Silicon Valley Bank: 2nd largest bank failure in U.S. history

The Sandbox Daily (3.13.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Silicon Valley Bank fails

FDIC steps in to backstop deposits

Implications of banking crisis on Fed policy

Market price action

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.79% | S&P 500 -0.15% | Dow -0.28% | Russell 2000 -1.60%

FIXED INCOME: Barclays Agg Bond +0.80% | High Yield -0.54% | 2yr UST 4.038% | 10yr UST 3.556%

COMMODITIES: Brent Crude -2.80% to $80.46/barrel. Gold +2.73% to $1,915.7/oz.

BITCOIN: +12.87% to $24,193

US DOLLAR INDEX: -0.92% to 103.615

CBOE EQUITY PUT/CALL RATIO: 1.11

VIX: +6.94% to 26.52

Quote of the day

“It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

-Mark Twain

Silicon Valley Bank fails

Last week, all eyes were on Jerome Powell and his semi-annual testimony in front of Congress as the Federal Reserve delicately attempts to thread the needle on inflation towards a soft landing. The headlines were driven by the spate of recent hot economic data requiring a higher terminal Federal Funds Rate. The 2-yr U.S. Treasury bill crossed the 5% yield mark for the 1st time since 2007, while the market firmly priced a 0.50% interest rate hike at the upcoming March 22 FOMC meeting.

By week’s end, we lay witness to the 2nd largest banking failure in U.S. history as a run on deposits at Silicon Valley Bank – a regional bank in California partnering with the wealthy and well-capitalized venture capital community – forced the FDIC to intervene and takeover its operations. At its peak, deposits at SVB swelled to $198 billion dollars as venture funding hit record highs and the startup community needed a place to store cash for business (working capital) and personal uses. In effect, the tech bubble had literally burst with the failure of SVB. The fallout in the market was staggering: yields cratered, the VIX exploded through 30, and the S&P 500 lost the 200-DMA.

Many have written long-form posts that cover SVB’s implosion in great detail (Bloomberg, Net Interest, The Macro Compass), so what follows is the Cliff Notes timeline for brevity:

2021-2022: SVB begins to meaningfully build up the investments in their bond portfolio, purchasing a mix of long-dated U.S. Treasury bonds and mortgage-backed securities (MBS) to earn an interest spread on its deposits

March 2023: SVB announces a fire sale of its $21 billion available-for-sale (AFS) portfolio consisting of Treasuries and MBS, realizing a $1.8 billion dollar loss; SVB must shore-up liquidity due to rising withdrawals

SVB surprises investors by announcing a plan to sell $2.3 billion additional stock and convertible preferred shares through Goldman Sachs to cover the aforementioned bond losses, but the deal falls through

Peter Thiel’s Founders Fund advises its portfolio companies to move money out of SVB, which in addition to other media reports on SVB’s balance sheet, helps spark a run on the bank

SVB discloses ~$42 billion dollars of deposits are withdrawn from the bank in one day

rating agency Moody’s downgrades credit rating on SVB from investment grade to junk

SVB announces intention to sell the company and partner with another institution in a strategic buyout

Friday, March 10: regulators close the 16th largest federally-insured bank as SVG is placed in FDIC receivership, becoming the biggest bank failure since Washington Mutual in 2008

At its core, SVB made some rather simple, yet critical mistakes in the management of their business.

The bank assumed net deposits would continue to grow ad infinitum. When deposits continue to grow on a net basis, the bank does not need to liquidate any of its investment portfolio to fund its operations and, in doing so, realize losses on its bad bond investments. Between the end of 2019 and 1Q22, the bank’s deposit balances more than tripled to bring it total deposits to $198 billion – compared to industry deposit growth of “only” 37% over that period.

The bank had a wealthy, highly concentrated customer base largely tied to technology. As the cycle turned over in 2021 when the tech/IPO boom faded into the rearview, the bank faced real headwinds as liquidity was being drawn from the bank. SVB had the highest percentage of uninsured domestic deposits of all big banks; these totaled nearly $152 billion, or about 97% of all deposits.

The bank purchased longer-dated bonds at an average yield of 1.75%, far below current levels. These bonds are down in excess of 10 or 20%. What’s more, U.S. banks were sitting on $620 billion in unrealized losses on available-for-sale (AFS) and held-to-maturity (HTM) securities at the end of 2022, up from $8 billion a year earlier, according to the FDIC.

And worse yet, SVB did not hedge their bond portfolio by engaging in interest rate swaps to offset or mitigate its bond investments from rising interest rates. For example, when you buy Treasuries, you lock in a fixed yield that you receive and rising interest rates/inflation (like 2022 and 2023) represent a major risk to your position. To hedge that risk, you enter into an interest rate swap: this time, you pay away a fixed yield and receive variable payments in exchange. See below for an overly simplistic diagram; SVB is the “Investor.”

Basic corporate risk management would call for SVB to implement a highly sophisticated derivatives portfolio to manage their interest rate risk, however internal documents show this was not the case – the portfolio duration roughly equals their hedge-adjusted duration. As a result, their bond book was dismantled when the Fed aggressively starting hiking interest rates.

Boom and bust – capitalism and cycles at work in real time.

Source: Wall Street Journal, Bloomberg, Visual Capitalist, The Macro Compass, Fortune

FDIC steps in to backstop deposits

The FDIC, U.S. Treasury, and Federal Reserve issued a joint statement late Sunday afternoon stating they would backstop every single depositor at Silicon Valley Bank, regardless of the deposit amount, as well as deposits at a second failed bank, Signature Bank New York. All depositors would have access to all their money on Monday morning – helping stem the immediate panic. As a reminder, the standard deposit insurance amount covered by the FDIC is $250,000 per depositor, per insured bank, for each account ownership category.

In addition, the Fed unveiled a new credit facility called the Bank Term Funding Program (BTFP) that will offer loans up to one year to banks, ensuring all banks can access cash on favorable terms should they see deposit runs of their own. BTFP will be backed by money from the Treasury’s Exchange Stabilization Fund.

The importance of this intervention cannot be overstated. The banking system is built on confidence. One lesson we can learn from 2008 is market contagion can spread very quickly and be nearly impossible to stop once the tipping point is crossed. Here’s a chart comparing the Global Financial Crisis versus 2023.

Goldman Sachs is calling this SVB situation “idiosyncratic, not systemic” as the risk of contagion from small to large banks is remote, considering the small market share of regional banks in the Investment Grade (IG) market. While the banking sector does make up a large share of the US dollar Investment Grade market at 25% of the notional outstanding, regional domestic banks only make up 6% of the banking sector, or ~1.5% of the broader IG market. What’s more, the low share of regional banks is itself also quite diversified, with 15 issuers and no one issuer accounting for more than 20% of the notional outstanding.

To be clear, a bank failure was not consensus view coming into 2023.

Jim Reid, a strategist at Deutsche Bank, had this to say: “We’ll have to see how this story develops but something always breaks hard during or after a Fed hiking cycle.” After all, strategists and economists have been crying wolf for nearly a year that something would break, the market just didn’t specifically know what would break.

As Sam Ro, author of TKer, eloquently writes: “the most destabilizing risks are the ones people aren’t talking about.” These unknown unknowns are what causes extreme market turmoil.

Besides the contagion risk, the other obvious near-term risk is locking up working capital for businesses running their Treasury accounts through SVB; if these accounts were not unlocked, companies would need to layoff or furlough workers because they would not be able to process payroll on Wednesday, March 15th. Nearly 200 companies issued 8-K’s and 6-K’s today commenting on their exposure to Silicon Valley Bank. Here is a list of companies with notable balances:

Source: Federal Reserve, FDIC, TKer, Sam Ro, Goldman Sachs, Statista, Bloomberg, The Kobeissi Letter, Wall Street Journal

Implications on Fed policy

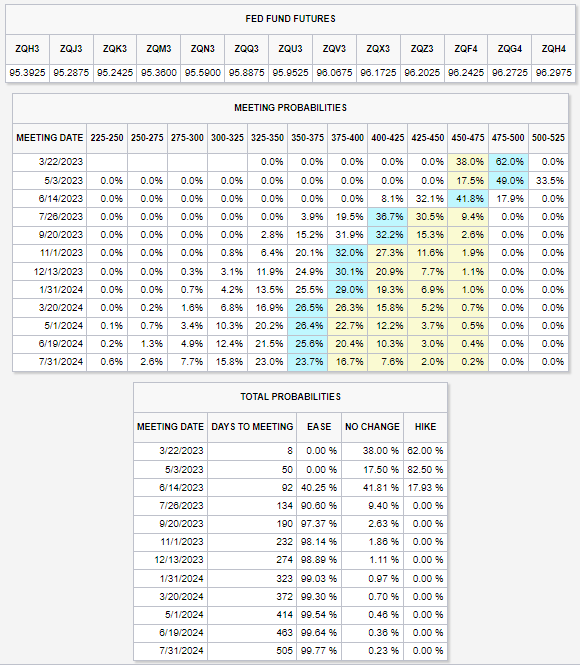

Fed Funds Futures show the market has flipped from a nearly 80% likelihood of a 50 bps rate hike on March 22nd to a 50-50 chance of no hike (4.50 – 4.75) and 25 bps (4.75 – 5.00).

Perhaps more important to this Fed tightening cycle, the terminal rate has been pulled forward from September to May/June over just the last three days.

In response to the moves in the bond market, Wells Fargo released a note suggesting the Fed will pause its rate hikes at its policy announcement next week: "The rapid tightening in financial conditions alongside the uncertainty of the situation makes us lean toward the FOMC taking a pause from its hiking campaign at its upcoming meeting on March 22."

Similarly, Goldman Sachs distributed a note late Sunday night, stating it also expects the Fed not to raise rates next week in “light of the stress in the banking system.”

Source: CME FedWatch Tool, Goldman Sachs

Price action

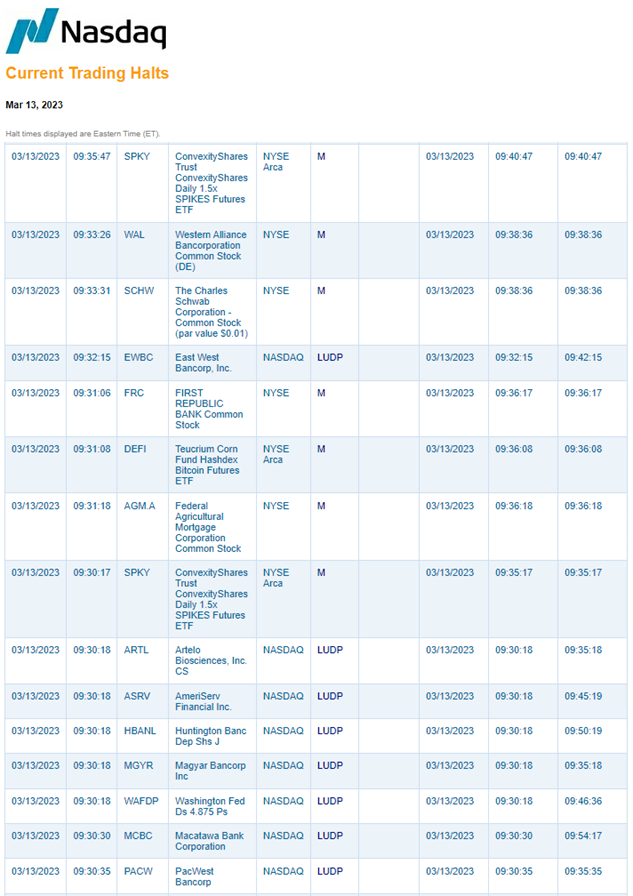

From the opening bell, the market experienced numerous trading halts today in many of the regional banking names on fears of contagion. Here’s a peak at just the 1st five minutes of trading.

Financials tumbled for the 3rd day in a row, posting one of its largest weekly losses in history. The Invesco S&P 500 Equal-Weight Financials ETF (RYF) is down -17% in the last week.

The market received a boost as concerns about the banking sector led to speculation the Federal Reserve may back off raising interest rates. Bond yields continued their plunge, with the 2-yr U.S. Treasury dropping 100 bps in just three trading sessions!

In fact, on an intraday basis, 2-year yields experienced their steepest 3-day downside move since Black Monday of October 1987.

As investors moved money into safe haven assets, gold prices surged – trading at its highest price since early February.

Finally, as equities have pulled back meaningfully, we are witnessing an expansion across multiple indices in the 52 week New Lows lists – getting back to level last seen in mid-October when the S&P 500 bottomed.

Source: Nasdaq, Axios, Bianco Research, CNBC, All Star Charts, Beat the Bench

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.