Small-caps, crude oil, behavioral finance, and Americans love to spend

The Sandbox Daily (6.29.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

small-cap companies face risks from rising rates

crude digging in at support

behavior vs. everything else

Americans love to spend money

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.23% | Dow +0.80% | S&P 500 +0.45% | Nasdaq 100 -0.16%

FIXED INCOME: Barclays Agg Bond -0.77% | High Yield -0.27% | 2yr UST 4.863% | 10yr UST 3.842%

COMMODITIES: Brent Crude +0.38% to $74.31/barrel. Gold +0.08% to $1,917.9/oz.

BITCOIN: +0.73% to $30,414

US DOLLAR INDEX: +0.43% to 103.346

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: +0.82% to 13.54

Quote of the day

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

- Sir John Templeton, CFA

Small-cap companies face risks from rising rates

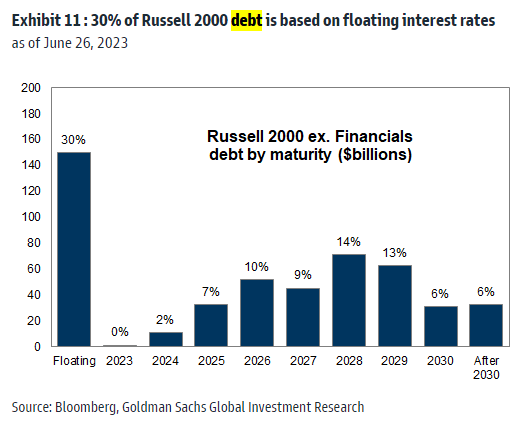

Russell 2000 companies are more vulnerable to the risk of rising interest rates than their larger counterparts.

In aggregate, the firms in the Russell 2000 index are more debt-laden than those in the S&P 500 index. But, more relevant to the current rising rate environment, nearly 1/3 of Russell 2000 debt is floating-rate, compared to just 6% for the S&P 500.

Source: Goldman Sachs Global Investment Research

Crude digging in at support

While market leaders are testing resistance from above, the laggards continue to hold above their respective support levels.

This is particularly true for crude oil, as price comes to a critical polarity zone at former highs. This area also coincides with the anchored volume weighted average price (AVWAP) from the pandemic lows, making it a confluence of support.

Bulls want to see this level hold, but if crude oil slips below this area, there could be further downside and increased selling pressure for energy-related assets and perhaps other cyclical names.

Source: All Star Charts

Behavior vs. everything else

When it comes to investing, nothing matters anywhere as much as your behavior.

A successful investment plan is the one you stick with. It means preparing yourself for a number of different scenarios so you don’t overreact when things don’t go as planned.

You can design the greatest portfolio ever created by humankind, yet one behavioral mistake after another could mean the difference between meeting financial goals and falling short.

Source: The Behavior Gap

Americans love to spend money

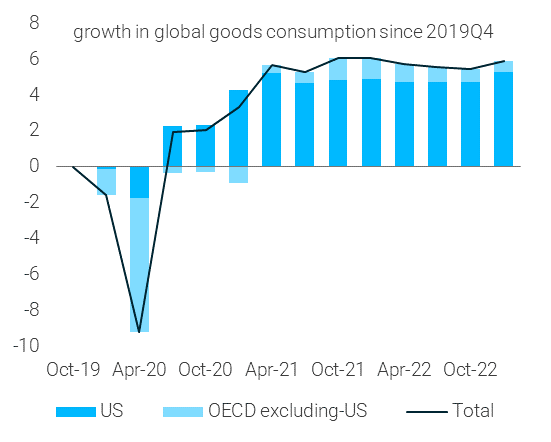

The growth in consumption habits around the globe since the start of the pandemic has basically all come from the United States compared to other developed nations.

Zooming out, you can see this trend was already in place for years but our spending habits started burning the thrusters when the COVID-19 pandemic hit.

Source: Dario Perkins

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.