September is a lock after this week’s jobs data, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (9.5.2025)

Welcome, Sandbox friends.

Quick publisher’s note before we begin today.

I’m heading west next week to Huntington Beach, CA for my 4th Future Proof Festival. This conference brings together the brightest minds across wealth management to tackle the most important themes and ideas shaping our industry. I’m thrilled to be speaking on a panel alongside Ben Carlson, Douglas Boneparth, and Callie Cox. Come say hi if you are attending!

As an administrative aside, The Sandbox Daily will be off the majority of next week due to time constraints.

Today’s Daily discusses:

U.S. labor market: cooling, not collapsing

weekend sprinkles

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.48% | Nasdaq 100 +0.08% | S&P 500 -0.32% | Dow -0.48%

FIXED INCOME: Barclays Agg Bond +0.47% | High Yield +0.05% | 2yr UST 3.526% | 10yr UST 4.091%

COMMODITIES: Brent Crude -1.96% to $65.68/barrel. Gold +0.98% to $3,642.1/oz.

BITCOIN: +1.32% to $111,691

US DOLLAR INDEX: -0.59% to 97.767

CBOE TOTAL PUT/CALL RATIO: 0.96

VIX: -0.78% to 15.18

Quote of the day

“The secret of happiness, you see, is not found in seeking more, but in developing the capacity to enjoy less.”

- Socrates

U.S. labor market: cooling, not collapsing

The key economic data releases this week for investors were unequivocally the various U.S. labor reports.

The overarching takeaway was the consistency in which the jobs data continues to sputter, adding to the growing signposts from the summer of labor market softness and keeps the Federal Reserve on track for a widely anticipated interest rate cut later this month.

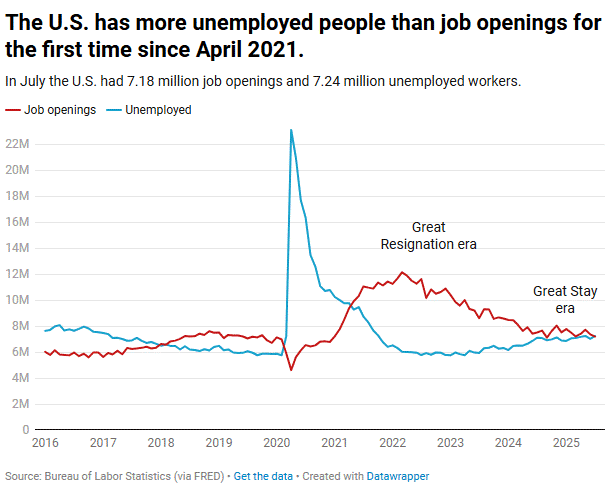

On Wednesday, it was the Job Openings and Labor Turnover Survey (JOLTS). The report showed job openings fell in July to a 10-month low, but more importantly, the U.S. now has more unemployed people than job openings for the first time since the pandemic. Even if employers' hiring plans have been put on ice, layoffs remain low – a hallmark of the current labor market.

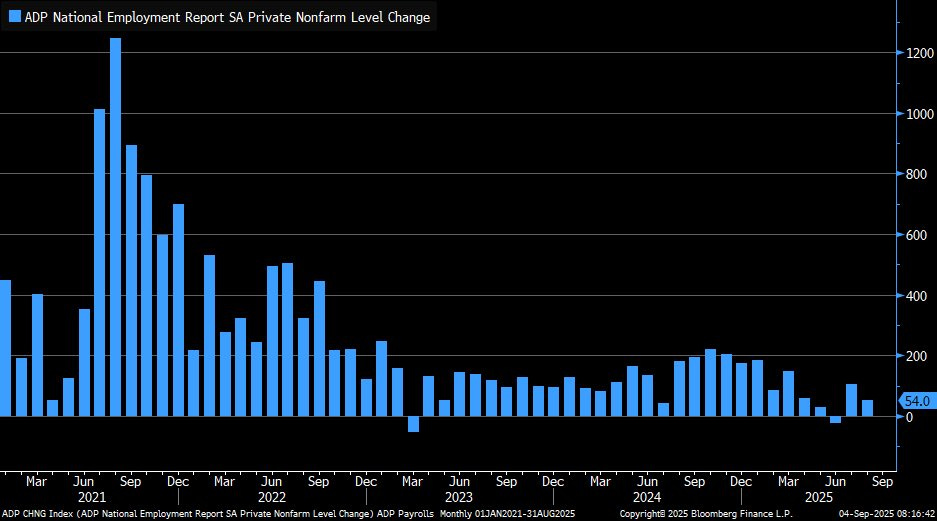

On Thursday, it was ADP private payrolls. The report showed private sector hiring rose by 54,000 in August versus expectations of 75,000. Meanwhile, the six-month average dwindled to 62,000, the lowest level since the pandemic five years ago. It reflects a significant moderation in labor demand this year, consistent with slower economic growth.

