Sentiment improves, plus recession markers, P/E multiple, and short covering

The Sandbox Daily (2.9.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the reversal in historic negative sentiment, credit spreads do not show imminent risk of recession, the S&P 500 P/E multiple is back to its 5-year average, and last week’s significant short covering.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.73% | S&P 500 -0.88% | Nasdaq 100 -0.91% | Russell 2000 -1.40%

FIXED INCOME: Barclays Agg Bond -0.39% | High Yield -0.65% | 2yr UST 4.484% | 10yr UST 3.664%

COMMODITIES: Brent Crude -1.03% to $84.21/barrel. Gold -0.92% to $1,873.4/oz.

BITCOIN: -4.58% to $21,910

US DOLLAR INDEX: -0.19% to 103.213

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: +5.50% to 20.71

Historic sentiment streaks come to a close

A record streak of bearish sentiment has come to an end following the most recent investor sentiment survey from the American Association of Individual Investors.

Although the S&P 500 has been essentially trading sideways since the FOMC's latest rate decision, investors have taken a far more optimistic tone. The latest data from the weekly AAII sentiment survey showed a surge in the percentage of respondents reporting as bulls. At 37.5%, it is the highest reading since the final week of 2021. Additionally, the current bullish reading is just a tenth of one percentage point below the historical average in bullish sentiment.

And the spread between bulls and bears finally ends after 44 weeks. The latest survey finally shows more bulls (37.5%) than bears (25.0%), the first occurrence in nearly a year!

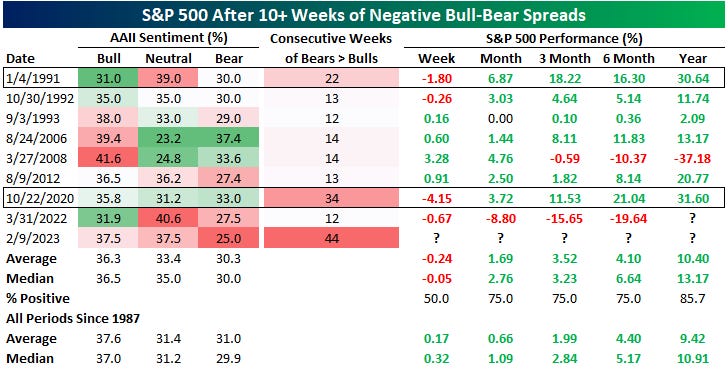

Of course, there are not many examples of bearish sentiment having remained this pessimistic for this long, but looking to the end of past streaks of negative bull-bear spreads that lasted for at least 10 weeks, forward performance has generally been positive once they end. As shown in the table below, across past streaks, returns generally improved with positive returns at least 75% of the time over the following 1-month, 3-month, 6-month, and 12-month time horizons.

Source: American Association of Individual Investors, Bespoke Investment Group

What recession?

Click data shows consumer sentiment in real time, never mind bad/negative headlines. Looks like recession fever broker in June 2022.

We can choose to ignore the headlines that are pushing the recession narrative because as we noted yesterday on credit spreads, go right to the credit markets when looking for signs of serious systemic risk. The perception of credit risk is just nowhere to be found (yet).

After last week’s blowout jobs reporting in which we added over 500,000 jobs in January, U.S. high yield bond spreads tightened to the lowest level since May 2022.

Source: Financial Times, Apollo, Bloomberg

P/E multiple back to 5-year average

The S&P 500 Index is trading at 18.3x its 2023 earnings estimate and 16.5x 2024 earnings. These valuations are no longer cheap like they were in the 4th quarter, but what the healthier stock market does show is that investors are looking forward to a more sustained economic outlook, controlled inflation, a healthy labor force, and no credit crisis.

The recent buying in the S&P 500 along with forward earnings estimates coming down has pushed the forward P/E ratio to its 5-year average of 18.5x.

Source: FactSet

Short covering

While some investors may not want to add new long positions at current prices, others are sprinting to cover their shorts.

Last week’s short covering was the largest since November 2015 and ranks in the 99.8th percentile versus the past 10 years.

Investors were caught offsides during January’s fierce equity rally, so larger institutional investors were forced to cover their (losing) shorts in historic proportions.

Source: Goldman Sachs Global Investment Management

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.