The contentious U.S.-China trade relationship

The Sandbox Daily (4.14.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the United States-China trade war

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.11% | S&P 500 +0.79% | Dow +0.78% | Nasdaq 100 +0.57%

FIXED INCOME: Barclays Agg Bond +0.59% | High Yield +0.50% | 2yr UST 3.847% | 10yr UST 4.382%

COMMODITIES: Brent Crude +2.59% to $64.97/barrel. Gold -0.46% to $3,229.5/oz.

BITCOIN: +0.88% to $84,809

US DOLLAR INDEX: -0.41% to 99.693

CBOE TOTAL PUT/CALL RATIO: 0.78

VIX: -17.76% to 30.89

Quote of the day

“The chief task in life is to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control.”

- Epictetus

United States-China trade war

Trade tensions between the United States and China have deteriorated meaningfully in recent weeks, with both countries implementing unprecedented tariff increases. For the moment, the U.S. has raised tariffs on Chinese goods to 145%, while China has countered with 125% tariffs on American products.

The situation continues to affect financial markets. While global tensions can create uncertainty, history shows that markets have weathered similar challenges in the past.

Tariffs against all trading partners have dominated market news, but the 90-day pause now puts the focus squarely on U.S.-China negotiations.

United States-China trade tensions come into focus

What makes this situation different from previous trade tensions is both the magnitude of the tariffs and the broader geopolitical context.

As shown below, the U.S. maintains a significant trade deficit with China.

Tariff levels above 100% effectively mean that goods crossing either border would more than double in price, all else equal. This increases the price of goods for consumers, raises costs for businesses, and can slow economic activity. The fear of high inflation and worsening profit margins have investors nervous, with a notable shift in consumer surveys and corporate earnings guidance.

Markets have also been worried about how far the White House would be willing to go in escalating a trade war with China. Since tariffs at these levels are unsustainable in the long run, it’s still likely these starting overtures represent negotiating tactics for the administration.

The 90-day pause on tariffs above 10% (except for China), and the exemption for technology products, are evidence that the White House’s main objective is still to achieve deals that benefit the United States.

The tariffs implemented in 2018 and 2019 provide some historical context for how markets and companies might respond as the situation evolves.

Many companies demonstrated resilience by adjusting supply chains, finding alternative suppliers, or absorbing portions of the increased costs. While markets stumbled in 2018, they performed well in 2019 and again during the post-pandemic recovery. The broader scope of tariffs makes it more difficult for companies this time around, but the historic market rally after the 90-day pause was announced is evidence that markets can recover once conditions improve.

For investors with long time horizons, this challenging market environment creates opportunities.

Valuations remain high based on history but are more attractive than they were even just a few months ago, both across the broad market and in sectors like Information Technology and Communication Services that drove the recent bull market.

China's economy faces many challenges

While much attention has focused on the U.S. provocations, China faces its own set of economic challenges.

China's post-pandemic recovery has been uneven, with GDP growth slowing to 5.4% YoY in late 2024, according to official Chinese government statistics. Many economists have already reduced their 2025 growth forecasts below the government's 5% target. Add on persistent concerns of its real estate bubble and aging demographics and the problems permeate.

Chinese leaders are reportedly considering more stimulus measures. This would be on top of significant stimulus measures implemented last year, including a 5-year, 10 trillion-yuan stimulus package to support local government debt issues, a commitment to increase the budget deficit, cut interest rates, reduce bank reserve requirements, and measures to support the real estate market.

In recent days, the People's Bank of China has also allowed the yuan to weaken as a potential offset to tariff impacts, including setting its currency peg to the weakest level since September 2023. Currency devaluation can help boost exports by making goods cheaper for foreign buyers. However, it also carries risks including capital outflows, which is especially risky for China since it could destabilize its financial system further.