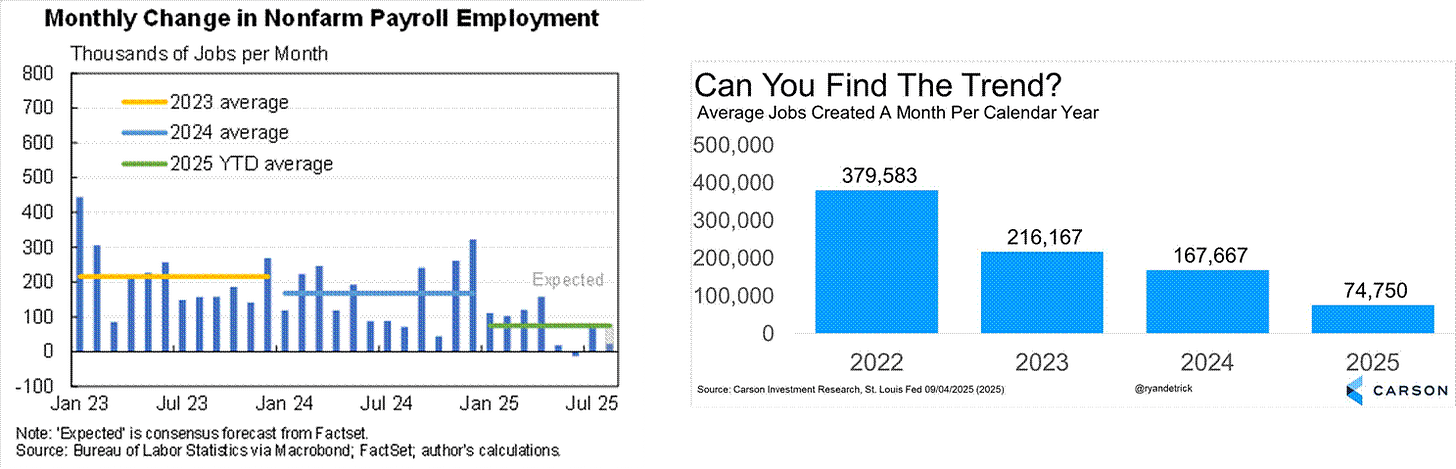

On Friday, it was the BLS nonfarm payrolls. The report showed the U.S. added a paltry +22,000 jobs in August versus expectations of +75,000. There was a modest downward revision of -21,000 to the prior two months, including June which was revised lower to a loss of -13,000 jobs (initial print was +147,000) – the first monthly job loss since December 2020. Despite slowing payrolls, the unemployment rate remains historically low at 4.3%. As shown below, the trend over the last several years shows job growth has stagnated.

Understanding labor market conditions and the direction of travel is so important because it directly affects economic growth, consumer spending, inflation, and Federal Reserve decisions. In turn, they can also affect the stock and bond markets.

In a recent speech, Fed Chair Jerome Powell said the labor market is in a "curious kind of balance" where job growth has slowed but unemployment hasn't picked up significantly. This week’s data confirms the committee’s thought process.

