Seasonal headwinds, plus the Fed's inflation measure, industrials, and EVs

The Sandbox Daily (8.31.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

September headwinds?

Fed’s preferred inflation measure picks up in July

industrials looking to reclaim leadership

EV market sees total collapse in valuations

BIG sad day for us – the little ones are all grown up. Having 4 under 3 was an absolute blessing, but boy did we endure our share of sleepless nights and bits of chaos under this roof. Now they’re all off to the same school – one drop off, all day, 5 days a week – for many years to come. No doubt, parents all across the world are experiencing the same set of mixed emotions right now – I feel you. Go get ‘em, rugrats !!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.25% | S&P 500 -0.16% | Russell 2000 -0.19% | Dow -0.48%

FIXED INCOME: Barclays Agg Bond +0.14% | High Yield -0.07% | 2yr UST 4.863% | 10yr UST 4.106%

COMMODITIES: Brent Crude +1.16% to $86.83/barrel. Gold -0.33% to $1,966.4/oz.

BITCOIN: -5.02% to $25,934

US DOLLAR INDEX: +0.46% to 103.632

CBOE EQUITY PUT/CALL RATIO: 0.86

VIX: -2.23% to 13.57

Quote of the day

“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.”

- Stephen Hawking

September headwinds?

After a brief and minor early-month pullback, stocks have regained their footing with growth and tech leading the charge. The major averages, however, close the month with losses.

As discussed heading into August, we are in the midst of the weakest seasonal period on the calendar. This we know.

September’s average gain since 1950 for the S&P 500 index is -0.66%, marking the worst performing month of the year. Combined with August, it was a perfectly logical spot for the major indexes to take a breather and digest gains.

The Dow Jones Industrial Average index is no different. Below are the average percentage changes by month over the last 20, 50, and 100 years. September is the only month in which the Dow declines on average across all three time frames.

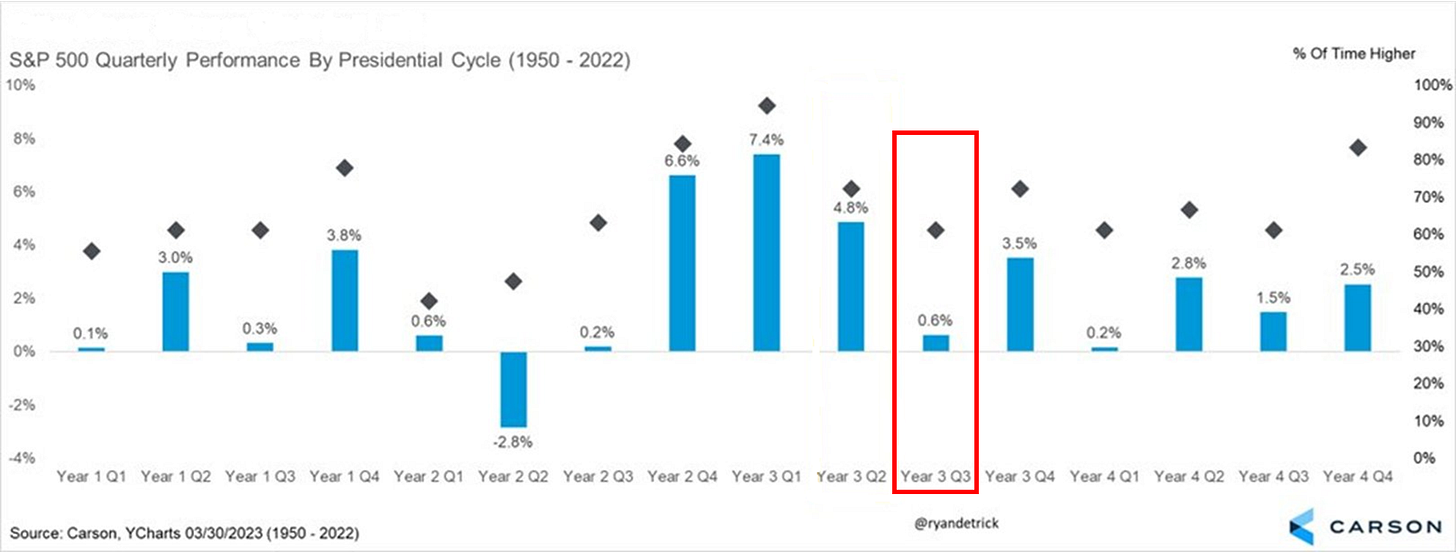

And when you review the 4-year Presidential Election cycles going back to 1950, the weakness in stocks is occurring at exactly the time they’re supposed to. After completing the most bullish periods of the 4-year cycle, the 3rd quarter of pre-election years – July to September 2023, in this case – is a great spot to take a pause.

At risk of stating the obvious, it’s important to remember that only price pays. These seasonal charts are just a roadmap for how humans have behaved historically.

We only use these tools to put the environment into context, similar to sentiment or positioning data.

Source: All Star Charts, Bespoke Investment Group, Ryan Detrick

Fed’s preferred inflation measure picks up in July

Inflation pressures continued to moderate in July, confirming the Fed’s shift to a slower pace of tightening this year.

The Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, showed core inflation increased +0.2% MoM – in line with estimates and the smallest back-to-back increases since late 2020.

As for the YoY change, core PCE inflation rose to +4.2%.

Since the year-over-year changes can be distorted by base effects, it’s better to measure the 3-month annualized rate of change as a better gauge of the core inflation trend. It eased for the 5th consecutive month in July to 2.9%, the lowest rate since January 2021.

Most of the slowdown in inflation has come from the goods side, but core inflation continues to run above the Fed’s target of 2%. As favorable base effects diminish in the 2nd half of this year, further progress on inflation will prove more difficult, especially if the labor market remains tight and consumer demand holds up.

This latest PCE report suggests that while the Fed should be nearing the end of its tightening cycle, it may keep rates higher for longer than markets currently anticipate.

Source: Bureau of Economic Analysis, Ned Davis Research, Dwyer Strategy, Bloomberg

Industrials looking to reclaim leadership

The Industrial Sector (XLI) has the highest correlation to major U.S. averages, making it a great indicator of market health.

Industrials consolidated sideways for 7 months before breaking out in May. XLI is currently in the process of testing and reclaiming its 2021 highs around $107-$108, flipping former resistance into support.

After this minor pullback in August, XLI is looking to take out its all-time highs next. As long as demand overwhelms supply at this crucial level, it is a bullish development for the broader market.

On a relative basis against the S&P 500 index, the upward trend remains intact confirming its leadership going back to the pandemic bottom.

If these key leadership groups continue this recent upward strength – semiconductors, tech, homebuilders, industrials, etc. – then expect the major indexes to follow suit.

Source: Brown Technical Insights

EV market sees total collapse in valuations

Generally, I don’t pay much attention to fake X accounts (f.k.a. Twitter), but this simple chart highlighting market performance from the fringe EV market is startling.

Investors must remind themselves to separate ideas across these 3 buckets – great ideas, great businesses, and great stocks – because they’re not the same things.

At the end of the day, fundmentals underlying the business matter to investors. These stocks suffered mightily because of excessive hype/hope in a legacy automotive industry that is nearly impossible to survive. Acing a business with huge R&D outlays, high fixed costs, and complicated supply chains is no small feat.

Obviously, this chart ignores more credible threats to Tesla, such as Ford Motor (F), General Motors (GM), Toyota Motor (TM), Volkswagen (VWAPY), Mercedes (MBGYY), BMW (BMWYY), or the Chinese manufacturers which will all carry growing market share in the years to come.

Source: Not Jerome Powell, Counterpoint

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.