S&P 500 YTD returns, plus Q2 earnings season, wage gains, and improving sentiment

The Sandbox Daily (7.17.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

S&P 500 market-cap weighted index vs. equal-weighted index

Q2 earnings season kicks off

real wage gains

consumer and investor sentiment is improving

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.04% | Nasdaq 100 +0.95% | S&P 500 +0.39% | Dow +0.22%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield +0.19% | 2yr UST 4.742% | 10yr UST 3.811%

COMMODITIES: Brent Crude -1.80% to $78.43/barrel. Gold -0.30% to $1,958.6/oz.

BITCOIN: -1.09% to $29,925

US DOLLAR INDEX: -0.02% to 99.892

CBOE EQUITY PUT/CALL RATIO: 0.48

VIX: +1.05% to 13.48

Quote of the day

“Risk is multi-dimensional and comes in all shapes and sizes. As any good trader or investment manager will tell you, even though you think that you have portfolio risk nailed down, the market will find a way to hurt you in a way that you will not have anticipated.”

- Cam Hui, Humble Student of the Markets

The average stock is chugging along

The headlines will continue to tell you this market’s narrative and performance is the “Magnificent 7.”

Sure, the leaders are leading, but the average stock in the S&P 500 is up +7.9% year-to-date and reaching its highest level since early February.

In fact, since the end of May, the equal-weighted index is leading the market-cap weighted index (+9.1% vs. +7.9%) as sector rotation continues and participation expands.

The bears narrative continues to show exhaustion as the bull market marches on.

Source: Willie Delwiche

Q2 earnings season kicks off

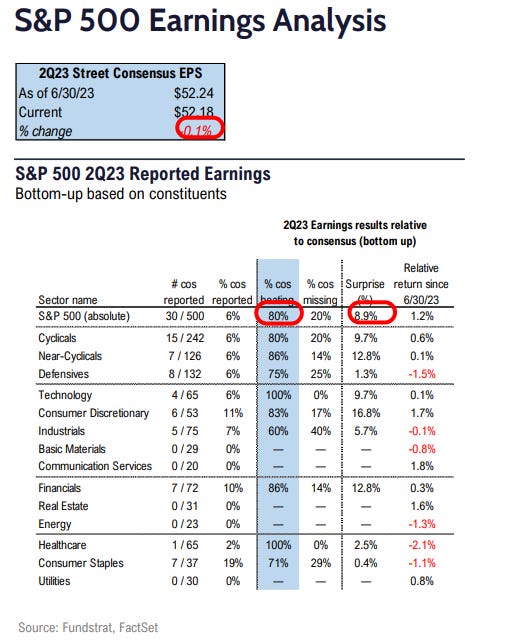

2nd quarter earnings season is in its early stages, with just 30 companies in the S&P 500 Index (SPX) having reported thus far and 60 more companies reporting this week.

Marquee names are reporting results every day, with Bank of America (BAC), Morgan Stanley (MS), Lockheed Martin (LMT), Goldman Sachs (GS), Tesla (TSLA), Netflix (NFLX), Las Vegas Sands (LVS), Johnson & Johnson (JNJ), Freeport McMoRan (FCX), and American Express (AXP) as some of the attention-grabbing headliners this week.

Many expect this reporting season to be the trough in the earnings cycle, however S&P 500 ex-Energy EPS already troughed in 4Q 2022, coinciding with the market bottom (October 2022).

We will find out much more on corporate profits for the weeks starting 7/24 and 7/31 when a combined 340 index companies report.

Of the 6% of companies in the S&P 500 that have reported, 80% have reported actual EPS above their estimates, which is above the 5-year average of 77% and 10-year average of 73%. In aggregate, companies are reporting earnings that are +8.9% above estimates, which is above the 5-year average of +8.4% and 10-year average of +6.4%.

The blended earnings decline (blended combines actual results for companies that have reported and estimated results for companies that have yet to report) for the 2nd quarter is -7.2% today, which would mark the 3rd consecutive quarter in which the index has reported a year-over-year decline in earnings – so the earnings valley/recession is here, as expected.

