Sam Bankman-Fried on trial, plus hot jobs report and bond losses exceed GFC stock losses

The Sandbox Daily (10.3.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the emperor has no clothes

JOLTS report shows job openings surge

staggering losses over in bond land

Let’s dig in.

Markets in review

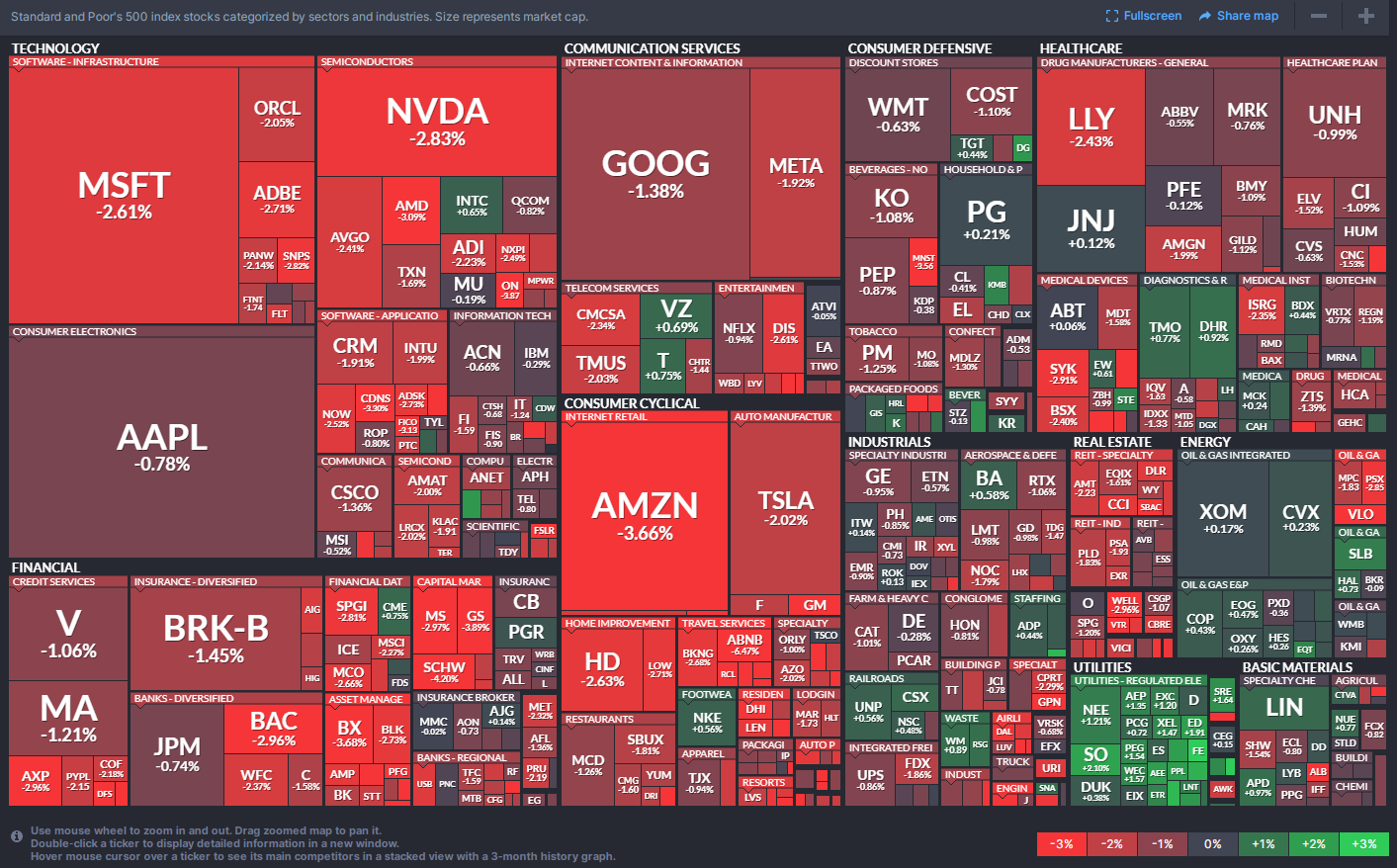

EQUITIES: Dow -1.29% | S&P 500 -1.37% | Russell 2000 -1.69% | Nasdaq 100 -1.83%

FIXED INCOME: Barclays Agg Bond -0.78% | High Yield -1.02% | 2yr UST 5.148% | 10yr UST 4.795%

COMMODITIES: Brent Crude +0.45% to $91.12/barrel. Gold -0.40% to $1,839.9/oz.

BITCOIN: -0.36% to $27,452

US DOLLAR INDEX: +0.11% to 107.025

CBOE EQUITY PUT/CALL RATIO: 0.76

VIX: +12.32% to 19.78

Quote of the day

“Your personal experiences with money make up maybe 0.00000001% of what's happened in the world, but maybe 80% of how you think the world works.”

- Morgan Housel, The Psychology of Money

The emperor has no clothes

The criminal trial of Sam Bankman-Fried, the disgraced founder and CEO of cryptocurrency exchange FTX and its sister trading company Alameda Research, began today with jury selection in lower Manhattan. The trial, expected to last 6 weeks, will not be televised – but will nonetheless dominate headlines over the coming months.

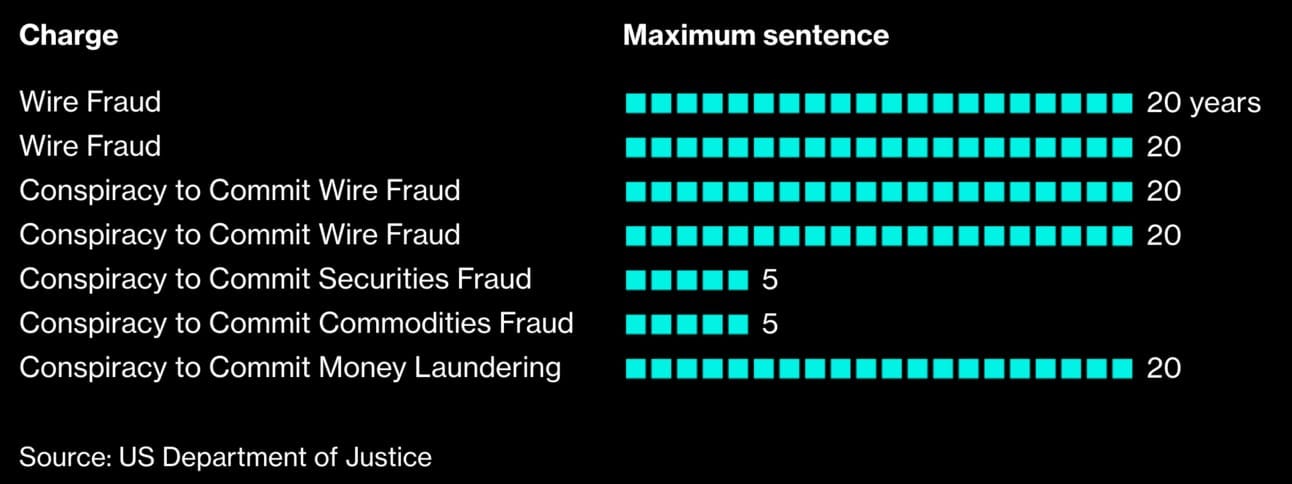

Federal prosecutors have charged him with siphoning billions of customer deposits for personal use (venture investments, political contributions, real estate purchases, charitable donations, etc.) as well as commingling customer funds, among many other crimes. SBF must overcome a mountain of evidence and damning testimony from his top 4 lieutenants who have all plead guilty and agreed to testify against him.

If convicted, many legal experts expect a sentence of 10 years to life in prison.

FTX, once valued as rich as $32 billion dollars in market cap, went into bankruptcy protection in November 2022 with ~$8-10 billion of customer deposits missing.

Once upon a time, FTX founder and CEO Sam Bankman-Fried was hailed as a white knight for the crypto ecosystem, led the regulatory charge to work with Congress for regulation, and as recently as last summer, had been featured on the cover of Fortune magazine receiving the moniker “the next Warren Buffet.”

The defense team for Sam Bankman-Fried will likely argue the company was undone by poor governance, clumsy management, and ineffective risk controls.

Yet, many are wondering how the best venture capitalists in the world were deceived by Sam Bankman-Fried. Here is a look at the due diligence process that Sequoia Capital, Softbank, Lightspeed Venture Partners, and Third Point, among many others, ran on FTX and their corporate financial statements:

The failure of FTX has been a stain on the industry and a significant setback for the digital asset ecosystem, damaging confidence and destroying trust.

Michael Lewis's biography on SBF – Going Infinite: The Rise and Fall of a New Tycoon – is out today.

Source: New York Times, CoinDesk, Bloomberg, CNBC, The Information

Job openings surge

Today, there was indiscriminate selling and few places to hide. The NYSE advance/decline ratio was a negative 5.4 to 1.

Unlike the last week or so, interest rates were not surging higher based on technicals or momentum or some other abstract explanation, but rather a tangible piece of economic data: this morning’s JOLTS report.

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

The number of job openings that employers reported in August rebounded strongly, up to 9.61 million available positions and above the consensus estimate of 8.8 million. This was the 1st increase in 4 months and the most since July 2021, however we are firmly off the cyclical peak of 12.0 million in March 2022 when the Federal Reserve initiated its tightening cycle. The number of openings remain ~40% higher than pre-COVID.

The report showed that the ratio of job openings to unemployed Americans edged down marginally to 1.51 from 1.53 in the prior month – well below the cycle peak of 2.01 which does reflect some labor demand/supply rebalancing.

Elsewhere, the Quits Rate was unchanged at 2.3%, its lowest level since January 2021 and in line with the pre-pandemic rate.

The Fed is closely watching the progress of labor demand/supply rebalancing. Persistent strength in the job market, however, could lead the Federal Open Market Committee to pursue another rate hike at their next meeting on November 1st.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg

Staggering losses over in bond land

Long Duration U.S. Treasury Bonds have now lost more in percentage terms than stocks did during the Global Financial Crisis (GFC) in 2008-2009.

The drawdown in the Vanguard Extended Duration Treasury ETF (-58.3%) now exceeds the peak-to-trough losses suffered in the S&P 500 during the GFC crash (-56.0%).

The selloff in bonds has also taken twice as long, so the suffering has been painful across both time and value.

Source: Callum Thomas

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.