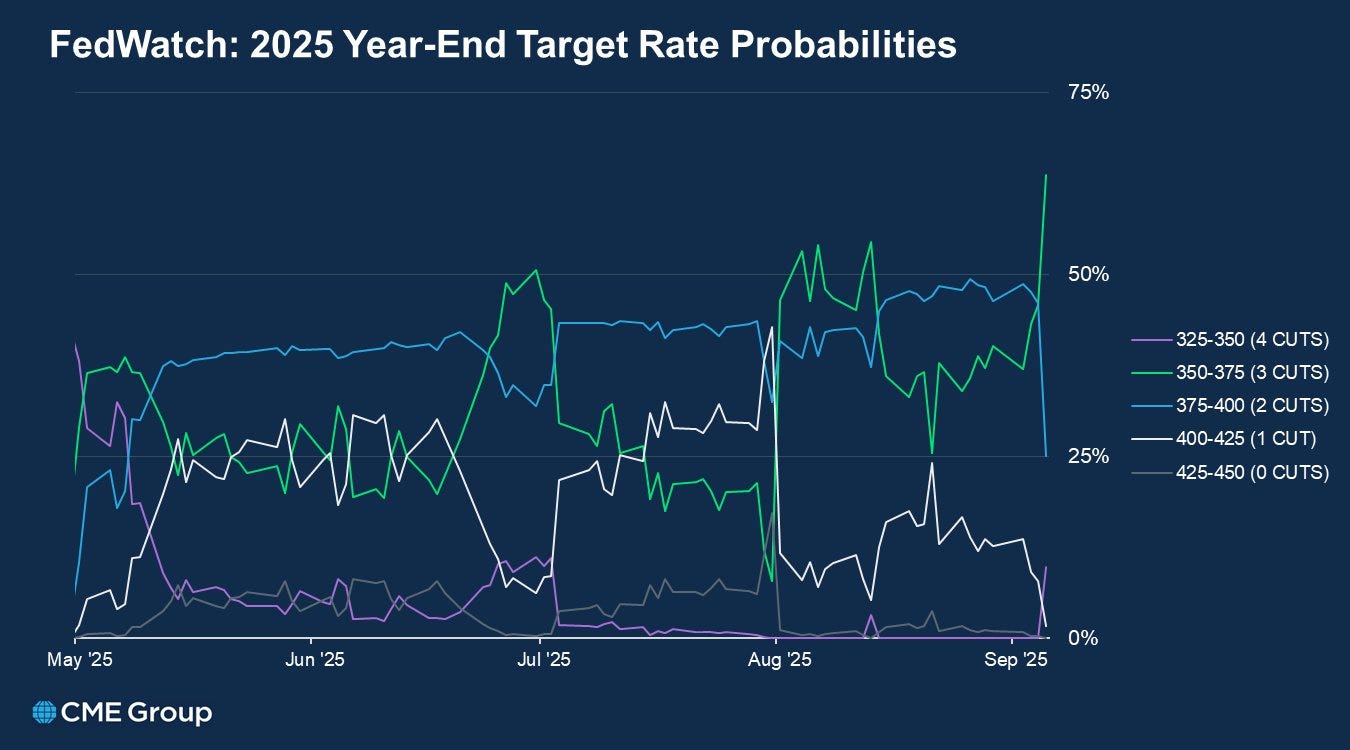

The sustained deterioration in the labor market data is leading investors to conclude that a September rate cut is imminent and a path of more aggressive cutting could be on the table.

Market-based measures from the CME now show the Federal Reserve to cut rates by 25 basis points at each of its remaining three meetings this year.

The Fed faces a delicate balancing act between supporting employment (which is cooling but not collapsing) and controlling inflation (which it’s still unclear what the impact of tariffs will be).

Bottoms up, Jerome. It’s the weekend.

Sources: Bureau of Labor Statistics, Bloomberg, CNBC, Jason Furman, Ryan Detrick, Clearnomics, CME Group

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The Contessa Counts – Choose Your F*cks Wisely (Alina Fisch)

Constructing the Future: Building Resilient Portfolios With Infrastructure (Neuberger Berman)

Chart Kid Matt – The Wisdom of Crowds (Matt Cerminaro)

Coinbase – It’s Time for Investors to Get Off Zero (Coinbase)

Abnormal Returns – Learning Who to Ignore in an Increasingly Degenerate Economy (Tadas Viskanta)

Capital Market Assumptions: Redefined (Man Group)

The Big Picture – The Probability Machine (Barry Ritholtz)

Podcasts

Invest Like the Best with Patrick O’Shaughnessy – Building Alpha School and The Future of Education with Joe Liemandt (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Hunting Wives – Malin Akerman, Brittany Snow, Dermot Mulroney (Netflix, IMDB, YouTube)

Music

Girlfriends – West Coast (Spotify, Apple Music, YouTube)

Books

Nick Maggiulli – The Wealth Ladder: Proven Strategies for Every Step of Your Financial Life (Amazon)

Fun

Tom Stewart – If Recreational Golfers Had Press Conferences (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)