Stocks: everyone's fully invested

The Sandbox Daily (9.25.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

allocation to stocks at records for households, institutions, foreigners

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.38% | Nasdaq 100 -0.43% | S&P 500 -0.50% | Russell 2000 -0.98%

FIXED INCOME: Barclays Agg Bond -0.14% | High Yield -0.28% | 2yr UST 3.659% | 10yr UST 4.172%

COMMODITIES: Brent Crude +0.51% to $69.66/barrel. Gold +0.33% to $3,780.5/oz.

BITCOIN: -3.68% to $109,386

US DOLLAR INDEX: +0.62% to 98.479

CBOE TOTAL PUT/CALL RATIO: 0.86

VIX: +3.46% to 16.74

Quote of the day

“Life might be a race against time but it is enriched when we rise above our instincts and stop the clock to process and understand what we are doing and why. A wise decision requires reflection, and reflection requires a pause.”

- Frank Portnoy

Allocation to stocks at records

While markets have masterfully navigated the wall of worry in 2025, I see another potential headwind worth flagging – positioning.

Understanding how investors are positioned is an important exercise that the best investors track and study.

Why? Because it shows what investors are actually doing with their money, as opposed to survey data that only reports what investors say they’re doing.

Asset prices often move up or down based on investor positioning as capital flows in and out of risk assets. This behavior is driven by the perceived trajectory of markets and the economy.

In other words: watch what they do, not what they say.

The Federal Reserve Board recently updated its Financial Accounts report for Q2, and while the data is a bit stale at this point, it’s still helpful for the general lay of the land.

The data shows households, the largest holders of stocks, owned equities valued at $51.1 trillion at the end of the quarter. This value represents a record-high allocation of 50.5% of household financial assets.

Ok, so the “retail” crowd appears to be fully invested – more so than any point in history.

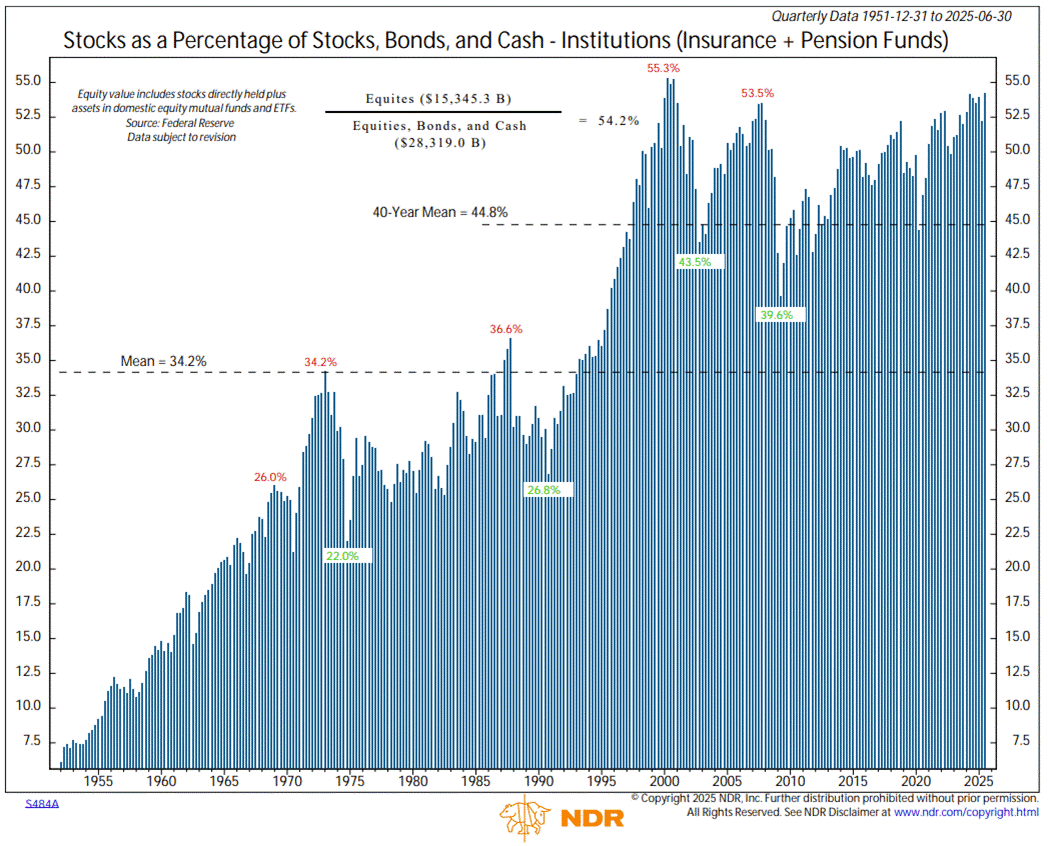

What about institutional money?

