Smaller banks are hurting, plus labor data, corporate defaults, homeowners, and bad market breadth

The Sandbox Daily (5.2.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

smaller banks bleeding both deposits and market cap

fresh batch of labor data shows job openings decline while layoffs pick up

corporate defaults are on the rise

homeowners selling due to growing household sizes

stock market continues to lack breadth

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.89% | Dow -1.08% | S&P 500 -1.16% | Russell 2000 -2.10%

FIXED INCOME: Barclays Agg Bond +0.97% | High Yield -0.09% | 2yr UST 3.992% | 10yr UST 3.431%

COMMODITIES: Brent Crude -5.06% to $75.30/barrel. Gold +1.70% to $2,026.0/oz.

BITCOIN: +2.23% to $28,698

US DOLLAR INDEX: -0.23% to 101.921

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: +10.57% to 17.78

Quote of the day

“The hardest work in investing is not intellectual; it's emotional... The hardest work is not figuring out the optimal investment policy; it's sustaining a long-term focus – particularly at market highs or market lows – and staying committed to your optimal investment policy. That's why benign neglect is, for most investors, the secret of long-term success.”

- Dr. Charles Ellis, Winning the Loser's Game

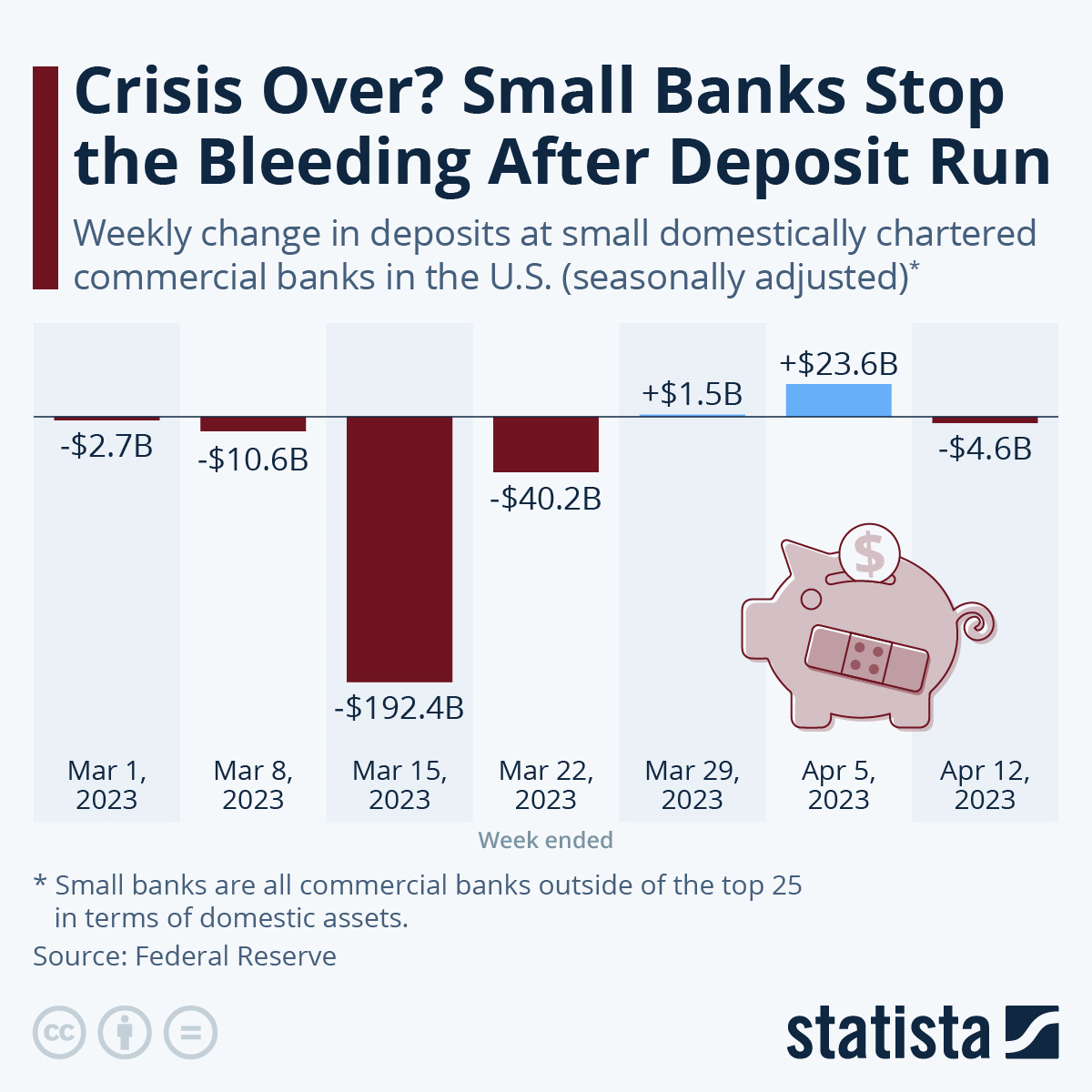

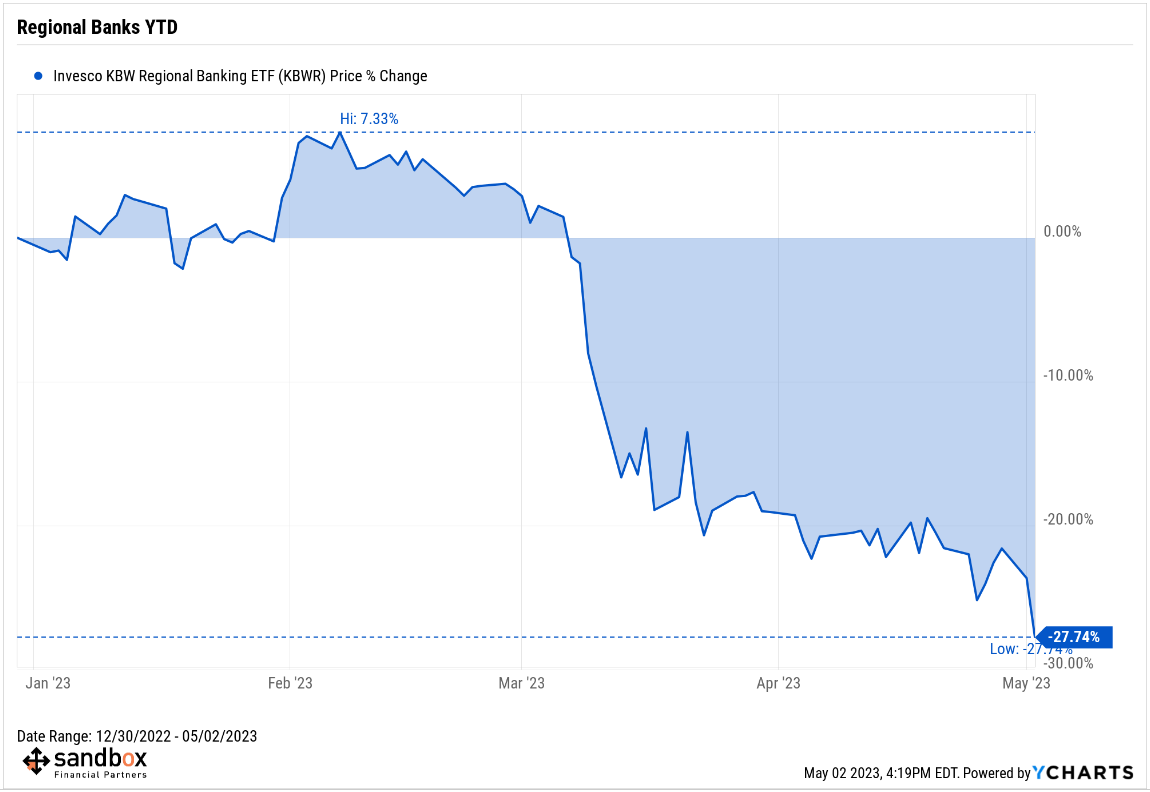

Smaller banks bleeding both deposits and market cap

Banks are as much a game of confidence as they are stewards of capital.

