Social Security's 2.5% COLA adjustment, plus easy-does-it for the Fed and LEIs down again

The Sandbox Daily (10.21.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Social Security sets its 2025 COLA increase at 2.5%

easy does it for the Fed

manufacturing slump drags down Leading Economic Indicators

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.18% | S&P 500 -0.18% | Dow -0.80% | Russell 2000 -1.60%

FIXED INCOME: Barclays Agg Bond -0.69% | High Yield -0.40% | 2yr UST 4.027% | 10yr UST 4.194%

COMMODITIES: Brent Crude +1.33% to $74.03/barrel. Gold +0.18% to $2,734.9/oz.

BITCOIN: -2.69% to $67,254

US DOLLAR INDEX: +0.46% to 103.975

CBOE EQUITY PUT/CALL RATIO: 0.42

VIX: +1.89% to 18.37

Quote of the day

“Success seems to be connected with action. Successful people keep moving. They make mistakes but they don't quit.”

- Conrad Hilton

Social Security sets its 2025 COLA increase at 2.5%

There is no bigger problem for retirement planning than inflation. Rising prices erode the purchasing power of savings and make it more difficult to plan for the future. To account for the higher cost of goods and services, the government makes an annual adjustment.

The Social Security Administration recently announced a 2.5% Cost-of-Living Adjustment (COLA) increase to their benefits for 2025. This increase will benefit more than 72.5 million Americans who receive both Social Security and Supplemental Security benefits from the government.

The average Social Security retiree benefit will increase $49 per month, from approximately $1,927 in 2024 to $1,976 in 2025.

Every October, the Social Security Administration (SSA) announces how much more seniors will receive from the government welfare program the next year due to inflation.

The 2025 adjustment is a big step down from the increases received over the last three years in which COLA saw its largest upward adjustments in four decades.

Given the difficult inflationary conditions of the past few years, the risk that worries most retirees continues to be outliving their savings.

Until recently, the market and economic environment presented classic challenges to retirement planning, including high inflation rates and volatile financial markets. While stocks have rebounded to new all-time highs, and bond yields remain above historical averages, retirees may still be concerned about whether their portfolios will keep pace.

Source: Social Security Administration, CNBC, AARP

Easy does it

The slower the Federal Reserve moves, the better.

The Fed-centric people don’t seem to realize how good this moment is. Once the Fed decides it’s time to lower interest rates, you want measured, methodical rate cuts. Nothing brash or abrasive. Nothing exciting. The longer and more drawn out the rate cutting cycle, the better. In that sense, the market is looking for economic data that is neither too hot (less cuts) nor too cold (more cuts).

A slower pace of cuts has been bullish historically. If the economy is heading toward a soft landing, the Fed can afford to move gradually – like 1984, 1995, and 1998.

Conversely, the Fed slashes rates rapidly if the economy is falling apart – like in the months after the 2001, 2007, and 2019 first cuts.

A fast cycle is five or more cuts over a 12-month period. Anything less than five is considered a slow cycle.

The S&P 500 has risen an average of 24.4% during the first year of slow easing cycles versus 5.2%, amid higher volatility, during the first year of fast cycles.

Source: Federal Reserve, Ned Davis Research, Charles Schwab

Manufacturing slump drags down Leading Economic Indicators

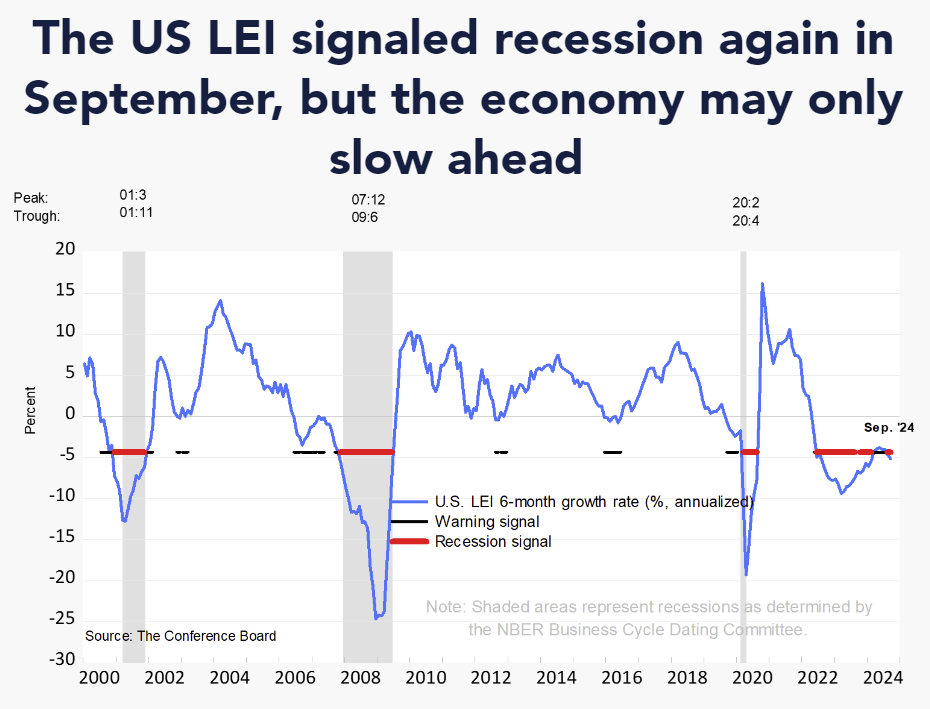

Although real GDP rose above trend in the first half of this year and is tracking above 3.0% annualized growth for Q3, the Conference Board’s Leading Economic Index (LEI) continues to fire recessionary warning shots for our economy.

The LEI fell by a larger-than-expected -0.5% in September and has been sliding since early 2022.

For the six-month period ending in September, it has declined at a 2.6% annual rate, worse than the 2.2% decrease in the prior six months.

The latest decline was led by a negative contribution from ISM new orders. In fact, the manufacturing slump has been the predominant driver of LEI weakness over the past couple of years. In addition, the inverted yield curve, worsening consumer expectations of business conditions, and a pullback in building permits also contributed to the decline last month.

The persistent weakness in the LEI has not been corroborated by other leading indexes, which has led many investors and strategists to discard the Conference Board’s signal for quite some time.

The Federal Reserve will offer up its own assessment of the current state of the economy on Wednesday when it releases its “beige book” for September. This is a survey of economic conditions around the country from the Fed’s regional banks.

Source: The Conference Board

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: