💥 Small business optimism surges most since… 2016 election 💥

The Sandbox Daily (12.11.2024)

Welcome, Sandbox friends.

Due to a data-scrapping AI bot issue with a previous report, I will no longer include source hyperlinks going forward. Should you wish to see an original report sourced from the public domain (i.e. not behind a subscription paywall), just respond to this e-mail and we can discuss. Onward…

Today’s Daily discusses:

small business optimism surges

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.85% | S&P 500 +0.82% | Russell 2000 +0.48% | Dow -0.22%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield +0.03% | 2yr UST 4.155% | 10yr UST 4.273%

COMMODITIES: Brent Crude +1.91% to $73.57/barrel. Gold +1.29% to $2,753.5/oz.

BITCOIN: +4.54% to $101,418

US DOLLAR INDEX: +0.26% to 106.675

CBOE TOTAL PUT/CALL RATIO: 0.84

VIX: -4.23% to 13.58

Quote of the day

“Be the reason someone believes in the goodness of people.”

-Karen Salmansohn

Small business optimism surges most since… 2016 election

The NFIB Small Business Optimism Index soared a record 8.0 points in November to 101.7, the highest level since June 2021 after 34 months remaining below the 50-year average of 98.

The surge is similar to the Trump bump in November/December 2016 (total jump of 10.9 points across both months), as small businesses expect to benefit from tax cuts and other pro-growth Trump policies.

The exuberance supports a positive outlook for economic growth in 2025.

Nine of the ten NFIB components rose. The biggest improvements by far were in the outlook for the economy and expectations for real sales growth in the near-term, both of which soared after being depressed for most of this business cycle.

Not surprisingly, more firms indicated now was a good time to expand their business. CapEx plans jumped to their best level since early 2022, supported by expectations for more favorable credit conditions. Additionally, more firms reported open positions, while hiring plans for the next three months hit their best level this year, consistent with some downward pressure on the unemployment rate in the near-term.

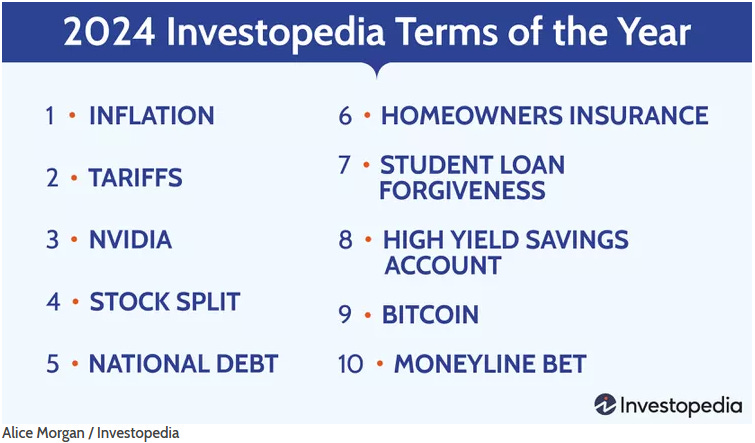

Inflation continues to top the list of small businesses’ most important problems, largely because of rising wage and other cost pressures.

Investopedia agrees, naming it atop its 2024 Terms of the Year.

Some remain cautious about this exuberance, though.

In a note to clients, Neil Dutta of RenMac wrote:

“There might be some room for the optimism to fall short of expectations. Put differently, the uncertainty heading into next year is still quite high.”

One final point reflecting over the chaotic chapter in the economy and markets these past few years.

For months on end, everyone and their mother was bracing for a recession. Despite sentiment and the like (soft data) plunging over the previous four-year period, the actual economic and business activity (hard data) during the Biden period held up just fine.

Here’s Joe Weisenthal on the historic divergence shown in the chart below:

“If you wanted to make an argument that notions of a “vibecession” — or a disconnect between reality and sentiment actually exists — then at least in this one corner of the economy, this is the money chart.”

Trump wins the election last month and the gap immediately closed, as small businesses across America rejoice all things taxes, deregulation, and the economically-sensitive President-elect.

In other words, sentiment around the economy overshot the actual reported economy by an extreme measure – just like investor behavior around market tops and bottoms.

Sometimes things aren’t as bad as they appear.

Sources: National Federation of Independent Business, Bloomberg, Renaissance Macro Research, Investopedia

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: