Social Security projected to cut its benefits in 2035, barring reform

The Sandbox Daily (5.8.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Social Security, by the numbers

Let’s dig in.

Markets in review

EQUITIES: Dow +0.44% | S&P 500 0.00% | Nasdaq 100 -0.04% | Russell 2000 -0.46%

FIXED INCOME: Barclays Agg Bond -0.21% | High Yield -0.23% | 2yr UST 4.843% | 10yr UST 4.501%

COMMODITIES: Brent Crude +0.69% to $83.73/barrel. Gold -0.34% to $2,316.3/oz.

BITCOIN: -2.03% to $61,734

US DOLLAR INDEX: +0.13% to 105.553

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: -1.74% to 13.00

Quote of the day

“Americans are obsessed with money. It’s one of the things that makes us great and miserable at the same time.”

- Ben Carlson, A Wealth of Common Sense in Seinfeld on When Money Became Everything

Social Security, by the numbers

Social Security, signed into law under the Social Security Act by President Franklin D. Roosevelt on August 14, 1935, is the largest U.S. federal government program – the total cost of this institution was $1.392 trillion in 2023. It’s also unsustainable as currently structured, but more on that later.

Each year, the trustees of the Social Security trust funds issue reports on the current and projected funding status of the program.

This year’s report, released earlier this week, repeated the long-standing concern about the program’s financial stability: more money will be going out than coming in.

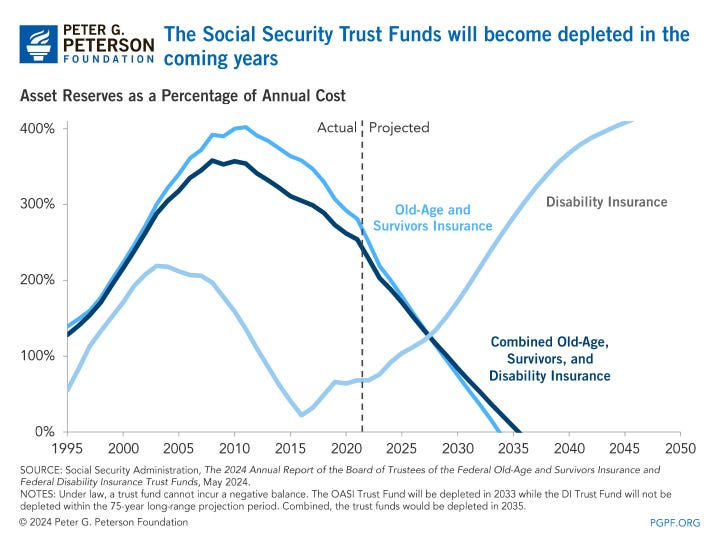

Social Security consists of two trusts:

Old-Age and Survivors Insurance (OASI) Trust Fund

Disability Insurance (DI) Trust Fund

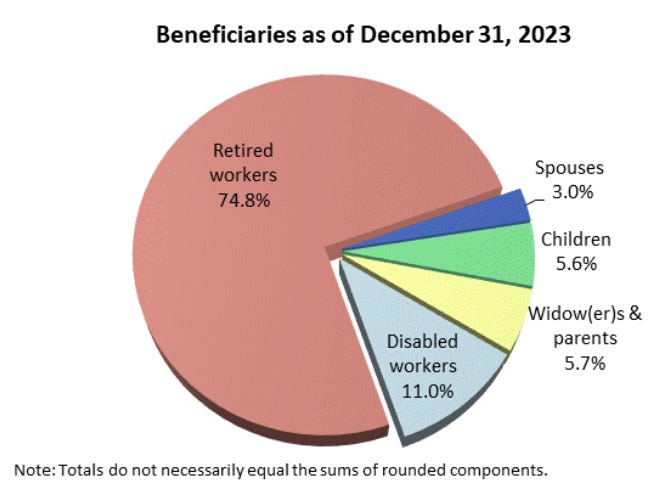

An estimated 70 million Americans, or roughly 1 in every 5 U.S. resident, collected Social Security benefits in 2023. Retirees make up ~75% of the beneficiaries, with the remaining share split up amongst disabled workers, spouses, widows, and children.

