Safe-haven assets, plus staggering losses for bonds, Fed's balance sheet, and finance/tech jobs

The Sandbox Daily (4.23.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

safe-haven assets

staggering losses for long-dated bonds

Fed balance sheet amidst ongoing Quantitative Tightening (QT)

finance, tech job drought nearing its end

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.79% | Nasdaq 100 +1.51% | S&P 500 +1.20% | Dow +0.69%

FIXED INCOME: Barclays Agg Bond +0.21% | High Yield +0.41% | 2yr UST 4.937% | 10yr UST 4.605%

COMMODITIES: Brent Crude +1.62% to $88.41/barrel. Gold -0.41% to $2,336.7/oz.

BITCOIN: -0.17% to $66,456

US DOLLAR INDEX: -0.36% to 105.691

CBOE EQUITY PUT/CALL RATIO: 0.57

VIX: -7.38% to 15.69

Quote of the day

“Life is what happens when you’re busy making other plans.”

- John Lennon

Safe-haven assets

Over the past few weeks, risk assets have struggled on the back of a combination of stronger-than-expected inflation in the United States – leading to a repricing of Central Bank policy in a more hawkish direction – and geopolitical tensions flaring in the Middle East.

The uncertainty around the outlook has contributed to investors' appetite for safety. Investors seek safe-haven assets to help hedge a portfolio during difficult markets.

While safe-haven asset volatility has increased recently, it does not look particularly elevated versus history. Gold, the U.S. dollar, and the Swiss Franc (vs. the Euro) have turned the most expensive, rising above the levels around the Hamas attack last October.

The recent few years of major geopolitical shocks have many investors wondering how to protect their portfolios from these adverse tail risks.

While geopolitical and political events represent key risks for portfolios, they are particularly difficult to position for and thus risk premia might not reflect related risks until they become prominent. Geopolitical episodes, in particular, can drive rapid and sharp drawdowns in assets, but timing and market impact tend to be hard to anticipate.

Given the challenges in timing geopolitical events and their heterogeneity due to potentially very different drivers of risks and underlying macro conditions, I think robust portfolio construction and diversification still represent the first line of defense for investors.

However, in periods of heightened geopolitical risk, investors may want to hedge more proactively, resorting to safe-haven assets.

The Dollar and U.S. Treasuries have been the most consistent portfolio hedges throughout historical geopolitical conflicts, but commodities exposure has also tended to help as conflicts have often had spillover effects on the supply-side.

Source: Goldman Sachs Global Investment Research

Staggering losses for long-dated bonds

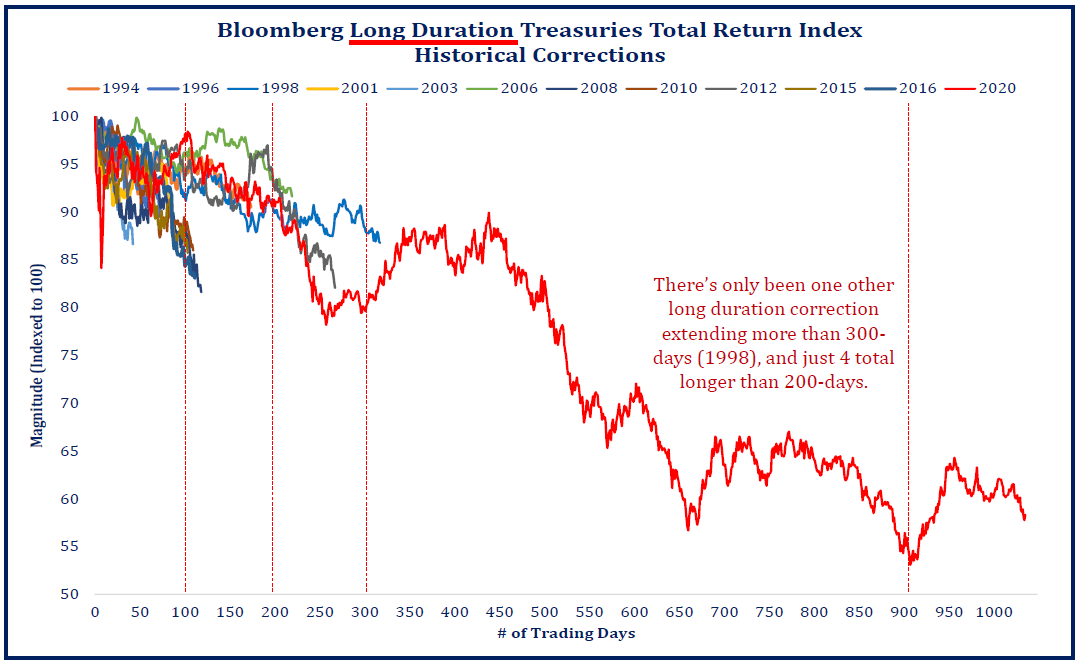

The drawdown in long duration U.S. Treasuries is now 1,000 days and counting (red line).