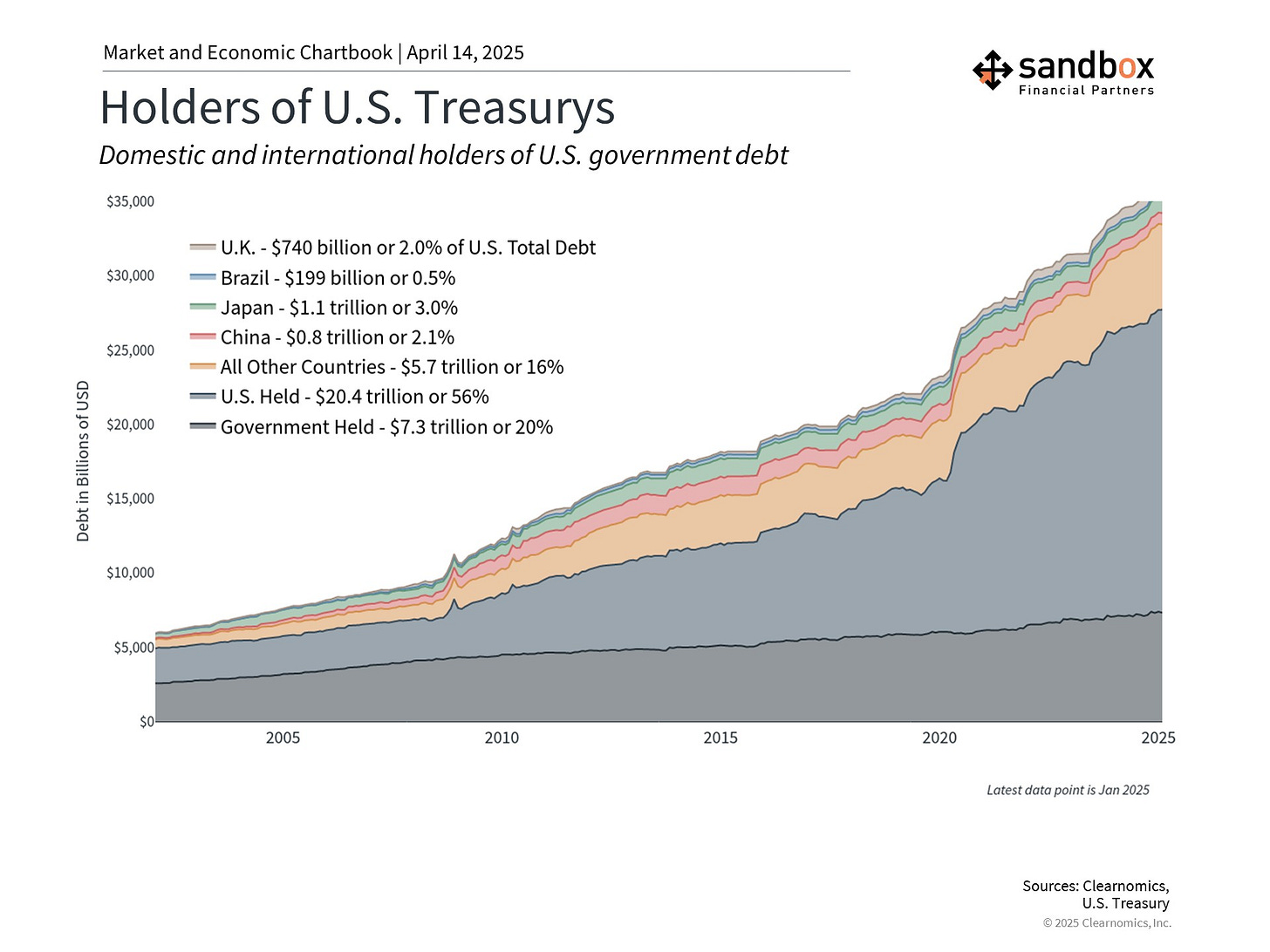

Most U.S. debt ownership is held domestically

One narrative floating around last week centered around China's holdings of U.S. Treasury securities that gives them undue influence over the U.S. economy.

Concerns that recent moves in the bond market were the result of countries like China dumping their Treasury holdings had markets on edge. While this is difficult to verify right now, what’s clear is that China's Treasury holdings represent roughly 2% of total U.S. government debt.

More importantly, most Treasury securities are still held domestically by U.S. individuals, corporations, and other federal, state, and local government entities.

If China were to significantly reduce its Treasury holdings, it could potentially cause short-term market volatility and temporarily push up U.S. interest rates. However, China and other countries hold U.S. Treasuries, the dollar, and other foreign assets for an important reason: to maintain financial stability.

The U.S. dollar and Treasury securities have consistently maintained their "safe haven" status even during periods of uncertainty. This has been true over the past few years despite inflation fears, budget crises, and U.S. debt downgrades.

Bottom line?

While escalating U.S.-China trade tensions create uncertainty, history shows that financial markets are resilient in the long run.

Long-term investors are better served focusing on their own portfolio than navigating the fluid and ever-changing global landscape via short-term tactics.

Sources: Wall Street Journal, Goldman Sachs, Clearnomics, Bloomberg

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: