Staggering bond drawdowns, plus oil supply, QT, and the week in review

The Sandbox Daily (9.22.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

staggering bond drawdowns

shifts in oil capacity

Quantitative Tightening

a brief recap to snapshot the week in markets

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.05% | S&P 500 -0.23% | Russell 2000 -0.30% | Dow -0.31%

FIXED INCOME: Barclays Agg Bond +0.42% | High Yield +0.18% | 2yr UST 5.108% | 10yr UST 4.434%

COMMODITIES: Brent Crude +0.30% to $93.58/barrel. Gold +0.27% to $1,944.8/oz.

BITCOIN: -0.17% to $26,568

US DOLLAR INDEX: +0.24% to 105.613

CBOE EQUITY PUT/CALL RATIO: 0.88

VIX: -1.94% to 17.20

Quote of the day

“There are two times in a man’s life when he should not speculate: when he can’t afford it, and when he can.”

- Mark Twain

Staggering bond drawdowns

The biggest driver of bond prices is a metric known as duration. Duration is a mathematical measure that measures the sensitivity of a bond’s price to a change in interest rates.

In simple terms, the longer a bond’s maturity implies a greater duration and thus a larger change in price (up or down) given a 1% move in interest rates.

Here are the current drawdown percentages for bonds of different durations, listed below shortest to longest.

Source: YCharts

Shifts in oil capacity

To mitigate energy prices’ impact on headline inflation, the U.S. government has released record amounts of crude from the Strategic Petroleum Reserve (SPR).

The SPR reserve is at a level not seen since 1983 – the latest reading was 351M a/o September 15 – and roughly 40% below the long-term average of 600M.

Meanwhile, as OPEC and its key members embarked on voluntary production cuts and global demand remained robust, the barrels from “core members” have been mainly replaced by rising production from “sanctioned members” (Iran, Libya and Venezuela – not subject to OPEC quotas). These dark inventories are reaching their own peak capacity:

Source: J.P. Morgan

Quantitative Tightening

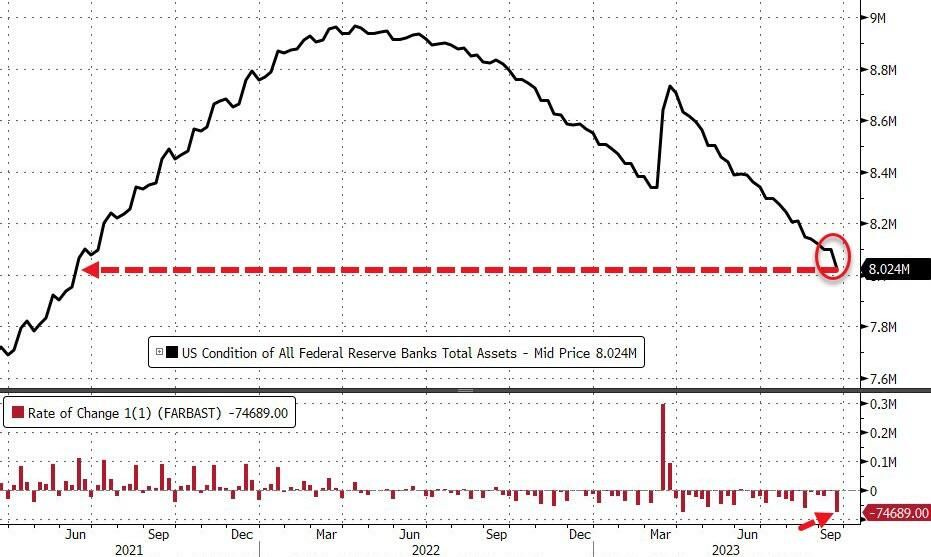

Since June 2022, the Federal Reserve has been engaging in Quantitative Tightening (QT) to reduce the size of their balance sheet.

Alongside the interest rate hikes everyone mentions, the Fed has utilized this 2nd monetary policy tool to passively shrink its footprint – any maturing security on their balance sheet is “rolled off” without being replaced.

The caps currently in place are $60B in U.S. Treasuries per month and $35B in MBS, effectively reducing liquidity by $95B per month – although the actual amounts have been less than the caps (mainly on the MBS side).

The Fed’s balance sheet plunged by almost $75B last week – its biggest weekly drop since July 2020 – and has nearly reduced the balance sheet by $1B since its peak.

Source: Federal Reserve Bank of Richmond, ZeroHedge

The week in review

Talk of the tape: The major markets lost ground this week. A hawkish tilt to the Fed’s updated Summary of Economic Projections, a lack of incremental buyers, waning momentum, and seasonal weakness all chalked up as contributors. Bank of America noted that global equity funds witnessed outflows of $16.9 billion for the week ending September 20, including $17.9 billion from U.S. equity funds; both fund outflows represent the highest levels since December 2022.

Soft-landing expectations remain the key driver of the bullish narrative. The 2H23/2024 earnings rebound, earnings revisions trend, and record amount of money market assets on the sidelines flagged as some of the bullish drivers. Disinflation traction cited as another tailwind, although recent inflationary pressures from commodities have stoked inflationary embers. Consumer resilience, although showing some signs of fatigue, continues to be a higher-profile bright spot.

The backup in interest rates, liquidity headwinds, and the lagged effects of policy tightening (18 months now) are talking points among the bearish narrative. The higher-for-longer Fed another overhang as markets decide what to make of Fed Funds Rate expectations for 2024. Seasonal headwinds shouldn’t be dismissed. Geopolitical scrutiny continues to lurk in the shadows.

Stocks: The major markets ended mixed this week, with Apple’s challenges in China causing the information technology sector to be this week’s laggard. The S&P 500 remains in a sideways range of 4300-4600. According to the AAII Sentiment Survey, the percentage of bullish investors declined from 42.2% to 34.4% this week, tracking below the historical long-term average of 37.5%. Meanwhile, looking down the cap stack, small-caps have continued to struggle, on both an absolute and relative basis.

Bonds: The Bloomberg Aggregate Bond Index ended the week decidedly lower on the back of this week’s FOMC meeting. In addition, high yield bonds lost ground this week as rising default risks appear to not yet be fully priced into credit. Yield-based buyers seem like they’re becoming more comfortable that the Federal Reserve could be on hold or close enough to terminal, so much so that some are adding to duration (interest rate sensitivity).

Commodities: Energy prices declined this week despite tightening supply expectations following Saudi Arabia and Russia’s decision to extend their production cuts until December. Supply constraints on top of increasing demand are causing many analysts to forecast a price of $100 per barrel of West Texas Intermediate crude oil.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Hey, thank you for not putting up a paywall on your sub. It’s pretty challenging educating myself on the navigation of financial markets alone. Guys like you, Andrew Moss, and Callum Thomas are really appreciated. Z

Great coverage!!!