Stock volatility, plus Mastercard/Visa, Chamath Palihapitiya, and sequence of returns risk

The Sandbox Daily (8.30.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

volatility the key to unlocking 2023?

Mastercard, Visa jump to new highs

sequence of returns risk

Happy 93rd birthday, Warren Buffett!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.56% | Russell 2000 +0.40% | S&P 500 +0.38% | Dow +0.11%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield -0.04% | 2yr UST 4.882% | 10yr UST 4.112%

COMMODITIES: Brent Crude +0.54% to $85.95/barrel. Gold +0.31% to $1,971.1/oz.

BITCOIN: -2.34% to $27,261

US DOLLAR INDEX: -0.35% to 103.171

CBOE EQUITY PUT/CALL RATIO: 0.69

VIX: -3.94%to 13.88

Quote of the day

“We’ve got three boxes at the company: in, out, and too hard. A lot of things end up in the ‘too hard’ pile, and it doesn’t bother us. We don’t have to be able to do everything well. If you go to the Olympics and you run the hundred meter well, you don’t have to throw the shotput. So, we try to stay within the circle of competence.”

- Warren Buffett, 2006 Berkshire Hathaway Annual Shareholder Meeting

Volatility the key to unlocking 2023?

Equity markets have been very calm this year after a volatile and frustrating 2022.

We’ve only experienced 2 trading sessions where the S&P 500 index moved up or down by more than 2%, whereas a typical year sees 17 trading days.

To be fair, like any data series, most years don’t experience the “average” – in fact, it’s quite the opposite. Markets seem to experience periods of persistent volatility or a vacuum of chop.

So, what is the VIX saying?

The CBOE Market Volatility Index, or VIX, has been volleying back and forth in a fairly narrow range of 12 to 18 since June. Let’s unpack how we got to these levels.

The inflation narrative dominated headlines in 2022, peaking sometime around October. And when inflation “hit a wall” in October, so did equity volatility. This is around the same time when the U.S. dollar peaked and interest rates stopped backing up.

Refreshing our memory banks a little bit, October 13th is when we received the jumbo-sized +0.6% MoM core inflation reading, causing the S&P 500 to gap down pre-market over -2% to only end the day positive (+2.6%, in fact) on the back of a fierce intra-day rally. This marked the stock bottom.

Ever since, the collapse in VIX has been impressive, especially when weighed against the incredibly uncertain macro backdrop and tightening of financial conditions (bank failures, SLOOS credit conditions, M2 money supply, etc.).

And, most importantly, falling volatility is generally a good thing for asset prices. In fact, after a negative return year (like 2022), the median equity gain the next year is +22% (win ratio 83%, n=23) when the VIX falls, versus equity losses with a median -23% return (win ratio 14%, n=7) when the VIX continues rising.

As the scatter plot below highlights, we can see the sizable influence of the VIX. Even in “All Years,” the bifurcation in outcomes shows VIX is a key differentiating input in realized returns.

I’ve shared these important Fundstrat charts before but it bears repeating: is 2023 just a volatility narrative?

Source: Independent Vanguard Adviser, FS Insight

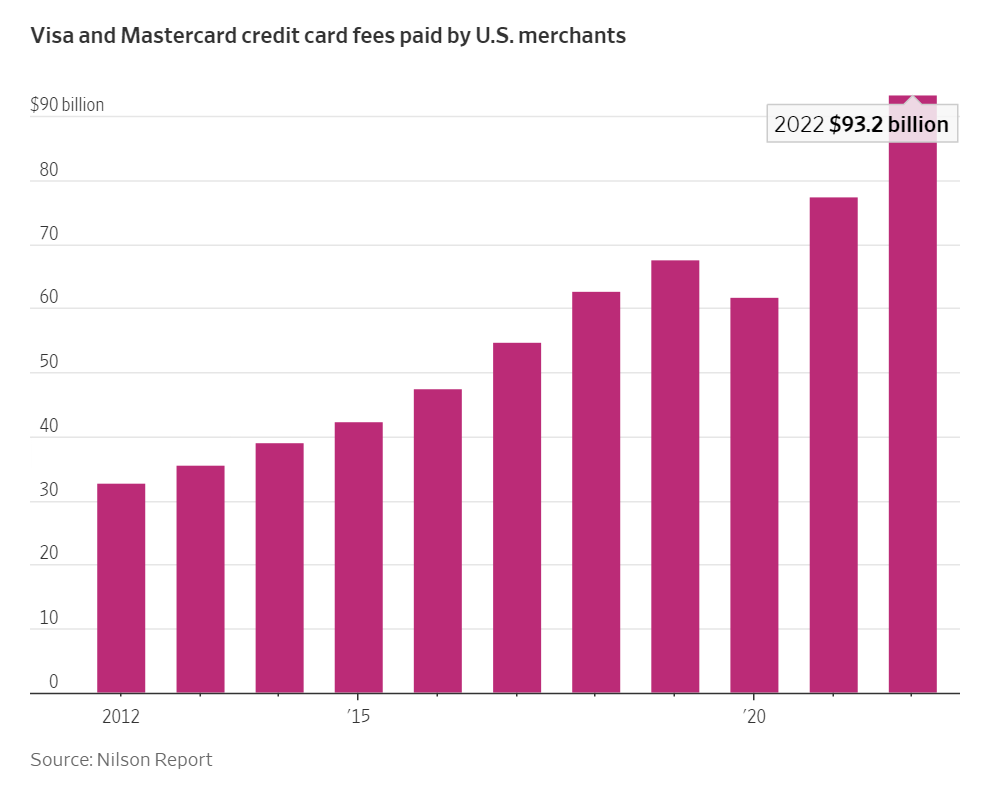

Mastercard, Visa jump to new highs

Mastercard hit fresh new all-time highs today (see chart below), while Visa printed new 52-week highs and sits just below all-time highs itself (no chart but looks the same) .

Today, both Mastercard (MA) and Visa (V) announced they are planning to increase fees that many merchants pay when they accept customers’ credit cards. These two payment-processing corporations handle the most credit card transactions in the United States. Domestic merchants paid an estimated $93 billion in Visa and Mastercard credit-card fees last year, alone.

A cautionary tale when listening to high profile investors and capital allocators.

Former Facebook executive and billionaire investor, Chamath Palihapitiya, had this to say on the All-In Podcast: “My biggest business loser for 2022 is Visa and MasterCard and traditional payment rails and the entire ecosystem around it." Moments later, Chamath added the most likely profitable spread trade of his lifetime is “to be short these [two] companies and be long well-thought-out, Web3 crypto projects that are rebuilding payments infrastructure in a completely decentralized way.”

While still early innings, so far the legacy businesses continue to dominate the payment-processing space despite many young, innovative tech-adjacent companies challenging their moats:

But, who knows? Chamath is just in the arena trying things out…

Source: Wall Street Journal, Ian McMillan, Chamath Palihapitiya

Sequence of returns risk

Sequence of returns risk is the risk that comes from the order in which your investment returns occur.

The two investors below arrived at the same ending portfolio value, yet their perception of those outcomes are entirely different due to the path each experienced along the way.

This risk arises most often in retirement planning discussions but is applicable to investors of all situations.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.