Tech near all-time highs, plus cardboard boxes, semiconductors, social security, and the week in review

The Sandbox Daily (6.16.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Tech party within reach of all-time highs

informal economic indicators

Social Security tradeoffs

a brief recap to snapshot the week in markets

Two quick notes to address ahead of the long weekend.

Happy early Father’s Day to all the dads out there! Whether it’s a family barbeque or watching the U.S. Open in Los Angeles or something else entirely, cheers to celebrating your big day!

Programming note: Monday is Juneteenth National Independence Day, so The Sandbox Daily will be taking a short break in observance of the holiday, returning to your inbox on Tuesday.

For now, let’s dig in.

Markets in review

EQUITIES: Dow -0.32% | S&P 500 -0.37% | Nasdaq 100 -0.67% | Russell 2000 -0.73%

FIXED INCOME: Barclays Agg Bond -0.31% | High Yield -0.25% | 2yr UST 4.725% | 10yr UST 3.767%

COMMODITIES: Brent Crude +1.15% to $76.54/barrel. Gold -0.08% to $1,969.2/oz.

BITCOIN: +4.08% to $26,356

US DOLLAR INDEX: +0.19% to 102.307

CBOE EQUITY PUT/CALL RATIO: 0.52

VIX: -6.62% to 13.54

Quote of the day

“The crazy thing is thinking humans always act logically.”