First Republic Bank (FRC) lost nearly half of its deposits in recent weeks – roughly $100 billion dollars to be precise! As a result, the San-Francisco based bank was seized by federal regulators and sold most of its operations to JPMorgan and the most powerful banker on Wall Street, CEO Jamie Dimon. A transaction that bypassed laws against acquiring another bank while already controlling 10%+ of total U.S. deposits…

Unfortunately, the news doesn’t get much better for other notable regional banks. Under intense scrutiny across the broad regional and mid-sized banking system, several banks have experienced billions of dollars of deposit flight to mostly larger banking institutions.

This trend of failed banks falling into the hands of the country’s largest, most powerful banks only contributes to the decades-long consolidation trend in the banking sector, a trend that saw the number of U.S. banks shrink drastically from its peak in the early 1980s. 40 years ago, there were 14,469 commercial banks in the United States. By the end of last year, that number was down to 4,135, according to the FDIC.

Despite a series of federal government emergency measures implemented to shore up confidence in the banking system, the KBW Nasdaq Regional Banking Index (KRX) was down another 5-6% today, hitting its lowest since November 2020. The index is in the midst of a historical drawdown with no floor in sight.

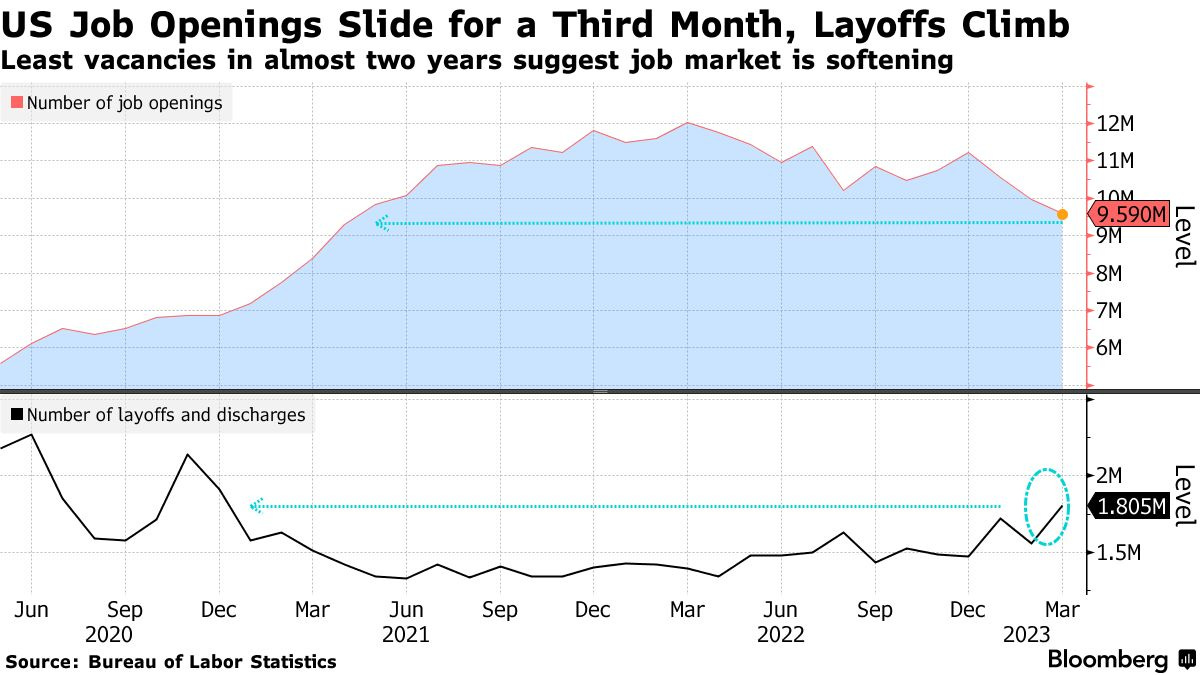

JOLTS show some easing in labor demand

Every month, we turn to the Labor Department's Job Openings and Labor Turnover (JOLTS) survey to understand the ebbs and flows of what's really happening among businesses and their workers.

