Tech prints new all-time highs, plus Nasdaq 100 rebalance, U.S. Treasuries, and Retail Sales

The Sandbox Daily (7.18.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Tech prints new all-time highs

Nasdaq 100 rebalance implications

investors loving higher rates on U.S. Treasuries, for now

Retail Sales data looks soft-landing-ish

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.27% | Dow +1.06% | Nasdaq 100 +0.82% | S&P 500 +0.71%

FIXED INCOME: Barclays Agg Bond +0.08% | High Yield +0.28% | 2yr UST 4.764% | 10yr UST 3.787%

COMMODITIES: Brent Crude +1.41% to $79.61/barrel. Gold +1.31% to $1,982.1/oz.

BITCOIN: -0.58% to $29,755

US DOLLAR INDEX: +0.09% to 99.932

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: -1.34% to 13.30

Quote of the day

“Decision makers can satisfice either by finding optimum solutions for a simplified world, or by finding satisfactory solutions for a more realistic world. Neither approach, in general, dominates the other, and both have continued to co-exist in the world of management science.”

- Herbert Simon, Economist and Nobel Prize Winner

Tech prints new all-time highs

No investment style or sector endured more pain in 2022 than tech. The Technology Sector SPDR ETF (XLK) was down -34% at one point in October of 2022.

Fast forward 9 months and XLK is breaking to its highest level in history, closing today at a fresh new all-time high.

Perhaps even more interesting, XLK is the 2nd sector ETF to make a new all-time high behind the Industrials Sector SPDR ETF (XLI). If you’re bearish, try wrapping your head around that one.

First industrials, the most diverse sector and the most positively correlated with the major U.S. indexes, posted new all-time highs. Now tech, the largest sector weighting in the S&P 500, has reached its highest level ever.

These aren’t bear market signposts; it simply confirms more bull market checkpoints.

Source: All Star Charts

Nasdaq 100 rebalance implications

On July 24th, the Nasdaq 100 index (NDX) will undergo its second ever “Special Rebalance” to address the index’s high level of concentration among a handful of stocks.

The rebalance is intended to prevent issuers with individual index weights greater than 4.5% from collectively accounting for more than 48% of the index. On July 3rd, the 6 largest issuers each had an index weight greater than 4.5% and collectively accounted for 51% of the index – leading to Nasdaq announcing the “Special Rebalance” just days later.

The weight of the largest 7 stocks in the index will be reduced by 12% (56% to 44%). Apple (AAPL) and Microsoft (MSFT) will remain the largest constituents, but their index weights will be reduced by roughly 4% (12% and 10%, respectively). Broadcom’s (AVGO) index weight will increase the most (+0.6% to 3%). At the sector level, Information Technology will decline slightly, from 51% to 49%, but will continue to account for roughly half of the NDX.

$261 billion in mutual fund and ETF AUM is benchmarked to the NDX while hedge funds have an estimated $20 billion of net short exposure.

Passive funds that track NDX must rebalance their portfolios, but the 2011 special rebalance experience suggests the stock-level impact will be limited. In 2011, Nasdaq slashed the NDX weight of AAPL from 20% to 12%, but this change had no clear negative effect on the stock’s performance. Likewise, there was no clear impact on MSFT despite its index weight rising from 3% to 8% following the rebalance.

Source: Goldman Sachs Global Investment Research

Investors loving higher rates on U.S. Treasuries, for now

It’s been a long time since cash and cash equivalents, like short duration U.S. Treasuries, have paid a meaningful interest rate.

The 2-year U.S. Treasury Note, currently yielding 4.74%, has not risen to this level since July 2007.

Many investors were enamored with cash paying 4-5% and felt safe rotating into the traditional safe-haven asset during a risk-off environment that saw all major stock indices drawdown meaningfully. Last year, the S&P 500 index fell -25.43% while the Nasdaq 100 index stumbled -35.56% peak-to-trough.

But these impressive yields from U.S. Treasuries won’t last if and when interest rates fall. If you’re purchasing these short-term instruments, higher rates are not locked in for long and you’ll need to reinvest principal more often.

These Treasury yields are quoted as annualized yields that assume the investor will reinvest all proceeds at the prevailing rate again and again as these short-dated Treasuries mature. This is defined as reinvestment risk.

Source: Vanguard

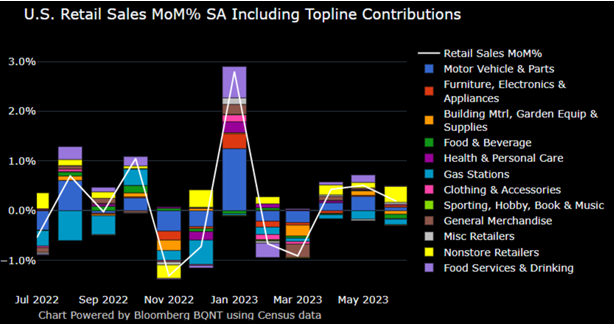

Retail Sales data looks soft-landing-ish

Retail sales – an economic metric that tracks consumer demand for goods – surprised to the downside against expectations, climbing +0.2% in June vs. +0.5% estimated. June marked the 3rd straight monthly gain in sales, the longest winning streak since April 2022 and indicating that consumer spending power remained intact in Q2 despite a choppy Q1.

The strongest performance last month came from furniture and electronics stores, up +1.4% and +1.1% respectively. The weakest categories in June were department stores (-2.4%), gas stations (-1.4%), and building material stores (-1.2%).

Adjusted for inflation, retail sales volumes were flat last month. In fact, after adjusting for inflation, U.S. retail sales fell -2.5% over the last year, the 8th consecutive YoY decline. That’s the longest down streak since 2009.

Source: Ned Davis Research, Kathy Jones

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.