The prior record was just over 300 days in 1998 (royal blue line).

The iShares 20+ Year Treasury Bond ETF (TLT) is -48% off its highs, just a smidge better than its absolute low of -51%.

The bond market continues to struggle with rising rates and higher inflation.

Source: Todd Sohn

Fed balance sheet amidst ongoing Quantitative Tightening (QT)

Since June 2022, the Federal Reserve has been engaging in Quantitative Tightening (QT) to reduce the size of their balance sheet.

Alongside the interest rate hikes that grabs the lion’s share of attention, the Fed has utilized this 2nd monetary policy tool to shrink its footprint on markets – any maturing security on their balance sheet is “rolled off” without being reinvested.

The caps currently in place are $60B in U.S. Treasuries per month and $35B in MBS, effectively reducing liquidity by $95B per month – although the actual amounts have been less than the caps (mainly on the MBS side).

The Fed's balance sheet is now at its lowest level since January 2021, down $1.5T from its peak in April 2022.

Below is a snapshot of just the U.S. Treasuries on the asset side of the Fed’s balance sheet, which is lighter by ~$1.23T USTs from the 2Q22 peak.

How much more Quantitative Tightening (QT) is needed to unwind the massive Quantitative Easing (QE) from March 2020 – April 2022?

$3.3T.

Source: Piper Sandler, YCharts

Finance, tech job drought nearing its end

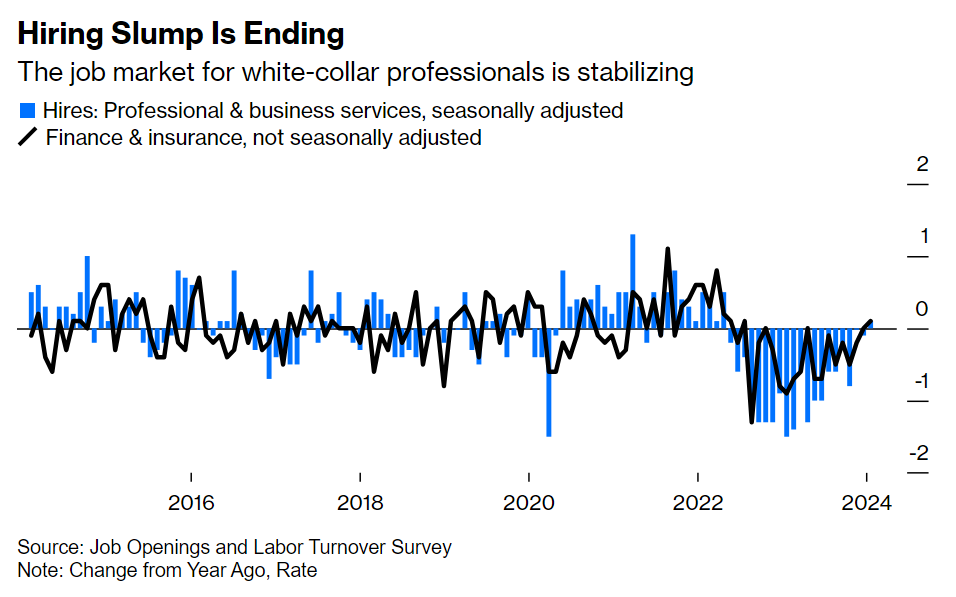

After roughly two years of white-collar shrinkage, the job drought in finance and tech may be over.

In 2022 and 2023, Wall Street largely cheered on the cost-cutting measures of layoffs as many businesses needed to right-size their employee base after the hiring boom in 2020 and 2021. Showing a commitment to cost discipline and operating profits, shareholders rewarded tech and bank stocks by sending many to new all-time highs or new 52-week highs.

Below is a chart using data from the BLS Job Openings and Labor Turnover Survey (JOLTS) report showing the two categories hooking higher in 2024. The professional and business services category – encompassing corporate managers, accountants, lawyers, and technical workers – is shown in blue, while the finance and insurance category is shown in black.

“Labor market conditions now appear to be somewhere between stabilizing and improving for these workers, pointing to better times ahead.”

Source: Bureau of Labor Statistics, Conor Sen

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.