- Dr. Richard Thaler, Fuller & Thaler Asset Management

Tech party within reach of all-time highs

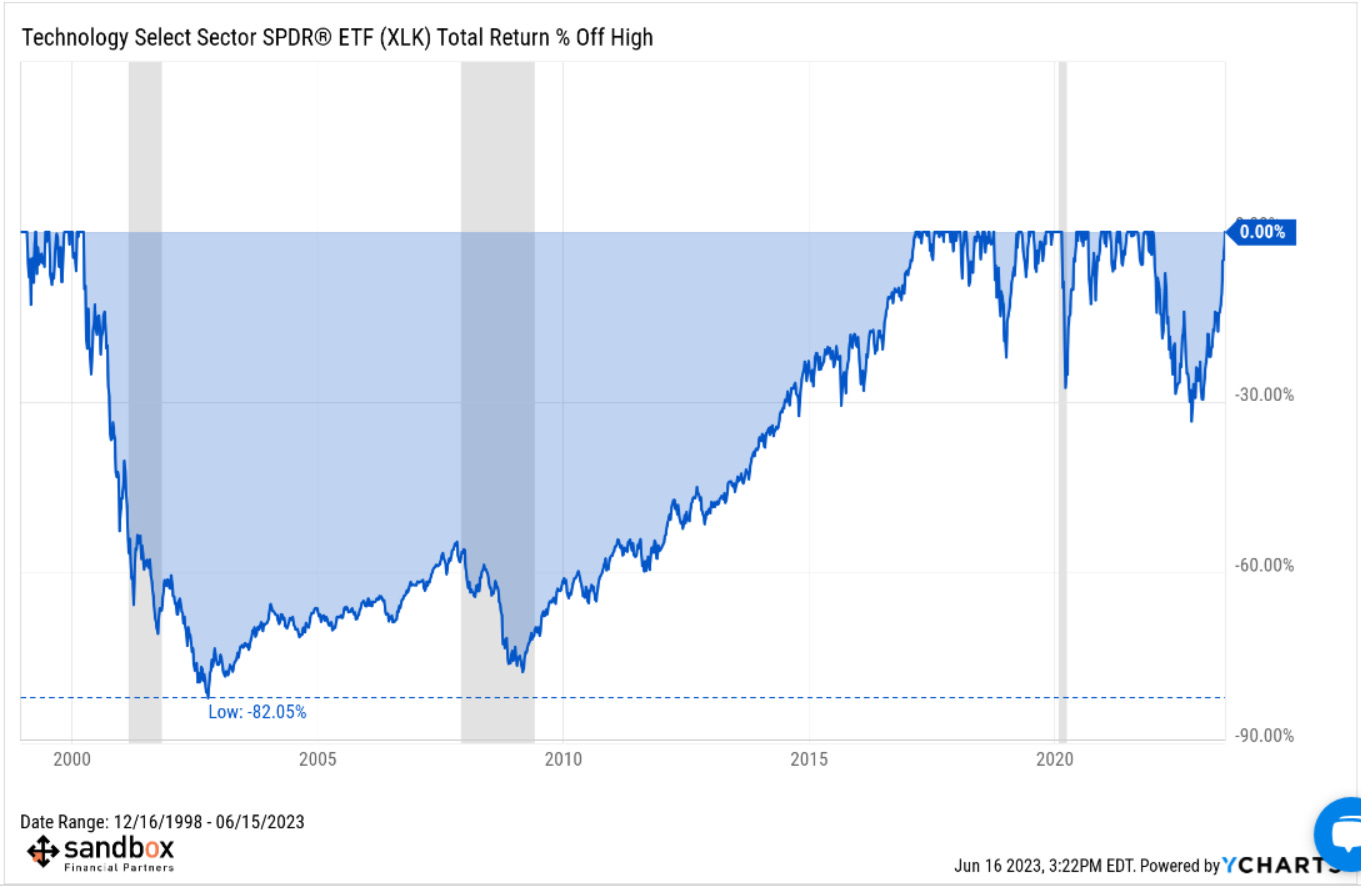

Technology strength continues to be the market story of 2023, as the SPDR Technology Sector ETF (XLK) is now up +40% year-to-date. It’s top 2 holdings, Microsoft (MSFT) and Apple (AAPL), represent 24.2% and 22.6% of the sector and are both up over 40% individually.

$XLK is within 1% of its all-time highs after clawing its way out of a vicious -33.6% drawdown.

This was the worst drawdown for $XLK since it recovered the dot-com bubble highs in 2017. After all, recovering from a -82% drawdown can take a while!

Technology is by far the largest sector in the S&P 500 index with a 28% weighting. With tech partying for months now, other investors are looking for continued breadth expansion and other lagging sectors to catch up to the leaders.

