Super Bowl LVII, plus active management, U.S. interest expense, Bitcoin, and the week in review

The Sandbox Daily (2.10.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the Super Bowl advertising business, active management ready for a big year, Interest Expense on U.S. Public Debt, Bitcoin takes a breather, and a brief recap to snapshot the week in markets.

The Super Bowl is finally here, and yet somehow Monday is still not a Federal (hangover) holiday.

Let’s dig in.

Markets in review

EQUITIES: Dow +0.50% | S&P 500 +0.22% | Russell 2000 +0.18% | Nasdaq 100 -0.62%

FIXED INCOME: Barclays Agg Bond -0.44% | High Yield -0.77% | 2yr UST 4.525% | 10yr UST 3.743%

COMMODITIES: Brent Crude +2.39% to $86.52/barrel. Gold -0.21% to $1,874.5oz.

BITCOIN: -1.02% to $21,634

US DOLLAR INDEX: +0.35% to 103.578

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: -0.87% to 20.53

Super Bowl ads

The Super Bowl has finally arrived! The Kansas City Chiefs and Philadelphia Eagles play for the Lombardi Trophy on Sunday night at 6:30pm on Fox. Time for wings, dips, and beer – lots of ‘em!

As with many past Super Bowls, much attention will be directed at the Super Bowl commercials.

This year, crypto is out and beer is back! Anheuser-Busch’s exclusive alcohol advertising partnership with the NFL is up for the first time since 1989, opening the door for other alcohol brands to crash the party.

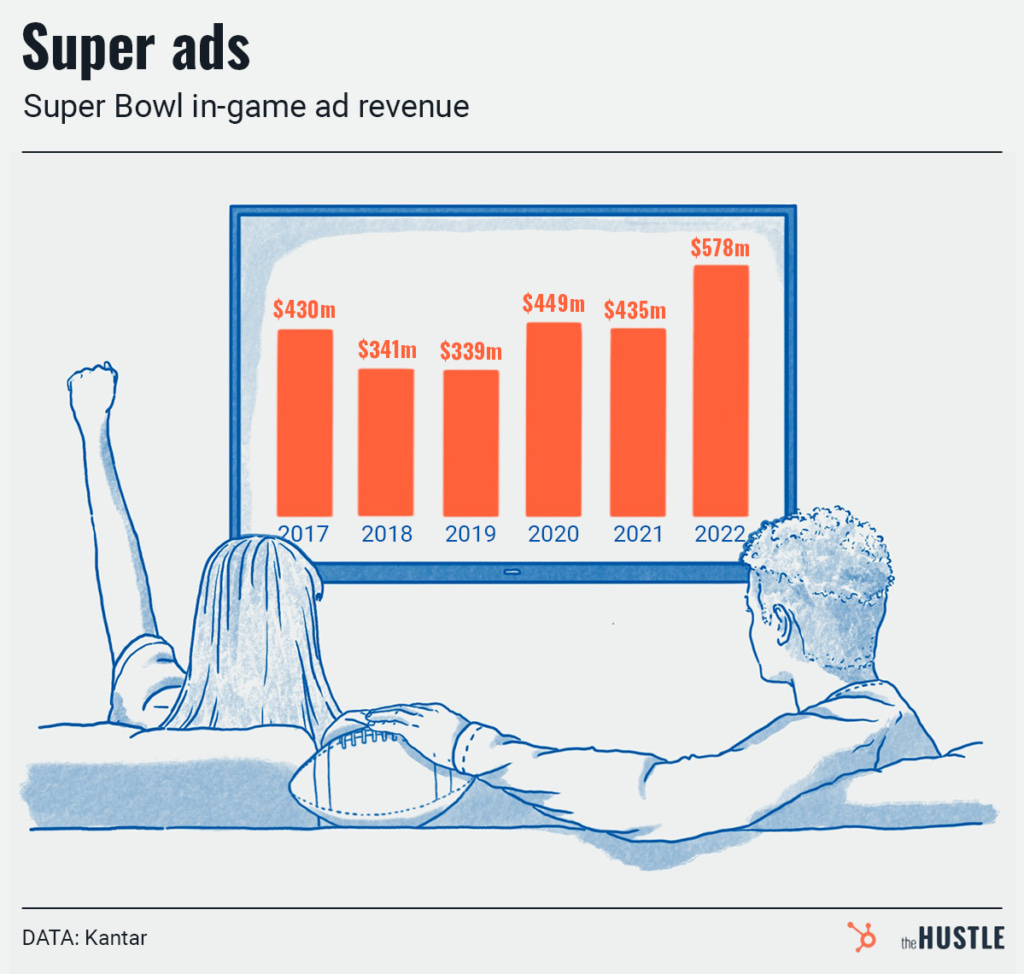

Super Bowl advertisements is big business. In 2022, NBC’s broadcast of Super Bowl LVI generated $578m+ just from in-game commercials. Take pre- and postgame ad revenue into account, and you’re looking at $636m.

This year, Fox charged up to $6.0mm-$7.0mm+ for 30-second ad slots, and the company says slots sold better than usual throughout the day. For instance, a 30-second ad during early pregame programming can cost $100k, and one before kickoff can sell for ~$3m.

But the path to selling out all advertising slots wasn’t without hiccups – Fox was still negotiating as recently as last week – with some companies pulling back on ad spend last year as the economy soured.

