Short squeeze, plus the hot job report, Tesla, AMEX, int'l stocks, tech layoffs, Rocket Man, and the week in review

The Sandbox Daily (2.3.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the short squeeze hitting markets this week, the hot hot hot BLS labor report for January, Tesla slashes car prices, American Express says card data shows a resilient consumer, improvement in international breadth readings, tech layoffs grabbing headlines, the Rocket Man’s farewell, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.38% | Russell 2000 -0.78% | S&P 500 -1.04% | Nasdaq 100 -1.79%

FIXED INCOME: Barclays Agg Bond -0.96% | High Yield -1.05% | 2yr UST 4.287% | 10yr UST 3.519%

COMMODITIES: Brent Crude -2.91% to $79.78/barrel. Gold -2.75% to $1,877.7/oz.

BITCOIN: -0.42% to $23,392

US DOLLAR INDEX: +1.22% to 102.992

CBOE EQUITY PUT/CALL RATIO: 0.49

VIX: -2.14% to 18.33

The squeeze is on

Short squeezes are the big news of the week as the most beaten-down and heavily-shorted names are leading the latest leg higher for stocks, while the list of stocks resolving from bases and making new highs continues to grow.

Coinbase (COIN), the $18 billion cryptocurrency exchange, provides an excellent example of the kind of moves we’re seeing from some of the most speculative stocks on the market.

Forty-four million shares of COIN, representing roughly 28.5% of the public float, are currently held short. The stock has rallied over 150% since bottoming less than a month ago, as short sellers rush to cover their positions and further fuel the buying frenzy.

With the stock hitting extreme overbought levels as price hits a logical shelf of resistance at the upper bounds of its range, the run higher in COIN and other heavily-shorted names could be due for a pause. With that said, the roaring rallies that have taken place in the weakest stocks over the past few weeks can be viewed as a positive development for risk appetite.

Source: All Start Charts

Jobs data comes in HOT

Economists were expecting jobs growth to decelerate, but instead it surged ahead, with an addition of a half million jobs (517,000) added in January (vs. 185,000 expected). The unemployment rate ticked down to 3.4% – the lowest reading since May 1969! Average hourly earnings rose +0.3% in January and are up +4.4% YoY.

The blowout job gains may be exaggerated by seasonal adjustments or other statistical quirks. But even if they are ultimately revised lower, a consistent message is being sent by labor data across the board with ultra-low jobless claims and rising numbers of job openings. The hiring slowdown that was supposed to come alongside the Fed's aggressive tightening has not materialized, which sets up something of a conundrum for Fed officials trying to create some slack in the labor market.

"It's difficult to see how wage pressures can soften sufficiently when jobs growth is as strong as this," Seema Shah, chief global strategist at Principal Global Investors, wrote in a note. "It's even more difficult to see the Fed stop raising rates and entertain ideas of rate cuts when there is such explosive economic news coming in."

Source: Bureau of Labor Statistics, Axios, Ned Davis Research

Tesla slashes prices

In January this year, Tesla made the surprising announcement that it would be cutting prices on its vehicles by as much as 20%.

While price cuts are not new in the automotive world, they are for Tesla. The company, which historically has been unable to keep up with demand, has seen its order backlog shrink from 476,000 units in July 2022, to 74,000 in December 2022.

This has been attributed to Tesla’s robust production growth, which saw 2022 production increase 41% over 2021 (from 930,422 to 1,313,851 units).

With the days of “endless” demand seemingly over, Tesla is going on the offensive by reducing its prices—a move that puts pressure on competitors, but has also angered existing owners.

Recent data compiled by Reuters shows that Tesla’s margins are significantly higher than those of its rivals, both in terms of gross and net profit.

Source: Visual Capitalist

Consumer spending shows resiliency

"We aren't seeing recessionary signals... the consumer is really strong, travel bookings are up over 50% vs pre-pandemic…. T&E spending is still really strong with the consumer…. We're feeling good."

- American Express CEO Stephen Squeri

Source: Wall Street Journal, American Express

International breadth

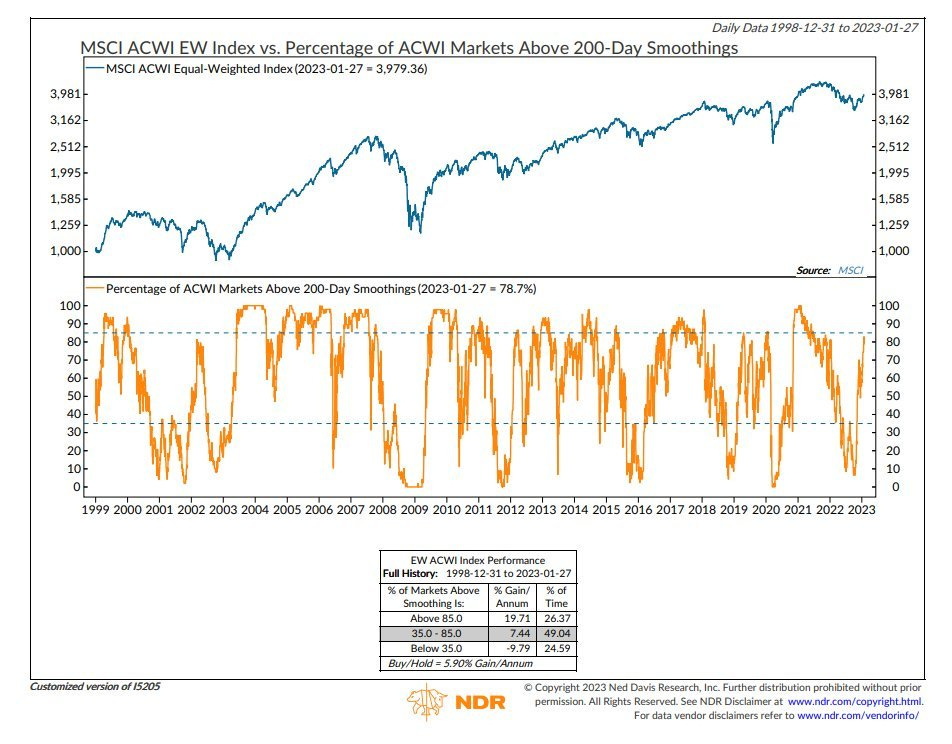

The improvement in long-term breadth readings has been global in scope.

The percent of All-Country World Index (ACWI) markets trading above their 200-day moving averages is now 79%, the highest level in over a year.

When you see such broad-based participation, you want to make sure that you have some exposure.

Source: Ned Davis Research

Tech layoffs just a small piece

The current tech layoffs are only a small fraction of what was hired during COVID.

The recent layoff announcements have been welcome news to stock prices. Doing more with less and increasing cash flow is what the stock market wants right now.

Source: Bloomberg

Rocket Man’s farewell

Elton John’s Farewell Yellow Brick Road tour, his last outing before retirement, has become the highest-grossing tour of all time, taking a total of $817m according to new figures from Billboard.

However, even after 5 years and 278 shows, the Rocket Man is not done yet — with 51 more European dates and a final sign-off performance headlining the iconic Glastonbury festival to come.

What jumps off the page is the notable absence of top-bill female acts, as a number of artists quickly come to mind that are worthy of these dollar amounts: Madonna, Whitney Houston, Beyonce, Taylor Swift, and Adele.

Source: Chartr

The week in review

Talk of the tape: Despite Friday’s pullback, stocks navigated a tricky week, especially in light of some big misses from the mega-cap tech names. A less hawkish Powell and better-than-feared earnings are the latest tailwinds for risk sentiment. The path of least resistance has been higher throughout the better part of early 2023 with positioning and technicals flagged as drivers.

Widely discussed bullish talking points include disinflation, near-peak Fed, soft landing narrative, lower earnings bar, China reopening, and no European energy crisis.

Bears still focused on economic and earnings recession risks, Fed's higher for longer messaging, a divergence between Fed and market on pivot expectations, QT, extended ECB tightening cycle, valuation (particularly ERP) overhang, and elevated geopolitical tensions.

Stocks: The major market averages finished mostly higher, led by growth sectors consumer discretionary, communication services, and information technology. Energy underperformed on the back of slowing demand. International stocks finished lower amid better-than-expected international economic results, U.S. dollar weakness, and improving international earnings expectations.

Equities have done well despite 4th quarter earnings coming in lighter-than-expected. Thursday’s earning results from some big tech names revealed how macroeconomic pressures are weighing on corporate America regardless of their competitive positioning.

Bonds: The Bloomberg Aggregate Bond Index finished the week higher as yields declined as investors believe the Fed will pivot on monetary policy later this year. In addition, high-yield corporate bonds, as tracked by the Bloomberg High Yield index, finished the week higher, leading all bond markets in year-to-date returns.

Given higher bond yields, U.S. pension funds are set to de-risk investment plans, which could send over $1 trillion into the bond market, according to a Bloomberg report. The largest U.S. corporate pension plans, as per the Milliman 100 Pension Funding index, have an average funding ratio of 110%, which is the highest level in two decades. Fixed-income flows are outpacing equity funds this year, marking the most lopsided relationship since July 2022

Commodities: Oil and natural gas prices finished the week lower. Natural gas prices continue to trending lower as warmer-than-anticipated weather and storage facility inventories remain at record seasonal highs. On Wednesday, U.S. government data showed large builds in crude oil, gasoline and distillate inventories as OPEC and its allies continue to follow their output policy. Amid weak demand, U.S. crude oil and fuel inventories increased to their highest levels since June 2021. The major metals, including gold, silver, and copper finished the week lower.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.