Source: Honeystocks Charting

Informal economic indicators

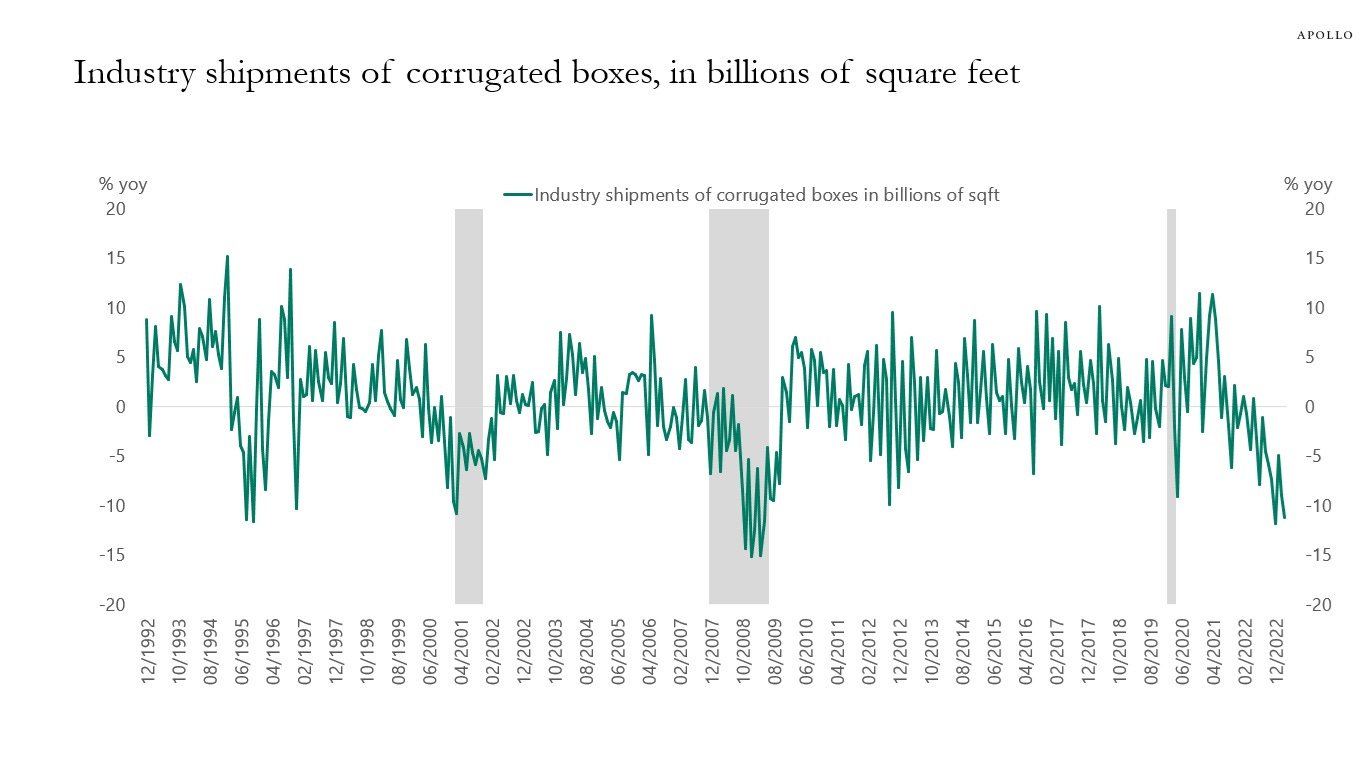

The cardboard box indicator is used by some investors to gauge consumer goods demand. Meaning, the output of cardboard boxes is believed to be a soft leading economic indicator of the future production of consumer goods, since cardboard containers are so common for packaging and shipping these goods.

Torsten Sløk, Chief Economist at Apollo Global Management, notes the sales of cardboard boxes have been declining over the past year, reflecting the ongoing weakness in the goods part of the economy.

I’d argue a better soft economic indicator are semiconductors, given most everything we do these days – cellphones, computers, cars, etc. – require this critically important hardware to function. And how are the semis holding up?

The VanEck Semiconductors ETF (SMH) is up +52% year-to-date and is within 2% of an all-time high. Look at the technical formation of an inverse head-and-shoulders pattern – a textbook example of a bearish-to-bullish reversal pattern.

As tech and the growth areas have led the market higher this year, industry groups like the semis are showing tremendous absolute and relative strength in 2023. If semiconductors are behaving this well, certainly an economic recession cannot be right around the corner.

So, which of these soft leading economic indicators is more correct? Only the future holds that answer.

Source: Apollo Global Management, All Star Charts

Social Security tradeoffs

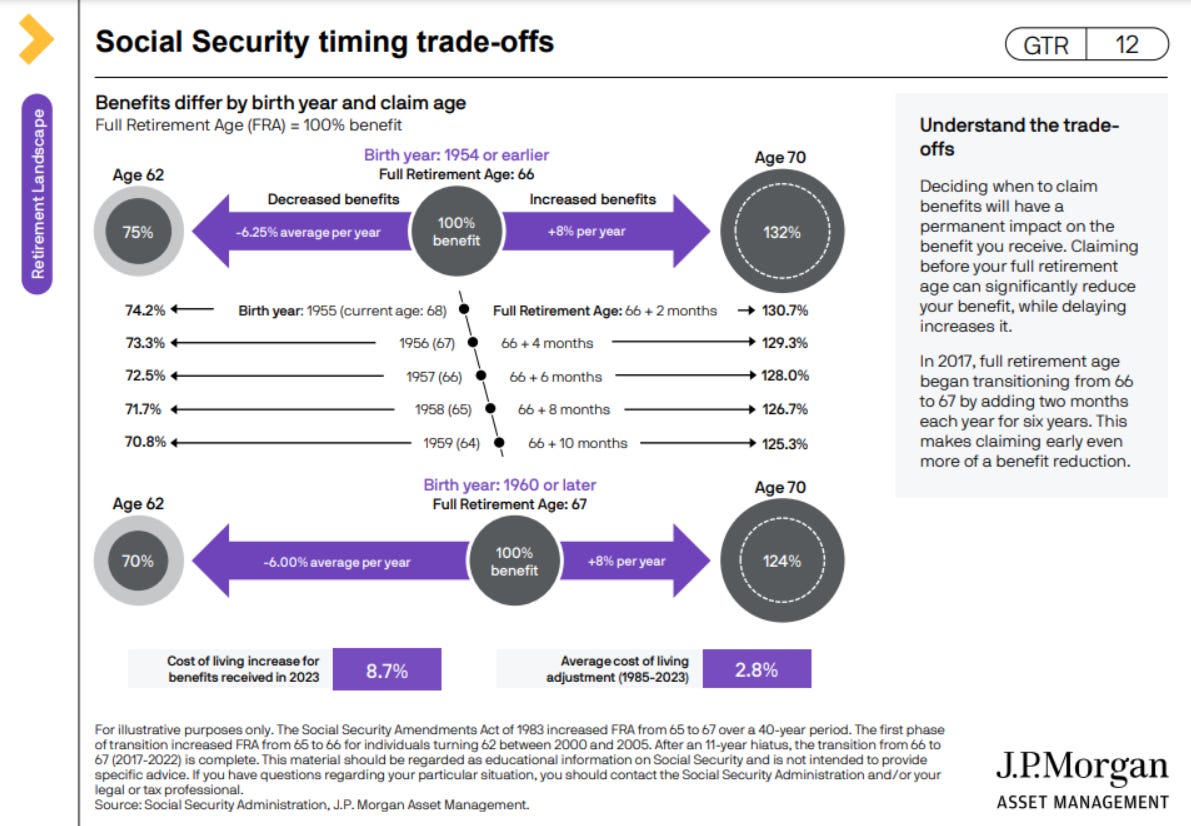

Social Security is one of the most frequently debated questions in personal finance.

Social Security benefits can be claimed at any point between ages 62 and 70. So when should you claim your benefits?

For each year that you wait, the government will increase your benefit, and that increase lasts for life. But of course you have to give up a year of benefits in order to earn that larger check in the future. As a result, there is a mathematical break-even point in deciding whether to delay. See below for an awesome visual from JPMorgan that quantifies this important decision:

But that math is just one consideration. You should also consider a variety of other factors:

