Sticker shock: the soaring cost of cars

The Sandbox Daily (9.24.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

cars are expensive

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -0.28% | Nasdaq 100 -0.31% | Dow -0.37% | Russell 2000 -0.92%

FIXED INCOME: Barclays Agg Bond -0.19% | High Yield -0.14% | 2yr UST 3.604% | 10yr UST 4.149%

COMMODITIES: Brent Crude +2.26% to $69.16/barrel. Gold -1.37% to $3,763.3/oz.

BITCOIN: +1.58% to $113,592

US DOLLAR INDEX: +0.62% to 97.871

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: -2.76% to 16.18

Quote of the day

“If you want to go fast, go alone. If you want to go far, go with others.”

- African proverb

Cars are expensive

Recently, I ventured down a Reddit rabbit hole and stumbled upon a sobering statistic: new cars have become so expensive that ~20% of buyers are signing up for a monthly loan payment of $1,000 or more, which is up from ~4% in 2019 per a recent Edmunds report.

What’s more, those who cannot afford such a hefty monthly payment are increasingly turning to longer-term loan structures, borrowing for up to seven years instead of the more traditional three-to-five year tenors.

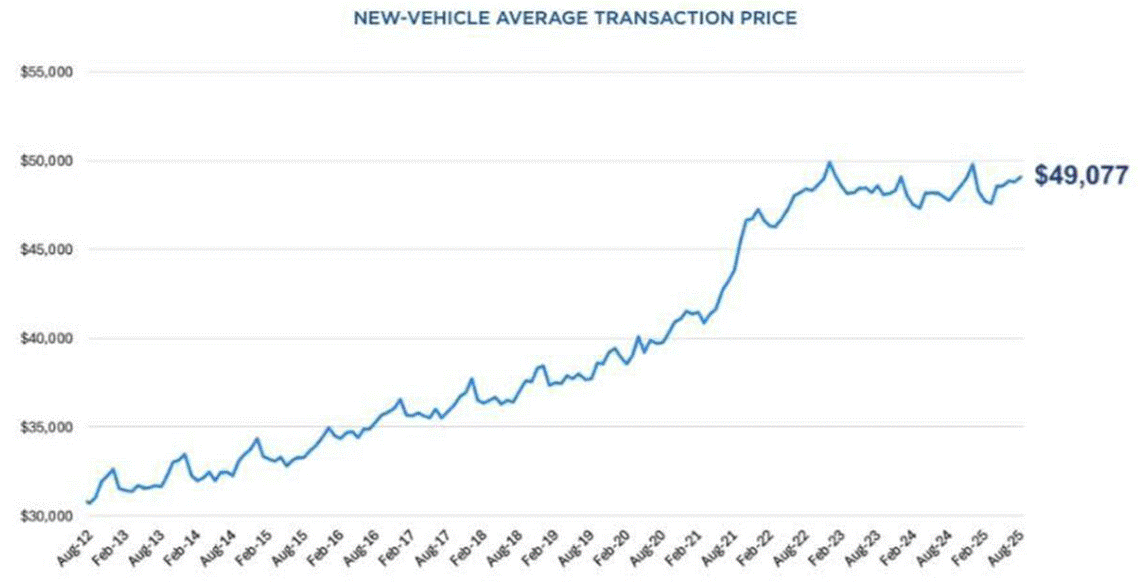

Because the average new car now costs over $49,000 – higher by $10,500 versus pre-covid levels – a record share of car shoppers (22%) opted for seven-year auto loans in Q2, which has doubled in the last five years.

So, what gives?

Well, fall is the most popular time to buy a car because dealerships often offer deals to make room for the following year’s models and inventory buildout.

And, if you’re in the market, you too may need a lengthier loan to give your monthly budget some breathing room.

But, there are downsides to borrowing for longer that you’ll want to be aware of.

First, the most basic reason: while longer loan terms reduce the monthly payment, it does increase your total cost of borrowing, especially with interest rates for new car purchases averaging 7% or more.

The other notable consideration is the risk of becoming “underwater” on a longer duration loan. In other words, if you sell or trade-in your car before the term of your loan is up, you could wind up owing more money than the car is worth. This is because auto loans are amortized, like most mortgages, meaning a bigger share of your fixed payment is interest in the beginning and equity is built slowly over time.

All that said, there are several ways to cut down on interest expense or offset your costs if you do go the lengthier-loan route. Things to consider:

Timing. Tariffs haven’t led to any major price increases on cars… yet. Automakers and dealers have absorbed much of the tariff impact, but that may not last much longer, according to Kelley Blue Book.

Buying American. Eligible taxpayers can now get a federal tax deduction of up to $10,000 a year on auto loan interest. A provision of the Big Beautiful Bill Act passed earlier this year, this applies to loans taken out between 2025 and 2028 on new American-made cars. It even applies if you don’t itemize your deductions – as long as you meet the income and other eligibility requirements.

Buying used versus new. This is a double-edged sword. Used cars are cheaper – averaging about $25,500, according to July data from Kelley Blue Book. But interest rates for used cars are generally higher than new cars, and used cars typically have higher maintenance costs.

Changing your payment schedule: One example: if you make payments every two weeks rather than once a month, you’ll make 13 payments rather than 12 payments in a year, shortening your payoff time by one month every year and saving you some interest.

Paying extra when you can. If you get an annual bonus from work or a tax refund every spring, consider deploying some money towards your auto loan to accelerate your payoff – as long as there’s no prepayment penalty.

Maximizing your trade-in value. If you’re trading in your current vehicle, don’t assume every dealer will make you the same offer. Because of the relatively low inventory of used cars, some dealers may be more competitive than others if they’re in need of your vehicle type.

Sticker shock at the dealer lot is just one more reminder of how the post-covid inflation surge has stretched household budgets, forcing many families to juggle higher costs across nearly every consumer category.

It’s a sobering snapshot of how inflation lingers, reshaping what affordability really means.

Sources: Edmunds, Kelley Blue Book

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)