The aging American Dream 🏡

The Sandbox Daily (5.20.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the aging American dream

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.05% | Dow -0.27% | Nasdaq 100 -0.37% | S&P 500 -0.39%

FIXED INCOME: Barclays Agg Bond -0.17% | High Yield -0.05% | 2yr UST 3.973% | 10yr UST 4.485%

COMMODITIES: Brent Crude +0.18% to $65.66/barrel. Gold +1.95% to $3,296.6/oz.

BITCOIN: +1.25% to $106,783

US DOLLAR INDEX: -0.37% to 100.054

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: -0.28% to 18.09

Quote of the day

“The best things in life are on the other side of fear.”

- Will Smith

The aging American Dream

The American housing market is aging – literally.

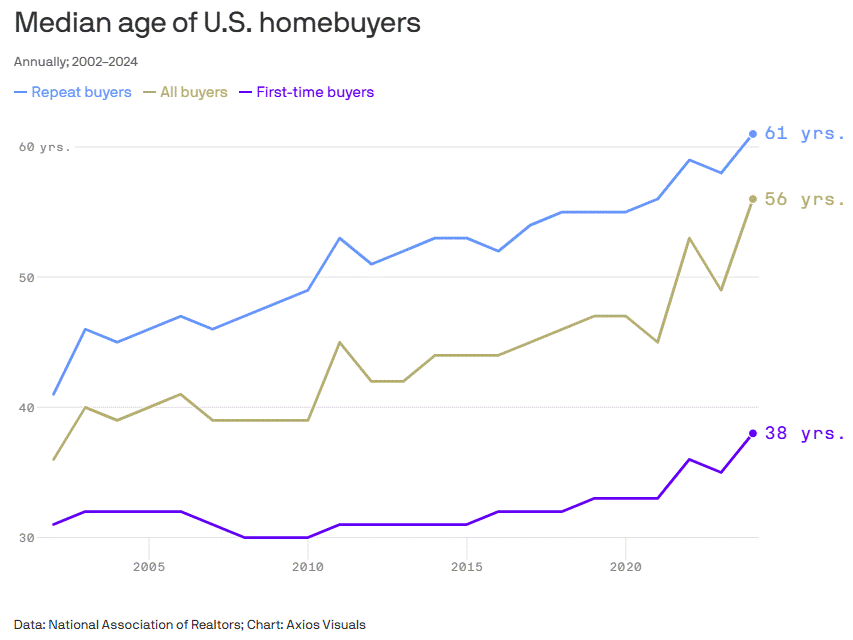

In 2024, the median age of a first-time U.S. homebuyer hit a record 38, up from 29 in 1981.

Meanwhile, the average age of all homebuyers now sits at 56, a staggering 44% jump from two decades ago.

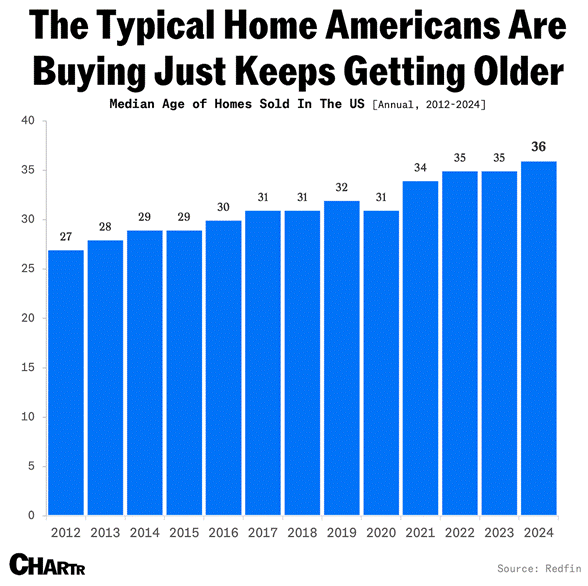

And it’s not just the buyers getting older – the median home sold this year is 36 years old, up from 27 in 2012.

Behind the numbers is a generational squeeze.