Source: Earnings Whispers, FactSet, Fundstrat, Goldman Sachs Global Investment Research

Real wage gains

Workers are finally seeing real pay gains as inflationary pressures come off the boil.

The latest data shows that American workers' earnings grew at a healthy rate of +4.2% over the last 12 months, marking the first time in over 2 years that raises have not been wiped out by soaring prices. Last week’s Consumer Price Index report for June shows that inflation has come down from a peak of +9.1% in June 2022 to just +3.0% YoY.

Workers in sectors like leisure, hospitality, and manufacturing saw a more pronounced impact with wages rising relatively faster, while the tech-heavy information sector has seen narrower pay gains — with headlines have been dominated by rolling layoffs at big tech companies.

Source: Business Insider, Chartr

Consumer and investor sentiment is improving

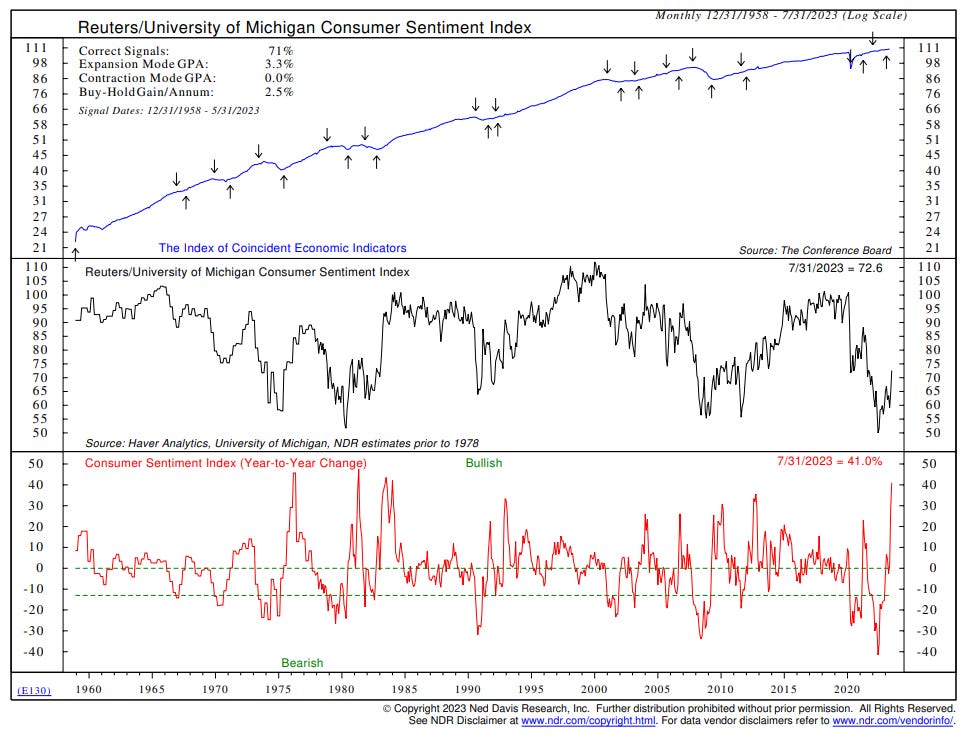

Consumer sentiment was much stronger than expected.

The Reuters/University of Michigan Consumer Sentiment Index increased for a 2nd month to 72.6 in July, the highest level since September 2021 and above forecasts of 65.5. Both current economic conditions and consumer expectations improved, largely attributed to an easing of inflation and stability in labor markets.

The index is up 41.0% from a year ago, the steepest YoY gain since January 1984. Such strong momentum is consistent with continued economic expansion.

Meanwhile, bullish sentiment has gained momentum among retail investors on the back of a strong market recovery in the 1st half of 2023.

Last week the American Association of Individual Investors (AAII) reported bullish sentiment was 41.0%, with neutral investors at 33.1% and bearish sentiment the lowest of the categories at 25.9%.

With macro risks receding and recession odds subsiding, 2023 has been a materially better environment than many expected.

Source: Ned Davis Research, Dwyer Strategy

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.