The number of job openings that employers reported decreased by 384,000 in March – falling to 9.59 million open jobs from February’s 9.97 million – reaching the lowest level since April 2021. This is the third consecutive month that employment openings dropped; that's consistent with a story in which employers react to a slowing economy by pulling back on hiring.

Layoffs jumped 15.9% to 1.805 million, the highest level since December 2020. It confirms the upward trend in initial jobless claims.

The other closely watched metric, the ratio of job openings to unemployed Americans, fell slightly in March to 1.64 and is firmly off the cycle peak of 1.99, but it remains in the same historically high range it has been in since late 2021. Normal is considered 1.0 to 1.2.

Though the data set runs a month behind the BLS nonfarm payrolls number (due Friday 5/5), the Federal Reserve watches the JOLTS report closely for signs of labor slack. The bottom line is that while softer labor demand supports a near-end of the Fed rate hiking cycle, still-tight labor market conditions and elevated wage pressures suggest that rates will support the Fed’s “higher for longer” message.

Source: Ned Davis Research, Bureau of Labor Statistics, Bloomberg, CNBC

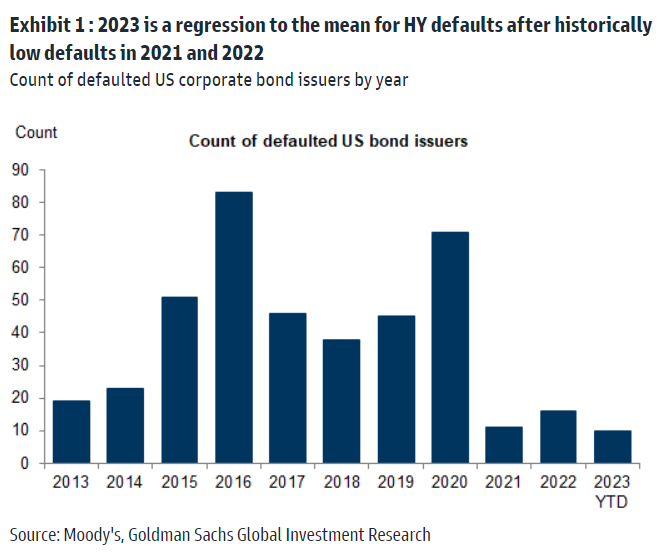

Corporate defaults are on the rise

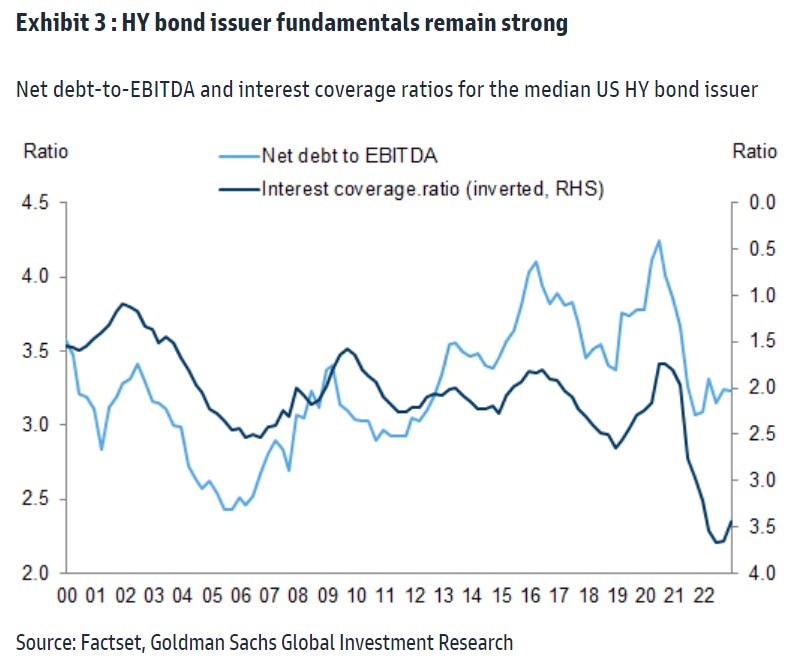

After a period of exceptionally low defaults in 2021 and 2022, the uncertain macro backdrop and uptick in defaults this year has investors asking whether the next default cycle has already begun and how high default rates will go. Three considerations come to mind.

