📈 The Bullish Trifecta 📈

The Sandbox Daily (1.31.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the seasonal Bullish Trifecta we just witnessed from the S&P 500: 1) the Santa Claus Rally, 2) the First 5 Days, and 3) the January Barometer.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +2.45% | Nasdaq 100 +1.59% | S&P 500 +1.46% | Dow +1.09%

FIXED INCOME: Barclays Agg Bond +0.41% | High Yield +0.78% | 2yr UST 4.205% | 10yr UST 3.511%

COMMODITIES: Brent Crude -0.48% to $84.47/barrel. Gold +0.31% to $1,945.3/oz.

BITCOIN: +1.18% to $23,065

US DOLLAR INDEX: -0.17% to 102.101

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: -2.71% to 19.40

Bullish Trifecta: Santa Claus Rally (signal #1)

The Santa Claus Rally delivered this year – the S&P 500 rallied +0.80% during the period – setting up the first leg of the Bullish Trifecta.

Is this good news? Well, as the saying goes, "If Santa should fail to call, the Bears will come to Broad & Wall."

A seasonal term coined by Yale Hirsch (founder of the Stock Trader’s Almanac) back in 1972, the Santa Claus Rally describes what happens over the last five trading days of the year and the first two trading days of the new year. So, this year it began Friday, December 23rd and ended Wednesday, January 4th.

The seasonal pattern garners headlines because of its impressive historical results. The average performance during these 7 days is +1.33% and is positive 79.2% of the time. This is a big difference from all other rolling 7-day periods throughout the year that only average +0.24% returns and are positive less than 60% of the time.

When the Santa Claus Rally period is positive, the S&P 500 has averaged +10.9% returns per year, and it's been higher 75.4% of the time! When Santa doesn't show, those numbers drop to just a +4.1% average return and higher only 66.7% of the time.

Source: Bespoke Investment Group, All Star Charts, LPL Research

Bullish Trifecta: The First 5 Days (signal #2)

With the Santa Claus Rally checking the 1st box, what’s the next signal of the Bullish Trifecta?

The First 5 Days.

While it’s never wise to build your gameplan based on five trading days, this seasonal indicator catches people’s attention because it has a solid track record of how the year might go. The First 5 Days are literally the first 5 trading sessions of the new year – so January 3rd to January 9th.

Reviewing data since 1950 (N=73), when the First 5 Days are higher for the S&P 500, the full year is higher 80.9% of the time and returns +14.0% on average. Hit rates over 80% garner some attention.

Compare this to when the First 5 Days are lower: the index is up 53.8% of the time and returns just +0.3% on average. Obviously, the numbers fall off dramatically when the First 5 Days are down.

The First 5 Days of 2023 returned +1.37% for the S&P 500, checking the 2nd box.

Source: All Star Charts, Carson Group

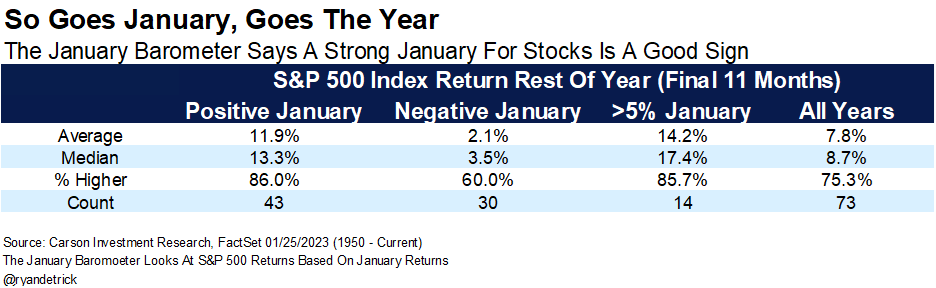

Bullish Trifecta: January Barometer (signal #3)

The January Barometer is the last leg of the early year triple crown.

“As goes January, so goes the year” is the saying around Wall Street.

Historically speaking, when the first month is positive for stocks, the rest of the year is up +11.9% on average and higher 86% of the time.

And when that first month is lower? The stock market is up +2.1% on average and higher 60% of the time. Big difference.

What’s more? If we go one step further and look at calendar years completing the Bullish Trifecta that follow a negative year on the S&P 500 (like 2022), great things tend to happen. The market has never been lower for the year and averages a +27.1% return.

With January officially in the books, the S&P 500 returned +6.18% this month – checking the 3rd and final box.

As such, we’ve completed the Bullish Trifecta. All three seasonal trends fired green at the same time.

Let’s see if history is at our backs and these market anomalies drive home positive stock performance for 2023.

After all, with more and more positive signs popping up for stocks (market breadth, moving averages, election cycles, etc.), the market looks primed for a better year than last.

Source: Investopedia, Seeking Alpha, Carson Group, Ryan Detrick

To be clear, Seasonality should only play a very small role in your everyday decision making. One should use seasonal trends like sentiment indicators, to help put things into context, not for timing purposes or shifting your positioning between risk on and risk off. Markets are a messy picture full of conflicting data – and data that changes constantly – so it’s important to weigh all the evidence before developing your own opinion.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.