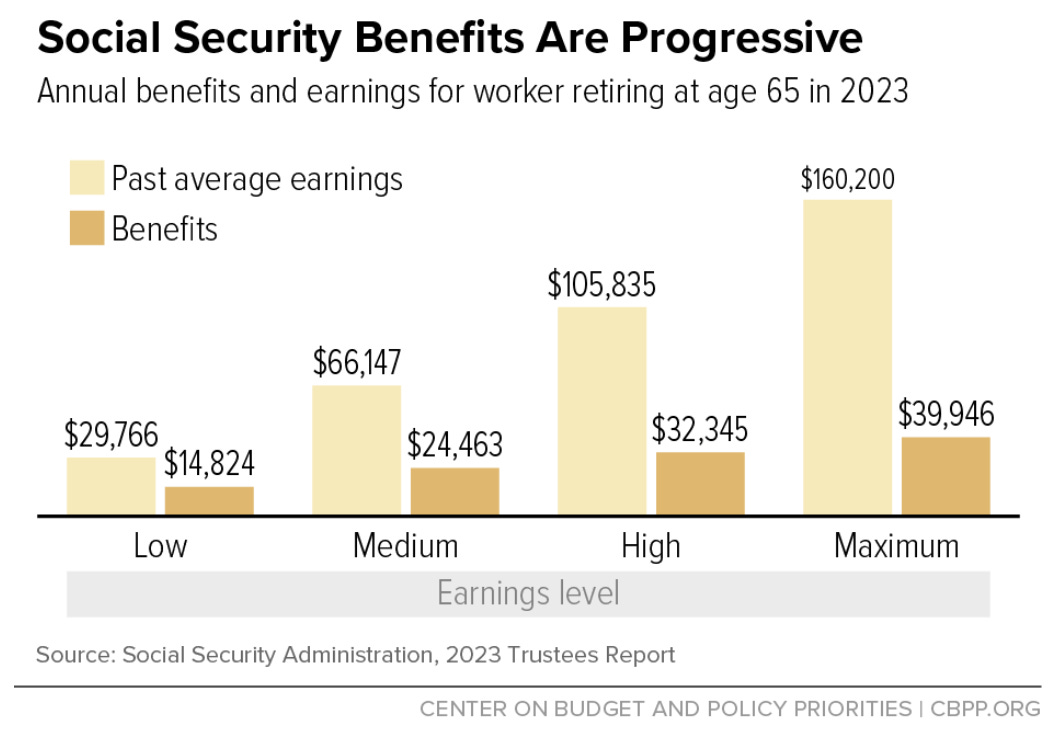

Benefits are based on the earnings on which people pay Social Security payroll taxes. The higher their earnings – up to a maximum taxable amount, $160,200 in 2023 – the higher their benefit.

Social Security benefits are progressive: they represent a higher proportion of a worker’s previous earnings for workers at lower earnings levels.

The average Social Security benefit is modest at $1,782 per month, or $21,384 per year. For someone who worked all of their adult life at average earnings and retires at age 65 in 2022, Social Security benefits replace an estimated 37% of past earnings.