First, while defaults have undoubtedly picked up this year, the recent uptick is a return to normalcy rather than the start of a full-blown default cycle. 2021 and 2022 saw defaults materialize at exceptionally low levels, with only 11 and 16 defaulted bond issuers, while 2015-2020 averaged 56 defaulted bond issuers per year.

Second, history suggests it typically requires an outright recession to push the High Yield bond and leveraged loan markets into a full-blown default cycle (i.e. double-digit default rates). The next chart shows that apart from the 2016 default cycle that was concentrated almost exclusively among Oil & Gas and Commodities issuers, every other significant period of defaults was presaged by a recession.

Third, if a recession does materialize, High Yield issuers are currently in a position of strength from a fundamental standpoint, which would allow them to weather the storm better than in previous cycles. Interest coverage ratios, or a company’s earnings as a function of its debt interest expenses, are hovering at healthy levels, while net leverage remains the near the lows of the post-GFC era.

Source: Goldman Sachs Global Investment Research

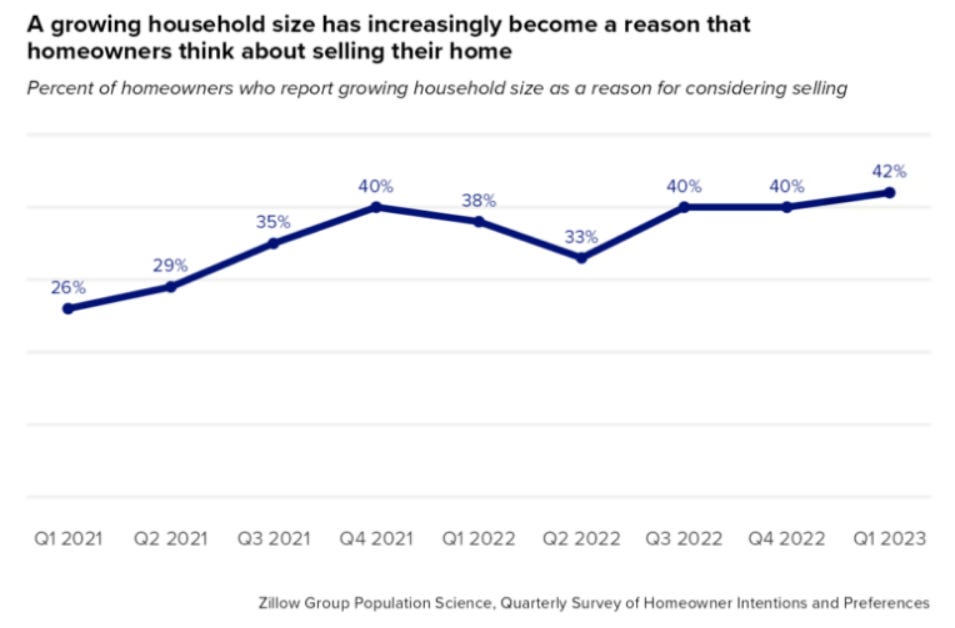

Homeowners selling due to growing household sizes

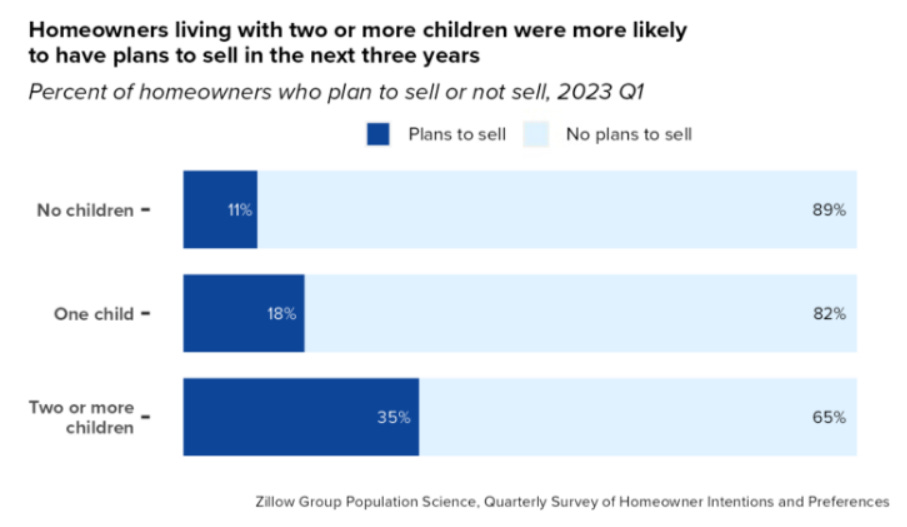

A recent Zillow (Z) survey shows that the more children exist in a family, the more likely they are to move. This makes intuitive sense; as your family grows, so do your housing needs.