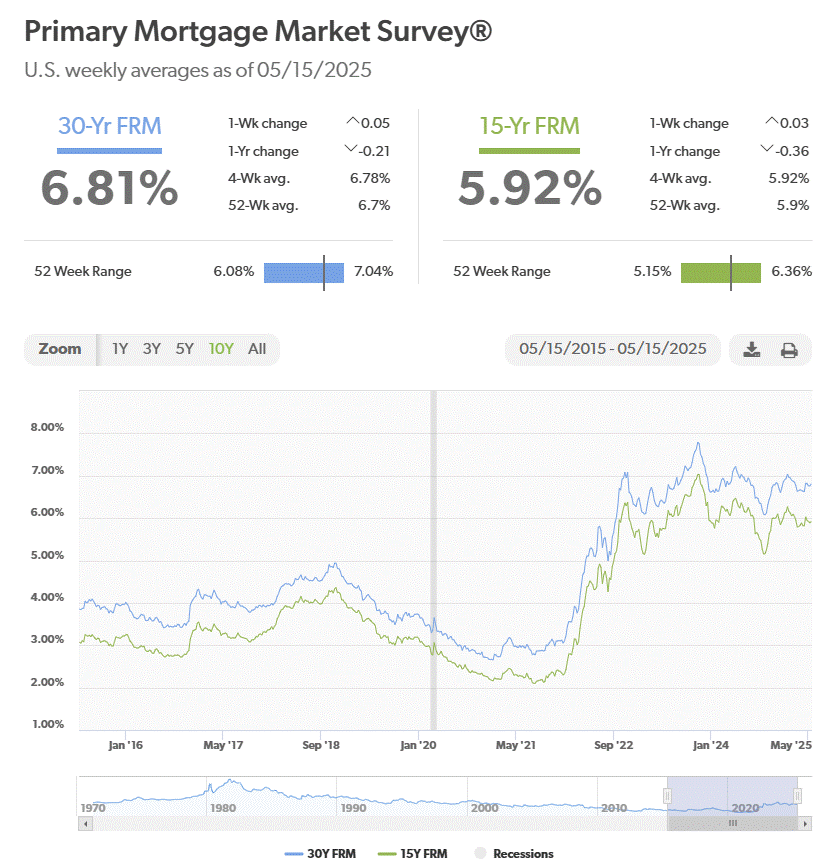

Younger buyers are largely priced out, sidelined by a one-two punch of elevated home prices – up over 40% nationally since the pandemic – and mortgage rates that remain stubbornly elevated – with 30-year fixed-rate mortgages rangebound between 6% and 7% over the last year.

The result: a monthly mortgage payment on a median-priced home has more than doubled in just four years.

Pre-pandemic, first-time buyers made up roughly half of all home purchases. Last year, it was just 24%.

The vacuum has been filled by older, wealthier Americans – often repeat buyers or investors – who are less sensitive to financing costs. With cash or existing equity, they’re better positioned to compete in a tight market. This dynamic reinforces a growing divide: homeownership is increasingly skewed toward those who already have assets.

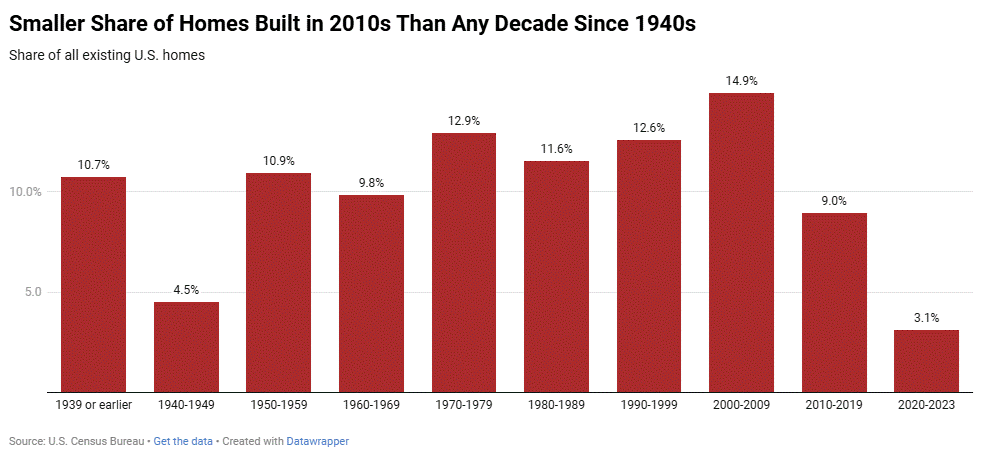

First-time buyers are also a symptom of the supply side crisis. The U.S. is underbuilt by an estimated 3-4 million homes after the 2000s housing bubble burst in 2008. PTSD from the Global Financial Crisis, zoning restrictions, labor shortages, and NIMBYism have choked inventory. The Millennial generation has now reached peak homebuying age but they're confronting a market that has failed to meet their demand.

Fewer first-time buyers means slower household formation and deferred family life. Less turnover also weighs on consumer goods, such as weaker demand for new furniture, big-ticket appliances, and home upgrades.

It also means the aging housing stock will drive up homeownership costs down the line on first-time buyers as older homes will require renovation services.

Longer term, the imbalance between supply and demand remains the structural story. And yet, within this chasm, lies opportunity.

Policy shifts that enable more building – such as upzoning, permitting reform, and infrastructure spending – could be tailwinds for builders and materials suppliers. Prospective buyers should also keep an eye on regional migration patterns, as affordability drives demand toward Sunbelt and Midwest markets.

The American Dream of homeownership isn’t dead, but it’s certainly graying.

And in today’s market, age isn’t just a number – it’s a competitive edge.

Sources: National Association of Realtors, Redfin, Axios, Chartr

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)