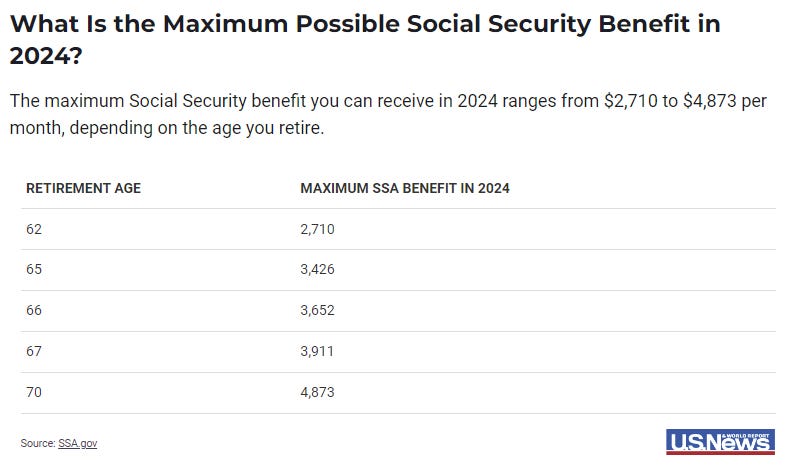

The maximum Social Security benefit you can receive in 2024 ranges from $2,710 to $4,873 per month, depending on the age you retire.

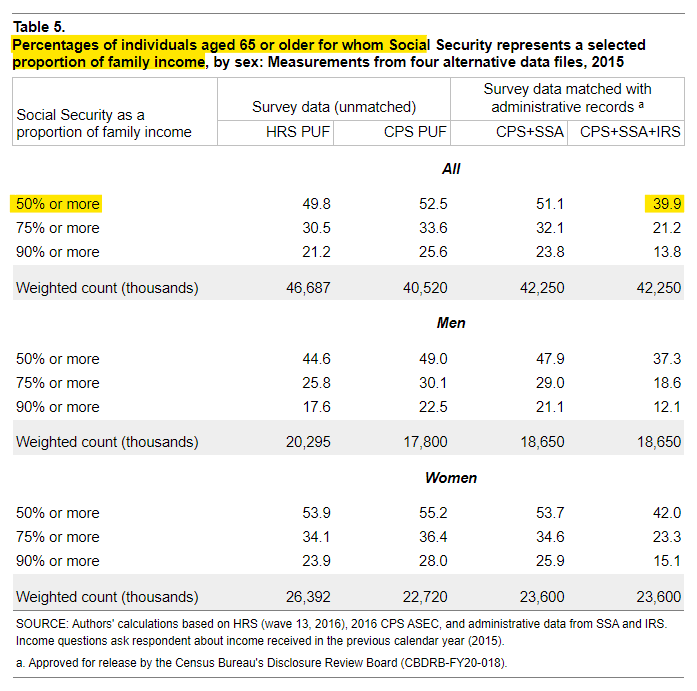

Social Security is the biggest source of retirement income for most retirees. In fact, for every 4 in 10 retirees, it provides at least 50% of their income.

So, with the release of the new annual report, what did we learn?

The Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivor benefits, will be able to pay 100% of benefits until 2033. After that, the income received is projected to cover only 79% of scheduled benefits, an automatic 21% haircut overnight. That means Congress has less than a decade to fix the shortfall.

The program’s Disability Insurance (DI) Trust Fund would not be depleted over the 75-year projection period.

If the two trust finds were hypothetically combined, they would be exhausted by 2035 and lead to a 17% reduction in benefits at that point.

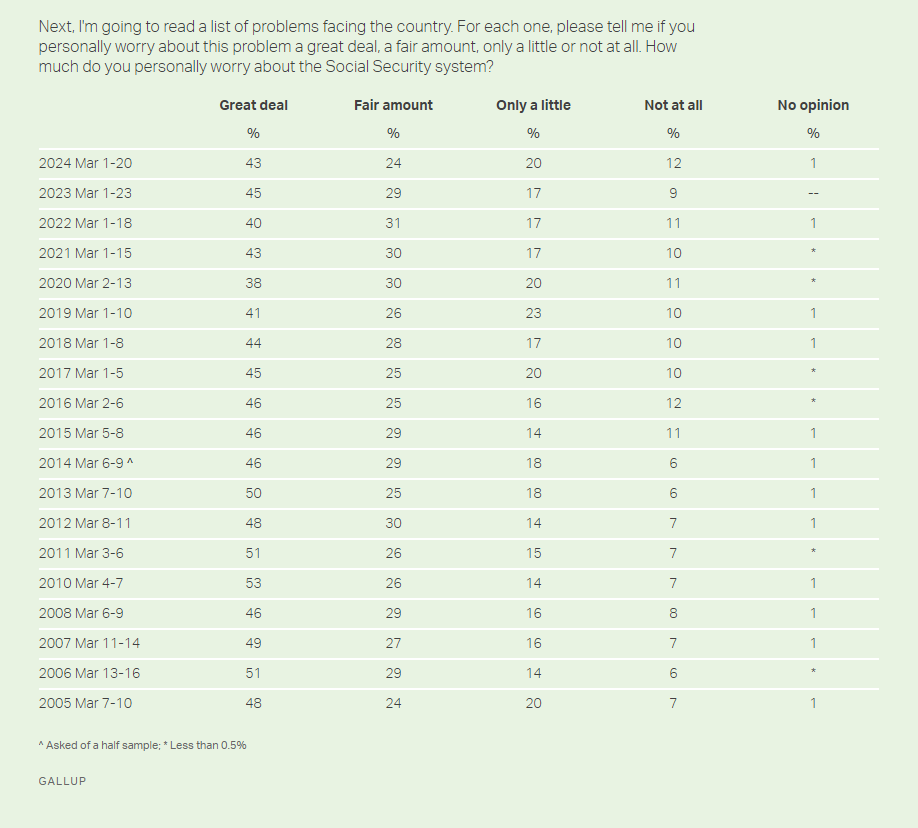

And Americans have been paying attention to this shortfall.

Gallup polls for years have showed that Americans are concerned Social Security will not be available when they become eligible.

The report makes clear that the trust funds of this vital program remain on an unsustainable path.