Source: The Hustle, Statista, ESPN

Active management ready for a big year

The return of a micro-driven market and the flat outlook for stocks (beta risk) sets stage for active managers.

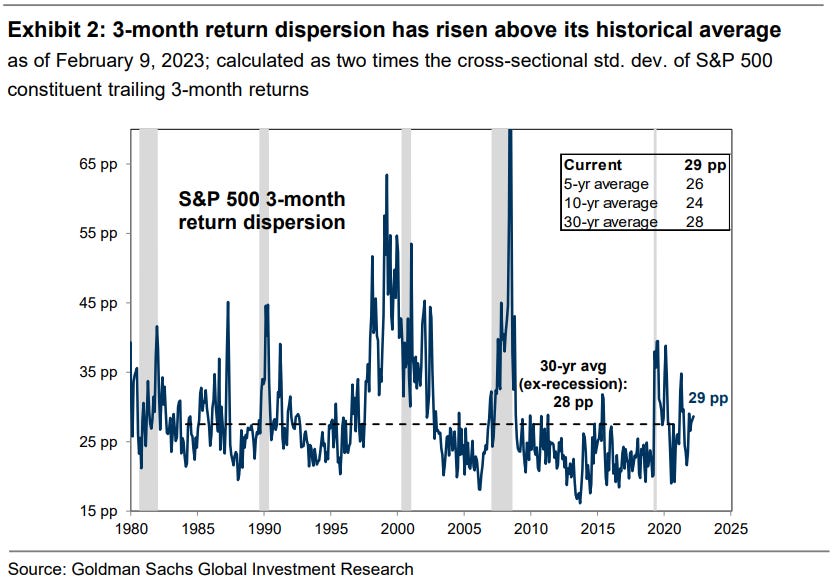

Contrary to mainstream media headlines, resilient U.S. macroeconomic data and abating recession risk has been accompanied by an S&P 500 index driven more by company-specific factors and less by macro variables.

In a micro-driven market a high share of the typical stock’s return is explained by company-specific factors, while a macro-driven market means the returns for the typical stock are primarily explained by factors such as beta, sector, size, and valuation.

As the equity market has become less macro-driven, return dispersion has increased. All else equal, return dispersion is lifted by high single-stock volatility and low stock correlation. Goldman’s forecast for a flat S&P 500 index return in 2023 means beta is unlikely to be a tailwind for performance, underscoring the importance of alpha and active management.

Source: Goldman Sachs Global Investment Research

Expensive tastes

With a balance sheet that has ballooned since COVID-19 and interest rates materially higher than just one year ago, the cost to finance America’s debt is becoming very expensive.

The Interest Expense on U.S. Public Debt rose to $783 billion over the past year, a record high.

If it continues to increase at the current pace, it will soon be the largest line item in the Federal budget, surpassing Social Security.

Source: Charlie Bilello

Bitcoin takes a breather

Growth stocks and other long-duration assets led the way lower this week as equity markets around the world experienced some overhead supply.

This was particularly true for Bitcoin, as sellers appeared exactly where they did back in August of last year, rejecting the recent advance at the $24,500 level.

Although the bullish momentum regime (as measured by the 14-period RSI) remains intact, momentum has been waning as of late. This resulted in a bearish divergence as price reversed at a critical level of interest.

Seeing Bitcoin fail at such a critical level suggests buyers may need more time to absorb the overhead supply before we get a decisive upside resolution. Under this scenario, price could remain in an uncertain market for the foreseeable future.

Source: All Star Charts

The week in review

Talk of the tape: The S&P 500 posted its worst weekly decline since mid-December, though the index still up strongly since the October 2022 low and remains above the 4000 level. But given some notable weakness over prior two sessions, some question of whether path of least resistance has flipped to the downside.

Still a lot of moving pieces to the broad market narrative. Despite Chair Powell's less-hawkish tone last week, Friday's blowout jobs report and consistent higher-for-longer Fedspeak helping monetary policy remain an overhang. Also, a lot of debate about whether the positioning tailwind that has helped propel stocks this year may be abating. Emerging disinflationary trends have been helping, but also a sense the path to lower inflation could be bumpy (some focus on this week's report of higher used-car prices in January). Underwhelming Q4 earnings and growing bullish sentiment also in the mix.

Stocks: The major market averages finished lower, as the only sector to finish positive was energy. Energy performed well as oil prices rebounded on Russian production cuts. With the S&P 500 well above its October 2022 low and the 4,000 level, some investors believe the path to lower inflation and a Federal Reserve (Fed) pause could still be bumpy for markets. Underwhelming fourth quarter earnings have also added support for the market selloff..

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as yields increased. Bonds have been directly influenced by hawkish Fed speak this week amid last week’s Powell comments regarding “disinflationary” conditions.

According to the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices, released on Monday, over 40% of banks have recently tightened lending standards for commercial and industrial (C&I) loans. C&I loans are an important funding source for companies that can’t (or don’t want to) access capital markets for additional monies to fund growth initiatives or to just help pay the bills.

Commodities: Oil and natural gas prices finished the week higher. Russian plans to reduce oil production next month after the West imposed price caps on the country’s oil and oil products helped to stabilize recent weakness. OPEC country officials believe that the commodity may resume its rally in 2023 as Chinese demand recovers after COVID curbs were lifted as well as a lack of investment limiting supply. Many commodity watchers believe oil could return to $100 a barrel. The major metals, including gold, silver, and copper finished the week mixed.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.