Based on Zillow’s report, 42% of homeowners that are considering selling in the next three years cited growing family size as a reason for moving. This is consistent with the increase seen during the second year of the pandemic when most COVID-19 restrictions began to lift, with the proportion rising from 26% to 40% between March and December 2021.

There’s clear evidence to suggest that the desire to move grows consistently as children are added to a household. And these trends appear to be driven primarily by households with two or more children. See below.

More kids means you’ll want a home closer to good schools, daycares, parks, and other family-friendly amenities. But unlike other reasons to relocate, such as a job change, these needs rarely require a major cross-country move. Upsizing locally is often a great option for homeowners in this situation, as it is less likely to disrupt the routines and relationships you and your children have made.

Just another change in behavior and preferences borne out of the pandemic.

Source: Zillow, The Brookings Institution

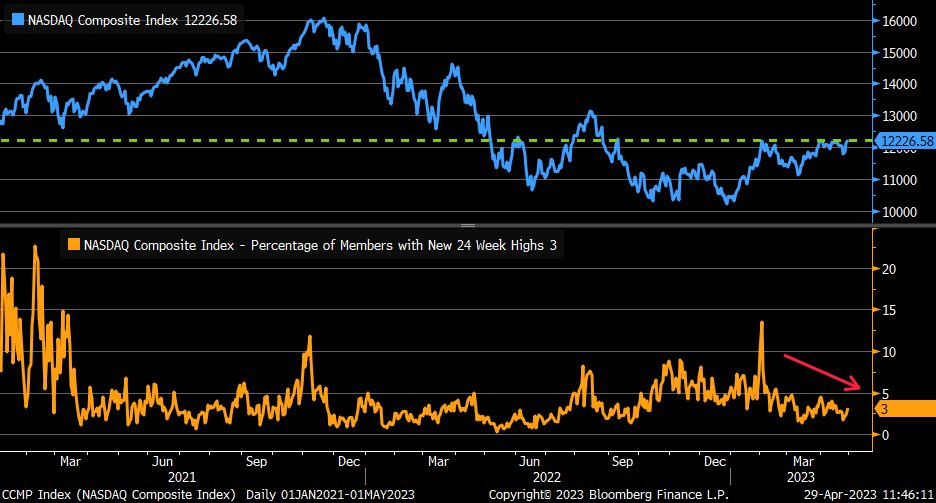

Stock market continues to lack breadth

The Nasdaq Composite continues to be the leader of the major U.S. stock indices in 2023 – climbing to its highest level since September 2022 and returning +15% YTD – yet only 3% of index constituents have made new 6-month highs.

It’s clear that just a handful of mega-cap tech stocks (MSFT, AAPL, NVDA, GOOGL, META, AMZN, TSLA) are doing much of the heavy lifting.

Healthy markets are broader markets, but so far this year’s market is extraordinarily narrow. If this market is to continue higher, we will need to see an expansion in this 6-month new highs list.

Source: Liz Ann Sonders

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.