Institutions – including insurance companies, pension funds, endowments, and the like – are also heavily weighted to stocks. The reading has only been higher during the period around the dotcom peak.

Taken together, the latest data from the Fed’s Financial Accounts report suggest households, institutions, and foreigners are very much overweight stocks.

Each group saw equity holdings jump during the quarter as stock prices surged off the April Liberation Day lows.

To me, this tells me two things that are diametrically opposed to one another:

Investors have been comfortable maintaining this level of stock ownership because they remain optimistic on the intermediate- to long-term prospects of the stock market and by extension the U.S. economy.

Along with high valuations, full positioning doesn’t leave much room for future buying power beyond the margin. Any change in risk appetite, or a series of negative risks materializing (as if we haven’t seen enough in 2025 !!), could leave the market susceptible to a leg lower.

As is the life of an investor, one must always balance upside risks against downside risks and be comfortable in doing so.

One final consideration.

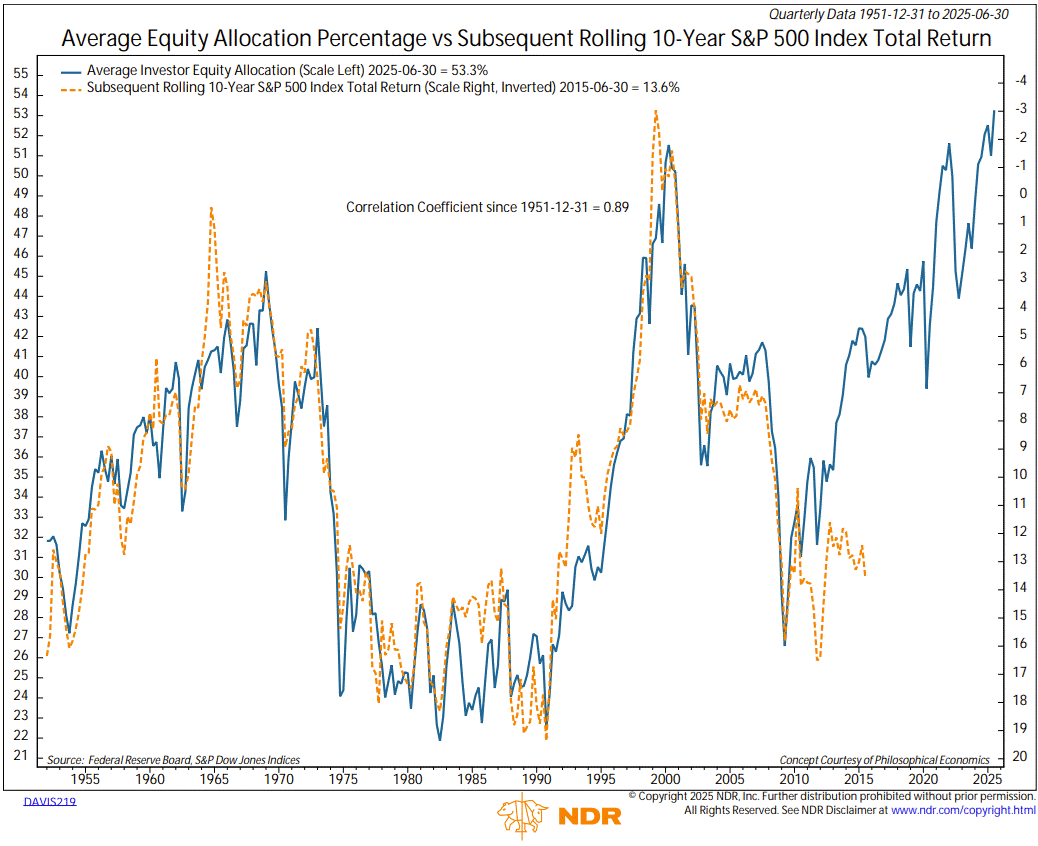

How meaningful is all this data? Or stated differently, how useful has asset allocation been as a gauge for the market?

The chart below shows the historical record by plotting household equity allocation (blue line) versus subsequent 10-year returns (orange line). The correlation has been remarkably strong at 0.89.

While not a great short-term timing tool, the message from these asset allocation reports is that risks are growing for equities, and investors should remain open to the idea of a downshift in the magnitude of returns during the next 10 years compared to the last 10.

At least that’s what the historical record suggests.

Source: Federal Reserve, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)