Tax policies becoming key battleground in 2024 election, plus recession check, commercial real estate, China, and balancing time-money-energy

The Sandbox Daily (9.9.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

the future of the Tax Cuts and Jobs Act is uncertain

recession temperature check

Commercial Real Estate sentiment improving

China deflation risk grows as signs of economic weakness mount

balancing time, money, and energy

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.30% | Dow +1.20% | S&P 500 +1.16% | Russell 2000 +0.30%

FIXED INCOME: Barclays Agg Bond +0.15% | High Yield +0.24% | 2yr UST 3.671% | 10yr UST 3.702%

COMMODITIES: Brent Crude +1.24% to $71.94/barrel. Gold +0.43% to $2,535.5/oz.

BITCOIN: +5.92% to $57,824

US DOLLAR INDEX: +0.45% to 101.628

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: -13.09% to 19.45

Quote of the day

“Time is the only currency you spend without knowing your balance. Use it wisely.”

- Unknown

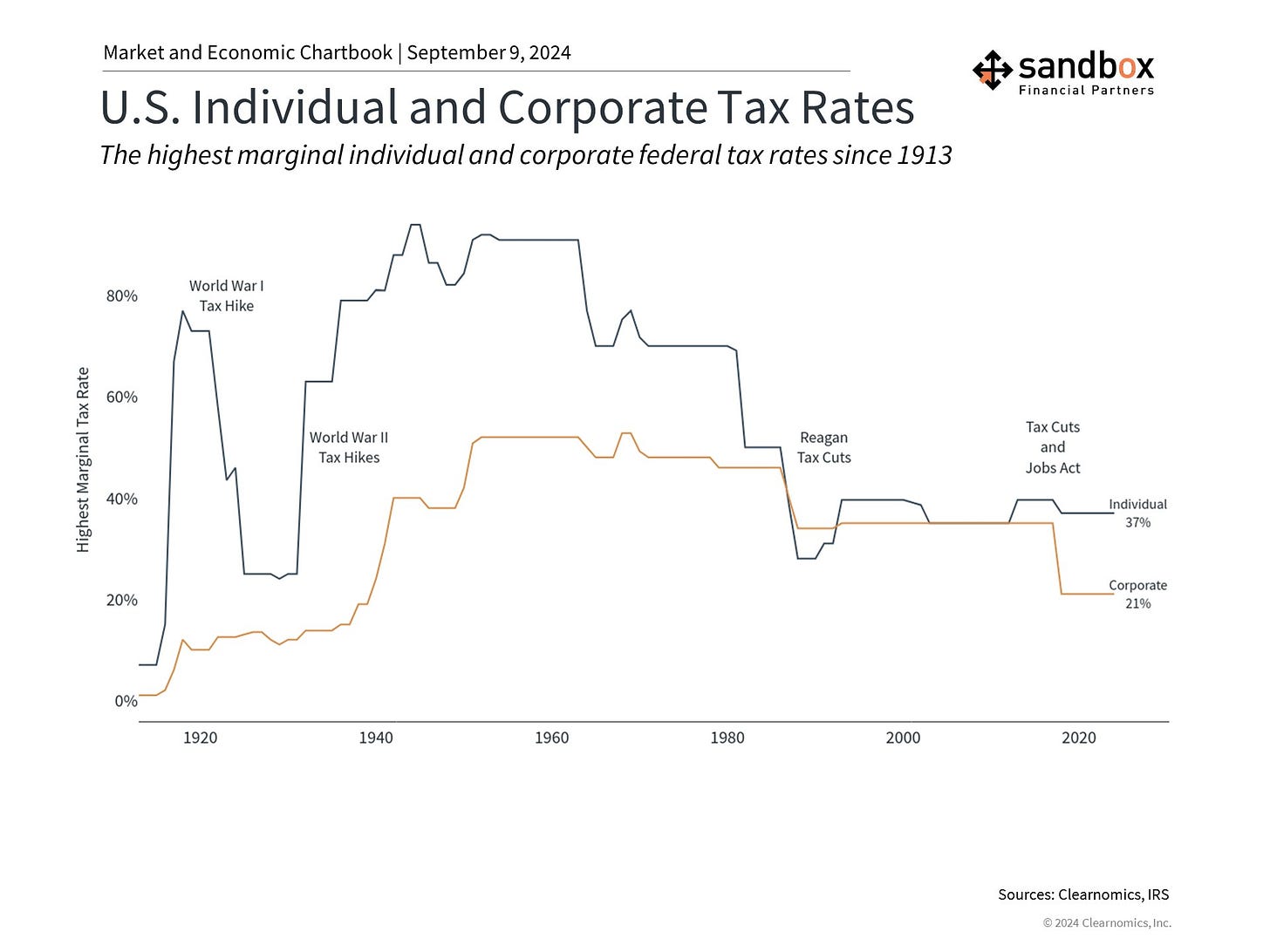

The future of the Tax Cuts and Jobs Act is uncertain

With less than two months until the presidential election, the policy platforms for President Donald Trump and Vice President Kamala Harris are gradually forming. Through speeches and town halls – as well as the highly anticipated nationally-syndicated debate set for Tuesday, September 10 at 9pm ET – each candidate is laying out what they stand for and how they would change existing policies.

For investors, perhaps the most scrutinized area is taxes, and there are concerns over how changes to tax rates could impact both Wall Street and Main Street.

Front and center will be the changes to the tax system that were enacted by former president Donald Trump under the Tax Cuts and Jobs Act (TCJA) signed into law on January 1, 2018.

This overhaul of the tax code included reducing individual income tax rates with the highest rate declining from 39.6% to 37%, nearly doubling the standard deduction, dropping the corporate tax rate from 35% to 21%, and implementing a territorial tax system for corporations. The TCJA also lowered estate taxes, eliminated personal exemptions, and adjusted several other deductions and credits.

Unless action is taken by the president and Congress, many provisions of the TCJA will expire for the 2026 tax season, creating a so-called “tax cliff.” This makes taxes especially contentious this election season.

Here are some of the items the candidates are discussing:

Trump proposes cutting corporate taxes further from 21% to 15% for some companies, including manufacturers who make their products domestically. Harris is in favor of increasing the corporate tax rate to 28%, in line with President Biden’s position.

Trump has discussed extending the TCJA’s individual tax rates, but specifics are still unclear. Harris supports allowing the top marginal rate to revert to 39.6%.

Harris proposes raising the capital gains rate from 20% to 28%. Along with an increase in the “net investment income tax” introduced with the Affordable Care Act, the top capital gains rate would rise to 33%, the highest since 1978.

Both candidates propose new enhanced child tax credits and not taxing tips. Trump has discussed eliminating taxes on Social Security for seniors.

Harris proposes expanding the startup expense deduction from $5,000 to $50,000 and $25,000 in support of first-time homebuyers making down payments.

Harris proposes a new tax on unrealized capital gains for those worth $100 million or more. Such a tax would be historic. The recent Moore v. United States case in the Supreme Court loosely touched on this by allowing a provision in the TCJA that imposed a one-time tax on unrepatriated foreign earnings.

Source: Clearnomics

Recession temperature check

Like it or not, a group of eight economists at the National Bureau of Economic Research (NBER) are the official arbiters for declaring U.S. economic recessions.

This committee is tasked with tracking the well-being of our economy by reviewing a diverse set of economic indicators that go far beyond the simpler definition of two sequential quarters of negative GDP growth.

The NBER reviews six monthly variables in determining whether the nation is officially in a recession, with most of these inputs being leading or coincident markers to provide economists with real-time data.

Right now, none of the indicators are flashing red.

The NBER defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

The current hard data suggests an economy that continues to grow albeit perhaps at a slower pace. Unless the incoming data on economic output indicates a loss of momentum across several categories, it’s hard to align with the recessionary bears at the moment.

Source: National Bureau of Economic Research, Anastasia Amoroso

Commercial Real Estate sentiment improving

The Real Estate Roundtable Sentiment Index – a measure of senior executives’ confidence and expectations about the Commercial Real Estate market environment – climbed 3 points to 64 in Q3, its highest level since early 2022 and firmly above last year’s reading at this time of 46.

