The bullish case for bonds

The Sandbox Daily (5.28.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the bullish case for bonds

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.45% | S&P 500 -0.56% | Dow -0.58% | Russell 2000 -1.08%

FIXED INCOME: Barclays Agg Bond -0.18% | High Yield -0.06% | 2yr UST 3.992% | 10yr UST 4.475%

COMMODITIES: Brent Crude +1.01% to $64.74/barrel. Gold -0.22% to $3,320.9/oz.

BITCOIN: -2.38% to $107,201

US DOLLAR INDEX: +0.37% to 99.887

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: +1.85% to 19.31

Quote of the day

“God is not in a hurry. You are.”

- Unknown

The bullish case for bonds

The selloff in bond markets over the last month has been notable, with 10-year U.S. Treasuries (IEI) down ~3% and 30-year U.S. Treasuries (TLT) down ~8%.

Bond yields are moving higher for the wrong reasons – a combination of tariff-driven inflation pickup, rising fiscal deficit concerns, scorching high debt service costs, the big beautiful bill from the House, and a recent Moody's downgrade of the U.S. government's credit rating.

Taken together, a somewhat punitive cocktail and one the bond vigilantes drink hand over fist.

Then, last week’s auction of 20-year U.S. Treasury bonds was the cherry on top.

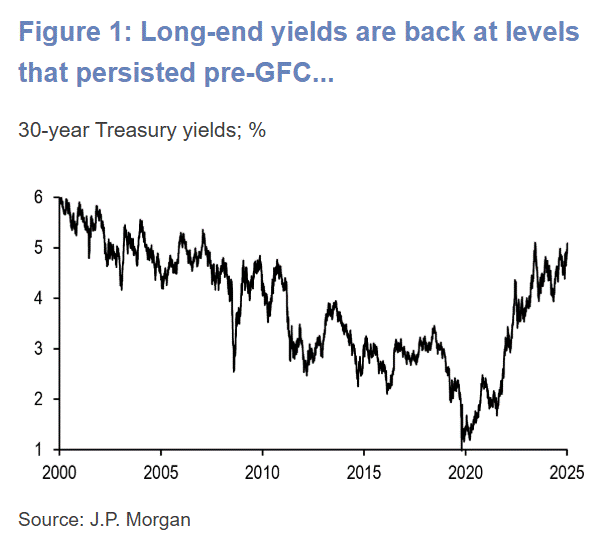

The typically run-of-the-mill, non-event in which Treasury auctions off new debt to finance the whole party, showed surprisingly soft demand from investors. This lead the long-dated 30-year U.S. Treasury to touch 5.13%, eclipsing the October 2023 cycle highs and reaching the highest level in yield since 2007 – when the Fed Funds Rate was 100 bps higher than it is right now.

What’s more, the carnage in rates is really a bigger, global phenomenon if we zoom out. Investors are demanding higher rates around the world.

Take Japan whose 30-year sovereign bond climbed to a 20+ year high, while their newer 40-year sovereign bond yield printed an all-time record.

Call it the fiscal yips.

Revisiting cycle highs amid easier monetary policy is consistent with rising term premiums and rapid supply outstripping demand in this environment.

Joe Brusuelas, chief economist at RSM, recently wrote in a note to clients: “This rise has taken place not for virtuous reasons around faster growth but rather because of risks around higher inflation and the need for higher interest rates to compensate for holding long-dated dollar-denominated assets.”

It’s hard to find a fan of bonds these days.

Although trend components remain negative and the fiscal side remains an ongoing decades-long mess, it’s important to take note of certain elements that are bullish for bonds.

As we know, it’s important for investors to beware of the crowd at extremes. Per Ned Davis Research’s proprietary sentiment index, bond sentiment is about as pessimistic as it gets. See the orange line in the bottom pane below.

The bond market has gotten oversold, as measured by Relative Strength Index (RSI). Similarly, the put/call ratio of options on Treasury bond futures have hit important levels, indicating excessive hedging.

Oil prices have been under pressure all year, which means inflation expectations must remain anchored. This keeps a lid on yields.

The Senate needs to pass its version of the big beautiful bill before it can be reconciled against last week’s House version. This leads to a likely outcome the final bill will be less onerous than current reporting and is reprieve for a possible rally in bonds.

Tariff revenue, in its earliest stages of collection, is showing promise as an offset, although falling far short of the initial promises of $2B per day from the White House. In March, the Treasury Department collected $9.6B. In April, it was up to $17.4B. In May, with a few days remaining, the total is up to $22.3B. For the year, $92B has been received. For context, U.S. government receipts were $80B in all of 2023.

Finally, betting against Treasury Secretary Scott Bessent and the voice of reason within this administration has proved to be a dangerous proposition.

The current move appears extended, just as everyone turned bearish at the same time. While rate cuts appear to be on hold, further upside risk to rates seems overdone.

Sources: J.P. Morgan, YCharts, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Very interesting read.