S&P 500 looking for support, plus what investors can control, U.S. economic outlook, and the average investor

The Sandbox Daily (8.22.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

S&P 500 looking for support

what we control vs. what we don’t

what recession?

the average investor

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.19% | S&P 500 -0.28% | Russell 2000 -0.28% | Dow -0.51%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield +0.05% | 2yr UST 5.048% | 10yr UST 4.332%

COMMODITIES: Brent Crude -0.56% to $83.99/barrel. Gold +0.16% to $1,926.1/oz.

BITCOIN: -1.09% to $25,813

US DOLLAR INDEX: +0.29% to 103.598

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: -0.93% to 16.97

Quote of the day

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

- Paul Samuelson, 1970 Nobel Prize Winner

S&P 500 looking for support

Since peaking at 4,588 on July 31st, the S&P 500 has come under pressure as the U.S. dollar has reversed higher, interest rates push up to GFC levels, and August seasonal headwinds favor some weakness.

After a modest ~5% pullback in August, investors are looking to potential support levels for the popular benchmark. The cloud around the general 4315-4325 level represents the August highs from the 2022 summer rally and the 61.8% Fibonacci retracement of the 2022 bear market, making it a critical level of interest worth watching.

Friday and Monday showed the bulls stepping in as support. Oversold conditions were nearly in place based on RSI and breadth. Also notable was a meaningful contraction in sentiment and elevated put/call ratios. Bulls would like to see follow through this week and next.

However, if sellers regain control and we violate this critical shelf, investors should be prepared for further downside and increased volatility.

This all comes as Federal Reserve Chairman Jerome Powell is set to speak on Friday morning in Jackson Hole, a potential catalyst in the same way markets witnessed in 2022.

Source: All Star Charts

What we control vs. what we don’t

Focus on what you can control, forget the rest.

Successful investing requires understanding what matters and recognizing what you can control. This includes:

1) the amount of risk you take through your asset allocation and investment selection

2) minimizing costs (management fees, expense ratios, transaction charges, etc.) so the investor captures a greater share of an investment’s return

3) establishing time horizons so we allow the power of compounding to do its magical thing and work simultaneously towards a myriad of short-, medium-, and long-term goals irrespective of market uncertainty and cycles

4) minimizing investor behavior mistakes because, after all, personal finance is more personal than finance –> we should recognize that a calculator can only take you so far on paper and that the real world is full of emotions, biases, and our own conflicting thoughts

What we cannot control are investment returns, yet it’s impossible for many investors not to focus on the bottom-line number. While stocks have returned roughly 8-9% over time, your portfolio will not go up and to the right in a straight line every year. In fact, volatility and uncertainty are the prices we must pay over years and decades to achieve those sweet, beautiful 8-9% annualized returns.

Other areas we cannot control include the economy, tax laws, changes to the retirement system, entitlement programs, inflation, and politics.

For additional perspective on this topic, check out Ben Carlson’s 2013 post Focus on What You Can Control.

Source: Vishal Khandelwal

What recession?

Economists are becoming increasingly optimistic and see a stronger U.S. economy into the next year alongside a smaller rise in unemployment, supporting expectations that the Federal Reserve will keep interest rates higher for longer.

According to an August Bloomberg survey of 68 economists, consensus expects GDP to advance to an annualized 1.8% in 3Q23, nearly 4x the 0.5% pace projected last month. Economists also see the economy expanding in 4Q23 rather than a minor contraction.

Consumer spending – which accounts for roughly 2/3rds of GDP – is seen as driving the momentum as Americans continue to spend at a healthy clip.

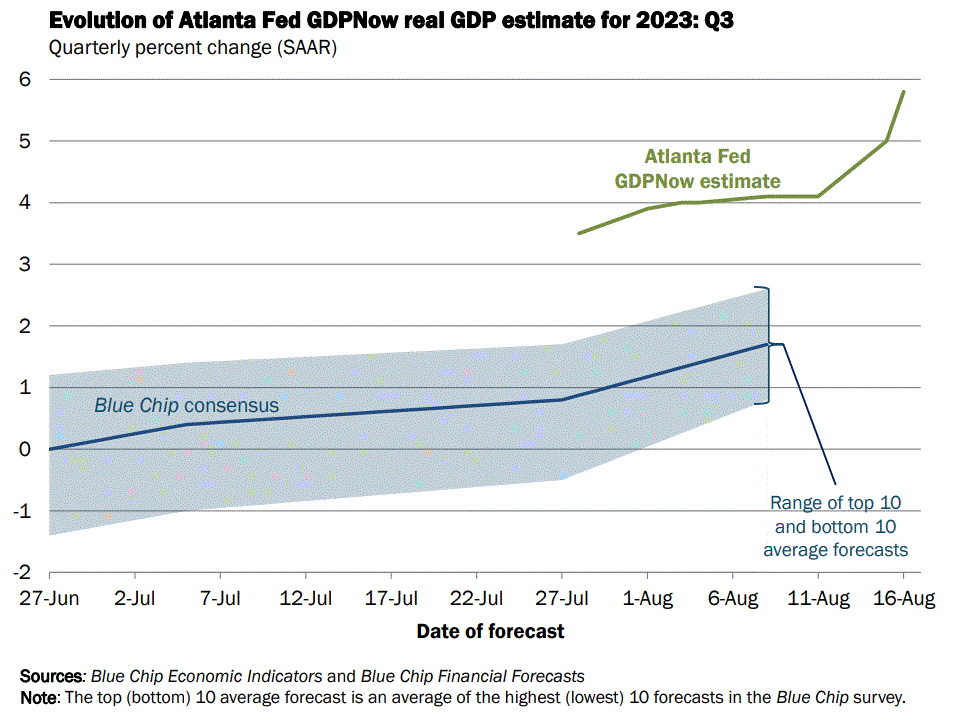

This survey follows the recent Atlanta Fed GDPNow economic forecast which showed the early estimates for 3rd quarter GDP are expanding at a robust 5.8% annualized rate based on available economic data for the current measured quarter. Wow.

On the surface, the latest GDPNow reading seems like bad news for the Federal Reserve, which has been attempting to cool the economy via aggressive interest-rate hikes to bring down inflation. The current federal funds rate target range is 5.25% to 5.50%, the highest in 22 years.

Source: Bloomberg, Federal Reserve Bank of Atlanta

The average investor

J.P. Morgan’s flagship publication, Guide to the Markets, offers a vast array of market data and insights to capture key topics that investors are focused on.

Periodically, they publish the following exhibit that compares returns across various assets classes as well as the average investor (orange bar below).

The examination by Dalbar, which provides a quantitative analysis of investor behavior by measuring buy/sell/switch patterns over various time frames, shows that the average investor annualized a paltry 3.6% over a 20-year period from 2002-2021.

Results such as this J.P. Morgan exhibit, and countless others, consistently show that the average investor earns less – in many cases, much less – than mutual fund and ETF performance reports would suggest. This implies people are simply selling assets that have already gone down in value and/or buying things that have already run up.

Source: J.P. Morgan

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

https://www.clevelandfed.org/en/indicators-and-data/yield-curve-and-predicted-gdp-growth , GDP expectations look different here