The bulls are back in town!

The Sandbox Daily (6.9.2023)

Today’s Daily discusses:

S&P 500 enters textbook definition of bull market

Loss Aversion on staying invested

Eurozone revised into a recession

a brief recap to snapshot the week in markets

Tomorrow is the final leg of the Triple Crown; post time for the Belmont Stakes is 7:02pm ET. Forte, whose first race came at this track in May 2022, is the 5-2 favorite.

It’s a summer Friday. Hope everyone has a great weekend !!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.16% | Dow +0.13% | S&P 500 +0.11% | Russell 2000 -0.80%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield +0.03% | 2yr UST 4.596% | 10yr UST 3.743%

COMMODITIES: Brent Crude -1.29% to $74.98/barrel. Gold -0.15% to $1,975.6/oz.

BITCOIN: +1.14% to $26,634

US DOLLAR INDEX: +0.21% to 103.561

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +1.32% to 13.83

Quote of the day

“When it is a question of money, everybody is of the same religion.”

-Voltaire

The bulls are back in town

As of yesterday, the widely-tracked benchmark S&P 500 Index (SPX) is now up 20% from its October 12th closing low – officially back in bull market territory, at least by the textbook definition of some investors.

We are now 10-11% away from the all-time high established in January 2022.

If you prescribe to the textbook definition of bull and bear markets, this next chart shows you the historical context of the shift in market environment. The prior bear market saw the index fall -25.4% over 282 days, which is in line with the average bear market length of 286 days.

Goldman Sachs lifts their S&P 500 Index year-end target to 4,500, citing the worst of negative earnings revision cycle is likely behind us, slowing inflation, and healthy economic growth.

