Sector divergences, plus global inflation, SPACs, mortgage rates, and TIME's person of the year

The Sandbox Daily (12.7.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the sector divergences defining the S&P 500, inflation around the world, the collapse in SPAC markets, U.S. mortgage rates tumble for the 4th week in a row, and the TIME person of the year.

Let’s dig in.

Markets in review

EQUITIES: Dow 0.00% | S&P 500 -0.19% | Russell 2000 -0.31% | Nasdaq 100 -0.45%

FIXED INCOME: Barclays Agg Bond +0.89% | High Yield +0.55% | 2yr UST 4.264% | 10yr UST 3.420%

COMMODITIES: Brent Crude -2.47% to $77.39/barrel. Gold +0.79% to $1,798.7/oz.

BITCOIN: -0.83% to $16,853

US DOLLAR INDEX: -0.39% to 105.165

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: +2.30% to 22.68

Sector divergences

In a year where long-term investors and short-term traders have been chopped up alike, one only needs to drill down into sector performance to understand why.

Energy, once a heavyweight of the S&P 500, now only represents ~5% of the index and the sector group is returning +58.5% year-to-date. Remember, Energy returned +53.31% in 2021. And some talk about an energy supercycle…

Then we have defensive groups including utilities, consumer staples, and health care that are nearly flat on the year (+1.4%, +0.0%, -1.4%).

Skipping some sectors in the middle, we arrive at the worst performers: Tech -24.6%, Real Estate -24.9%, Consumer Discretionary -31.3%, and Communication Services at -35.6%.

This year, you’re looking at a return spread of 94.14% between the strongest stocks (energy) and the worst stocks (comm services). Wow!

Source: Sandbox Financial Partners

Which countries have the highest inflation?

Inflation is surging nearly everywhere in 2022.

Geopolitical tensions are triggering high energy costs, while supply-side disruptions are also distorting consumer prices. The end result is that almost half of countries worldwide are seeing double-digit inflation rates or higher. With new macroeconomic forces shaping the global economy, this infographic shows countries with the highest inflation rates.

As price pressures mount, 33 central banks tracked by the Bank of International Settlements (out of a total of 38) have raised interest rates this year. These coordinated rate hikes are the largest in two decades, representing an end to an era of rock-bottom interest rates.

Source: Visual Capitalist, Trading Capitalist

SPACs are struggling

If 2021 was the year of the SPAC, 2022 is the year of terminating the SPAC. This week alone saw $11 billion in SPAC deals called off within a single hour. That puts the total number terminated for 2022 at 54, twelve more than all SPACs terminated over the last five years.

SPACs are special purpose acquisition companies — essentially a company with a big blank check that buys private companies. They offer a quicker route to public markets, skipping long roadshows, negotiations and some of the due diligence of a traditional IPO process. When stock markets were near all-time highs, SPACs were an attractive option for private companies looking to go public – the total number of SPAC deals hit 613 last year. That euphoria is now long gone. So far this year, only 83 companies have gone public through a merger with a SPAC.

As investors become more cautious and required more rigorous due diligence, traditional IPO processes — which often involve deep scrutiny of the company and its financials — are looking a safer bet. Indeed, recent research by Bedrock found that 49% of the quarterly financial filings by de-SPACs since 2020 contained an admission of ineffective internal controls.