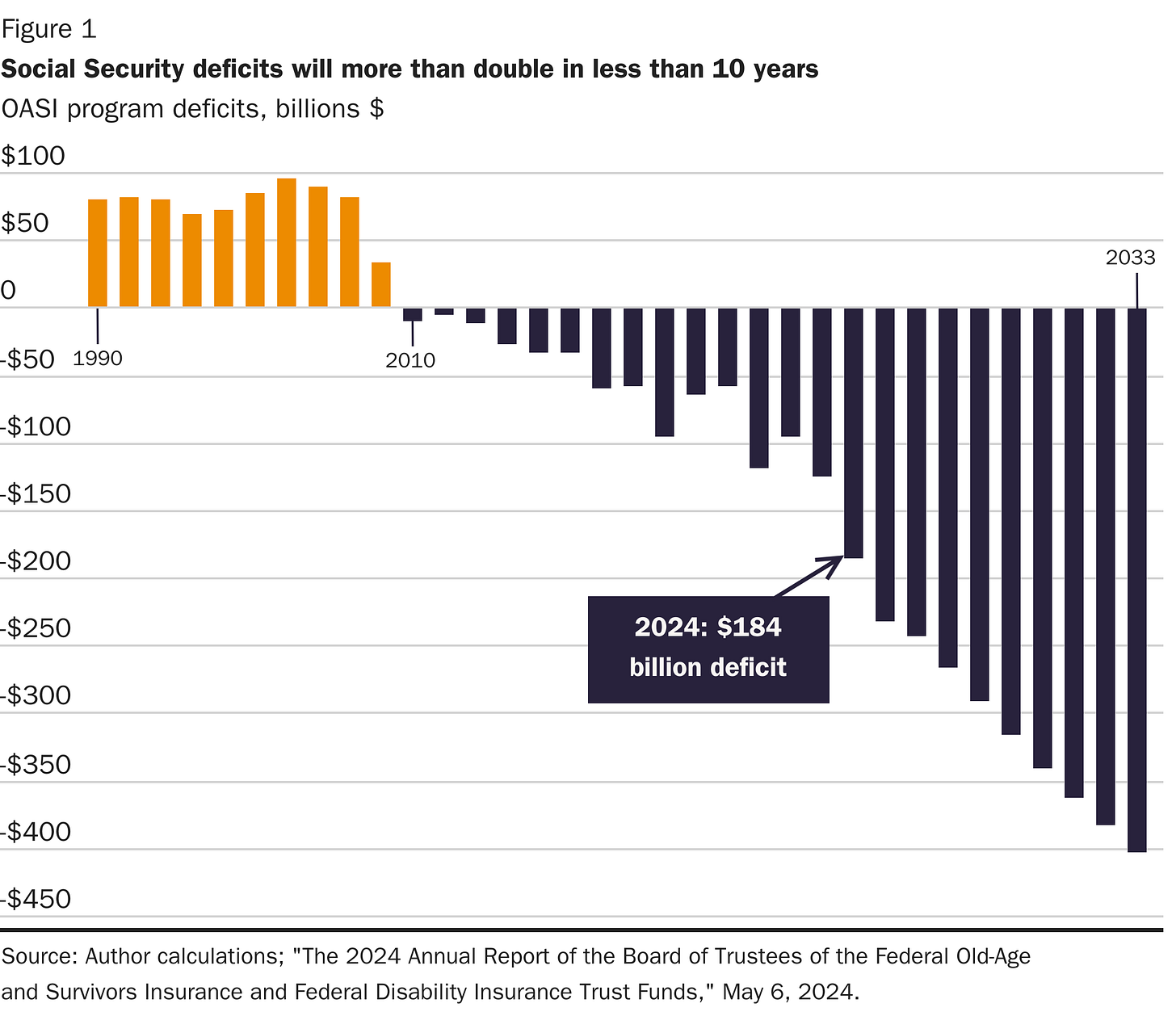

Social Security is projected to run a $184B deficit in 2024. By 2033, the deficit is expected to more than double, reaching $402B.

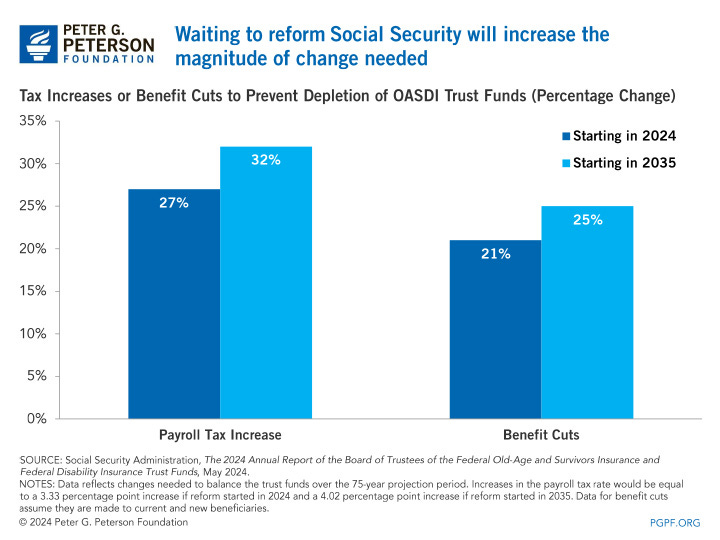

The good news is that it’s entirely within policymakers’ control to shore up Social Security. Doing so will is a political nightmare – one I’m not smart enough to solve – but it is necessary to protect the millions of beneficiaries as well as provide stability and strength to our fiscal and economic outlook.

The viable solutions are quite simple: fixing Social Security requires increasing payroll taxes, cutting benefits, or enacting both measures. More nuanced measures like actuarial assumption adjustments or changing to a flat-benefit structure are other reform options on the table, as well.

Social Security Administration Commissioner Martin O’Malley called the report “a measure of good news,” but told The Associated Press that “Congress still needs to act in order to avoid what is now forecast to be, in absence of their action, a 17% cut to people’s Social Security benefits.”

Social Security is the largest single line item in the federal budget and a key driver of the national debt. It’s also part of the fabric woven into our economy and society. Expect Social Security reform to gain momentum in the coming years.

Sources: Social Security Administration, SSA Actuarial Note 2023, Social Security Office of Retirement and Disability Policy, U.S. News, Peter G. Peterson Foundation, Barron’s, Associated Press, Gallup

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.