Whether you are married or single

Your health and thus your life expectancy

Your assets and net worth

Your spending needs

Your retirement timetable

Other income sources, such as a pension or annuity

Bequest goals

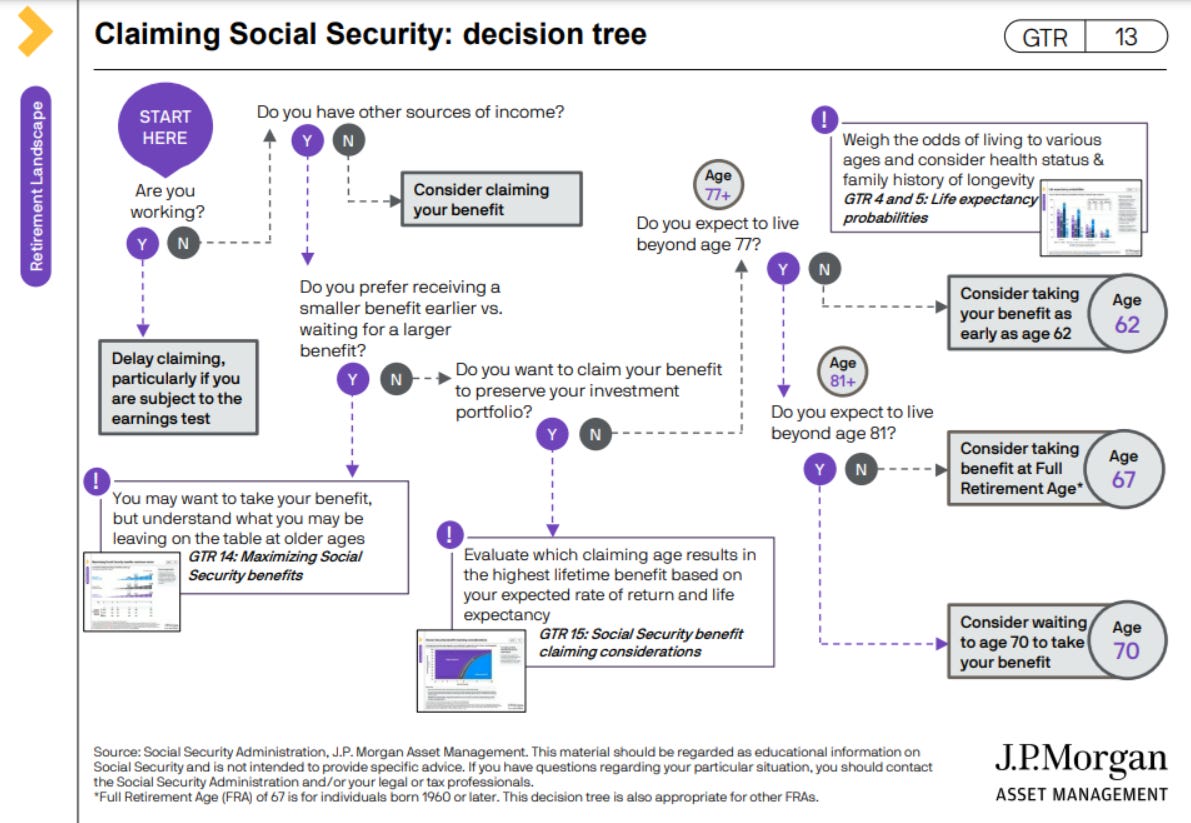

And this decision tree can also be helpful when coming to a decision for your Social Security Benefits:

Source: JPMorgan Guide to Retirement

The week in review

Talk of the tape: Market risk remains to the upside. The S&P 500 closes on a 5th straight week of gains, something that has not happened since November 2021.

Soft-landing expectations are the key driver of the bullish narrative. Disinflation traction, which has been in the headlines again this week, cited as another tailwind. Consumer resilience, although showing some signs of fatigue, is another bright spot. The early Treasury General Account (TGA) rebuild has not been a big drag on reserves and liquidity. The market is speculating that the Fed will not go through with another 50 bps of rate hikes. The AI secular growth tailwind another bullish talking point, while the last couple of weeks have seen a notable improvement in market breadth. Elsewhere, China is ramping up stimulus measures.

Some concerns linger about overbought conditions, dampened sentiment, and positioning tailwinds. The Federal Reserve and European Central Bank takeaways this week leaned hawkish. Some remain very concerned the Fed is too focused on lagging indicators and risks making another policy mistake.

Stocks: All major market indexes ended higher. Market breadth conditions continue to improve. Some investors believe the economy could witness a soft landing given better-than-expected payrolls, removal of the debt ceiling overhang, and a pause on interest rate hikes.

Bank of America reported that U.S. equity funds have attracted $38 billion during the past three weeks, which represents the strongest stretch since last October. Money market funds witnessed their first outflow in roughly two months. The bank noted that U.S. value mutual funds witnessed their first positive inflows in 13 weeks, breaking their longest outflow streak since June 2019.

Bonds: The Bloomberg Aggregate Bond Index finished higher this week amid high profile global central bank meetings. High-yield credit also had a positive week on the back of higher equity prices and continues to be a leader in the fixed income asset class year to date.

The U.S. Treasury Department has started to increase the issuance size of Treasury Bills (T-bills) in an effort to replenish its general account as well as fund government operations following the resolution of the debt ceiling standoff. Recent auctions have been well supported with demand from foreign investors significantly higher than in previous years, which should continue in the weeks and months ahead due to higher U.S. rates.

Commodities: Energy prices ended higher this week as natural gas prices continue to rally from this year’s pullback. The major metals (gold, silver, and copper) finished the week mixed. Prices for most commodities have moved lower year to date, with coal, natural gas, and nickel among 2023’s big decliners. Gold has also bucked the trend following increasing global central bank demand.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.