Source: Chartr

U.S. mortgage rates fall a 4th week, longest stretch since 2019

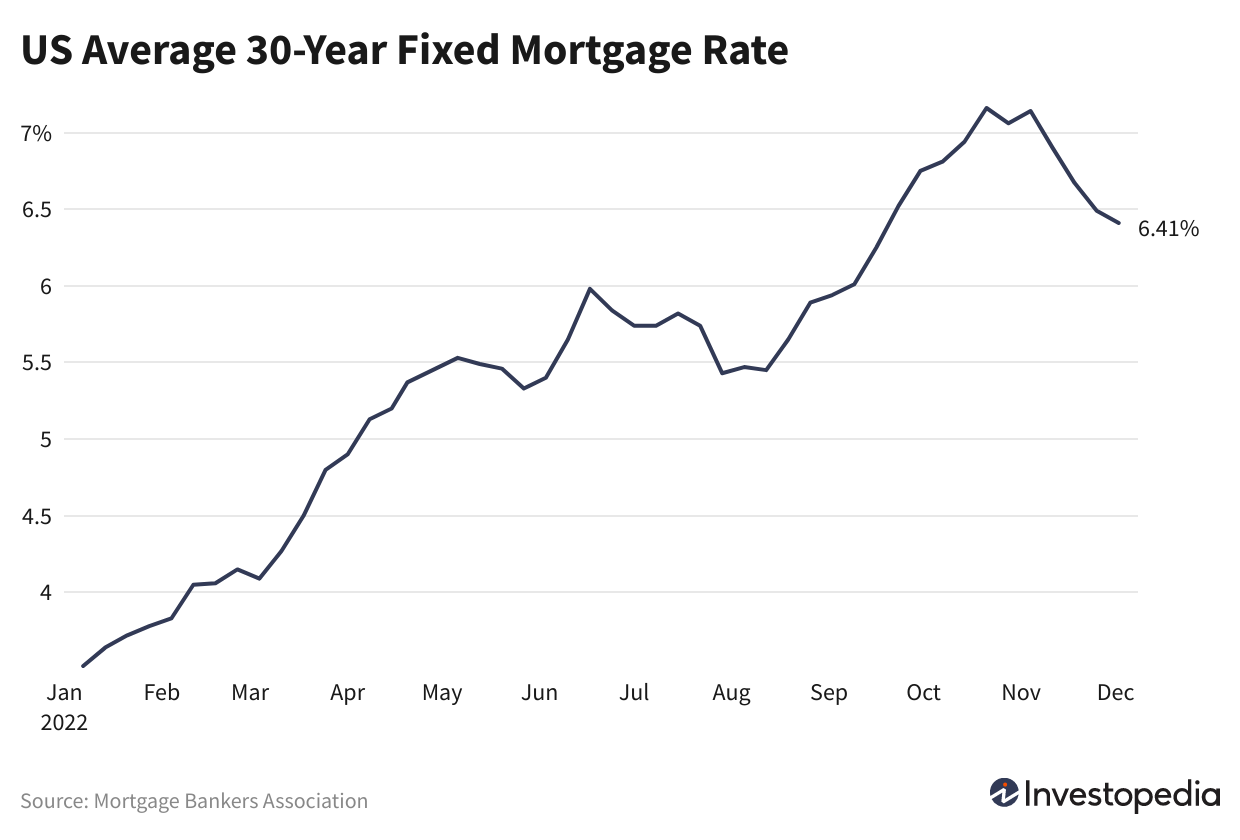

Mortgage rates dropped for the fourth consecutive week, the longest stretch of declines since May 2019.

The Mortgage Bankers Association (MBA) reported the average rate on a 30-year, fixed-rate conforming home loan (up to $647,200) for the week ending Dec. 2 was 6.41%, down from 6.49% the week before and the lowest it’s been since mid-September.

Rates had hit a more than two-decade high of 7.16% in October as the Federal Reserve boosted borrowing costs in an effort to bring down inflation.

Joel Kan, the MBA’s vice president and deputy chief economist, said that while the average 30-year mortgage rate was 73 basis points (bps) lower than a month ago, it was still more than 3 percentage points above what it was last December.

Source: Mortgage Bankers Association, Bloomberg, Calculated Risk, Investopedia

TIME’s person of the year: Volodymyr Zelensky and the spirit of Ukraine

This year’s choice was the most clear-cut in memory.

Whether the battle for Ukraine fills one with hope or with fear, Volodymyr Zelensky galvanized the world in a way we haven’t seen in decades. In the weeks after Russian bombs began falling on Feb. 24, his decision not to flee Kyiv but to stay and rally support was fateful. From his first 40-second Instagram post on Feb. 25 - showing that his Cabinet and civil society were intact and in place - to daily speeches delivered remotely to the likes of houses of Parliament, the World Bank, and the Grammy Awards, Ukraine’s President was everywhere. His information offensive shifted the geopolitical weather system, setting off a wave of action that swept the globe.

In a world that had come to be defined by its divisiveness, there was a coming together around this cause, around this country that some outside it might not be able to find on a map. At the U.N., 141 countries condemned the invasion; only North Korea, Syria, Eritrea, and Belarus – all dictatorships – voted with Moscow. Major companies pulled out of Russia en masse, erasing billions in revenues. Financial, material, humanitarian, and military support came pouring in. Strangers took in refugees; restaurateurs fed the hungry; doctors flew in to help the wounded. Ukraine’s flag unfurled across social media; its colors, blue and yellow, lit up landmarks from Tokyo to Sandusky, Ohio.

Honoring Volodymyr Zelensky shows the spirit of Ukraine is recognized by everyone around the world in solidarity. For proving that courage can be as contagious as fear, for stirring people and nations to come together in defense of freedom, for reminding the world of the fragility of democracy – and of peace – Volodymyr Zelensky AND the spirit of Ukraine are TIME’s 2022 Person of the Year.

Source: TIME

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.