S&P 500 hits 6000 (this bull is still an infant), plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (11.8.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

this bull is “still an infant”

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.71% | Dow +0.59% | S&P 500 +0.38% | Nasdaq 100 +0.07%

FIXED INCOME: Barclays Agg Bond +0.17% | High Yield +0.16% | 2yr UST 4.254% | 10yr UST 4.304%

COMMODITIES: Brent Crude -2.09% to $74.05/barrel. Gold -0.52% to $2,691.6/oz.

BITCOIN: +0.46% to $76,540

US DOLLAR INDEX: +0.39% to 104.914

CBOE EQUITY PUT/CALL RATIO: 0.82

VIX: -1.71% to 14.94

Quote of the day

- Unknown

This bull is “still an infant”

For appetizers, we are serving a labor market that is more resilient than a can of baked beans.

The main course features a Federal Reserve (like most global central banks) embarking upon an interest rate easing cycle, with sides of earnings expansion and an AI revolution.

And, for desert, President-Elect Donald Trump is bringing back his pro-growth policies.

The bull case remains “intact” says the brilliant Adam Parker of Trivariate Research.

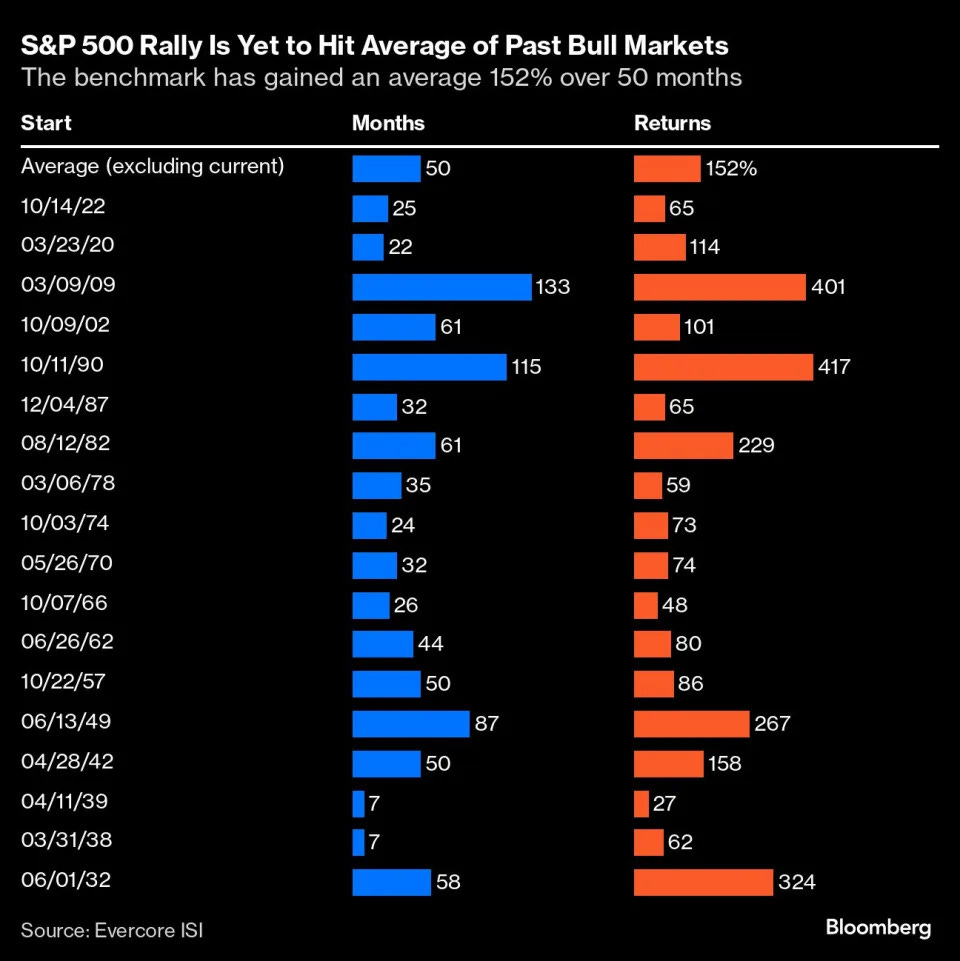

History shows the current bull run is “still an infant” per Evercore ISI’s Julian Emanuel.

It’s true.

When you compare the red line (current bull) to all the other colored lines (historical bulls), we’re just getting started.

In the past 100 years, the benchmark gauge has averaged a 152% gain over 50 months during bull markets.

The current bull off the October 2022 lows is 24-25 months old.

Over the past two weeks, investors have successfully navigated the treacherous waters of the:

Q3 GDP print

the September PCE inflation report

the October nonfarm payrolls disaster

Election Day

the Federal Reserve’s FOMC meeting.

Wow, that was quite the gauntlet !!

And… today, the S&P 500 hit 6000 for the 1st time.

It looks as if the U.S. economy has gone from soft landing to no landing to blastoff.

Source: Grant Hawkridge, CNBC, Yahoo Finance

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

All Star Charts – Betting Markets Got it Right (JC Parets)

Wall Street Journal – Some Final Personal-Finance Advice (Jonathan Clements)

A Wealth of Common Sense – Some Things I Don’t Believe About Investing (Ben Carlson)

Young Money – Ask Good Questions (Jack Raines)

Noahpinion – Americans Hate Inflation More Than Unemployment (Noah Smith)

The Block – BlackRock’s Bitcoin ETF Surpassed Its Gold ETF in Assets (Jason Shubnell)

Podcasts

Invest Like the Best with Patrick O’Shaughnessy and special guests Andrew Homan, Chris Miller – Redefining Semiconductor Progress (Spotify, Apple Podcasts)

Bloomberg Odd Lots with Joe Weisenthal and Tracy Alloway and special guest Max Read – How the Internet Got Infested With Garbage (Spotify, Apple Podcasts)

Music

Wiz Khalifa feat. Cam’ron – Be the Same (Spotify, Apple Music, YouTube)

Movies/TV Shows

The Covenant by Guy Ritchie – Jake Gyllenhaal, Dar Salim (IMDB, YouTube)

Books

Ryan Holiday – The Daily Dad: 366 Meditations on Parenting, Love, and Raising Great Kids (Amazon)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: