Small caps, plus auto insurance, U.S. oil output, labor market, and China's economy

The Sandbox Daily (4.16.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

what to make of small caps

auto insurance is having a moment

record U.S. oil output

labor market rebalancing one key to moderating inflation

China’s economy grew faster than expected in Q1

Let’s dig in.

Markets in review

EQUITIES: Dow +0.17% | Nasdaq 100 +0.04% | S&P 500 -0.21% | Russell 2000 -0.42%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -0.33% | 2yr UST 4.985% | 10yr UST 4.667%

COMMODITIES: Brent Crude -0.16% to $89.96/barrel. Gold +0.95% to $2,405.7/oz.

BITCOIN: -0.31% to $62,833

US DOLLAR INDEX: +0.12% to 106.338

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: -4.32% to 18.40

Quote of the day

“Don’t judge each day by the harvest you reap but by the seeds that you plant.”

- Robert Louis Stevenson

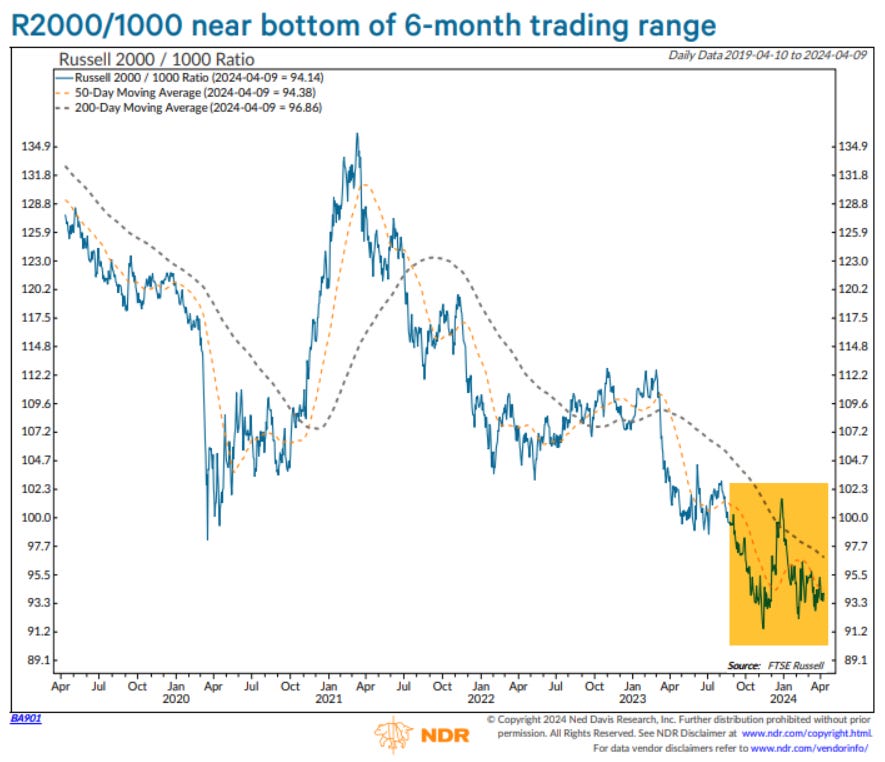

All eyes on small-caps after being named a top pick in 2024

Before its recent drop, the Russell 2000 index had rallied to the top of its 2-year range. A breakout above these key resistance level could lead to a push to its all-time highs.

Conversely, higher interest rates could push the benchmark toward the lower end of its range.

It’s also important to recognize from a relative perspective, the small cap-large cap ratio (Russell 2000-Russell 1000) ratio resides within a 6-month trading range within a long-term downtrend.

A decisive break below its November 2023 lows would suggest a renewed downtrend.

One key driver for small-caps over the next 6-12 months on which way these trends break?

Earnings estimates – which are finally hooking higher after nosediving much of the last three years. See bottom pane below.

Source: Ned Davis Research

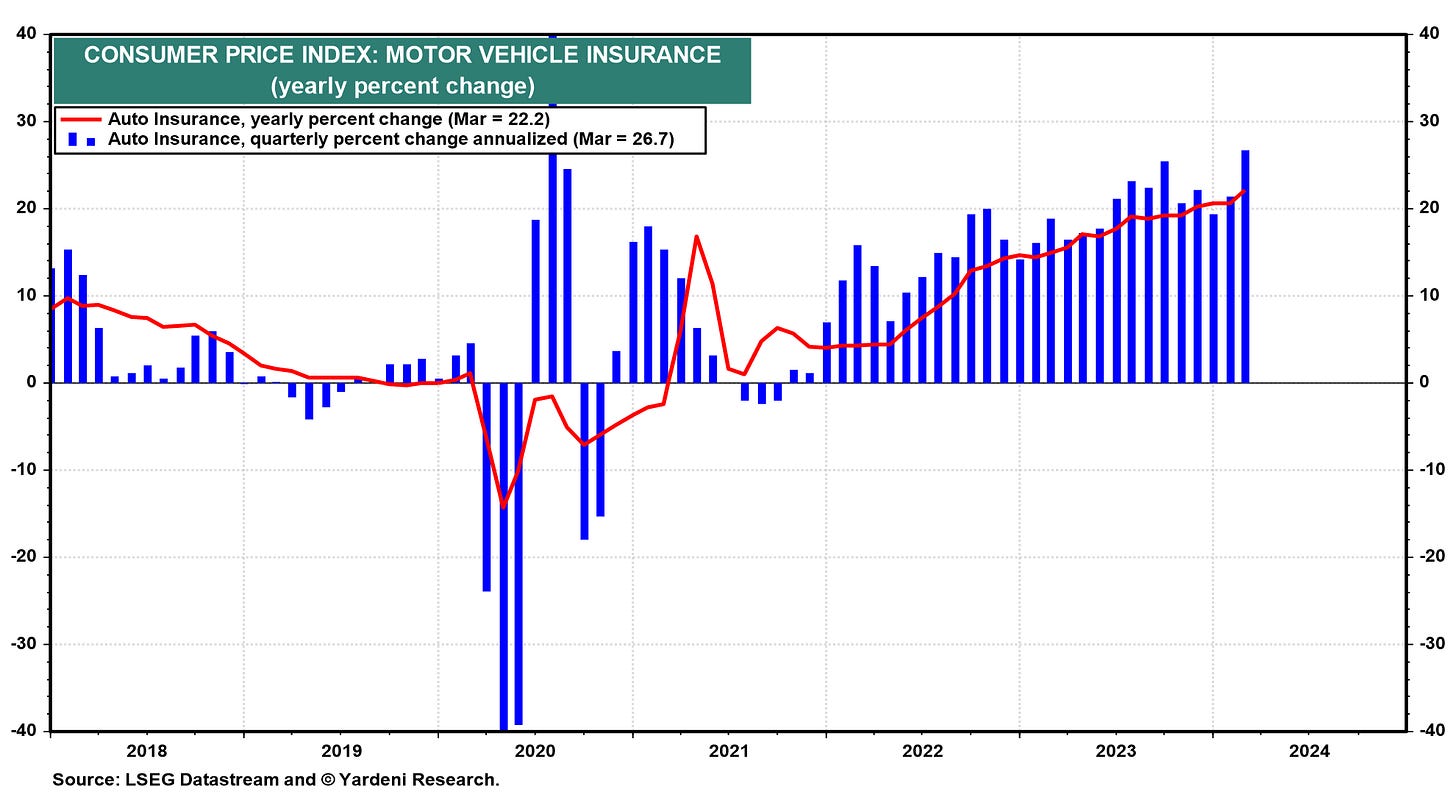

Auto insurance costs are rising at fastest rate in 57 years

As car prices moderate from a pandemic-era surge, auto insurance is reaching its highest levels in nearly 5 decades.

New data out last week from the Bureau of Labor Statistics showed auto insurance costs last month were +22.2% higher than they were a year ago. The rise in auto insurance prices is the largest gain since December 1976, when costs rose +22.4% over the prior year.

Why?

Bad driving for one, as car accidents are on the rise post-pandemic.

Other attributable factors include more expensive vehicles (insurable value is higher), replacement parts (newer cars are loaded with more expensive tech), and a shortage of mechanics and car parts.

Source: Yardeni Research, Bloomberg, A Wealth of Common Sense

Record U.S. oil output

According to the U.S. Energy Information Administration (EIA), the U.S. produced more crude oil last year than any nation at any time. Ever.

Crude oil production in the United States averaged a staggering 12.9 million barrels per day in 2023 and reached a high in December of 13.3 mn b/d – 10% above its December 2022 level.

Together, the United States, Russia, and Saudi Arabia accounted for 40% (32.8 million bpd) of global oil production in 2023.

These 3 countries have produced more oil than any others since 1971, although the top spot has shifted among them over the past decade.

Source: U.S. Energy Information Administration, Torsten Slok

Labor market rebalancing one key to moderating inflation

Despite the recent upside inflation surprises, the broader disinflationary narrative remains intact, albeit on shaky ground after upside inflationary surprises in Q1.

One key reason is that the labor market continues to rebalance nicely.

The jobs-workers gap is down to 2.0 million, the quits rate is below pre-pandemic levels, and the wage news (specifically unemployment claims) remains favorable.

As of March, average hourly earnings and the Atlanta Fed wage growth tracker are consistent with YoY wage growth of just over 4%, and Goldman Sachs expects the more reliable Employment Cost Index to show a similar pace for Q1.

Over the next year, wage growth should converge to 3.5%, the pace consistent with 2% assuming a productivity trend of 1.5% and stable profit margins.

Source: Goldman Sachs Global Investment Research

China’s economy expands by a surprisingly strong pace in Q1

Turning to the world’s 2nd largest economy, China's 1st quarter GDP growth came in stronger than forecast, while March activity data delivered a mixed bag that mainly underwhelmed investors.

Gross Domestic Product in the January-to-March period grew +5.3% compared to a year ago — slightly faster than the +5.2% expansion in the 4th quarter of 2023 and higher than the +4.6% consensus expectations from the market. On a quarter-on-quarter basis, China’s GDP grew +1.6% in the 1st quarter.

The market reaction, though, was acutely focused on the slowing metrics of March, where Industrial Production growth slowed meaningfully and missed expectations (+4.5 YoY vs. +6.0%), led mainly by slower output growth in computer, smartphone, and other electronics industries.

Other notable misses in the data release included:

1) Retail Sales, which show a weaker consumer (+3.1% YoY vs. +4.8%), and…

2) China’s embattled real estate sector, with property investments falling -9.5% YoY. Cement output itself plunged 22% in March – its largest monthly drop in recorded history.

One bright spot was the unemployment rate in major cities inched down to 5.2%, snapping a 3-month streak of increases.

Although Beijing’s 5% growth target this year remains on track, it’s likely that continued policy easing is still necessary, especially on the demand side (e.g., fiscal, housing, and consumption), to counteract long-term structural challenges.

Source: Bloomberg, Goldman Sachs Global Investment Research, Financial Times

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Crazy trend on Auto Insurance. I think you nailed the “why”. The bad driving is attributed to todays distracted drivers, distracted pedestrians, well, distracted everybody. We can’t take our eyes off of our phones.