The core to investing success: getting asset allocation right

The Sandbox Daily (9.16.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

determinants of portfolio returns… well, it depends

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.08% | Russell 2000 -0.09% | S&P 500 -0.13% | Dow -0.27%

FIXED INCOME: Barclays Agg Bond +0.04% | High Yield -0.07% | 2yr UST 3.507% | 10yr UST 4.028%

COMMODITIES: Brent Crude +1.57% to $68.50/barrel. Gold +0.28% to $3,729.4/oz.

BITCOIN: +1.19% to $116,859

US DOLLAR INDEX: -0.65% to 96.673

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: +4.27% to 16.36

Quote of the day

“In a world where you can be anything, be kind.”

- Anonymous

Determinants of portfolio returns… well, it depends

Asset allocation, or the mix of investments in your portfolio, refers to how your money is divided among different types of investments, such as stocks, bonds, and cash. This can also include commodities, alternatives (like private credit, real estate, or private equity), cryptocurrency, and others.

By diversifying your portfolio in a way that makes you feel comfortable, you can balance risk with potential returns.

Your asset allocation is one of the most important elements of long-term financial success.

In fact, the Brinson, Hood, Beebower study of 1986 estimated that roughly 90% of portfolio return variance is driven by your asset allocation.

Of course, a multitude of factors also influence the performance of a portfolio: timing of your entry points, the investment vehicle itself (ETF, mutual fund, underlying stock, etc), costs, the market cycle, geographical exposures, investor behavior, rules and regulations, and many others.

Ultimately, making sensible investment decisions about your portfolio’s allocation necessitates at least a rudimentary understanding of the range of possible outcomes a portfolio may endure over time.

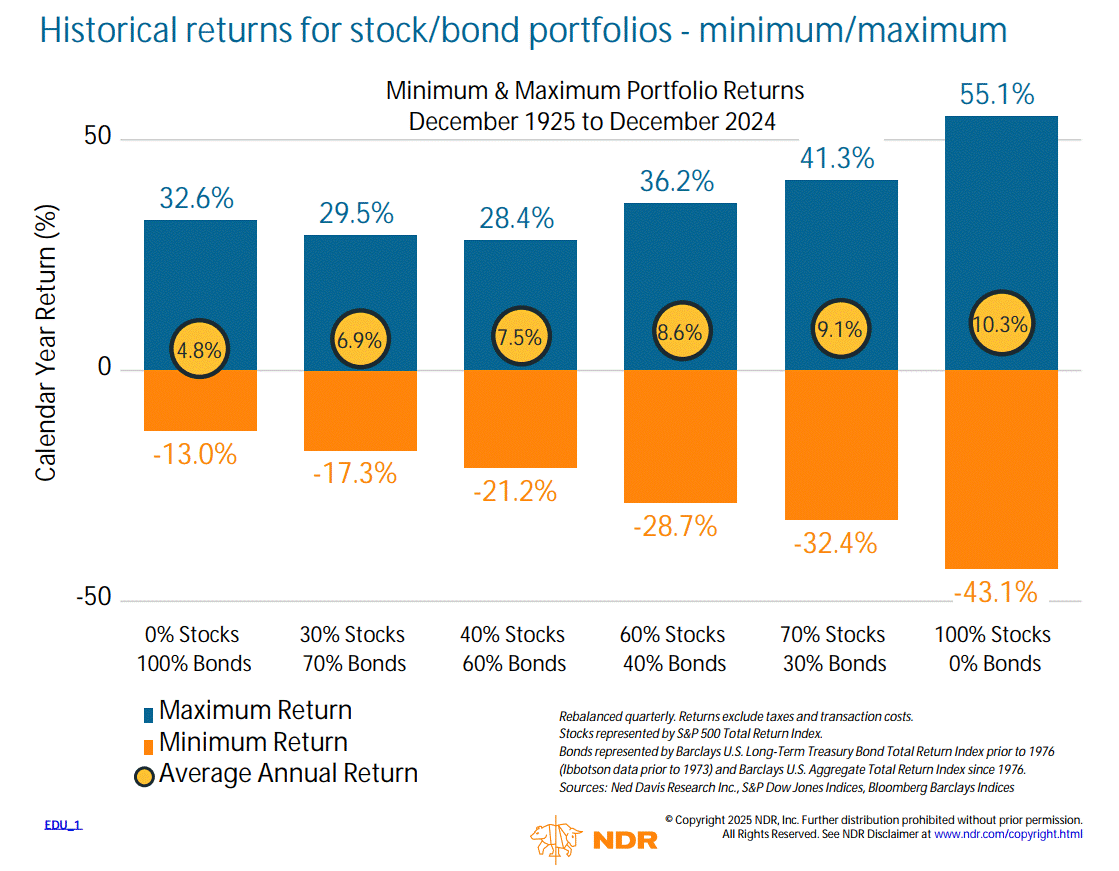

The graphic below shows various compositions of stock/bond portfolios, along with some important high-level risk and return attributes.

Stocks are typically the main driver of your portfolio’s growth and volatility. Bonds are generally recognized as the more stable asset class that offers a regular stream of income while balancing against the riskiness of stocks. Cash is the most stable asset and provides liquidity, however it struggles to maintain purchasing power over time.

Looking above, an all-stock portfolio – as represented by the S&P 500 – has averaged an annual total return of +10.3% over the last 100 years. And yet, it is by far the most volatile of the various allocations – a max gain of 55% in a calendar year while also suffering a max drawdown of -43%.

At the other end of the spectrum, a conservative portfolio consisting of just bonds has a much narrower range of outcomes. While averaging a +4.8% gain per year, the max gains and losses are more muted at +32% and -13%, respectively.

In the middle are different base allocations to consider. The greater the stock allocation, the greater the average return but also the higher dispersion.

Understanding what’s in your portfolio, your risk tolerance, and when you’ll need your money (or your time horizon) are all key factors when it comes to making smart decisions about your asset allocation. You could be missing out on growth opportunities or introducing risk to your portfolio without knowing it.

Today, investors can achieve a diversified portfolio by using target date funds, a broadly diversified asset allocation fund, or constructing the portfolio themselves.

So, how should you manage your asset allocation?

Balance the potential risks and returns that come with different asset classes.

Revisit your asset allocation periodically to help your investment strategy stay aligned with your goals.

Rebalance your portfolio to keep it in check with your time horizon (or the amount of time your money will be invested before you need it), risk tolerance, and shifts in the market.

Ultimately, choosing the right mix of assets will be determined by your risk tolerance, time horizon, goals, and liquidity constraints. Adjustments will be made over time as life events occur and/or when circumstances change.

And, as always, stay on target.

The market will throw tantrums and give you every reason to deviate from your plan. Execute your plan and stay the course.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)