Savings rates show Americans are serious about retirement, plus economic surprises, new home sales, and AMZN hits $2T

The Sandbox Daily (6.26.2024)

Welcome, Sandbox friends.

Amazon topped $2 trillion in market valuation for the 1st time ever and Fundstrat’s Tom Lee thinks we could see S&P 15,000 by 2030.

Today’s Daily discusses:

savings rates for 401(k) plans show Americans are serious about retirement

economic dashboard has softened

new home sales plunge

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.25% | S&P 500 +0.16% | Dow +0.04% | Russell 2000 -0.21%

FIXED INCOME: Barclays Agg Bond -0.45% | High Yield -0.22% | 2yr UST 4.753% | 10yr UST 4.329%

COMMODITIES: Brent Crude +0.28% to $85.25/barrel. Gold -0.19% to $2,308.9/oz.

BITCOIN: -1.81% to $60,966

US DOLLAR INDEX: +0.42% to 106.050

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: -2.26% to 12.55

Quote of the day

“The key is not to prioritize what’s on your schedule, but to schedule your priorities.”

- Stephen Covey, The 7 Habits of Highly Effective People

Savings rates for 401(k) plans show Americans are serious about retirement

The savings rate for the average 401(k) plan, including employee and company contributions, is at record highs.

This week, Vanguard reported the average 401(k) plan savings rate maintained a record 11.7% in 2023, matching the same record high from 2022. Vanguard runs a yearly analysis of more than 1,500 qualified plans and nearly 5 million participants.

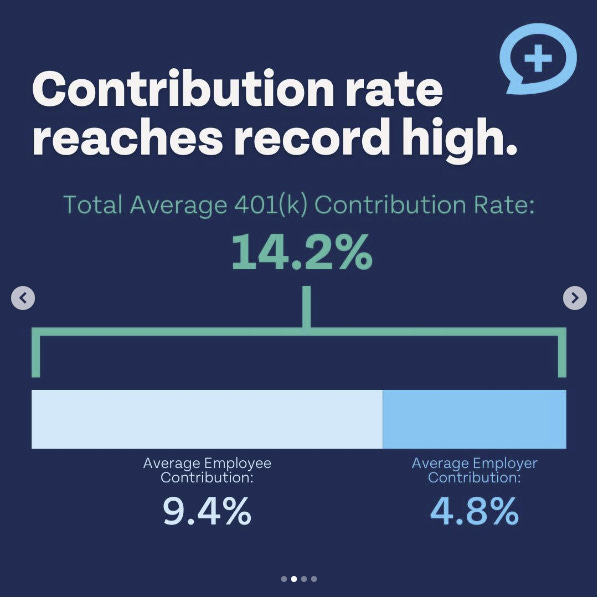

A separate report from Fidelity found on its platform the savings rate was a record high 14.2% in the 1st quarter of 2024, based on almost 26,000 corporate plans and nearly 24 million participants.

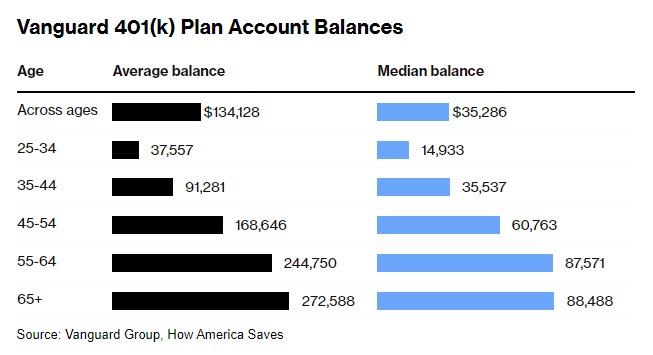

With strong market performance and contribution rates, it’s no surprise to see account balances achieve their highest levels since 2021.

Both platforms noted roughly 15% of participants hit the 401(k) deferral limit.

Higher savings rates are very encouraging for future prosperity, so both reports were widely celebrated.

On the less rosy side, the average account balance – while up last year – is still nowhere near the levels needed to afford a comfortable retirement, especially as Social Security benefits face their own challenges in the coming years.

Source: Bloomberg, Vanguard, Fidelity

Economic dashboard has softened

When will bad news be bad for markets?

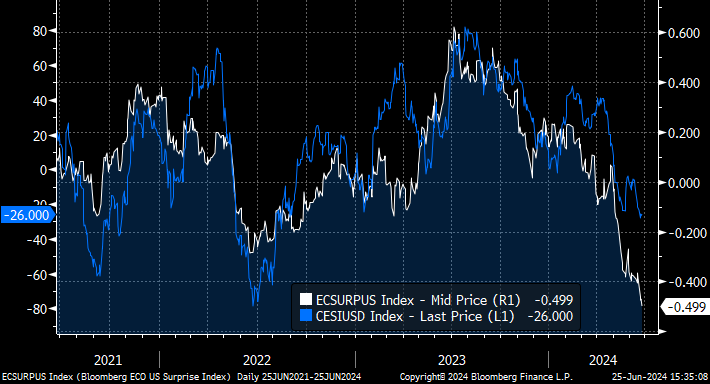

There certainly has been a lot of focus on the decline in U.S. economic data over the past few months, as both Citigroup and Bloomberg’s economic surprise indexes are in negative territory for the 1st time in over a year – these indexes measure how closely economic data points turn out to match analysts’ forecasts. In fact, in the next section below, we review today’s new home sales data that also badly missed expectations.

And yet, the market has mostly shrugged this off as the indexes print one fresh new high after another.

Two simple reasons why ecodata could improve in the 2nd half of 2024:

Expectations have declined somewhat in recent months in reaction to weaker data. As analysts lower their outlooks, the hurdle rate becomes more manageable. Wall Street’s been slinging this snake oil for decades.

Changes in financial conditions – i.e. 10-yr rates and stock prices – are creating mini cycles in survey (“soft”) data as the major macro impulses have largely faded (supply shocks, inflation shocks, Fed tightening, commodity spikes, etc.). The byproduct of this has led to less macro and market volatility.