Source: Reuters, Bespoke Investment Group

Loss Aversion on staying invested

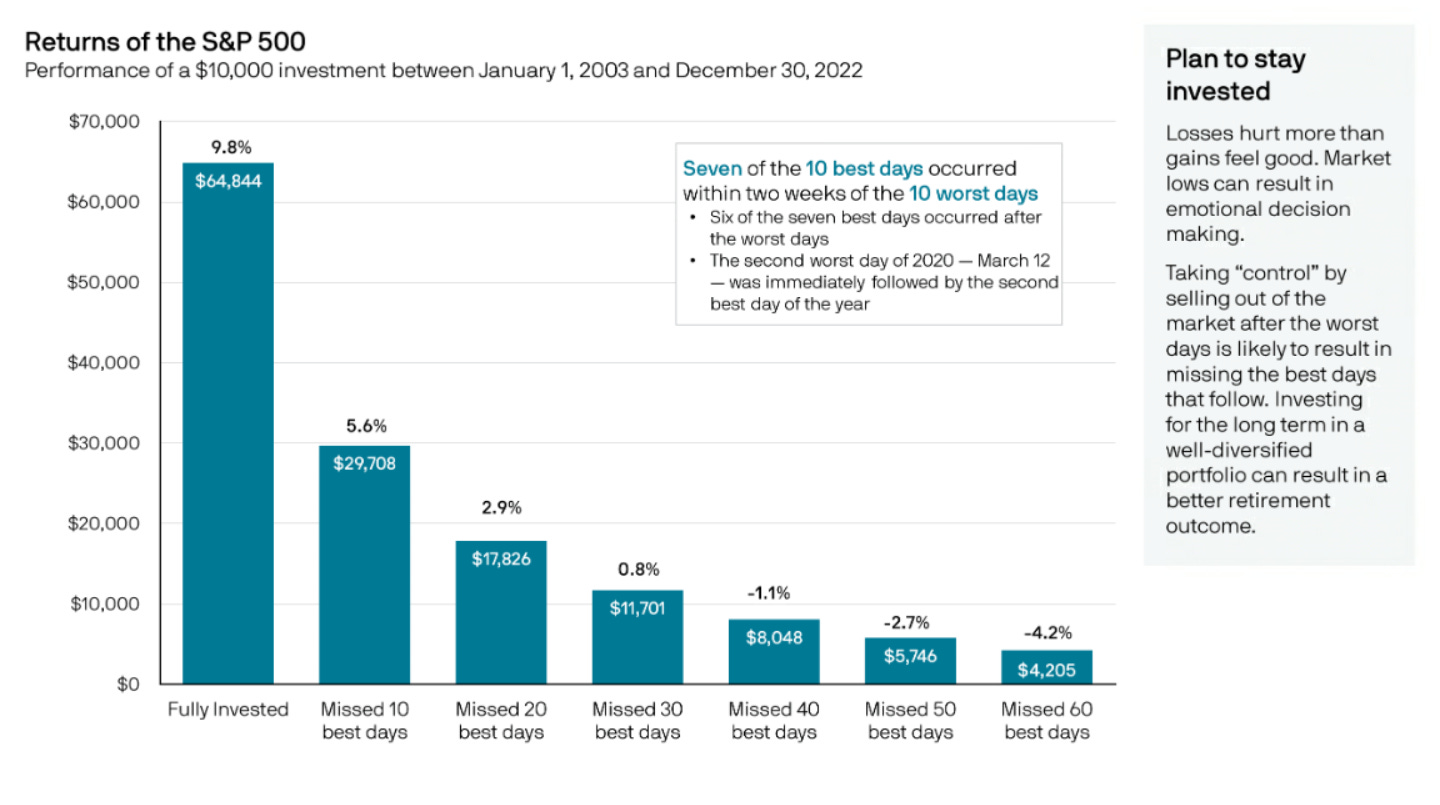

Loss Aversion is a critical bias of behavioral finance to understand.

On its surface, this one might seem obvious: after all, who isn't averse to losses? But thinking deeper, especially with the way our brains are wired, losses leave much more of an impression than gains. And those memories stick with us. If you've experienced a significant loss—no matter how long ago—you can probably relate. But gains, on the other hand, leave far less of an impression. We don't spend as much time thinking about all of those years when the stock market delivered 20% or 30% or more.

Meaning – people look at potential losses and potential gains differently. People dislike a $1 loss more than they enjoy a $1 gain. In fact, research shows that it takes a gain of about $2 to mentally offset a loss of just $1. Investors really hate losses. Unfortunately, losses are a part of the investing process and trying to avoid them can be costly to your future self.

Staying invested through difficult markets is tough, but the data shows how damaging it is when you decide to get out of the market.

Source: JPMorgan Guide to Retirement

Eurozone revised into a recession

The Eurozone just entered a recession as the region posted two consecutive quarters of negative economic growth.

The manner in which it entered a recession is a bit quirky. GDP shrank by -0.1% in the 1st quarter of 2023. But, it was a revision of previously reported data from positive to negative growth in the 4th quarter of 2022 that triggered the recession. Further confirming the weakness, Germany, the Eurozone's largest economy, shrunk by -0.3% in the most recent quarter which follows a -0.5% decline in the 4th quarter of 2022.

Regardless of the revision and debates about whether or not the Eurozone is an official recession, economic growth in the Eurozone is stagnant.

The European Central Bank (ECB) has been combatting stronger and more persistent inflation than in the United States, as shown above (blue line represents the Eurozone, red line for United States). Also keep in mind the region is more negatively impacted by the Russian-Ukraine conflict. And despite the two quarters of negative GDP growth and possibility that Eurozone is in a recession, the ECB will have to maintain a hawkish monetary policy due to inflation.

Source: St. Louis Fed

The week in review

Talk of the tape: Quiet week ends as the market looks ahead to a monster next week with a Federal Reserve FOMC policy meeting, the Consumer Price Index (CPI) report, and the Producer Price Index (PPI) report. The path of least resistance has been higher with help from a low volatility backdrop and some traction behind the soft-landing and disinflation narratives.

Stocks: The S&P 500 Index finished this week up more than 20% from its October 2022 closing low, marking the start of a new bull market. Leadership this week came from some of this year’s laggard groups, including small-caps and cyclicals.

Improving investor sentiment was evident in the latest American Association of Individual Investors (AAII) report showing the percentage of bulls increased from 29.1% to 44.5%, the first time it has risen above 40% since November 2021. Meanwhile, the VIX measure of implied volatility closed below 14 this week for the first time in over three years, either a sign of complacency or rising chances of a soft landing, or both.

Small caps have struggled for much of 2023 amid recession fears, particularly after the bank failures in March; however, these equities have received some traction over the past week as the Russell 2000 Index reached a new three-month high. Small cap valuations, along with last Friday’s strong May payrolls reports, have some investors believing in better prospects for these generally more economically sensitive equities.

Bonds: The Bloomberg Aggregate Bond Index finished little changed this week as investors anticipate next week’s May inflation reports along with the Federal Reserve meeting. Bond investors believe the Fed may be done tightening as inflation eases, but next week will provide additional confirmation with a rate hike in either June or July a roughly 50/50 proposition based on the fed funds futures markets.

Given the recent debt ceiling agreement, the Treasury Department has the ability to issue new debt again and add to the $31.4 trillion in outstanding debt. Currently, the Treasury was only set to issue shorter maturity bills this week but is expected to increase issuance significantly in the coming weeks.

Commodities: Energy prices finished mixed this week as natural gas prices rallied, though the commodity is still down almost 50% this year. The major metals (gold, silver, and copper) finished the week higher.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.