A reading above 50 indicates net positive sentiment in the industry, which has been the case for the past three quarters. Both current conditions and future expectations improved.

Although commercial real estate (CRE) values were still falling from a year ago, the pace of decline has moderated. Survey respondents expect prices to be higher a year from now. Valuations varied across property subsectors – i.e. positive for data centers and student housing, but still negative for office.

Debt and equity capital availability improved in the latest quarter, while the outlook for the year ahead remained broadly positive.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms, as well as leaders of major national real estate trade associations.

Source: The Real Estate Roundtable

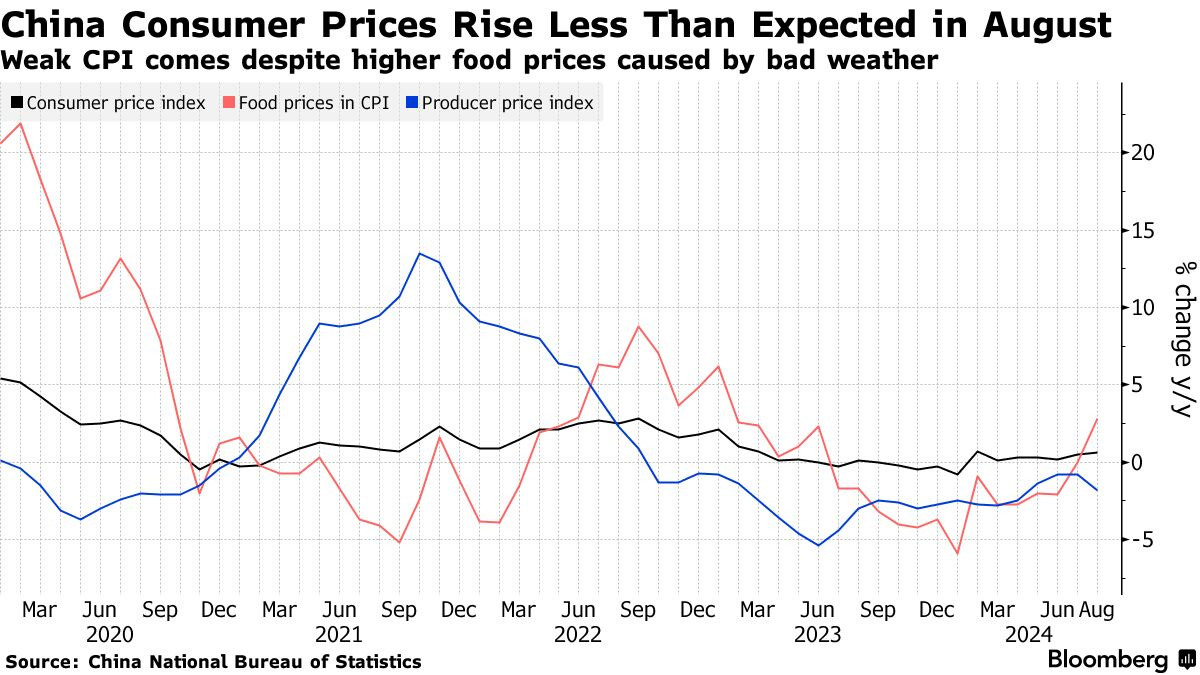

China deflation risk grows as signs of economic weakness mount

China’s monthly data deluge begins this week with inflation, which continues to point to subdued domestic economic momentum.

The CPI rose 0.6% in August from a year earlier, a 6-month high. But, the acceleration was entirely due to food (led by a 22% surge in fresh vegetable prices), which encompasses an outsized share of China’s CPI basket and was affected by adverse weather conditions that month.

Excluding volatile food and energy costs, core CPI edged up just 0.3% YoY, the least since March 2021 – as every major category saw weaker price momentum.

This sluggishness in inflation is a clear reflection of weak consumer demand in the world’s second largest economy, as the real estate slump, dismal income/job prospects, and uncertain regulatory environment have kept consumer confidence at rock-bottom levels.

Source: Bloomberg

One simple graphic

Time, money, and energy – the vast majority of people will never experience all three at the same time.

Choose carefully how you allocate each.

Source: Compounding Quality

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.