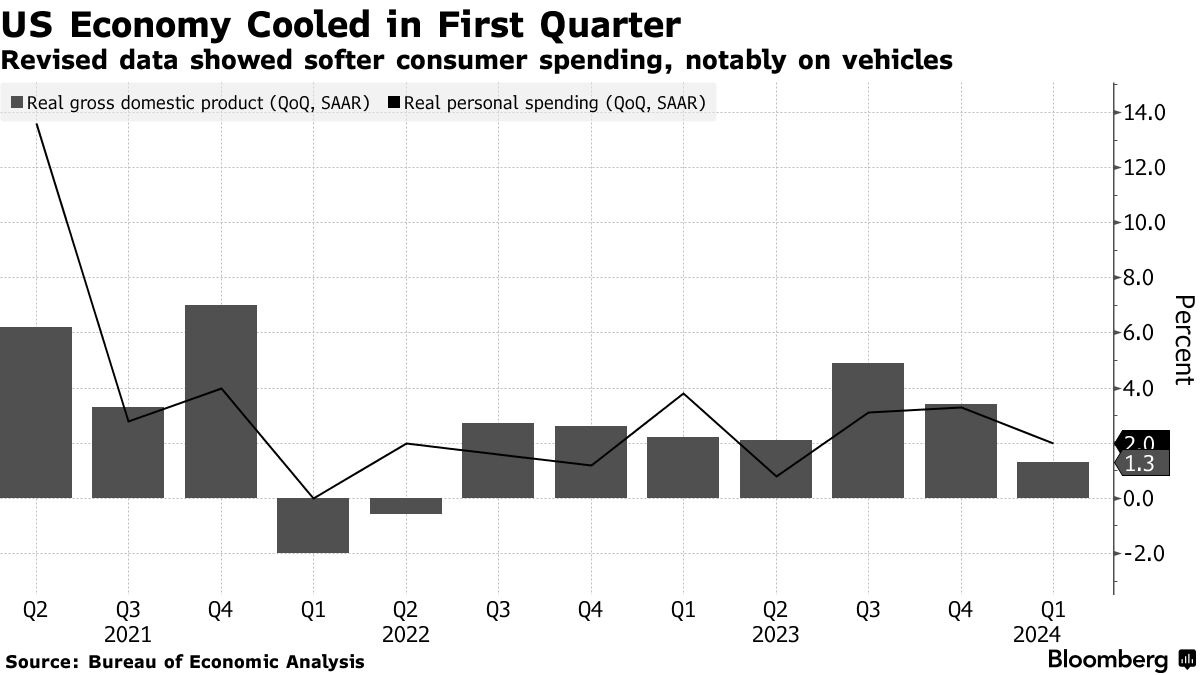

The economy has been running at or above trend for several quarters, so this soft patch could be just that – an economy coming off a high base.

Also keep in mind that different parts of the economy are performing along unique (and dissimilar) trajectories, which makes it hard to generalize about the U.S. economic situation. There have been upside surprises in two of the economy’s most important sectors: personal/household and the labor market. At the same time, results from retail and wholesale have been mostly as expected. Finally, there have been a spate of negative surprises in the real estate and industrial sectors.

Economic researcher Jim Paulsen had this to say: “Embrace economic diversity.”

The implication for the market is stocks will have to earn their returns through good old-fashioned earnings given we’ve probably seen the bulk of P/E expansion from lower rates and soft/bad data thus far.

Source: Bloomberg, Piper Sandler, Barron’s

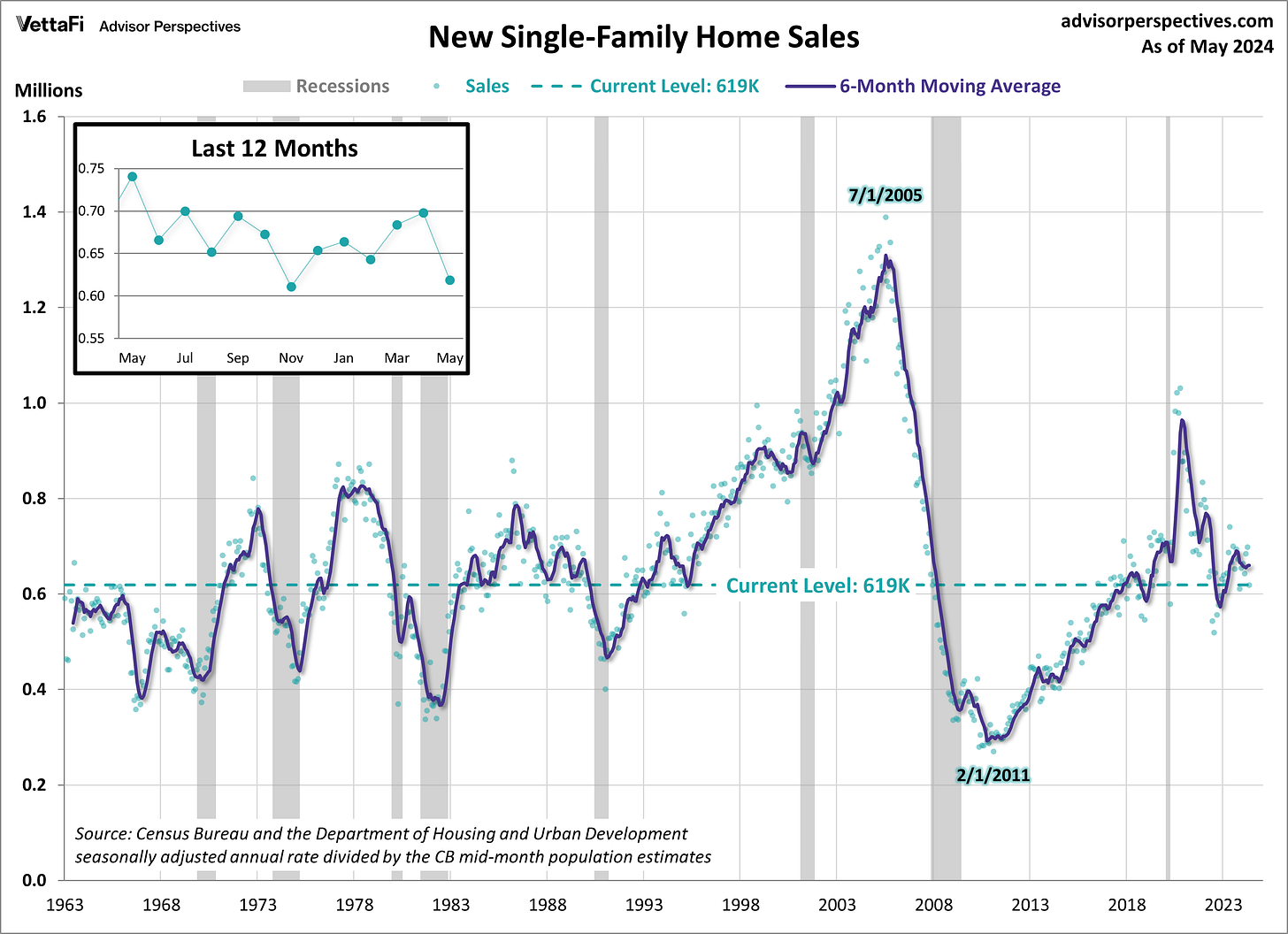

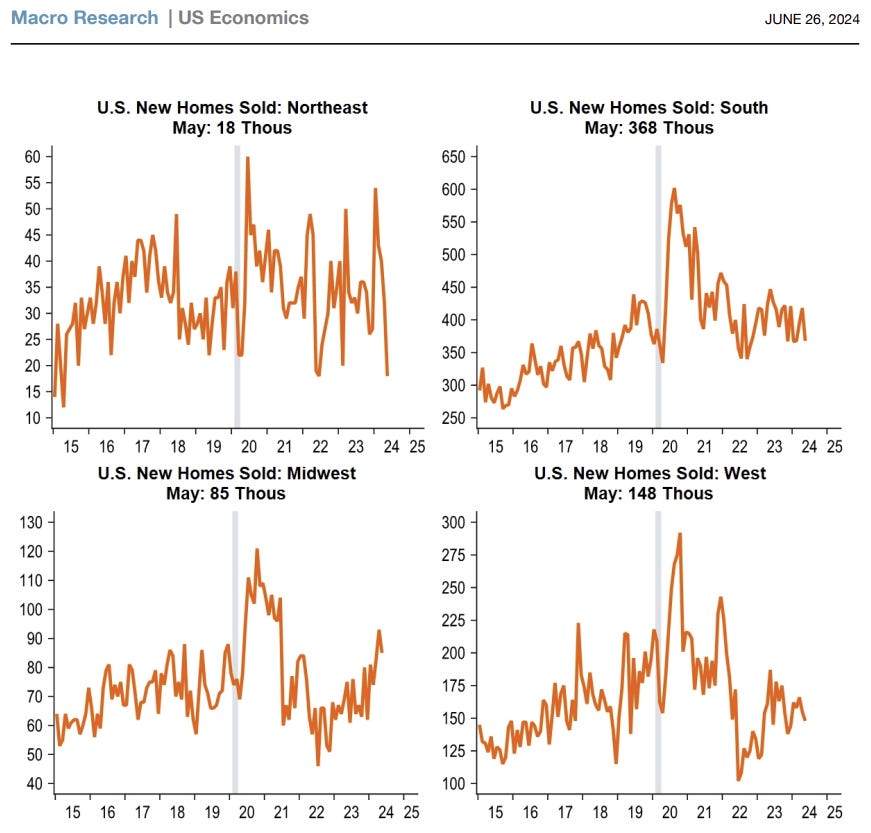

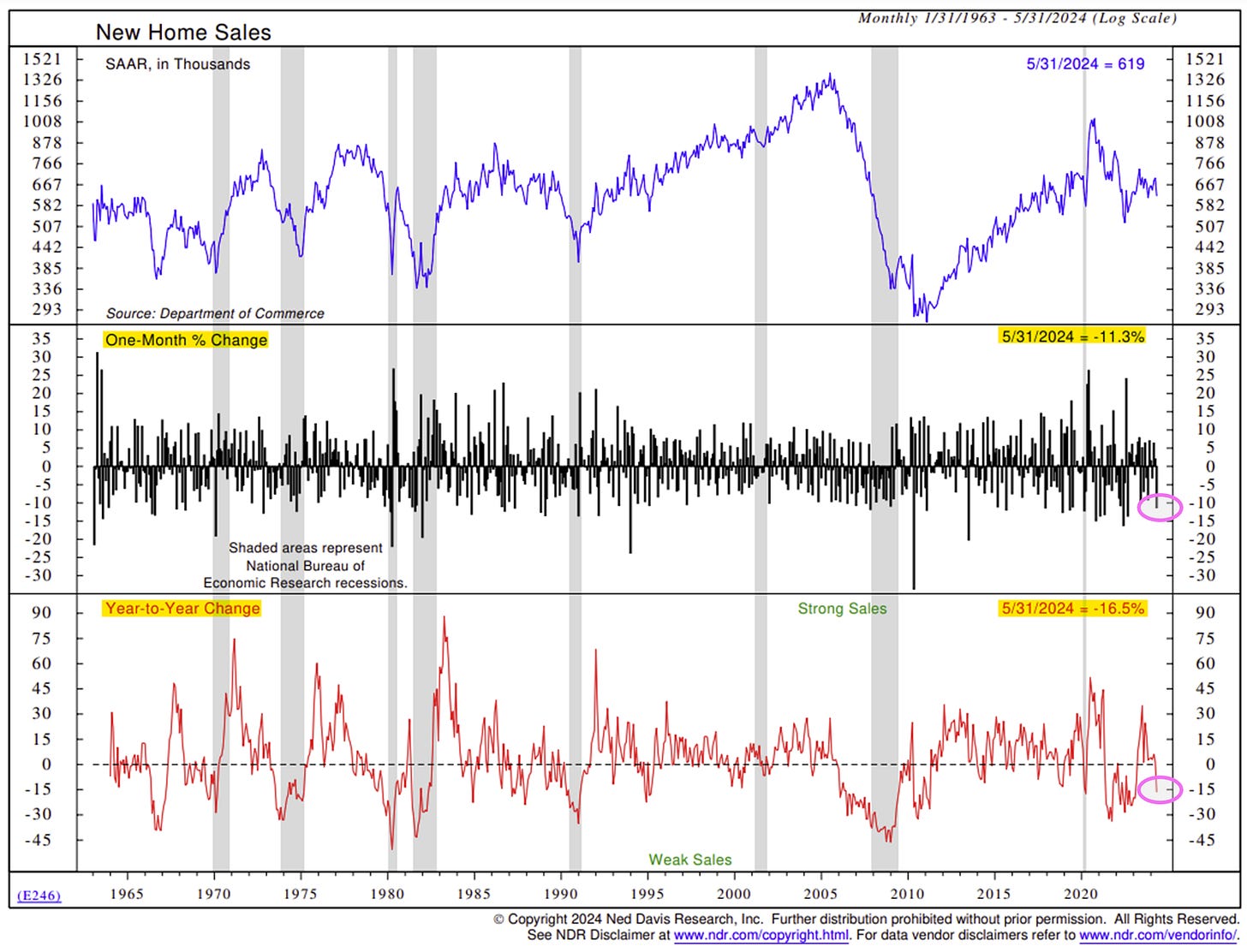

New home sales plunge

New home sales fell sharply in May by -11.3% to a seasonally-adjusted 619,000 annual rate, the largest decline since September 2022 and represents a 6-month low.

Today’s report – like much of the eco data of late – came in below the consensus expectation, which called for a +0.2% increase to a 636,000 rate.

On the positive side, the prior month was upwardly revised by 64,000 to a 698,000 annual rate.

Sales fell across all regions, led by a 43.8% collapse in the Northeast.

From a year earlier, new home sales are down -16.5%, the largest fall since February 2023.

Generally speaking, the level of sales continues to fluctuate sideways as it did for much of 2023.

Falling affordability, largely influenced by still-high mortgage rates, has dented demand for new home purchases. New home sales have struggled to grow despite an increase in mortgage applications to builders, a traditionally solid coincident indicator.

Source: Piper Sandler, Ned Davis Research, Advisor Perspectives

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.