Tariff turbulence looms over corporate profits

The Sandbox Daily (4.28.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

tariff turbulence looms over corporate profits

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.41% | Dow +0.28% | S&P 500 +0.06% | Nasdaq 100 -0.03%

FIXED INCOME: Barclays Agg Bond +0.27% | High Yield +0.05% | 2yr UST 3.689% | 10yr UST 4.214%

COMMODITIES: Brent Crude -1.59% to $65.81/barrel. Gold +1.96% to $3,363.1/oz.

BITCOIN: +1.64% to $95,076

US DOLLAR INDEX: -0.54% to 98.939

CBOE TOTAL PUT/CALL RATIO: 0.81

VIX: +1.25% to 25.15

Quote of the day

“The lack of a sense of history is the damnation of the modern world.”

- Robert Penn Warren

Tariff turbulence looms over corporate profits

The frenetic April across global markets has calmed down a bit as the month draws to a close this week, and it’s time to consider the costs to corporate profits.

As President Trump singlehandedly tries to re-write the rules of global trade, or at least the rules by which the world trades with the United States, businesses face higher costs and potential supply chain disruptions. As these first-order effects from the seismic policy shifts take hold later this year, the expectation is lower earnings power from corporate America.

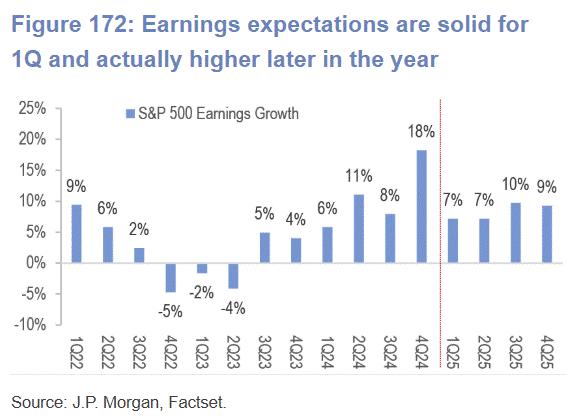

Earnings expectations are currently healthy with earnings growth expected at +7.2% YoY in Q1, marking the seventh consecutive quarter of EPS growth.

With roughly one-third the index having reported, the current actual blended earnings growth rate for Q1 is +10.1%.

So far, so good.

However, investors are likely to be more focused on forward guidance than Q1 results, given that Liberation Day came after the end of the quarter (April 2).

As you can see below, growth expectations for Q2 through Q4 remain high despite the ongoing uncertainty regarding tariff policies and growth, so it will be worthy of attention watching how earnings expectations get revised in the coming weeks.

While the first quarter's earnings reports and management calls should provide some clarity on tariffs and retaliation on U.S. corporates, the frustrating truth of the matter is the full impact of this disruption still remains a big unknown – given the policy decisions are still evolving, trade deals are yet to be finalized, and C-suites are deliberating their own responses and changes.

Expect full-year estimates to be revised lower – more than the ~2% cumulative 2025 calendar year revisions – as lower business investment activity, DOGE cuts, immigration, and higher costs from tariffs take shape.

Despite limited guidance to date, investors are focused this earnings season on whether elevated uncertainty has led companies to pull back on investment and spending plans.

The Economic Policy Uncertainty index has surged higher recently. Recent data releases, such as CapEx spending expectations in regional Fed surveys, show that uncertainty is already weighing on the soft data. However, the slowdown has yet been reflected in the hard data or analyst estimates in any material way. As shown below, corporate optimism has turned sharply negative.

And yet, thus far, S&P 500 CapEx revisions show only modest reductions. It’s quite likely companies and analysts are hesitant to make meaningful adjustments to official estimates during this fluid environment.

One lingering issue that remains is how much of the cost increase from tariffs is passed along to customers.

Assuming imports do not grind to a halt, the logic is this:

if corporations pass the tariff cost to customers, higher prices would lead to slowing consumer demand and lower sales

if corporations absorb the tariff cost, profit margins will suffer

Either scenario implies a hit on profits.

Furthermore, if profits slow materially, the risk of recession will increase further as the rational response by businesses is to cut payrolls, typically its biggest variable cost.

Sources: FactSet, JP Morgan, Bloomberg, Goldman Sachs

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Valuable read as usual

Dr. John