Seasonals support Santa Claus rally, plus sentiment, Fed's preferred inflation gauge, and Spotify's year-end lists (hello Bad Bunny, goodbye Beyonce)

The Sandbox Daily (12.1.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the seasonal data that supports a year-end rally for stocks, poor sentiment continues to plague investors, the October Personal Consumption Expenditures (PCE) report shows further moderation in prices (hard data is catching down to the soft data), and streaming giant Spotify releases their year-end report on music and podcasts.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.10% | S&P 500 -0.09% | Russell 2000 -0.26% | Dow -0.56%

FIXED INCOME: Barclays Agg Bond +0.83% | High Yield +0.37% | 2yr UST 4.236% | 10yr UST 3.510%

COMMODITIES: Brent Crude -0.44% to $87.03/barrel. Gold +1.63% to $1,788.1/oz.

BITCOIN: -0.78% to $16,947

US DOLLAR INDEX: -1.10% to 104.708

CBOE EQUITY PUT/CALL RATIO: 1.27

VIX: -3.60% to 19.84 (first close under 20 since August 18th)

Seasonal data supports year-end rally

Historically, December has been a strong month – averaging a +1.6% return since 1950 – which is the 3rd best month of the year (April and November are stronger).

In fact, no month is more likely to be higher for the S&P 500 than December, up 75% of the time over that period. To help setup this chart, the left y-axis shows the average monthly return while the right y-axis is right-sized to show the percentage of time that the month is a positive return.

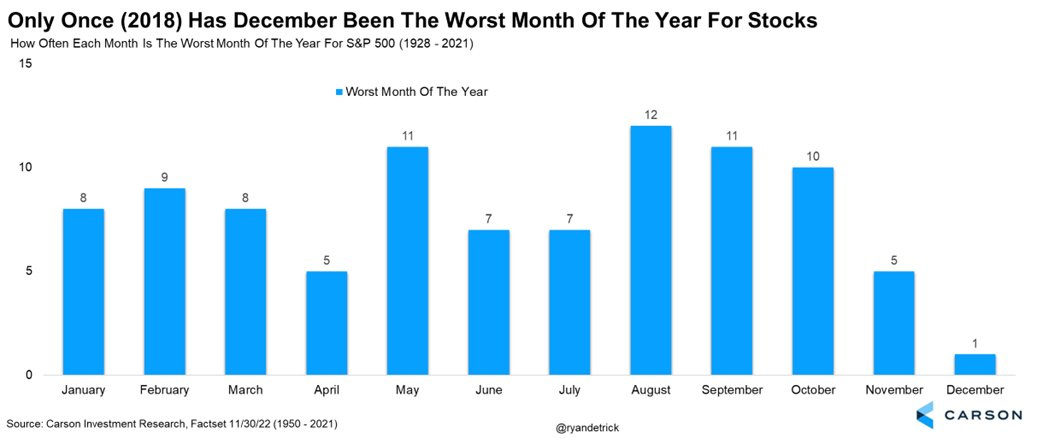

And if you back up the data to 1928, only once in history (2018) was December the worst month of the year for stocks.

But don’t get too comfortable. December could turn out to be a wild month with two important dates coming up:

Consumer Price Index (CPI) report arrives December 13th

The Federal Reserve delivers their next policy decision regarding rate hikes, balance sheet, inflation, and the rest on December 14th

Source: Carson Investment Research, Ryan Detrick

Poor investor sentiment continues

According to the most recent American Association of Individual Investors (AAII) sentiment poll, bears (red) have outnumbered bulls (green) for 35 consecutive weeks. Such is the longest streak going back to at least 1987.

2022’s investor sentiment hasn’t eclipsed the zero line (neutral), yet alone the long-run average of 6.7% for the entire data series.

Investors expressing their need for protection have more or less been held in check this year, until the recent spate of spikes we’ve witnessed that show an increasing desire for downside protection. Here’s a look at the Chicago Board Options Exchange Put/Call Ratio measuring the amount of puts (signaling bearish sentiment) versus calls (bullish sentiment) traded.

When looking at multi-asset performance this year, it’s no surprise to see sentiment totally washed out.

Source: American Association of Individual Investors, Lance Roberts, Sandbox Financial Partners

PCE deflator

The market received a rather benign inflation reading for the month of October, this time from the Federal Reserve's preferred inflation measure – the Personal Consumption Expenditures Index (PCE).

The overall price index increase +0.3% for a 3rd month and was up +6.0% from YoY, well above the central bank’s 2% goal. Excluding the more volatile food and energy categories, the core PCE index – which Fed Chair Jerome Powell stressed this week is a more accurate measure of where inflation is heading – rose just +0.2% after two straight months of +0.5% increases and is up 5% from a year earlier.

While the overall inflation levels remain high, the month-to-month moderation is encouraging and suggests the Federal Reserve’s policy for the tightening of financial conditions is feeding through the economy and slowing the rapid price growth we’ve seen over the last two years.

Source: Bureau of Economic Analysis, Ned Davis Research, Bloomberg

Spotify’s “Wrapped 2022” is here

Streaming giant, Spotify ($SPOT), released their year-end report yesterday.

Spotify unveiled the platform’s top performers, with Bad Bunny retaining his crown as the most streamed artist globally. It’s a three-peat for global recording artist Bad Bunny. The singer-songwriter is the year’s most-streamed artist in the world on Spotify—a spot he’s held since 2020. No other artist has ever accomplished the feat before. Taylor Swift’s new Midnights album helped propel her to the 2nd-most-streamed artist of the year globally. And, in a huge surprise, Beyonce’s big come back falls flat as her name is nowhere to be found on these lists.

Song of the summer 2022 creator Harry Styles takes the coveted honor of having the most-streamed song around the globe with his hit “As It Was.” My 4 kids listened to this song maybe 10,000 times. Where is Beyonce’s “Break My Soul” ??

The top podcasts were dominated by Spotify’s own programming, with The Joe Rogan Experience leading the pack.

And for those stuck living in the past, take a tour down Nostalgia Lane for the most-streamed songs that were released more than 20 years ago. RIP Coolio!

Source: Spotify, Variety, The Verge

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.