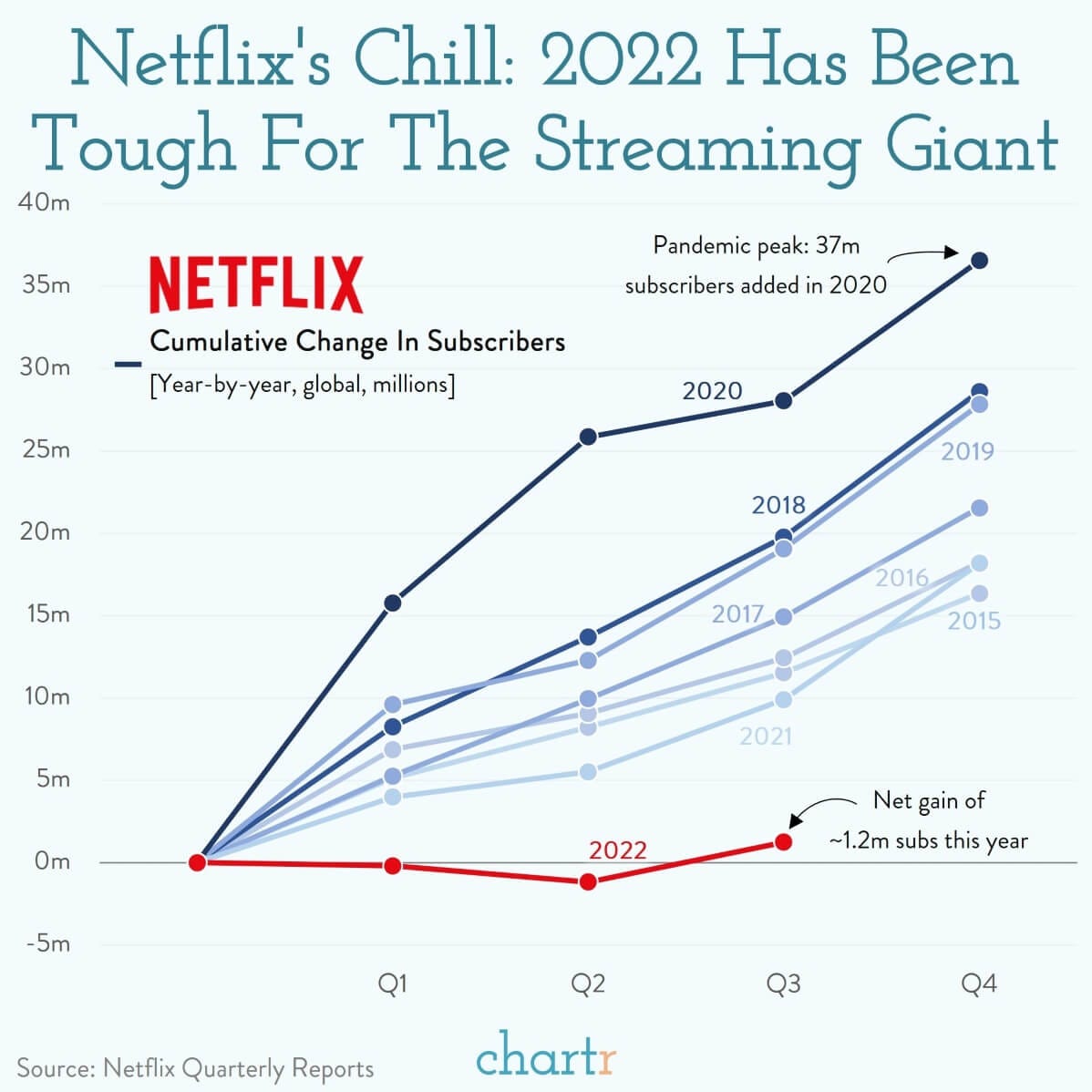

Earlier this week, Netflix reported that they had added 2.4mm new subscribers last quarter, confirming they’re still on top in the streaming wars. The return to growth couldn’t have come quicker for Netflix after a terrible first half of 2022 in which the company lost almost 1.2 million subscribers. Big TV hits like Dahmer, Stranger Things and Cobra Kai — the latter of which was the most-watched show on any streaming service in mid-September — have pulled Netflix out of the red.

With consumers tightening their belts, and competition in streaming as intense as ever, Netflix execs were noticeably relieved with CEO Reed Hastings saying “thank God we’re done with shrinking quarters.” Looking ahead, Hastings' confidence that Netflix will keep growing is probably well-judged — the launch of a cheaper ad-supported tier should drive new subscribers, as could a further crackdown on password sharing.

Netflix is now at a six-month high trying to fill the important gap down from April.

Source: Chartr, All Star Charts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.