S&P 500 runs into overhead supply, plus bonds, Dollar index, SPX downside volatility, a barrel of oil, and investor psychology

The Sandbox Daily (12.6.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the S&P 500 index running into overhead resistance, bonds catching a bid in December, the Dollar index retests old highs, downside volatility is amplified in bear markets, what we can you make from one barrel of oil, and investor psychology.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.03% | S&P 500 -1.44% | Russell 2000 -1.50% | Nasdaq 100 -2.01%

FIXED INCOME: Barclays Agg Bond +0.29% | High Yield -0.36% | 2yr UST 4.366% | 10yr UST 3.544%

COMMODITIES: Brent Crude -4.19% to $79.56/barrel. Gold +0.17% to $1,784.8/oz.

BITCOIN: -0.15% to $17,021

US DOLLAR INDEX: +0.28% to 105.579

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: +6.84% to 22.17

S&P 500 running into overhead resistance

The S&P 500 is in a downtrend. There are no two ways about it.

We have a clearly defined series of lower highs and lower lows throughout 2022, and until that pattern is broken, the bear market is ongoing. The S&P 500 ran right into the downtrend line connecting those peaks last Thursday and has so far been unable to overcome it. Add in the downward-sloping 200-DMA and the reversal is clear. The bulls have the shorter green uptrend line from the October lows, but one of these two is going to have to break this week.

Source: Beat The Bench

Bonds catching a bid

U.S. equity index ETFs have had a rough go of it so far in December. The S&P 500 index (SPY) has fallen on all four trading days to start the month for a decline of -3.4% already. Notably, though, Treasury ETFs and the aggregate bond market are up to start the month. All year we've seen both stocks and bonds fall in tandem, but recently we're seeing more divergence where bonds catch a bid as stocks fall.

Source: Bespoke Investment Group

Dollar index retests old highs

The U.S. Dollar Index (DXY) is running into support at a shelf of former highs. How it reacts could dictate how stocks fare heading into the end of the year.

The chart below depicts DXY futures retesting the breakout level of a massive seven-year base:

This could be a logical level for the dollar’s steep decline to pause. What follows could mean the difference between the end of another bear market rally or the ushering in of a more significant advance for risk assets.

If the principle of polarity kicks in and DXY bounces higher, selling pressure could resume for stocks. On the other hand, if the dollar slips back below support, we could expect a tailwind, or boost for risk assets worldwide.

Source: All Star Charts

Downside volatility is amplified in bear markets

The S&P 500 fell -1.4% today, its 59th decline of 1% or more this year.

Since 1950, the only years with more +1% declines than 2022: 1974, 2002, and 2008.

Source: Charlie Bilello

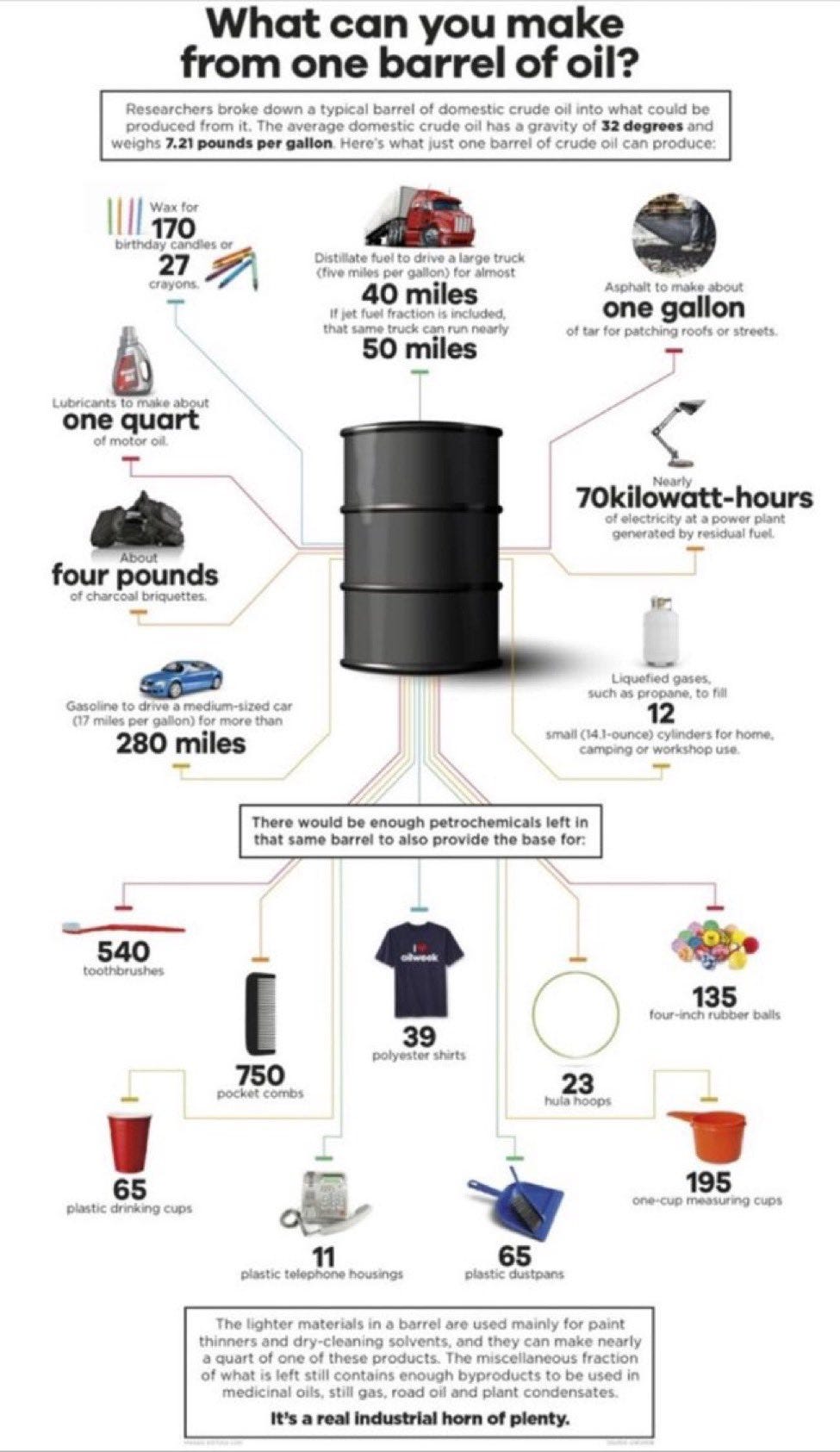

What can you make from one barrel of oil?

If the world looks to transition away from oil and gas, a new green economy will need to reconfigure key inputs into products seemingly across all sectors of the global economy.

The downstream utility of oil cannot be overstated. Oil creates over 65,000 different polymers. One of the most productive natural resources on planet earth. Everything is made of oil. Plastics, chemicals, food, asphalt, electricity, lubricants, jet fuel, clothing, toiletries, medical devices, home heating and much much more. Take a look.

Source: U.S. Department of Energy, Bushels Per Acre

Investor psychology

Behavioral finance 101: investor psychology matters.

Our emotions changes throughout the market cycle. Understanding our biases helps focus our attention on what does matter, such as interest rates, valuations, and earnings – to name a few.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.