State of the market, plus tech supercycles, bond market positioning, risk management, and pre-trade checklist

The Sandbox Daily (9.19.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

state of the market

AI ushers in new potential supercycle

Hedge Funds vs. Asset Managers

risk management framework

pre-trade setup

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.22% | S&P 500 -0.22% | Dow -0.31% | Russell 2000 -0.42%

FIXED INCOME: Barclays Agg Bond -0.29% | High Yield -0.31% | 2yr UST 5.092% | 10yr UST 4.365%

COMMODITIES: Brent Crude +0.16% to $94.58/barrel. Gold -0.04% to $1,952.6/oz.

BITCOIN: +1.49% to $27,178

US DOLLAR INDEX: -0.05% to 105.147

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: +0.79% to 14.11

Quote of the day

“In investing, a bull sounds like a reckless cheerleader, while a bear sounds like a sharp mind who has dug past the headlines.”

- Morgan Housel, Why Does Pessimism Sound So Smart? via Sam Ro

State of the stock market

The corrective phase for stocks, underway since July (as shown below by the right-most red arrow), has been frustrating long investors.

Here is the S&P 500 rangebound between 4300 and 4600 since June.

Investors get frustrated in sideways markets, but there are different tools for those types of environments.

In fact, since the New 52-week High List peaked on July 13th, only Energy has been working.

It’s difficult to make money long when New Lows outnumber New Highs, and we’ve seen more Net Lows happen 31 of the last 34 days.

So, what is weighing on stocks right now?

Maybe it’s the U.S. dollar, which bottomed the same day the new 52-week New Highs list peaked – more on that in yesterday’s note. Or it’s interest rates, pushing up against the highs of the cycle. Could be the September Fed meeting and uncertain policy outlook. Perhaps it is just the right time for consolidation as August and September are seasonably the weakest 2-month period of the calendar year.

Source: All Star Charts

AI ushers in new potential supercycle

Every super cycle of global business often originates from underlying technological innovation – a breakthrough moment. And the biggest variable at present may come from the emergence of generative AI.

Here is what Dan Ives had to say last week at Future Proof: “Artificial Intelligence is the largest transformational technology trend since the inception of the internet. This is a 1995 moment, not 1999. If you focus on a one year P/E valuation multiple, you will miss out on generational growth companies.”

Source: FS Insight

Hedge Funds vs. Asset Managers

With the Federal Reserve set to deliver its interest rate decision and policy statement on Wednesday, it’s interesting to note the positioning of two major players in the $25 trillion dollar Treasury bond market.

On one side, Hedge Funds have built up short positions in Treasury futures contracts to record levels in some maturities over recent weeks – reference the black line in the chart below. The risk of a potential dislocation event was significant enough to trigger a warning this week from the Bank of International Settlements:

“The current build-up of leveraged short positions in U.S. Treasury futures is a financial vulnerability worth monitoring because of the margin spirals it could potentially trigger. Margin deleveraging, if disorderly, has the potential to dislocate core fixed-income markets.”

In stark contrast, asset managers are roughly long equal-but-opposite contracts (red line below) positioned to benefit if/when interest rates fall.

Source: Financial Times, Bloomberg

Risk management framework

One of the toughest concepts in personal finance is risk. It's tough, in my opinion, because it's so hard to define and means something different to each person.

Open a finance textbook and you’ll find long missives about volatility, standard deviation, beta, Value-at-Risk, the Sharpe ratio, the Sortino ratio, the Treynor ratio and on and on and on. All of these measures are quantitative tools for measuring risk in your portfolio.

Developing a risk management system is critical to your future success. Even if it’s not perfect, one should always put one in place. Here is a rather simple infographic to get the tires kicking on a basic framework:

Ultimately, portfolio risk management accepts the right amount of risk with the anticipation of an equal or higher reward, then monitoring these measured risks in real time and making adjustments when necessary. It is an iterative process with no end.

Source: Project Management Institute

Pre-trade setup

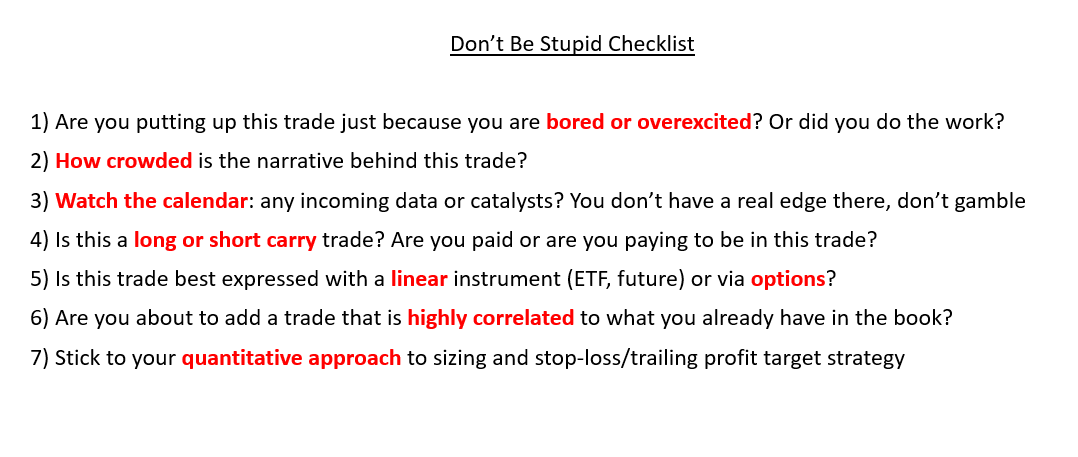

Before entering a new position, always remember to review your setup. Here’s a simple “don’t be stupid checklist”:

Source: The Macro Compass

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.