S&P 500 earnings review, bond market reset, investor protection, Bank of Japan, and Google's top trending searches of 2022

The Sandbox Daily (12.20.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the 2022 year in earnings for the S&P 500 index, the great bond market reset, investor protection rises to levels last seen in the Great Financial Crisis, the Bank of Japan shifts its policy without warning, and Google’s top trending searches of 2022.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.54% | Dow +0.28% | S&P 500 +0.10% | Nasdaq 100 -0.11%

FIXED INCOME: Barclays Agg Bond -0.68% | High Yield -0.26% | 2yr UST 4.268% | 10yr UST 3.694%

COMMODITIES: Brent Crude -0.11% to $79.71/barrel. Gold +1.70% to $1,828.3/oz.

BITCOIN: +1.48% to $16,872

US DOLLAR INDEX: -0.75% to 103.935

CBOE EQUITY PUT/CALL RATIO: 0.62

VIX: -4.19% to 21.48

2022 S&P 500 earnings review

The estimated year-over-year earnings growth rate for calendar year 2022 is +5.1%, which is below the trailing 10-year average (annual) earnings growth rate of +8.5% (2012 – 2021). It is also below the estimates of +9.1% on June 30 and +6.9% on September 30, as analysts have lowered earnings estimates in aggregate for CY 2022 over the past six months.

Most of the earnings growth for the year occurred in the 1st half. After posting +9.4% and +5.8% earnings growth in Q1 and Q2 respectively, the index reported earnings growth of +2.5% in Q3 and is projected to report an earnings decline of -2.8% for Q4 2022. Clearly, this has investor’s attention for 2023 as many expect an earnings recession is coming.

8 of the 11 sectors are predicted to report YoY growth in earnings this year, led by the Energy, Industrials, and Real Estate sectors. On the other hand, 3 sectors are projected to report a decline in earnings: Financials, Communication Services, and Consumer Discretionary. What’s more, if you exclude the Energy sector, the index would be expected to report a decline in earnings of -1.8% rather than growth in earnings of +5.1%.

Source: FactSet

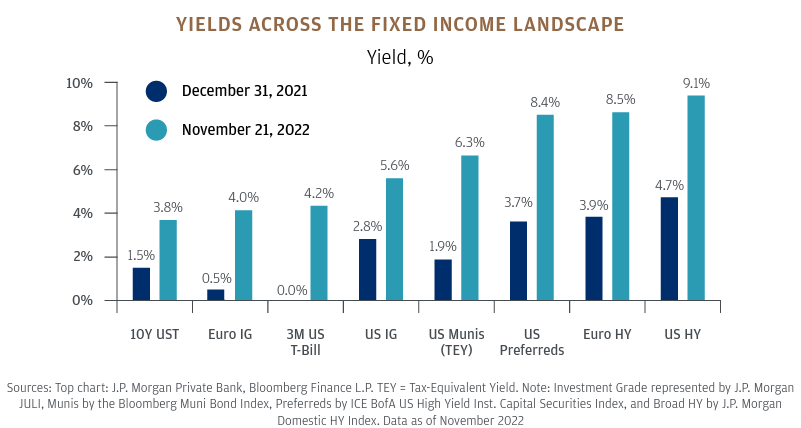

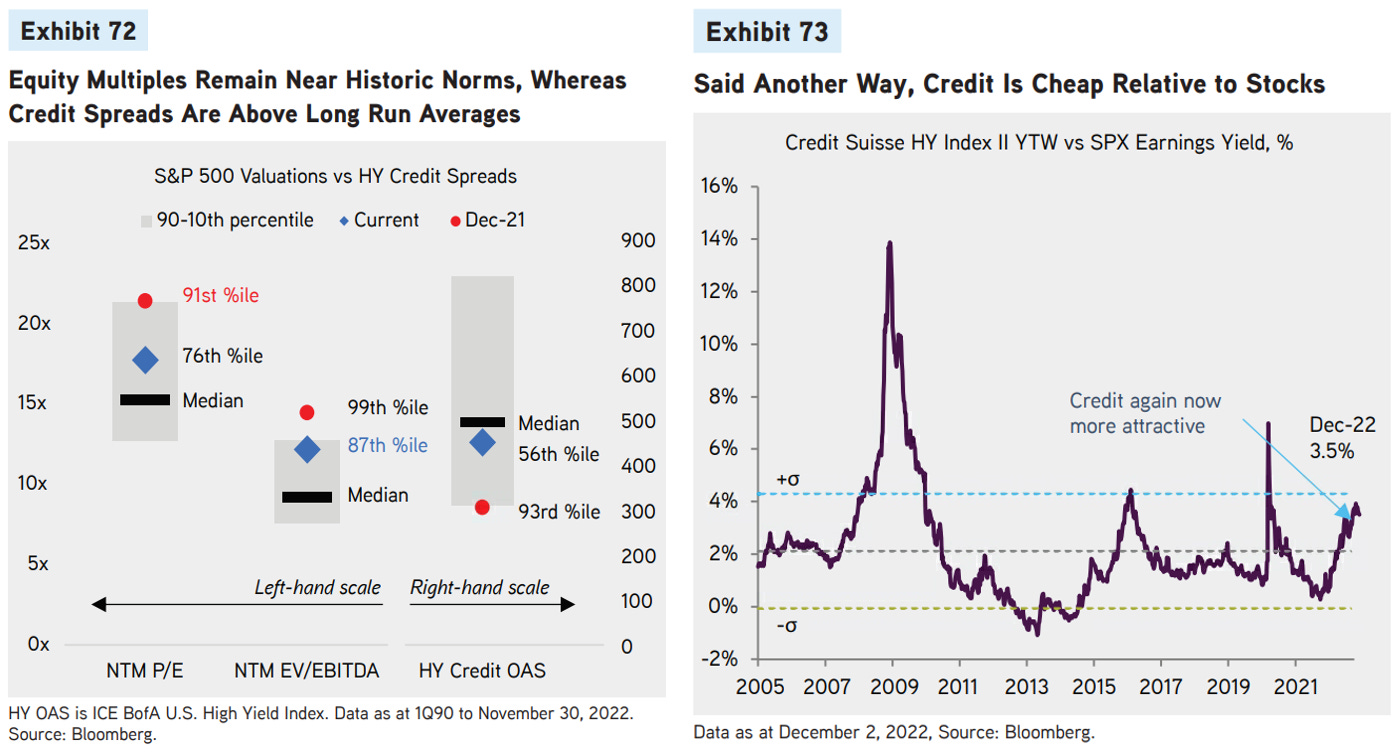

The great bond market reset

The increase in interest rates and reduced appetite for risk-taking has given fixed-income investors a major boost in yields worth buying.

As such, investors are shifting their portfolios to grab these yields for the first time in years!

In fact, one renowned asset manager and expert in credit markets, KKR, sees bonds more favorable than stocks.

If we are right, then Credit makes more sense to own than Equities right now across most asset classes. Indeed, given that many traditional banks are reining in their lending, now is a good time in many instances to be a provider of capital, especially to businesses that align with our key themes. Just consider that our S&P 500 target is up only marginally versus current levels, while senior Direct Lending offers returns well north of 10%. Within Credit, keep it simple. Specifically, we favor shorter duration, bigger companies, and attractive call protection features. Further, we also still favor collateral linked to higher nominal GDP growth.

2022 has been the great reset from TINA (there-is-no-alternative) to TARA (there-are-reasonable-alternatives) for stocks.

Source: JPMorgan, Bank of America, KKR

What diamond hands?

The 30-day moving average of the CBOE equity put/call ratio has risen to the highest level since November 2008.

Source: Liz Ann Sonders

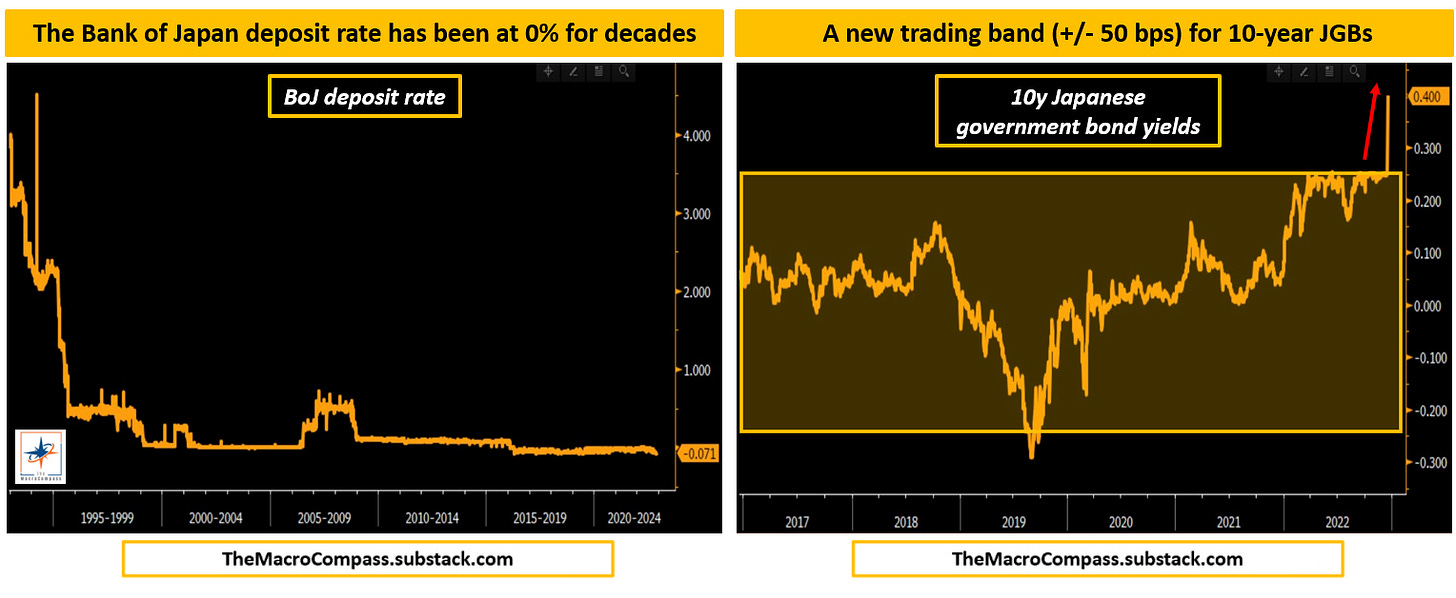

Bank of Japan shifts policy without warning, jolting markets

The Bank of Japan shocked markets by shifting its Yield Curve Control (YCC) stance, paving the way for the central bank to start normalizing policy after decades of extraordinary stimulative monetary policy.

Once the holdout for rock-bottom interest rates, the BOJ doubled its cap on 10-year yields, which sparked a major jump in the battered yen. The BOJ will now allow Japan’s 10-year bond yields to rise to around 0.50%, up from the previous limit of 0.25%, while keeping both short- and long-term interest rates unchanged.

“Whatever the BOJ calls this, it is a step toward an exit,” said Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official. “This opens a door for a possible rate hike in 2023 under a new governorship.”

Source: The Macro Compass, Bloomberg, The Daily Shot

Google’s top trending searches of 2022

Every year, Google looks back at the moments, people, and trends that sparked our collective curiosity through Year in Search. Around the world, people sought to learn more about everything from complex global issues to ways to help each other — not to mention the latest pop culture news.

“Wordle” was the top trending search globally, as guessing five-letter words every day became a way of life.

The way we search is also evolving beyond just typing into a search box. People are finding what they need in more natural ways, like humming a song, snapping a picture with Lens, or by asking Assistant, “Hey Google” when they want to learn more.

See what Google Trends reveal about the questions we shared, the people who inspired us, and the moments that captured the world’s attention each year.

Here is Google’s video montage of the Year in Search - give it a look!

Source: Google

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.